Novo Nordisk, Eli Lilly fall after Trump comments on weight loss drug pricing

The week ahead, July 10-15, will likely be one of the most important of the year for U.S. markets. There are two main reasons for that:

- U.S. inflation data

- U.S. earnings

Source: Investing.com

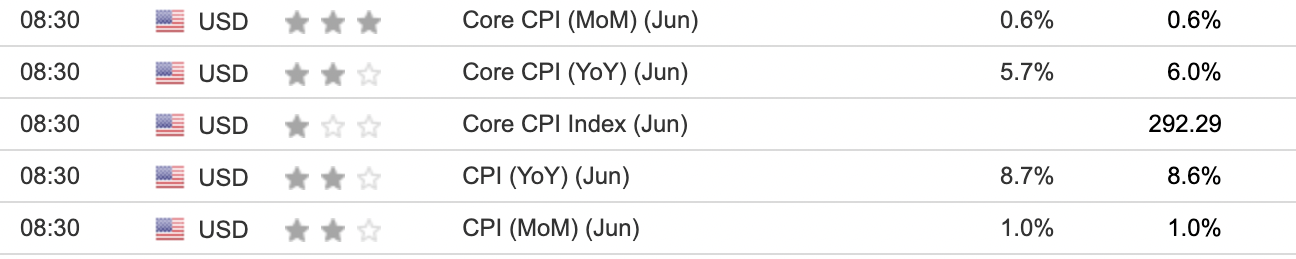

On Wednesday, July 13, the U.S. Bureau Of Statistics will release the widely-anticipated inflation data for May. Headline CPI (consumer price index) is expected to register an 8.7% year-on-year growth, up slightly from the previous 8.6% reading.

Since a pessimistic scenario has likely already been priced in by markets, a lower-than-expected figure could give investors breathing room at a much-needed time.

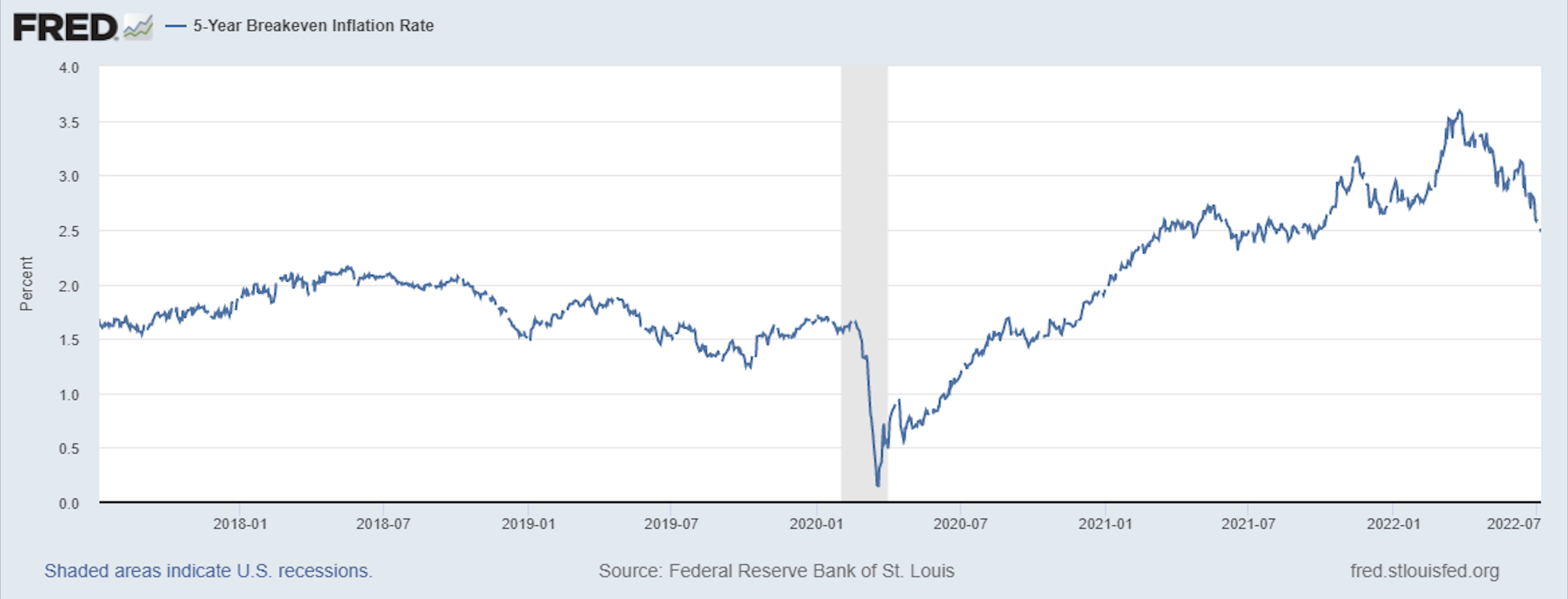

Furthermore, as mentioned in some of my earlier analyses, expected inflation is already showing signs of subsiding (see breakeven inflation below).

Source: Fred

The other pungent issue for the week is the health of U.S. earnings, particularly Big Tech stocks that, as we know, weigh heavily in the major stock indexes.

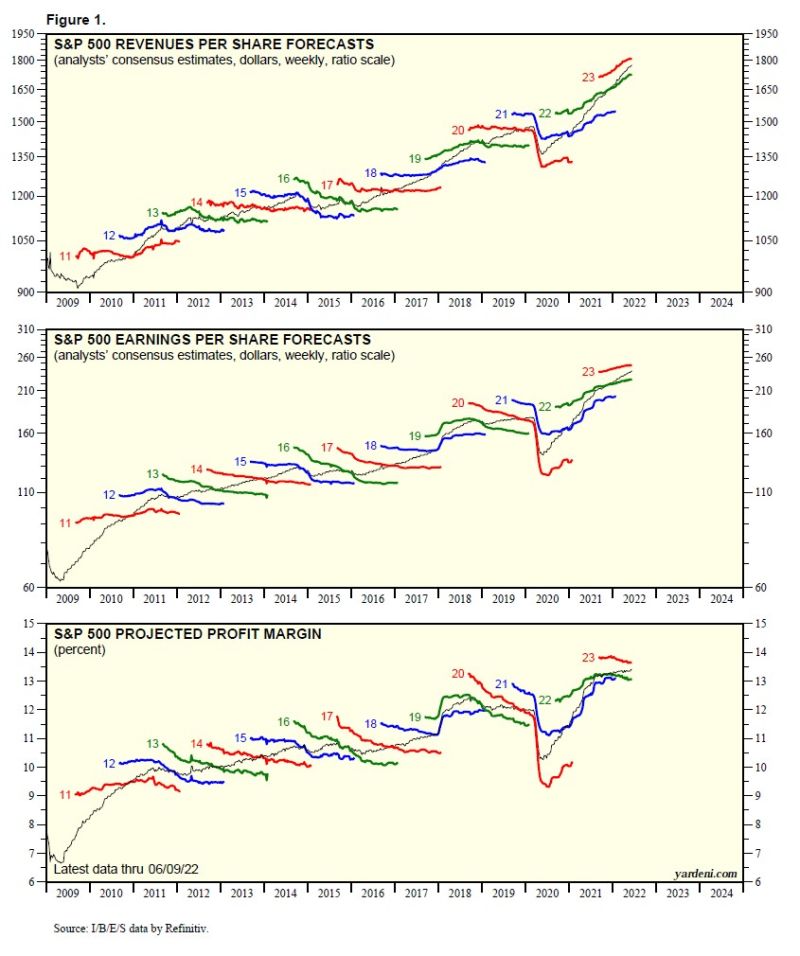

Looking at data from Refinitiv, we see how earnings per share (EPS, middle chart) estimates are still positive and rising.

Source: Yardeni

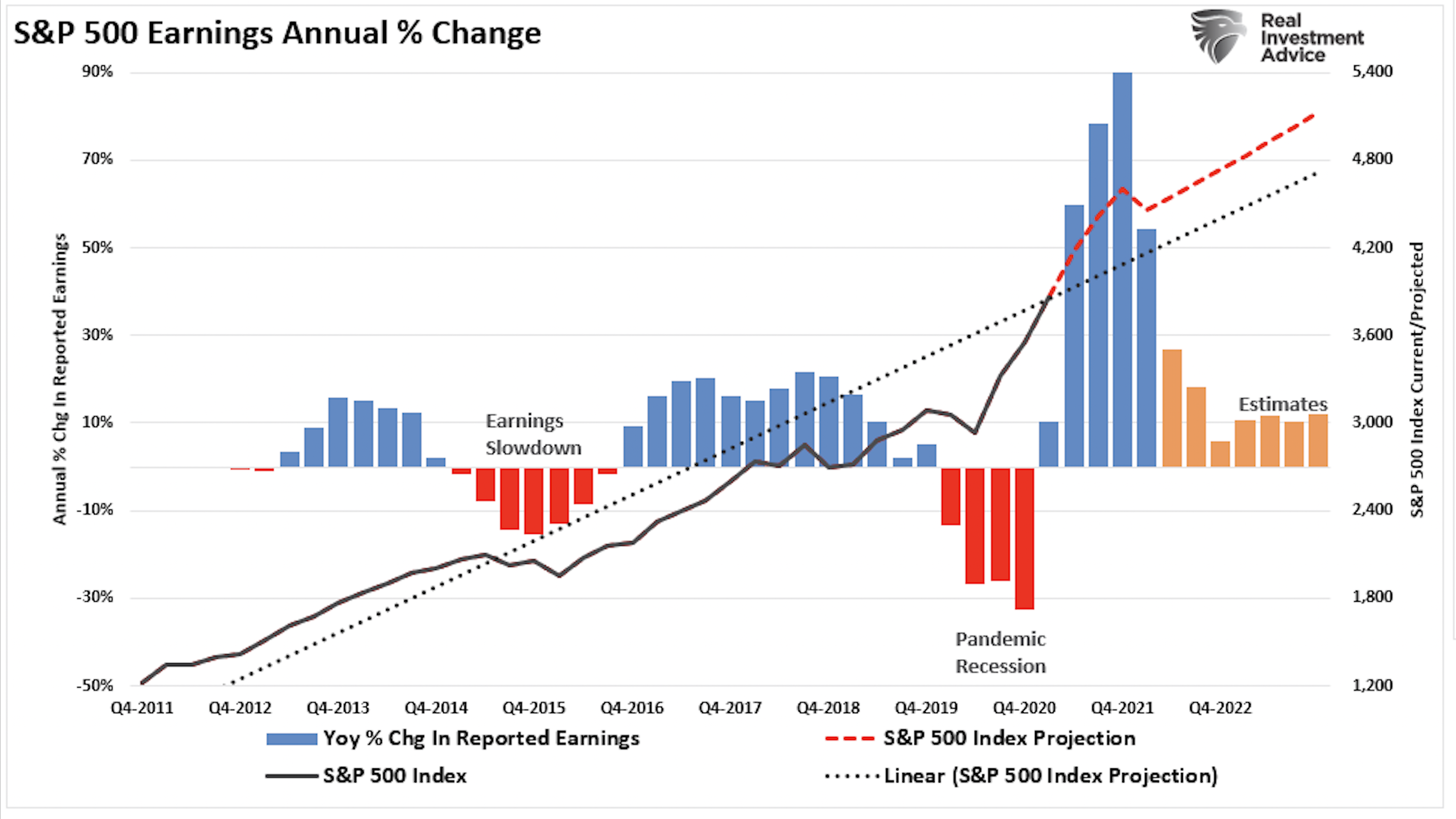

On the other hand, in the chart below, Lance Roberts reports that, in general, S&P 500's quarterly earnings are expected to be significantly down from last quarter (orange columns).

Source: Lance Roberts

Here, a better-than-expected reading is what’s most likely already priced in, contrasting to what we see regarding inflation. Therefore, expected or worse-than-expected average earnings could lead to new market corrections.

In any case, for both reasons, next week will be essential for the market’s trajectory in 2022.

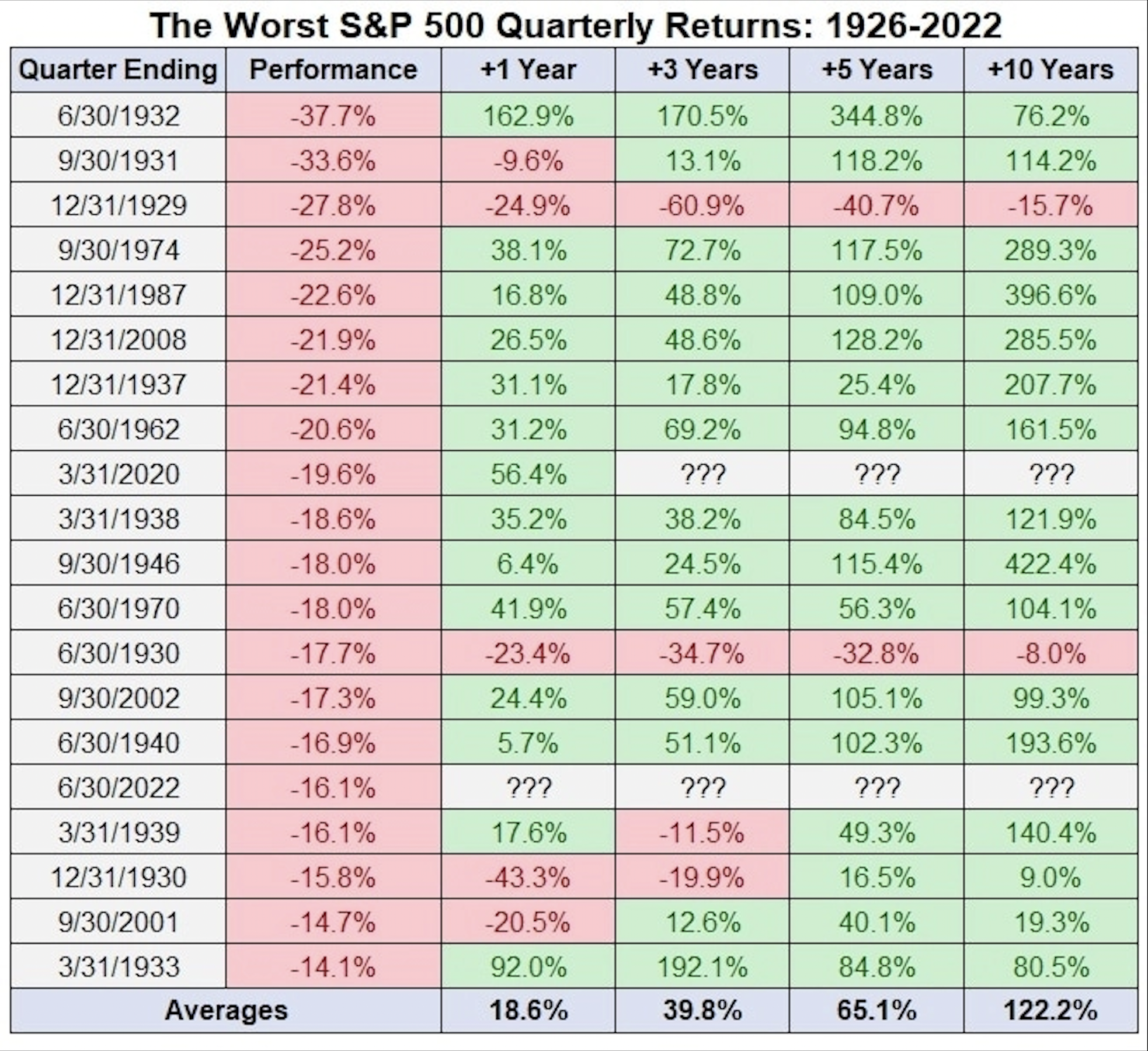

Meanwhile, with the close of the second quarter, equity markets reported negative performance again (-16.1% for the S&P 500 index), which, as mentioned on corrected horizons, can also represent an opportunity if we look at history (see table below).

Source: awealthofcommonsense

****

This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest; as such, it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remain with you.