United Homes Group stock plunges after Nikki Haley, directors resign

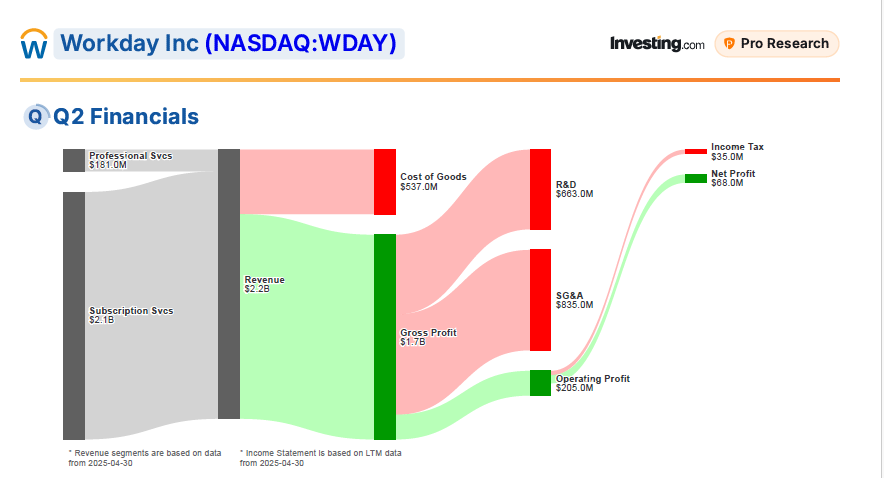

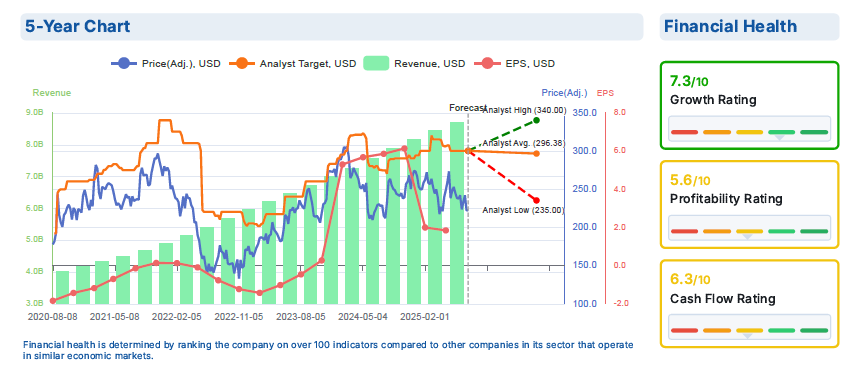

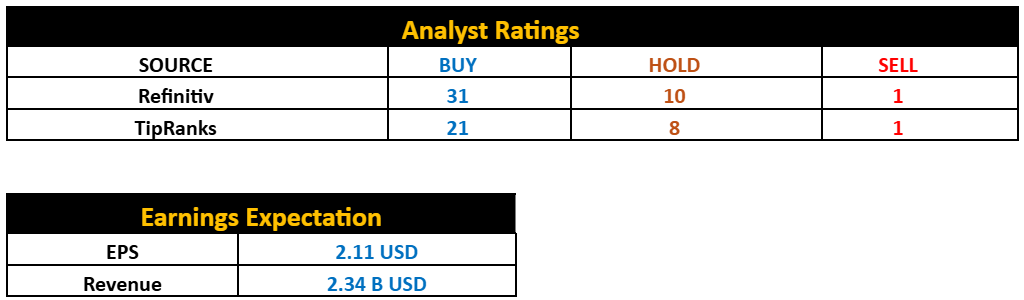

Workday Inc (NASDAQ:WDAY) reported $2.24 billion in revenue last quarter, up 12.6% YoY and 1% above expectations; EBITDA beat consensus, but billings missed materially. Analysts see revenue growth slowing to 12.3% YoY to $2.34B this quarter, with adjusted earnings pegged at $2.11 per share (versus 16.7% growth in the same quarter last year).

Key Highlights

- Workday Inc has named DailyPay its strategic on‑demand pay partner in the U.S. and Canada, the company said Tuesday. InvestingPro rates Workday "GOOD"; with a 2.07 current ratio and a net‑cash balance sheet, the partnership will let employers on Workday offer frontline and hourly workers real‑time access to earned wages.

- DailyPay has collaborated with Workday Human Capital Management and Payroll since 2023; the deeper partnership now offers joint customers a more connected experience.

- Workday faces a challenging business environment where large projects are less prioritized.

Analysts Expectation

- Evercore ISI stays at Outperform, expecting Workday to slightly beat its $2.16B subscription-revenue guidance (13.5% growth). Oppenheimer also reiterates Outperform, saying expectations are low but valuation is supported at certain multiples. Cantor Fitzgerald started coverage with an Overweight rating, expressing confidence despite slowing growth and potential AI disruptions. BofA trimmed its price target to $278 but kept a Buy on mixed deal activity, while Guggenheim reiterated Neutral.

- The key variable may be AI adoption. Analysts report positive channel checks for Workday’s ’agentic AI’ offerings — HigherScore, Talent Optimization, Extend Pro, and Eversource, which is reportedly growing at nearly triple‑digit rates, and believe Workday’s AI capabilities across Human Capital Management and finance workflows are undervalued.

WDAY Q2 2025 earnings after market on Thursday August 21, 2025.

Technical Analysis Perspective

- Workday formed a double‑top around 307–311 after rejections in Nov 2021 and Mar 2024.

- Price fell to 200 in Aug 2024, rallied to 294 in Dec 2024, then dropped to 205 in Apr 2025 and surged to 276 in May 2025.

- Last week formed a weekly bullish hammer after holding 206 — which sits on the rising trendline from the Oct 2022 low (129).

- As long as the rising trendline support (218–207) holds, a gradual push toward the falling trendline resistance at 271–279 (originating from the Feb 2024 311 high) is likely.

- A decisive, sustained break below 207–205 would invalidate the bullish case and trigger a sharp drop to 176–175, with further downside possible toward 160.

Weekly Candlestick Chart

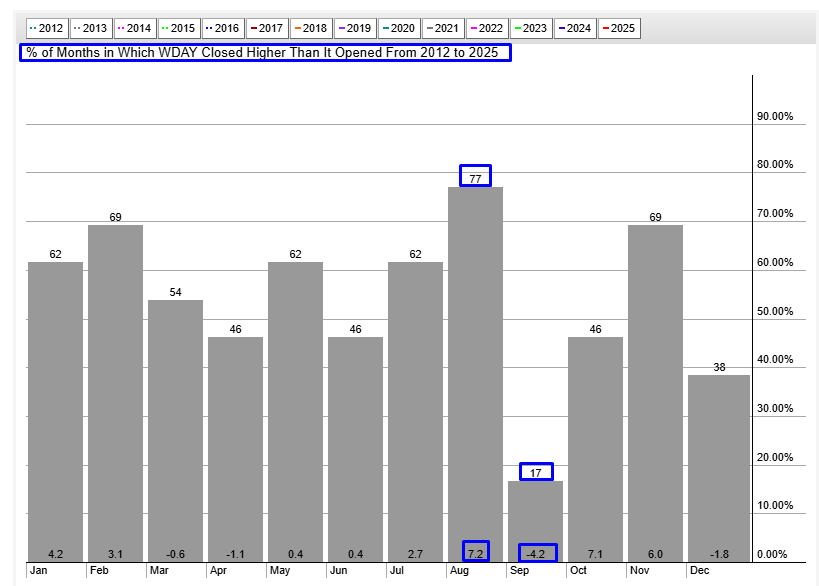

WDAY Seasonality Chart

Since 2012, Workday has experienced an average increase of 7.2% in August, with positive performance in 77% of those years, and an average decline of -4.2% in September, occurring in 17% of years.

Since 2012, Workday has experienced an average increase of 7.2% in August, with positive performance in 77% of those years, and an average decline of -4.2% in September, occurring in 17% of years.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly

- 10 years of historical financial data for thousands of global stocks

- A database of investor, billionaire, and hedge fund positions

- And many other tools that help tens of thousands of investors outperform the market every day!

Subscribe to InvestingPro at up to 50% off to see how simple smart investing can be when you have the right tools at your fingertips.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.