Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

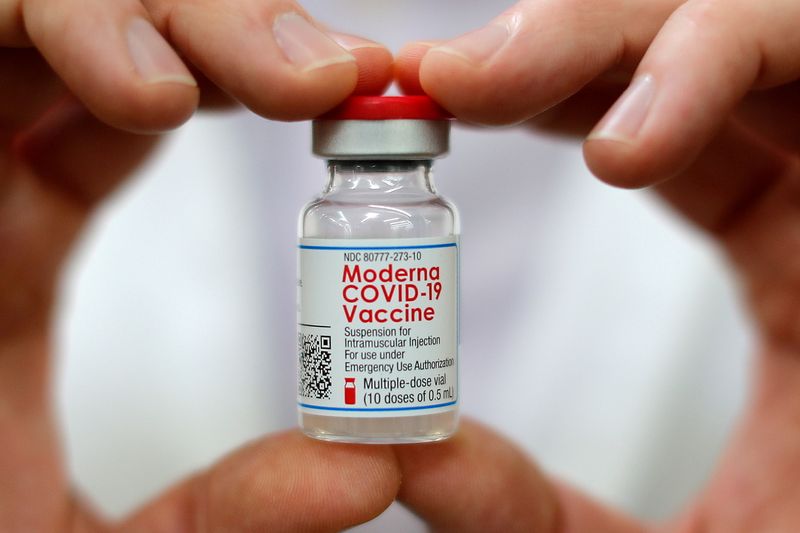

In a turbulent market environment, Moderna Inc (BMV:MRNA). shares have touched a 52-week low, sinking to $30.7, with concerning financial metrics showing negative EBITDA of $2.36 billion and gross profit margins at -27.55%. The biotechnology company, known for its mRNA technology and COVID-19 vaccine, has faced significant headwinds over the past year, reflected in a stark 1-year decline of -65.25%. According to InvestingPro analysis, the company is currently burning through cash rapidly, with negative free cash flow of nearly $4 billion. Investors have been cautious as vaccine demand projections adjust post-pandemic, and the company navigates the complex landscape of vaccine production, competition, and global health dynamics. This price level marks a critical juncture for Moderna (NASDAQ:MRNA), as stakeholders closely monitor its strategy and pipeline developments for future growth potential. InvestingPro analysis suggests the stock is currently undervalued, with 12 additional key insights available to subscribers, including detailed financial health scores and comprehensive research reports.

In other recent news, Moderna has been making significant strides in its operations. The biotechnology company recently secured a tender to supply its mRNA COVID-19 vaccine to the European Union, Norway, and North Macedonia, a development that’s expected to enhance the diversity of their vaccine supply. This follows the European Commission’s authorization of an updated version of Moderna’s Spikevax vaccine, tailored to combat the SARS-CoV-2 variant JN.1.

In another development, Goldman Sachs analyst Salveen Richter downgraded Moderna stock from Buy to Neutral, significantly reducing the price target to $51 from the previous $99. This was after a series of negative revisions to the company’s product revenue guidance over the past six months. Moderna’s recent forecast for fiscal year 2025 respiratory vaccine business revenue is set between $1.5 billion and $2.5 billion, with Goldman Sachs estimating the lower end of this range.

Additionally, Moderna stock experienced a decline after the Senate Finance Committee’s vote to advance Robert F. Kennedy Jr.’s nomination for Secretary of Health and Human Services to the full Senate. This decision has led to speculation about the future of vaccine policies in the United States. However, following RFK Jr’s comments clarifying his stance as not being anti-vaccine or anti-industry, Moderna’s stock climbed, indicating a positive market response.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.