(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world threatened by trade wars. Sign up here.

The European Central Bank has set out an ambitious timetable for its strategic review that could see a decision on whether to change its inflation goal by the summer, according to euro-area officials.

Speaking on condition of anonymity because the process is confidential, the officials described a rushed agenda under President Christine Lagarde, who reached her 100th day in the job over the weekend. Staff have started work despite some workstreams not yet getting formal approval by the Governing Council.

The aggressive start to the ECB’s first review since 2003 come amid rising concerns among some policy makers about the institution’s credibility. Despite years of controversial measures such as negative interest rates and bond purchases, it has so far failed to restore price growth to the goal of just under 2%.

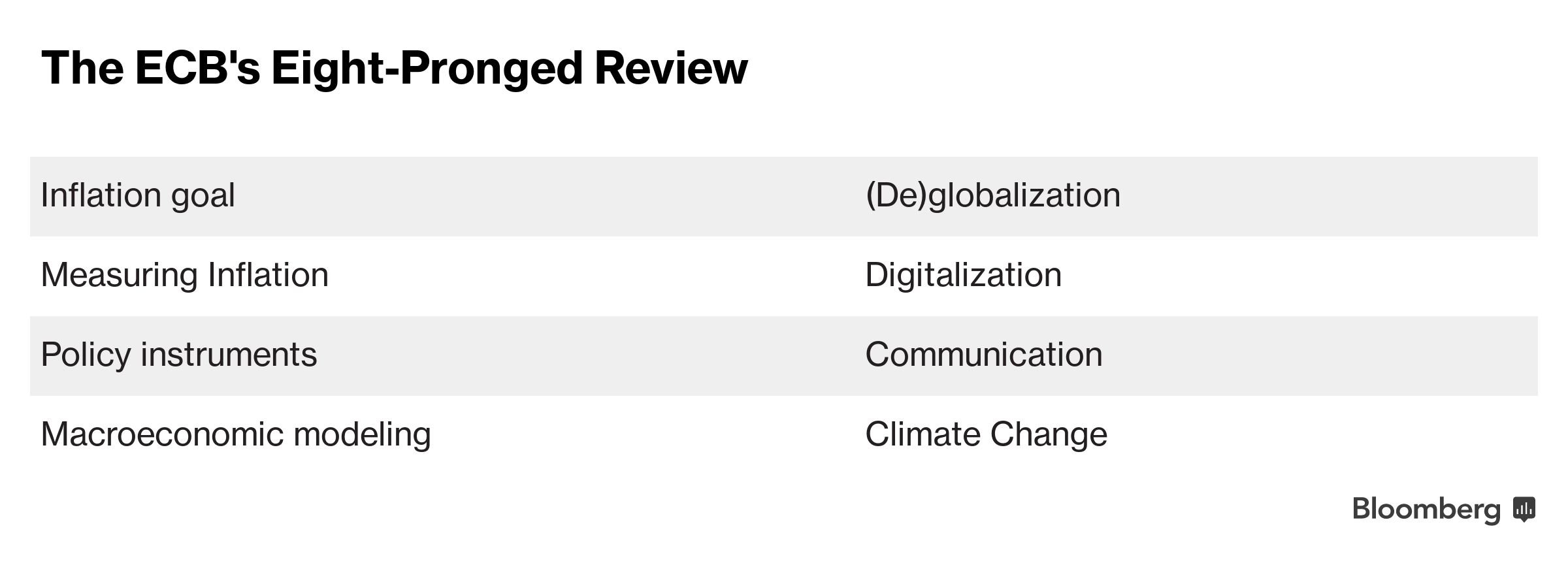

The reappraisal has eight study teams covering themes ranging from the core topic of inflation to modern challenges such as climate change and trade, the officials said. Governing Council members will attend seminars on specific issues immediately before their next two policy meetings in March and April, one of the people said.

Suggestions on whether to change the current inflation target might then be made at the following session in June, and a decision could taken in July, the person said.

While nothing is certain, many policy makers want a decision on the inflation goal by the summer, the officials said. Slovakian policy maker Peter Kazimir said last month that there is “great ambition” to agree on the inflation target by the end of June. For the review as a whole, Lagarde has indicated the results could be revealed around December.

The external listening events that she has promised as a way of reaching out to the public could be squeezed into a few months from March, when the first such event will be held in Brussels, to May.

An ECB spokesman declined to comment.

The tight schedule is reminiscent of Lagarde’s management style in her previous job as head of the International Monetary Fund. She starts policy meetings hours earlier than her predecessor, Mario Draghi, keeps presentations short, and discourages the use of phones in meetings.

The strategic review is also an opportunity to heal the divisions among policy makers that built up under Draghi. The president is seeking to coalesce her colleagues around a common desire: ensuring the ECB meets its primary mandate of price stability.

For now, that approach seems to be working. Two of Draghi’s most strident critics, Bundesbank President Jens Weidmann and Dutch governor Klaas Knot, have so far been relatively restrained in their public comments on the review.

Yet the eight themes in the review suggest areas of disagreement could arise in the future. They include climate change and digital currencies, both of which Lagarde has actively engaged with. On the former, some policy makers have already resisted calls for central banks to use bond-buying programs to favor so-called green issuers.