Bitcoin set for a rebound that could stretch toward $100000, BTIG says

Stewart Ellis, the Chief Financial Officer and Chief Strategy Officer of Hippo Holdings Inc. (NYSE:HIPO), recently sold a significant portion of the company's common stock. According to a recent SEC filing, Ellis sold a total of 10,000 shares on January 2, 2025, generating approximately $263,415. The sales were executed at prices ranging from $26.1116 to $26.6423 per share. The transaction comes as Hippo, currently valued at $624.58 million, has demonstrated remarkable performance with a 195% return over the past year. According to InvestingPro analysis, the stock appears to be trading below its Fair Value.

Following these transactions, Ellis holds 318,215 shares directly and an additional 10,335 shares indirectly through the Desertfish Nevada Trust, as managed by Preservation Trust Company, Inc. Notably, the sales were conducted under a pre-established Rule 10b5-1 trading plan set on September 10, 2024. InvestingPro data shows the stock typically trades with high volatility, with 12 additional key insights available for subscribers, including detailed valuation metrics and growth forecasts.

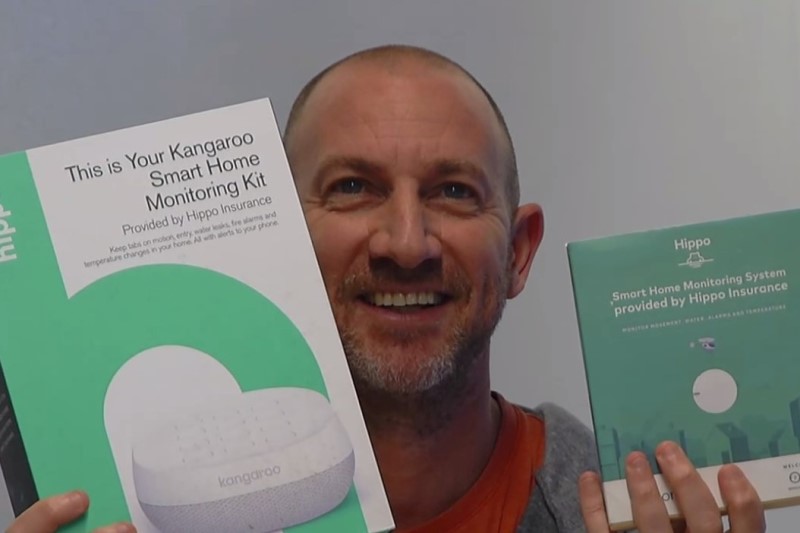

In other recent news, Hippo Holdings Inc. has announced significant changes in its executive leadership and financial growth. The company has appointed Andrea Collins, a seasoned professional with over twenty years of marketing experience, as its new Chief Marketing Officer. Concurrently, Yuval Harry, the Chief Revenue Officer, is stepping down from his executive role and transitioning to a consultative position within the company. At the same time, William Malone, an insurance industry veteran, has been named as the Vice President, Head of Agency.

These leadership changes coincide with Hippo's impressive financial performance. The company reported robust growth in total generated premium and revenue for the second quarter of 2024. This growth is attributed to strategic initiatives that have increased customer lifetime value, reduced acquisition costs, and significantly decreased weather-related losses. Furthermore, Hippo anticipates a positive adjusted EBITDA by the fourth quarter of 2024.

In other developments, Hippo's warrants were delisted from the New York Stock Exchange due to persistently low selling prices. However, this decision does not impact the company's common stock, which remains listed on the NYSE. These recent developments reflect Hippo's ongoing efforts to navigate financial markets and achieve its financial targets.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.