ReElement Technologies stock soars after securing $1.4B government deal

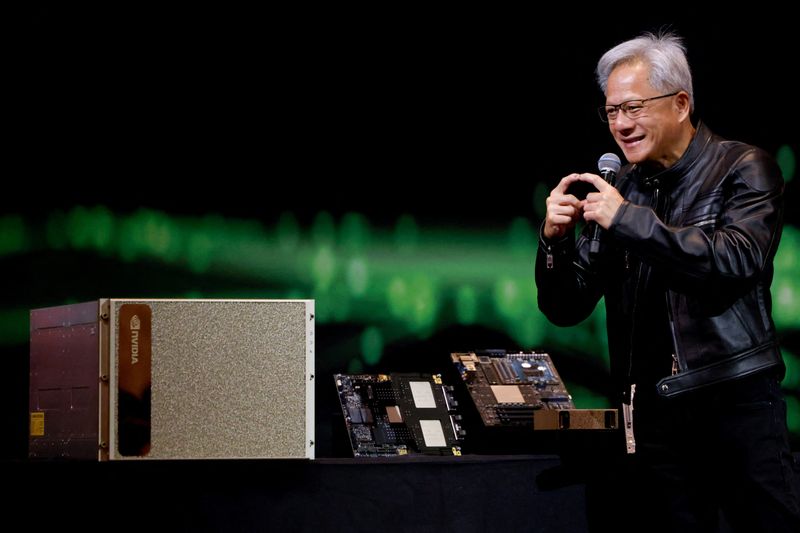

Investing.com -- Shares of AI-powerhouse NVIDIA Corporation (NASDAQ:NVDA) surged 5% Tuesday to over $200 per share for the first time after CEO Jensen Huang’s keynote address at the semi-annual GTC conference, where he downplayed any concern over an AI bubble. The company’s valuation is now nearing $5 trillion.

Grabbing investors’ attention was news that Huang stated that the company has visibility of more than $500 billion in cumulative Blackwell and Rubin revenue through CY26.

While details of the financial disclosure are murky, one analyst suggested that the guidance could indicate $140 billion or more of upside to datacenter GPU revenue over the period.

“Our analysis assumes NVDA means they will ship a total of $500bn of Rubin +Blackwell in CY25+CY26. Our total CY25+CY26 DC GPU revenue is for $360bn,” Wolfe Research analyst Chris Caso stated. “This disclosure therefore suggests on the order of $140bn upside to datacenter GPU revenue over that period. If our interpretation is correct, this would suggest ~$3 EPS upside to our current $6.20 CY26 estimate."

Huang unveiled an AI-native 6G wireless stack built in the U.S. with Nokia, introduced NVQLink to tightly connect quantum processors with GPUs, and announced major Department of Energy partnerships to build seven new AI supercomputers, including the 100,000-GPU Solstice system at Argonne, the largest public scientific AI platform to date.

Huang also positioned AI factories as the next generation of data centers, powered by new chips such as BlueField-4 and designed using Omniverse DSX. He highlighted expanding open-source AI model families, new industrial collaborations ranging from Foxconn and Caterpillar to Disney, and major autonomous mobility plans with Uber targeting about 100,000 Level-4 vehicles by 2027. The keynote closed with record-setting financial inference benchmarks from the Grace Hopper Superchip, underscoring NVIDIA’s expanding role across science, industry, and real-time AI services.