Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

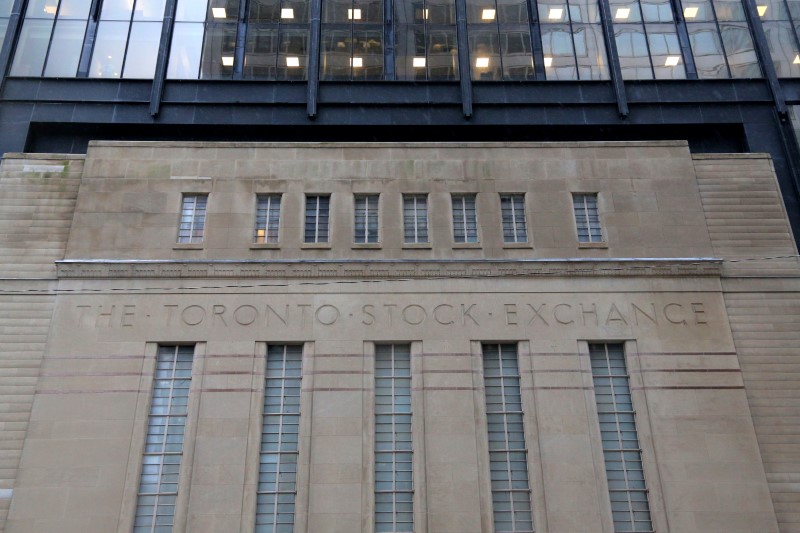

Investing.com - Canada’s main stock exchange closed slightly higher on Thursday, after the index edged away from a recent record high in the prior session.

By the 4:00 ET close, the S&P/TSX 60 index standard rose by 2 points or 0.1%.

Toronto Stock Exchange’s S&P/TSX composite index gained 14.8 points or 0.1%, having fallen by 214.46 points, or 0.8%, on Wednesday, retreating from an all-time closing high and ending a 10-day winning streak.

A jump in Canadian 10-year yields to their highest level since January weighed on equities. Investors have been cutting bets that the Bank of Canada will pursue interest rate reductions since recent data showed hot underlying inflation in April.

In earnings, Canada’s banking giant Toronto Dominion Bank (TSX:TD) beat Q2 estimates in eps and revenue, with the stock jumping 3.8% in trading as of 1:10 ET.

U.S. stocks mixed

U.S. stock indexes traded in a muted fashion Thursday, steadying after the previous session’s sharp selloff on concerns over high U.S. debt levels.

At the 4:00 ET close, the Dow Jones was flat, and the S&P 500 dropped 2.6 points or 0.04%. However, the NASDAQ Composite gained 53.1 points, or 0.3%.

The main averages slumped on Wednesday, with the blue chip Dow Jones Industrial Average falling over 800 points.

After U.S. President Donald Trump’s trip to the Middle East, G42, OpenAI, Oracle (NYSE:ORCL), NVIDIA (NASDAQ:NVDA), Softbank, and Cisco (NASDAQ:CSCO) announced a historic partnership to build the Stargate UAE cluster in Abu Dhabi.

Additionally, AI lab Anthropic unveiled their Claude 4 models, boasting wins in coding benchmarks. And Bloomberg reported Apple (NASDAQ:AAPL)’s commitment to AI-powered smart glasses, rivaling a popular Meta Platforms Inc (NASDAQ:META) and Ray-Ban glasses partnership and a recently-announced Google (NASDAQ:GOOGL) and Warby Parker Inc (NYSE:WRBY) partnership.

House passes tax and spending bill

U.S. President Donald Trump’s tax and spending bill narrowly passed the House of Representatives on Thursday morning, overcoming days of political wrangling between Republicans in control of the lower chamber of Congress.

The measure passed by a narrow 215-214 margin, with one member voting present, as all Democrats opposed the bill.

The bill now moves to the Senate, where some lawmakers are pushing for revisions, with a vote on approval expected by August.

The U.S. House Rules Committee on late Wednesday approved President Donald Trump’s expansive tax and spending bill after a nearly 22-hour session, media reports showed.

Along with the extension of 2017 tax cuts, the legislation would slash taxes charged on tips and car loans, while boosting spending on defense and border security. Reductions to key food and health programs for low-income Americans are also included in the bill.

Nonpartisan analysts have said the changes would add between $3 trillion to $5 trillion to the U.S.’s $36.2 trillion debt load.

Earlier, it was uncertain if House Speaker Mike Johnson would secure enough Republican support to pass the bill. Some GOP lawmakers demanded deeper spending cuts to offset Trump’s desired tax breaks, although Johnson said he was confident he could secure their backing to overcome united Democratic opposition.

Bitcoin hits record high

Bitcoin surged to a fresh record high above $111,000 on Thursday, driven by optimism over U.S. regulatory progress, particularly the advancement of the GENIUS Act aimed at establishing a national framework for stablecoins.

As of 6:00 ET, Bitcoin (BitStampUSD) was up 2.3%, pricing in at $110,881. The cryptocurrency has climbed over 18% in May so far.

Crude falls on OPEC+ output talk

Oil prices fell further Thursday on renewed oversupply concerns, following a report suggesting that a group of top producers was considering raising output levels once more.

At 6:00 ET, Brent Oil Futures fell 1.3% to $64.07 per barrel and West Texas Intermediate (WTI) crude futures dropped 0.2% to $60.64 per barrel.

The Organization of the Petroleum Exporting Countries and allies, a group known as OPEC+, is discussing whether to agree on another large production increase at their meeting on June 1, Bloomberg News reported on Thursday.

An output hike of 411,000 barrels a day (bpd) for July is among the options under discussion, although no final agreement has yet been reached, the report said, citing delegates.

OPEC+ has been in the process of unwinding output cuts, with additions to the market in May and June.

Gold prices inch lower

Gold prices dipped in European trade on Thursday, pulling back from recent gains due to a strengthening in the U.S. dollar that threatens the appeal of bullion from holders of foreign currencies.

However, demand for safe havens somewhat remained bolstered by persistent concerns over high U.S. debt levels and the passage of Trump’s tax bill.

Spot gold dipped 0.6% to $3,294.77 an ounce, while gold futures for June were flat at $3.294.80 by 1:20 ET.

(Scott Kanowsky also contributed to this article)