Street Calls of the Week

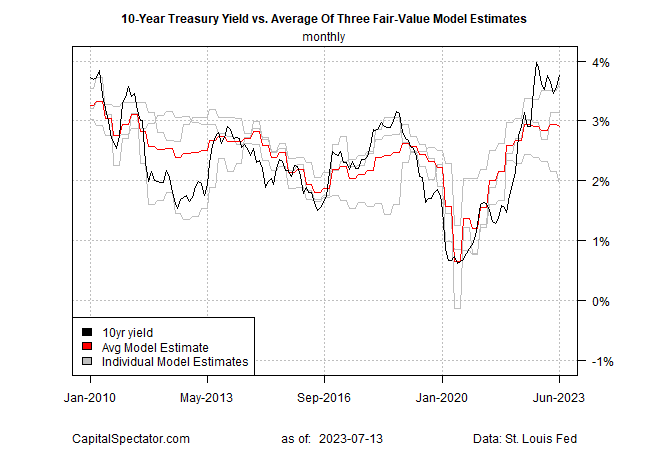

The 10-year Treasury yield looks elevated relative to CapitalSpectator.com’s fair-value modeling. But after yesterday’s news that US consumer inflation fell more than expected in June, the relatively wide spread will likely narrow in the months ahead.

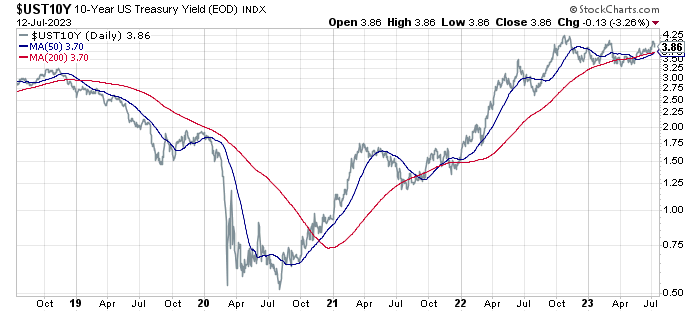

The 10-year yield closed at 3.86% yesterday (July 12), which is close to its recent high.

Our fair-value model, which reflects the average estimate for the three models, indicates a rate of 2.90%, well below the current market rate. Today’s fair-value estimate for June (based on the average of monthly data) marks a slight decline from the previous estimate.

There’s no assurance that the market rate will soon, if ever, align with the fair-value estimate. But history shows that the current gap is relatively wide, which implies that the market rate will, in time, fall, the fair-value estimate will rise, or some combination of both.

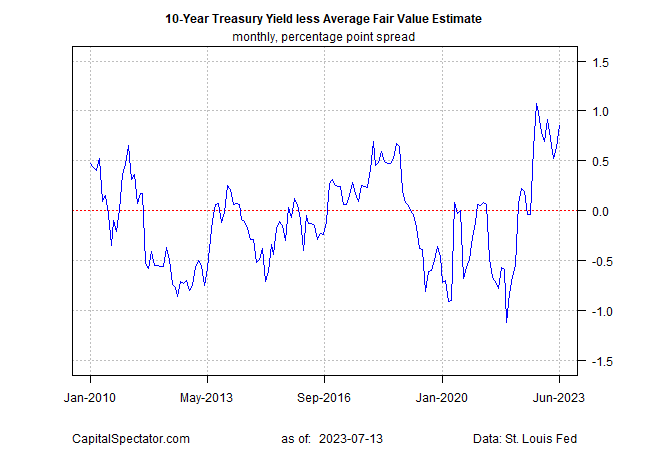

Meanwhile, the spread reflects a market rate substantially above the fair-value estimate by roughly 85 basis points.

One reason for thinking that the market’s downward repricing of the 10-year yield will do the heavy lifting for narrowing the spread: new signs that US inflation continues to soften, reducing upside pressure on interest rates.

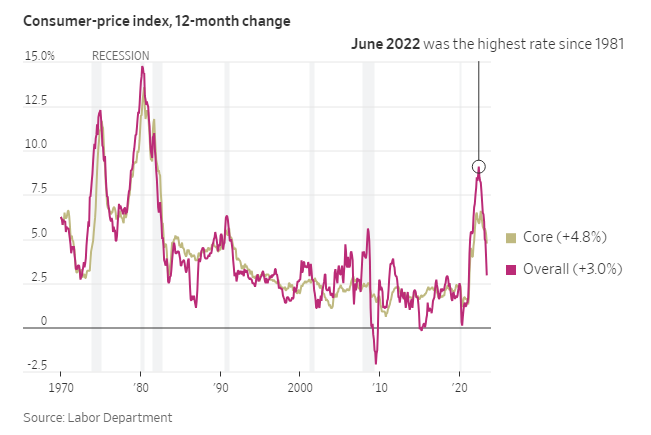

The Consumer Price Index eased in June to the slowest increase in more than two years, the Labor Department reports. Bill Adams, chief economist at Comerica Bank, said,

“After a punishing stretch of high inflation that eroded consumer’s purchasing power, the fever is breaking,”

The ongoing deceleration in inflation convinces Johns Hopkins University economist Steve Hanke to predict that “the inflation story is history.”

He tells CNBC:

“One reason for that is that money supply has been contracting on a year-over-year basis by minus 4% in the United States. We haven’t seen that since 1938. Money supply changes cause changes in the price index and inflation.”