BETA Technologies launches IPO of 25 million shares priced $27-$33

- In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience.

- Two such stalwarts, Johnson & Johnson and Coca-Cola, embody the essence of safe-play investments.

- For investors looking to weather the storm, these two giants offer the reassuring combination of safety and the prospect of steady returns.

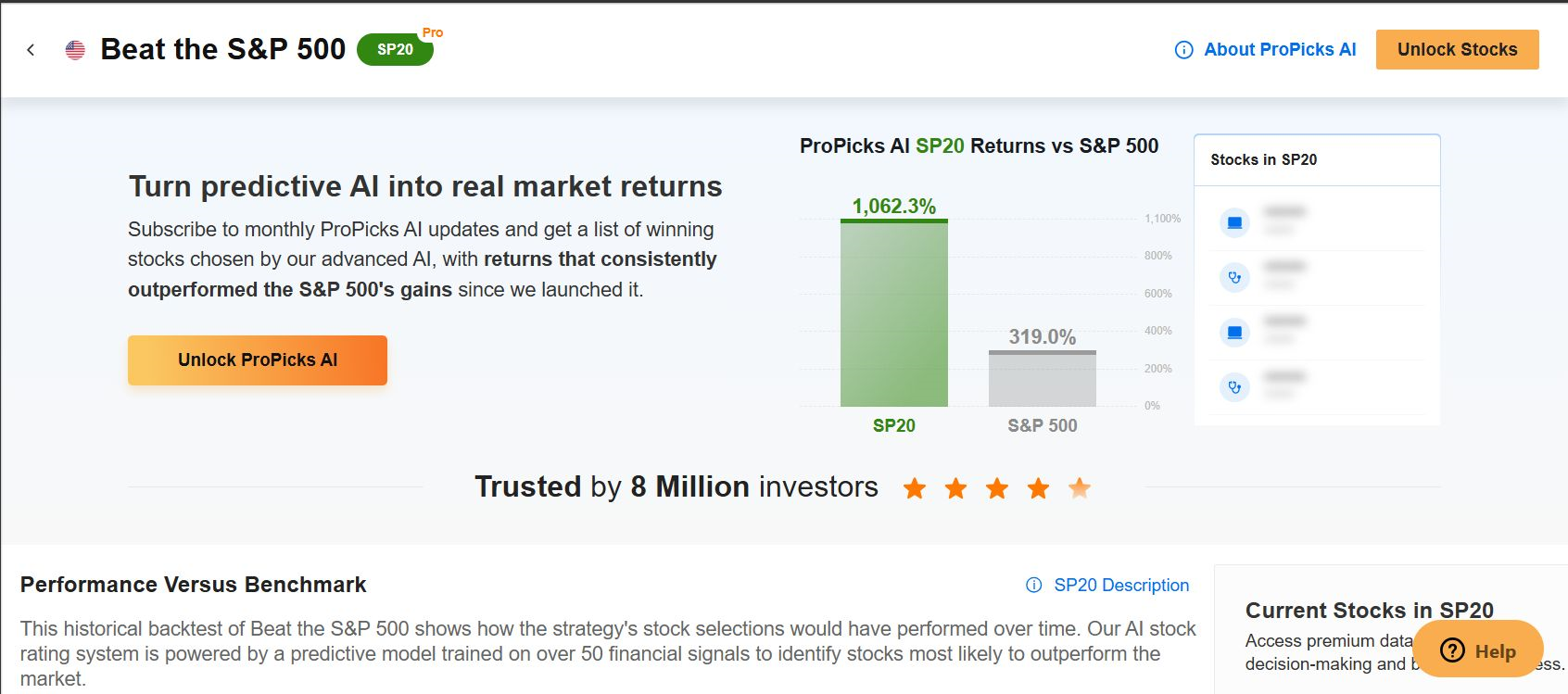

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

In turbulent market conditions, investors often turn to “boring” stocks—those steady, defensive plays that provide stability and reliable returns even when broader markets are volatile.

Two such stocks are Johnson & Johnson (NYSE:JNJ) and Coca-Cola (NYSE:KO), both of which have a long history of delivering consistent dividends, solid fundamentals, and resilience in challenging times.

For investors looking to weather the storm, these two giants offer the reassuring combination of safety and the prospect of steady returns, making them ideal for investors prioritizing capital preservation in February 2025’s uncertain climate.

1. Johnson & Johnson

- Year-To-Date Performance: +13.2%

- Market Cap: $394.2 Billion

Johnson & Johnson is one of the world’s largest healthcare companies, operating across pharmaceuticals, medical devices, and consumer health products. Its diversified business model and strong global presence have positioned the company as a defensive leader in the healthcare sector.

JNJ is currently at $163.73, earning the New Brunswick, New Jersey-based company a market value of $394.2 billion. Shares are up by roughly 13% so far in 2025.

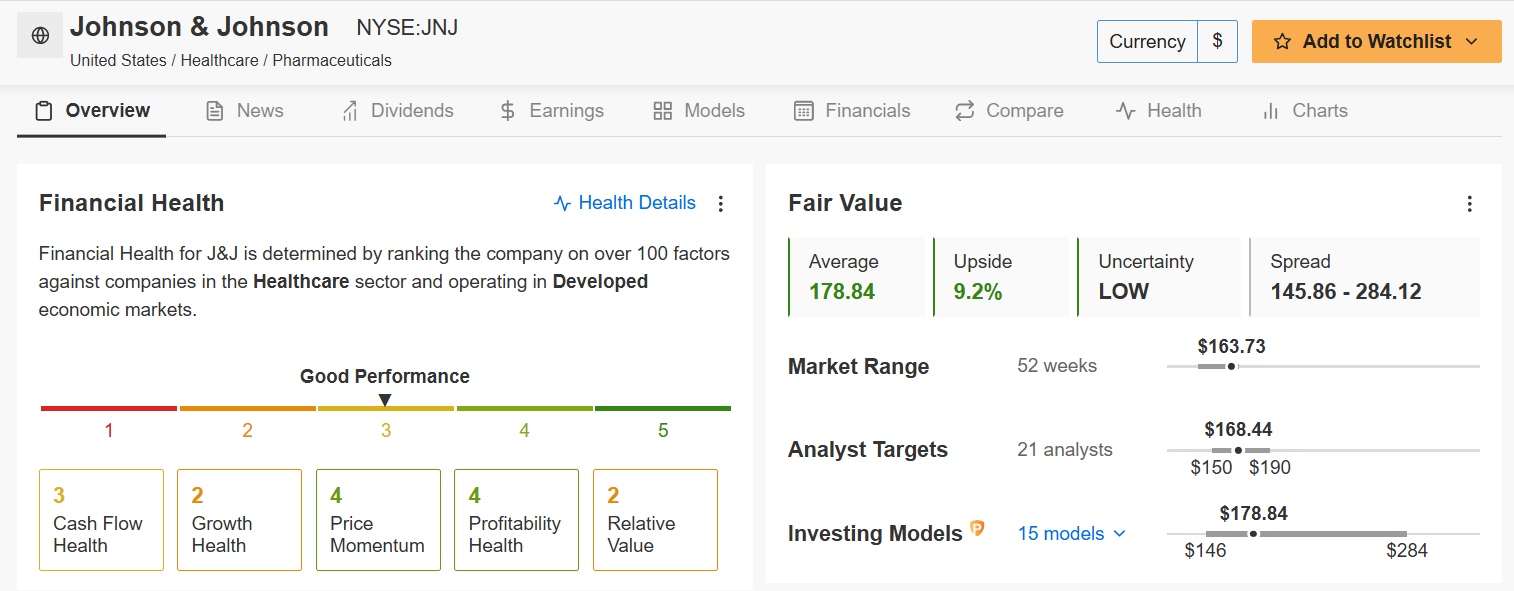

Source: Investing.com

In times of market turmoil, J&J’s defensive characteristics shine through, making it a reliable investment for risk-averse investors. Its strength lies in its broad market exposure, strong R&D capabilities, and a deep moat created by its diverse portfolio of successful brands.

Even in times of economic stress, the demand for essential healthcare products remains relatively stable, bolstering the company's earnings. Furthermore, J&J’s impressive history of steady dividend growth makes it an ideal safe-play stock in uncertain market conditions.

The company maintains a ‘GOOD’ Financial Health Score of 2.91 and exhibits low volatility with a beta of 0.51, making it an excellent hedge against market turbulence. It is worth mentioning that shares are currently trading below both their Fair Value estimate ($178.84) and the mean analyst target price ($168.44).

Source: InvestingPro

With its steady growth prospects, consistent revenue streams and strong track record of returning capital to shareholders through dividends, Johnson & Johnson is a standout defensive stock to own as market conditions evolve.

2. Coca-Cola

- Year-To-Date Performance: +13.8%

- Market Cap: $304.8 Billion

Coca‑Cola is a global leader in the beverage industry, renowned for its flagship soft drink and a diversified portfolio that includes juices, teas, sports drinks, and bottled water. Its portfolio includes household names such as its namesake Coca-Cola brand, as well as Sprite, Fanta, Powerade, and Dasani.

KO stock is currently trading at $70.87, earning the Atlanta, Georgia-based beverage giant a valuation of approximately $305 billion. Shares have been on a tear since the start of 2025, rising 13.8% year-to-date.

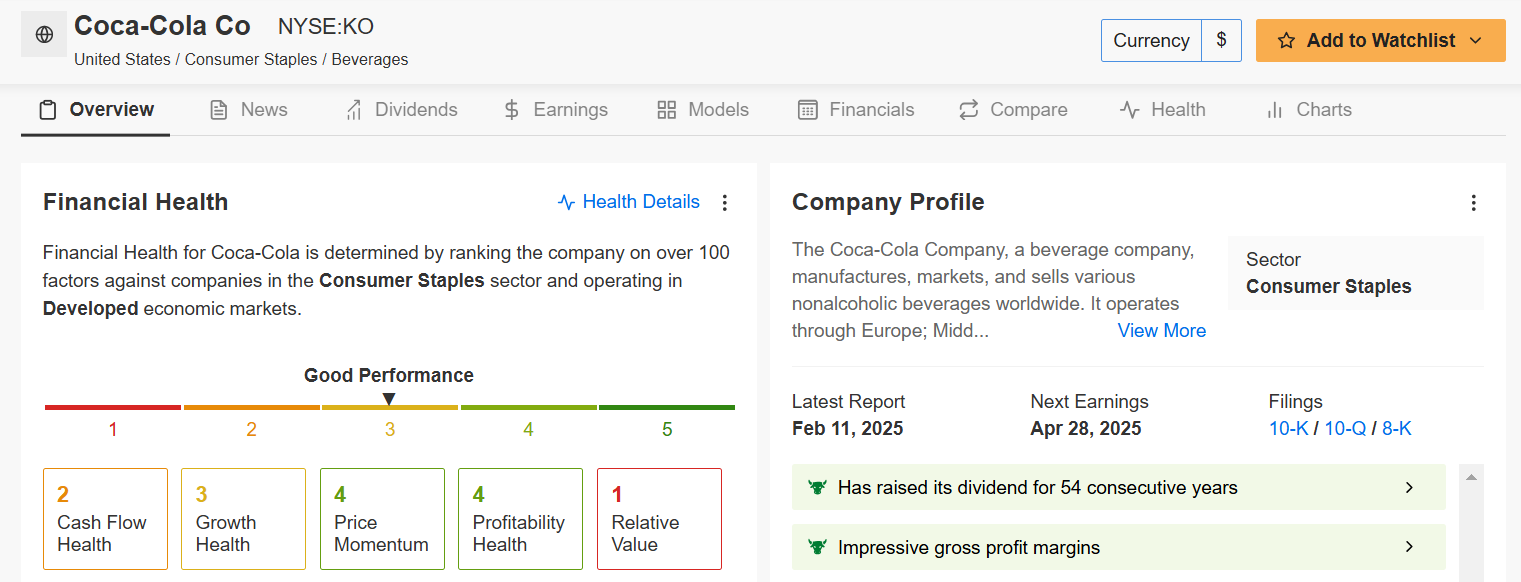

Source: Investing.com

Coca-Cola’s growth prospects may not scream excitement, but that’s precisely its strength. The company’s extensive distribution network and powerful brand recognition have made it a staple of consumer discretionary spending.

Coca-Cola’s revenue is underpinned by consistent demand for everyday products, making it a defensive stock that holds up well during economic downturns. Additionally, its focus on emerging markets and digital marketing presents significant avenues for future growth.

With a ‘GOOD’ Financial Health Score of 2.75, KO demonstrates robust operational stability, high profitability, and solid cash flow generation. Investors appreciate its predictable earnings and attractive dividend yield, which have provided steady income for over 50 years.

Source: InvestingPro

In a volatile market, Coca‑Cola’s ability to weather economic headwinds and maintain its market share makes it a safe play for protecting portfolios against uncertainty.

Conclusion

For investors looking to shield their portfolios from the current bout of market turmoil, Johnson & Johnson and Coca‑Cola offer compelling defensive strategies. These companies are not only leaders in their respective sectors but also exemplify stability, reliable dividends, and the ability to generate consistent cash flow regardless of economic cycles.

In a world of market volatility, these two “boring” stocks provide the safety and steady performance that can help anchor a diversified investment portfolio.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.