Functional Brands closes $8 million private placement and completes Nasdaq listing

- As we move into 2025, the financial sector presents compelling opportunities for investors seeking growth.

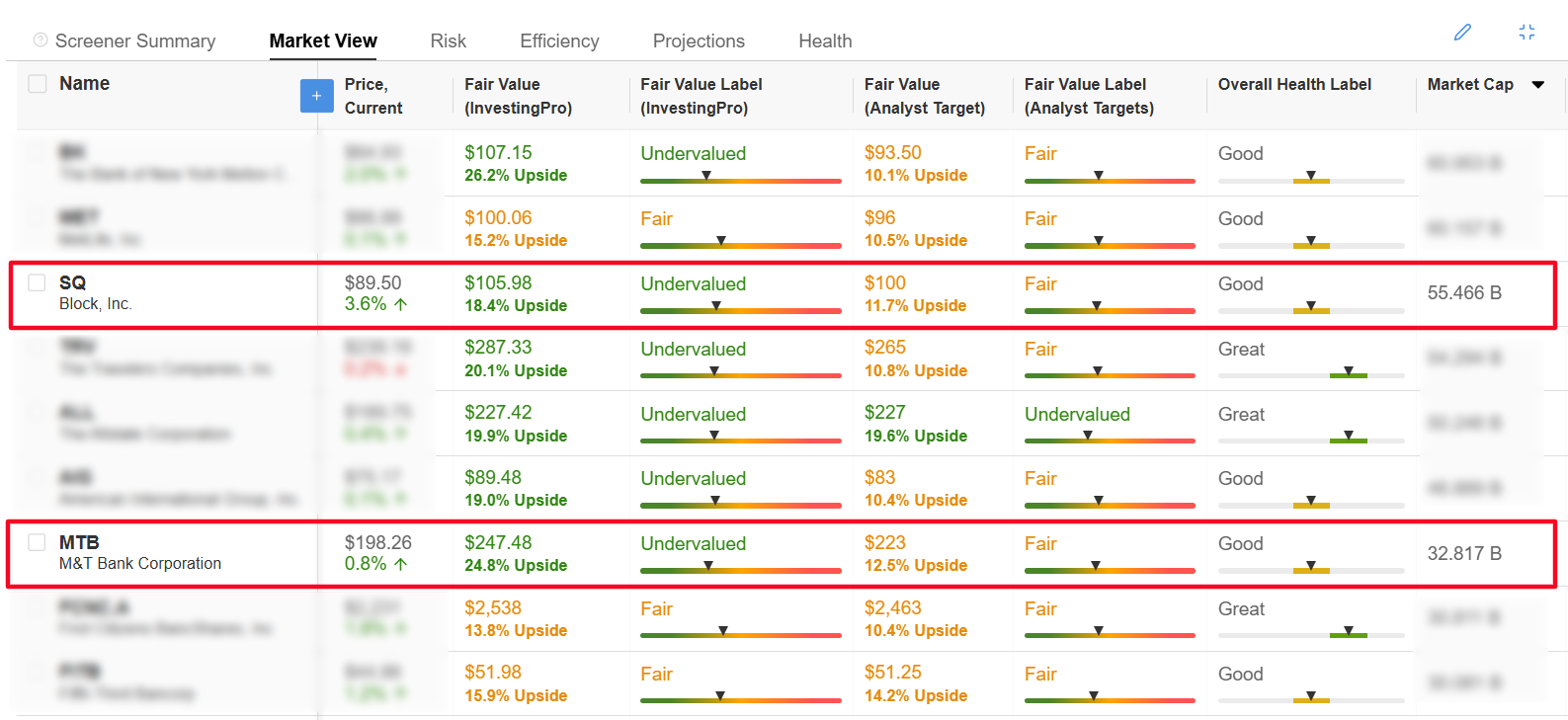

- Using the InvestingPro Stock Screener, I identified two stocks that have the potential to deliver impressive returns in the year ahead.

- While these companies operate in distinct areas of the financial landscape, both are positioned to benefit from strong tailwinds.

- Looking for more actionable trade ideas? Subscribe here for 50% off InvestingPro!

As 2025 unfolds, the financial sector offers promising opportunities for investors seeking growth and stability. As per the InvestingPro stock screener, two standout names poised for significant gains are Square-parent Block Inc (NYSE:XYZ) and M&T Bank Corp (NYSE:MTB).

Source: InvestingPro

While these companies operate in distinct areas of the financial landscape, both are positioned to benefit from strong tailwinds that could drive their stock prices higher in the coming year.

1. Block

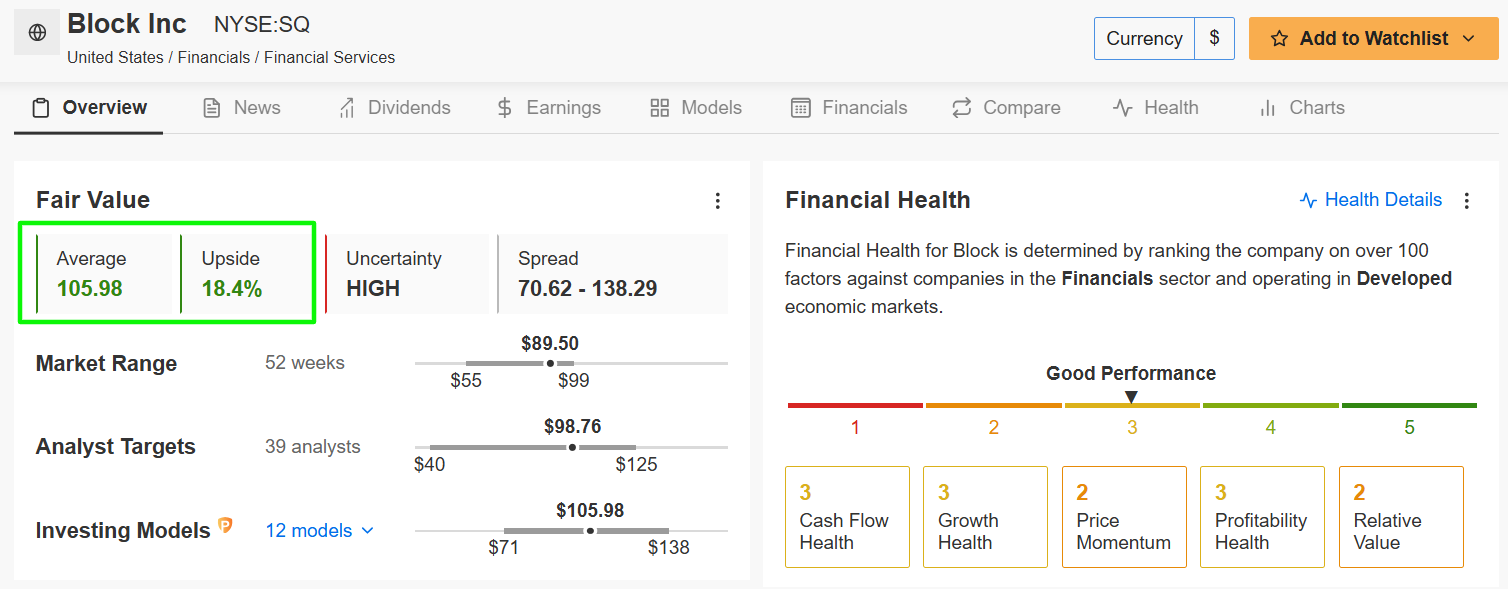

- Current Price: $89.50

- Fair Value Estimate: $105.98 (+18.4% Upside)

- Market Cap: $55.4 Billion

Formerly known as Square, Block is a financial technology leader that continues to revolutionize the payments industry. Known for its innovative point-of-sale systems, the Jack Dorsey-led fintech company empowers small and medium-sized businesses (SMBs) with cutting-edge payment, analytics, and financial tools.

Beyond its core SMB solutions, Block’s popular Cash App has become a favorite for peer-to-peer payments and digital banking, offering services like investing, savings, and direct deposits.

Source: InvestingPro

With its innovative business model and leadership in fintech, Square remains a top pick for growth-focused investors in 2025. Additionally, the company’s ventures into cryptocurrency and decentralized finance (DeFi) position it as a key player in the evolving fintech landscape.

Based on InvestingPro’s AI-powered models, Block's fair value is calculated at $105.98, while the stock is currently trading at $89.50. This indicates a potential upside of 18.4% from current levels.

The company's Financial Health Score stands at 2.7 out of 5, suggesting moderate financial stability. This score reflects various factors including the company's liquidity position, debt levels, and operational efficiency.

Source: Investing.com

At current valuations, Block, which recently changed its stock ticker symbol from SQ to XYZ, has a market cap of approximately $55 billion. Shares have gained 34.2% over the last 12 months.

2. M&T Bank

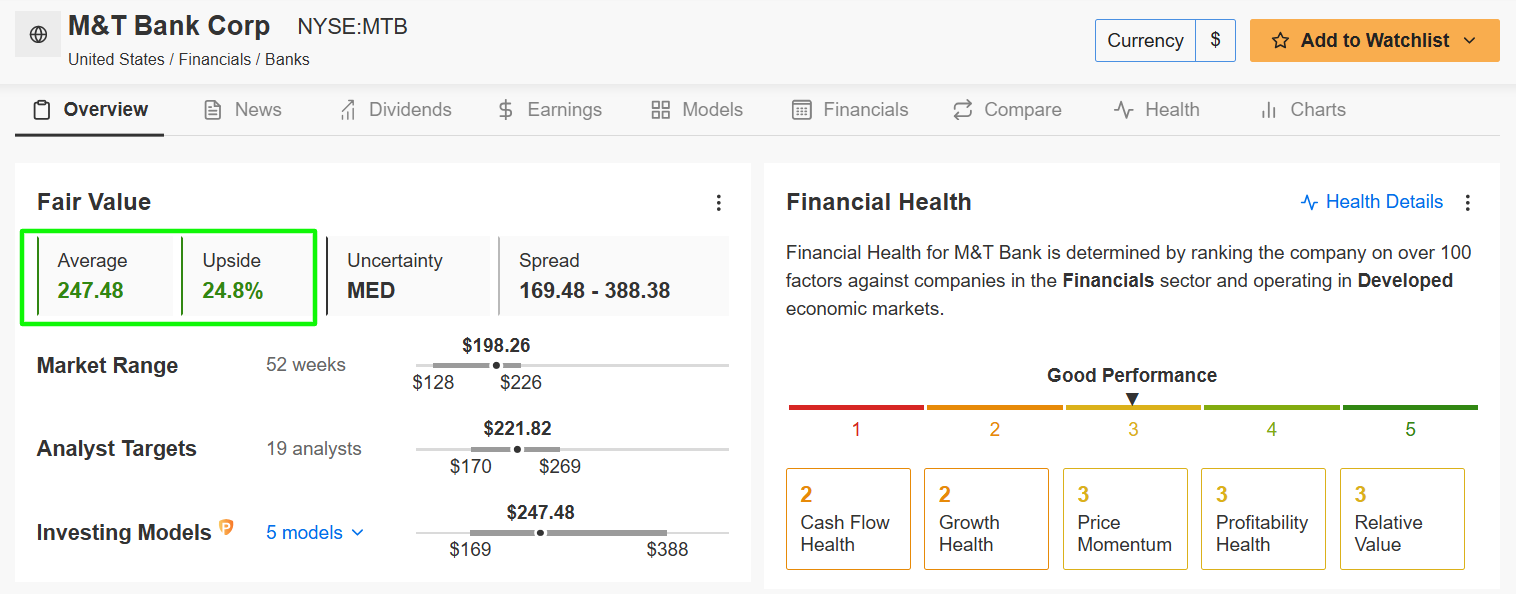

- Current Price: $198.26

- Fair Value Price Target: $247.48 (+24.8% Upside)

- Market Cap: $32.8 Billion

M&T Bank Corporation, on the other hand, offers a more traditional yet equally compelling investment opportunity. As a regional banking powerhouse serving customers primarily in the Northeastern United States, M&T Bank provides commercial banking, retail banking, wealth management, and mortgage services.

Its reputation for conservative lending practices and relationship-focused banking has cemented its status as a stable and reliable performer in the financial sector.

Source: InvestingPro

M&T is set to benefit from a range of favorable factors in 2025. Elevated interest rates are expected to expand net interest margins, boosting profitability. Additionally, the bank’s ongoing digital transformation and cost-cutting initiatives are likely to enhance operational efficiency, further improving its bottom line.

M&T Bank's fair value is calculated at $247.48, compared to its current trading price of $198.26. This suggests a significant upside potential of 24.8% for MTB stock from current levels.

Furthermore, the company’s Financial Health Score is 2.8 out of 5, slightly higher than Block's, indicating a relatively stable financial position. This score is supported by the bank's strong capital position, consistent dividend payments (current yield of 2.9%), and established market presence.

Source: Investing.com

At current valuations, the Buffalo, New York-based lender and financial services provider has a market cap of $32.8 billion. Shares have climbed 44.2% in the past year.

Conclusion

Block and M&T Bank represent two distinct but compelling opportunities in the financial sector.

The Cash App parent company offers the growth potential of a fintech disruptor, fueled by its innovations in digital payments and cryptocurrency. Meanwhile, M&T Bank provides stability and reliable profitability, backed by its strong regional presence and operational efficiency.

For investors looking to capture financial sector trends in 2025, both stocks are well-positioned to deliver impressive returns.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Subscribe now to get 50% off all Pro plans with our New Year’s holiday sale and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.