Functional Brands closes $8 million private placement and completes Nasdaq listing

This week, the financial markets are at a crossroads. Gold, long seen as a safe haven, is facing a pivotal moment as investors weigh their options in a rapidly changing landscape. As tensions between the U.S. and China ease and President Trump signals a surprisingly dovish stance on Tomahawk missile supplies, money is flowing out of gold and into riskier assets—including the ever-volatile Bitcoin.

With traders growing increasingly uncertain, all eyes are on gold futures for a decisive move that could set the tone for the weeks ahead.

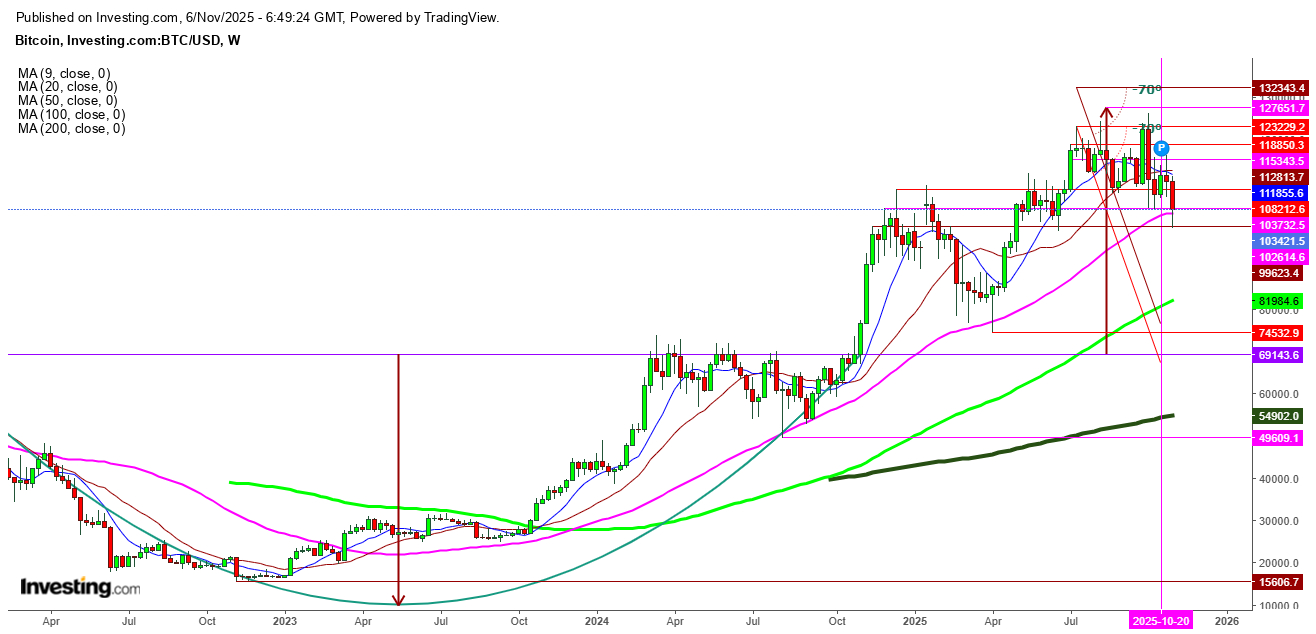

Undoubtedly, the current position of Bitcoin price could divert the money flow as the BTC/USD weekly charts indicate a sharp reversal after testing this week’s low at $9898.1 on Wednesday, currently trading at $103405, could continue this reversal since sustaining above the significant support at the 50 DMA ($102614).

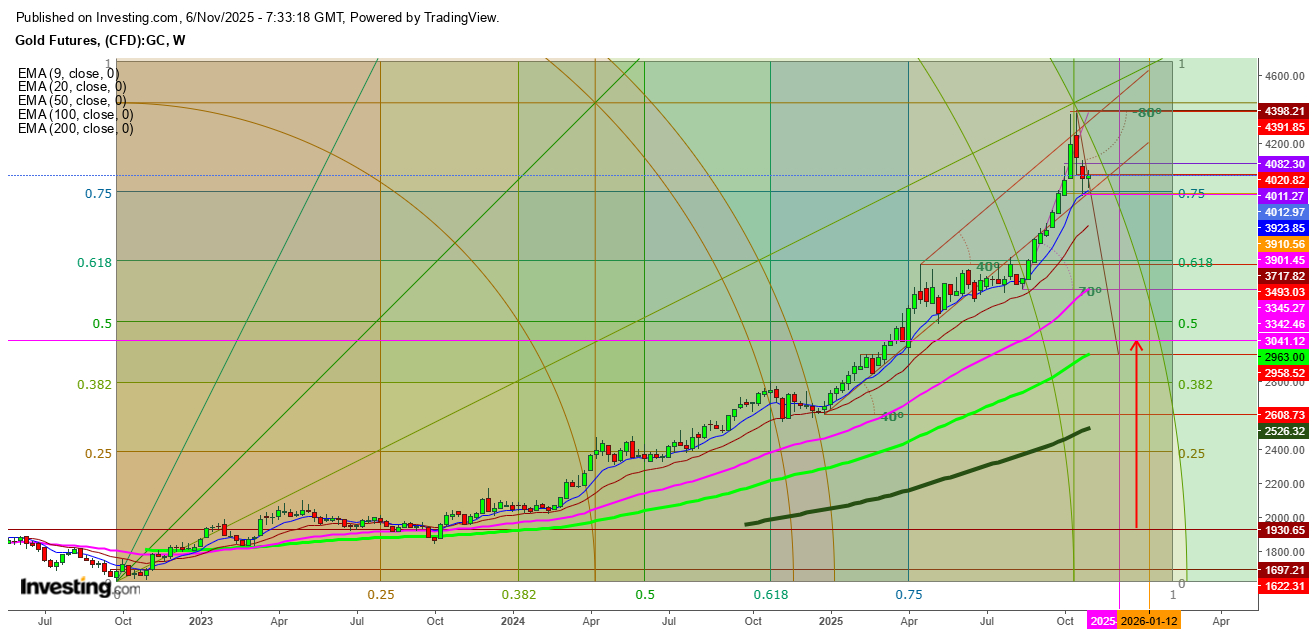

While the gold futures are trying to defend the immediate support at $3994 in the weekly chart, after testing this week’s high at $4042.95 and a low at $3937.55, they look ready to continue the last two weeks’ fall after testing a record high at $4398 on October 21, 2025.

Undoubtedly, gold futures could test this week’s low once again as the traders scaled back expectations for a December cut after the Federal Reserve’s Chair Jerome Powell has signaled last week that policymakers may pause further easing, resulting in a resilient U.S. dollar, which hovered near a three-month high, and has also weighed on gold by making it more expensive for overseas buyers.

In a daily chart, gold futures could see more exhaustion as despite Wednesday’s uptick, bearish pressure is still high as the gold futures could not even touch the immediate resistance at the 9 DMA ($4014.36) in today’s session, and the formation of a bearish crossover is about to complete as the 9 DMA has come below the 20 DMA ($4020.54).

Inversely, if the gold futures find a breakout above the immediate resistance at $4040, the next resistance will be at $4082, from where a selling spree could restart, as the easing buying spree from the central banks is visible, and the surging bearish pressure looks evident enough for the shifting money flow to other risky assets this month.

Finally, I conclude that if U.S. President Donald Trump doesn’t step back from his current agenda of renewing trade policies to ease geopolitical concerns, gold futures could experience a wave of liquidation this month.

Disclaimer: Readers are advised to take any position in gold and BTC/USD at their own risk, as this analysis is based only on observations.