Nvidia AI chips targeted in China customs crackdown- FT

- Energy and healthcare stocks have been some of this year’s top gainers

- Consider buying ConocoPhilips, and Eli Lily

Even as the S&P 500 has plunged into bear market territory, shares of energy and healthcare-related companies have offered a bit of a relief, outperforming the broader market by a wide margin this year.

Investors have piled into those areas of the market as the Federal Reserve hikes interest rates to combat surging inflation, raising the likelihood of a recession.

Amid the ongoing volatility, I believe that ConocoPhillips (NYSE:COP), and Eli Lilly (NYSE:LLY) are poised to hit new all-time highs in the months ahead.

ConocoPhillips

- Year-To-Date Performance: +76.1%

- Market Cap: $157.8 billion

ConocoPhillips has been a standout performer in the thriving oil sector this year, as it benefits from a potent combination of high energy prices, improving global demand, and streamlined operations. Shares of the Houston, Texas-based company, which rose to their highest level on record at the start of the week, have soared by a whopping 76.1% in 2022, making it one of the market’s top performers of the year.

At current levels, the U.S. oil-and-gas giant is the world’s fourth most valuable energy company.

As I look for new investment ideas at a time of such uncertainty, ConocoPhillips meets my strict criteria of profitable value companies that do well in challenging macroeconomic and geopolitical environments.

In my view, COP remains one of the best names to own amid the current backdrop thanks to its attractive valuation, improving balance sheet, high free cash flow, and continuous efforts to return capital to shareholders, mainly through stock buybacks and variable dividends.

As such, I expect ConocoPhillips to continue its strong performance, with shares likely to break out to fresh all-time highs heading into the final weeks of the year despite robust year-to-date returns.

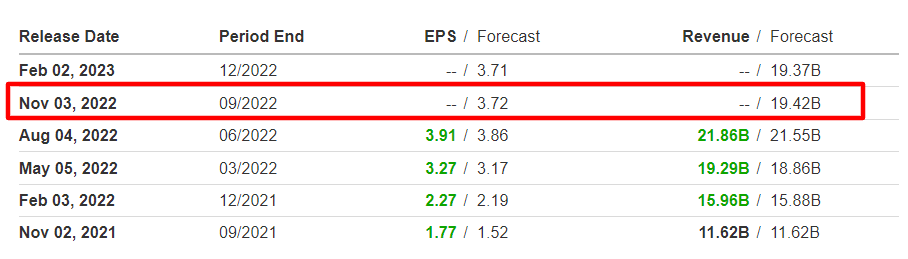

ConocoPhillips is forecast to deliver strong profit and sales growth when it releases Q3 earnings

According to Investing.com, ConocoPhillips is forecast to report Q3 EPS of $3.72, up 110% year on year (yoy) and a 67.3% increase in revenue to $19.4 billion as it continues to cash in on high energy prices when it reports ahead of the opening bell on Thursday, Nov. 3.

The robust results will likely prompt the oil giant to lift its profit and sales outlook for the months ahead.

Eli Lilly

- Year-To-Date Performance: +27.2%

- Market Cap: $333.8 billion

Eli Lilly’s stock has been spared some of the market carnage as investors pile into the booming healthcare space. Year-to-date, shares of the pharma giant have jumped 27.2% thanks to robust demand for its various blockbuster drugs.

LLY stock ended at an all-time high of $351.31 on Tuesday, above the prior record high close of $347.90 from the day before. At current levels, the Indianapolis, Indiana-based pharmaceutical firm is the second-largest drug manufacturer in the world, trailing only Johnson & Johnson (NYSE:JNJ).

Eli Lilly checks all the marks on my list which helps me identify high-quality blue-chip companies with high free cash flow and low debt levels to add to my portfolio amid the current bear market rally. Stocks of defensive companies whose products and services are essential to people’s everyday lives, such as healthcare names, tend to perform well in environments of slowing economic growth and market turbulence.

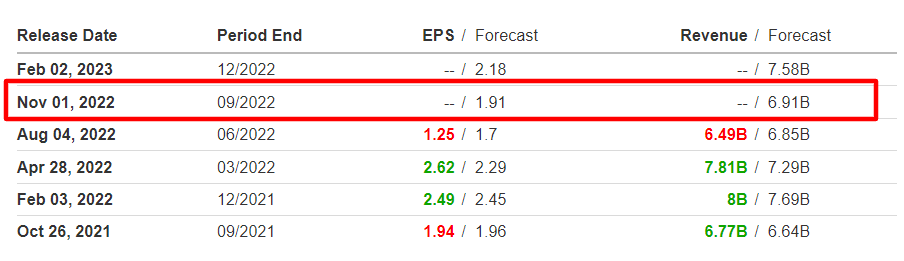

Lilly is well-placed to extend its run to fresh highs in the months ahead as it continues to shine as it is set to deliver a beat on both the top-and-bottom lines when it releases its Q3 results ahead of the U.S. open on Tuesday, Nov. 1, amid strong demand for its best-selling anti-diabetic medication called Trulicity.

As per Investing.com, it is anticipated to report EPS of $1.91 and revenue is forecast to improve 2% yoy to $6.91 billion.

The drug maker missed Q2 profit and sales estimates due primarily to the negative impact of a stronger dollar. Despite the miss, the company left its full-year revenue outlook intact, highlighting the resilience of its business.

Disclosure: At the time of writing, Jesse is long on the S&P 500 via the SPDR S&P 500 ETF (SPY). He is also long on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV). The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.