Nvidia AI chips targeted in China customs crackdown- FT

- Buying and holding quality dividend stocks can generate consistent income

- Honeywell has an impressive track record when it comes to paying dividends

- Pepsi is a reliable dividend provider. It has hiked its payout for 50 years in a row

If your investment goal is to save for retirement, buying and holding some quality dividend-paying stocks in your portfolio makes sense. To find such companies, you must focus on 'boring' names that don't usually move daily headlines but rather offer consistent income through payouts.

A dividend track record spanning several decades is a solid indicator that these companies can produce steady, reliable income for investors during good times and during downturns and recessions.

According to Benjamin Graham, the great investment analyst of the 20th century and Warren Buffett's mentor:

"... (The true investor) will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies."

Below, I've put together a list of two stocks that can power your retirement income over time through their consistent dividend payments:

1. Honeywell

Honeywell International (NASDAQ:HON) manufactures products that are crucial to everyday life. Its diversified portfolio provides a lifeline to many industries, including homes and buildings, aviation, defense and space, oil and gas, chemicals, and automotive.

The company's competitive advantage is so large that it's hard to challenge its dominance. The recent global health crisis was a good example that showed the strength of the Charlotte, North Carolina-based industrial giant's diversified portfolio.

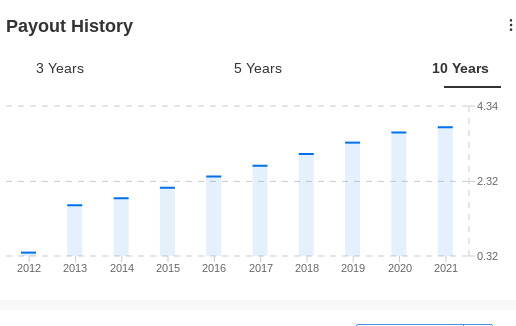

Honeywell also has an impressive record of paying dividends, thanks to its solid financial outlook. Yielding at around 2%, the company's $0.98 a share quarterly payout has grown over 9% per year during the last five years. Honeywell has paid uninterrupted dividends for over two decades while maintaining a low payout ratio of 53%.

Source: InvestingPro

Honeywell's powerful combination of growth momentum, low payout ratio, and diversified portfolio signals that the company is safe and well-positioned to reward its long-term investors.

Deutsche bank this month added HON to its fresh money list and said the giant is well positioned to withstand a recession. Its note said:

"We see HON as favorably positioned here given its late-cycle bias and high-quality/defensive attributes that should hold up well on a relative basis if we were to enter a widespread recession."

2. PepsiCo

Food companies may not provide a hefty capital gain, but they offer stability to your portfolio due to the defensive nature of their businesses. The snack and beverage giant PepsiCo Inc (NASDAQ:PEP) is one of my favorites from this group.

In its most recent earnings, Pepsi showed a similar strength that separates it from risky market areas. Despite inflationary pressures hurting other industries, the maker of Mountain Dew, Fritos, and Quaker Oats is successfully passing on surging commodity costs by persuading consumers to pay more for their soda and chips.

The higher prices actually enabled the company to increase its profit outlook, saying it expects revenue to grow 10% this year.

In a note this week, Morgan Stanley said it sees further sales momentum for the beverage and snacks giant. Its note adds:

"We continue to see clear topline upside at Pepsi, supported incrementally by accelerating US scanner data QTD in contrast to decelerating forward consensus estimates."

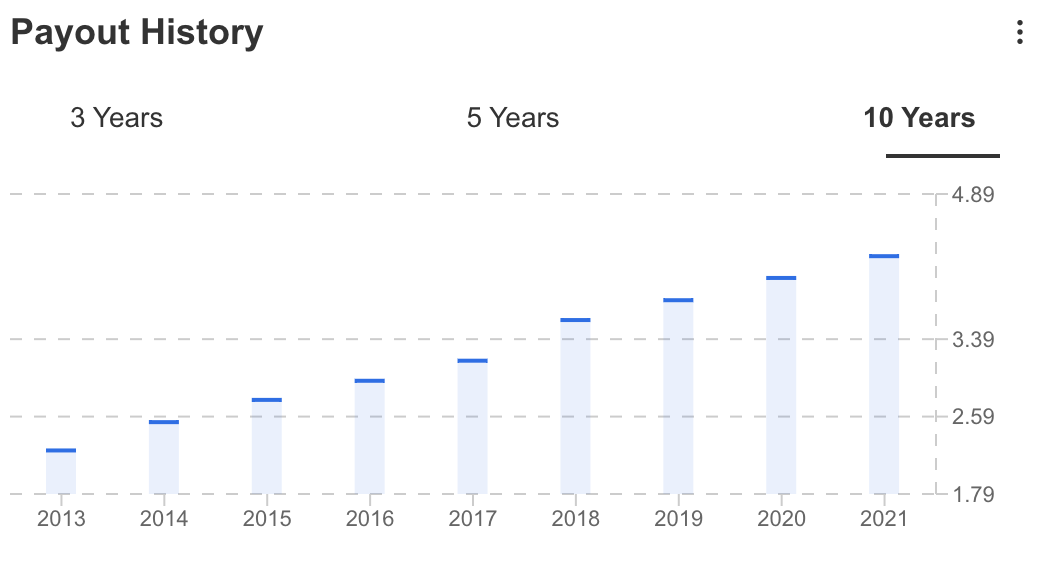

Pepsi is also a reliable dividend provider with a diversified product portfolio. It has hiked its payout for 50 years in a row, showing that the company's dividend is very safe, making it a comfortable choice if you're a risk-averse income investor.

Source: InvestingPro

The stock currently pays a $1.15 a share quarterly dividend, which translates into a 2.57% annual yield at the current share price. Given this impressive track record, the company should have little trouble continuing to raise its dividend in the years to come.

Disclosure: The author currently does not own any of the securities mentioned in this article.