Trump administration authorizes CIA for covert action in Venezuela - Bloomberg

- The renewed rally in China-based stocks is unveiling hidden opportunities.

- While Alibaba, Tencent, and Baidu dominate the country’s landscape, there are numerous lesser-known players to keep an eye on.

- For investors willing to brave near-term volatility, these two under-the-radar stocks offer compelling exposure to China’s next growth wave.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

As Chinese equities continue their rally, discerning investors are increasingly turning to undervalued gems with robust growth prospects. Two companies that stand out in the current environment are Futu Holdings (NASDAQ:FUTU) and Atour Lifestyle Holdings (NASDAQ:ATAT).

Both are poised to benefit from the country’s economic recovery, rising domestic consumption, and technological innovation, making them attractive long-term buys for 2025 and beyond.

Here’s why these companies are compelling buys amid the current rebound.

1. Futu Holdings

- 2025 Year-To-Date: +54.4%

- Market Cap: $17 Billion

Futu Holdings operates at the cutting edge of China’s rapidly expanding fintech market. The disruptive online brokerage and wealth management platform serving over 24 million users has carved a niche with commission-free trading of stocks, options, and ETFs across U.S., Hong Kong, and mainland markets.

FUTU stock has surged dramatically since the start of the year, climbing 54% to near the highest level since July 2021. Shares closed at $123.56 on Tuesday, pushing the company’s market cap to $17 billion.

Despite robust fundamentals, Futu trades at a reasonable 19x forward earnings, a steep discount to U.S. peers like Robinhood (NASDAQ:HOOD) (36x). Regulatory uncertainties and market volatility have suppressed its valuation, but its growth trajectory remains intact.

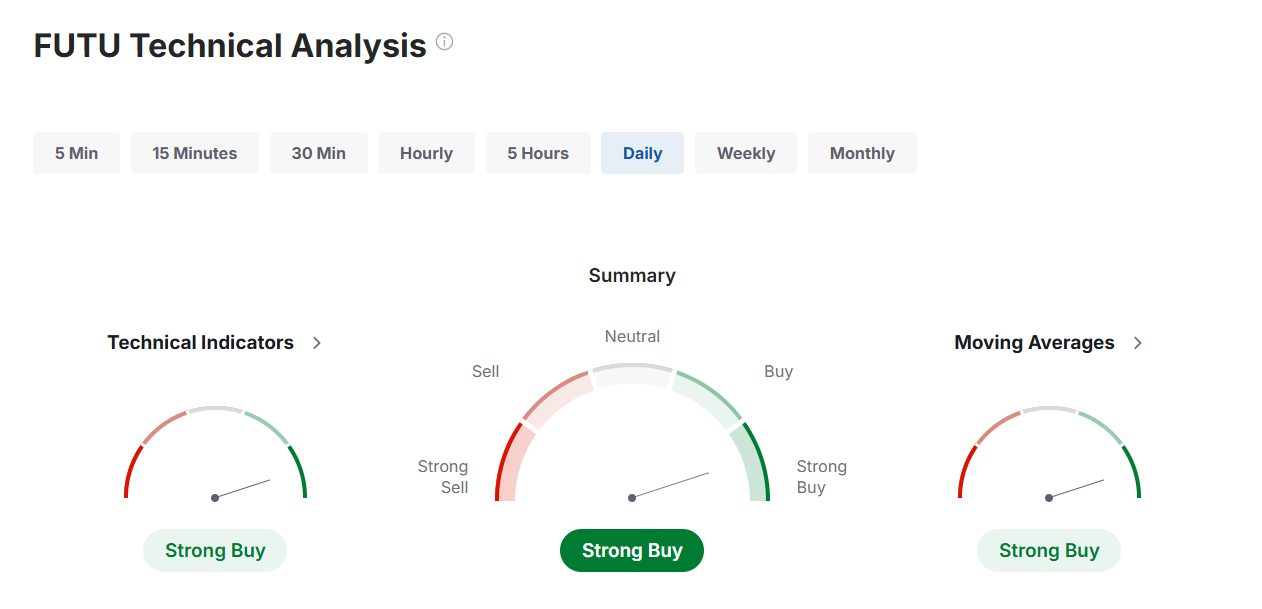

Futu Holdings has 14 analysts covering the stock with a “Strong Buy” rating. The mean analyst price target stands at $125.27, ranging from $95.09 (low) to $160.30 (high), suggesting a potential 29.7% upside. In addition, Futu maintains a ‘GREAT’ Financial Health Score, indicating robust operational performance and financial stability.

Source: Investing.com

Regulatory easing in China and a surge in retail investor interest are expected to drive significant growth in Futu’s user base and transaction volumes. The company’s platforms, Futubull and Moomoo, have earned significant recognition across key markets, ranking as the leading stock trading app by downloads and daily active users in Hong Kong, Singapore and Malaysia.

Meanwhile, Futu's wealth management business, branded as Futu Money Plus, is fueling high-margin growth. As Chinese consumers become more digitally savvy, Futu’s innovative approach and strong market positioning could lead to sustained revenue expansion in the coming years.

2. Atour Lifestyle Holdings

- 2025 Year-To-Date: +18.9%

- Market Cap: $4.2 Billion

Atour Lifestyle Holdings is a consumer-centric company focused on the leisure, tourism, and lifestyle sectors. The Shanghai-based company has established itself as China’s leading upper-midscale hotel chain, redefining hospitality with a blend of affordable luxury and technology-driven experiences.

Shares have been on a tear, hitting a series of record highs in recent sessions. ATAT closed at $31.96 on Tuesday, earning the company a market cap of $4.2 billion. Shares have gained 18.9% year-to-date.

Despite the surge in its stock over the past year, Atour remains undervalued at just 27x forward earnings, a significant discount to global peers like Hilton and Marriott, which trade at 43x and 35x, respectively. This discrepancy stems in part from broader pessimism toward China’s hospitality sector.

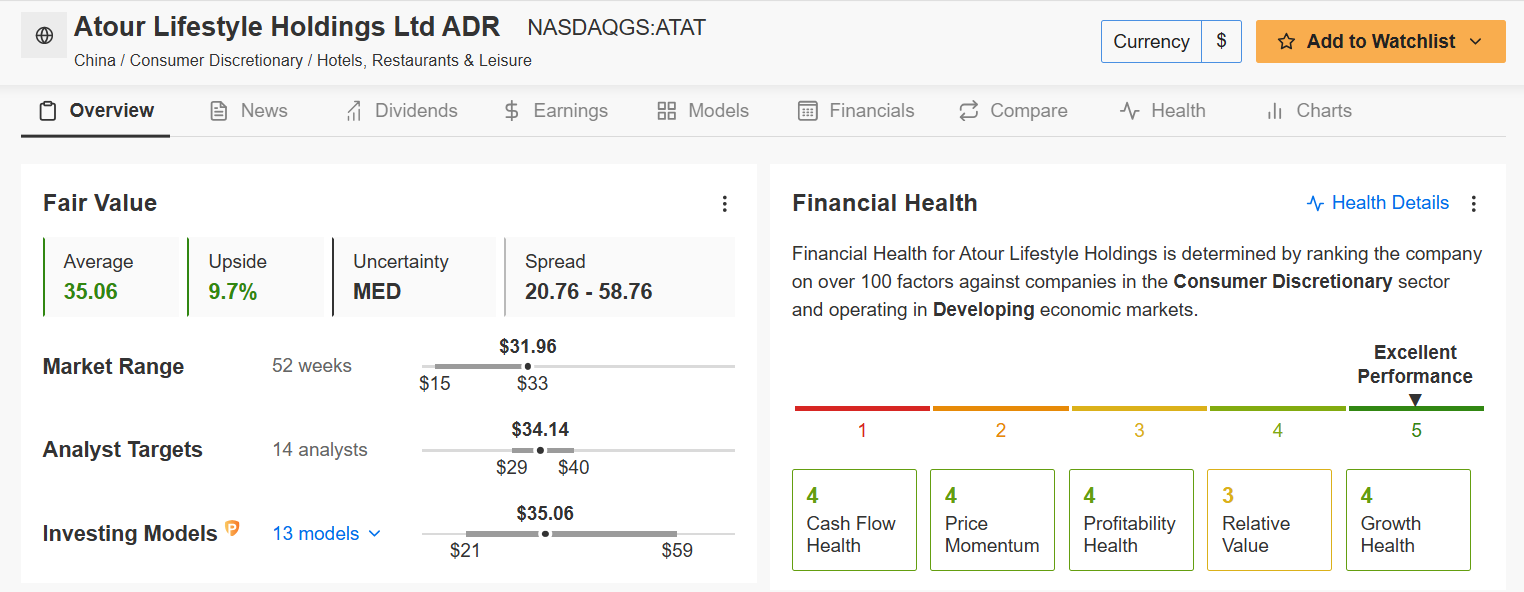

Atour Lifestyle’s InvestingPro Fair Value analysis suggests a 9.7% upside potential from its current price, with a calculated price target of $35.06. Furthermore, Atour demonstrates exceptional financial strength with an ‘EXCELLENT’ Financial Health Score, placing it among the top performers in its sector.

Source: InvestingPro

As China’s domestic travel and leisure spending rebound, Atour is uniquely positioned to capture the surge in demand. The company’s strategic focus on mid-tier cities, where 60% of its properties are located, aligns with the “travel democratization” trend as middle-class consumers prioritize experiences over savings.

With government policies aimed at boosting consumption and tourism, Atour’s diversified portfolio is set to benefit from improved consumer sentiment. Moreover, its strategic focus on digital transformation and innovative service offerings enhances its competitive edge, setting the stage for accelerated growth in 2025 and beyond.

Conclusion

Both Futu Holdings and Atour Lifestyle Holdings are significantly undervalued, and they boast strong financial health metrics that reinforce their resilience. Their business models are well aligned with long-term tailwinds such as a recovering domestic economy, digital transformation, and increased consumer spending.

For investors looking to build a portfolio with exposure to China’s growth story, these two stocks represent compelling opportunities with substantial upside potential in 2025 and beyond.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.