Wall St futures flat amid US-China trade jitters; bank earnings in focus

The Mean Reversion Awakening

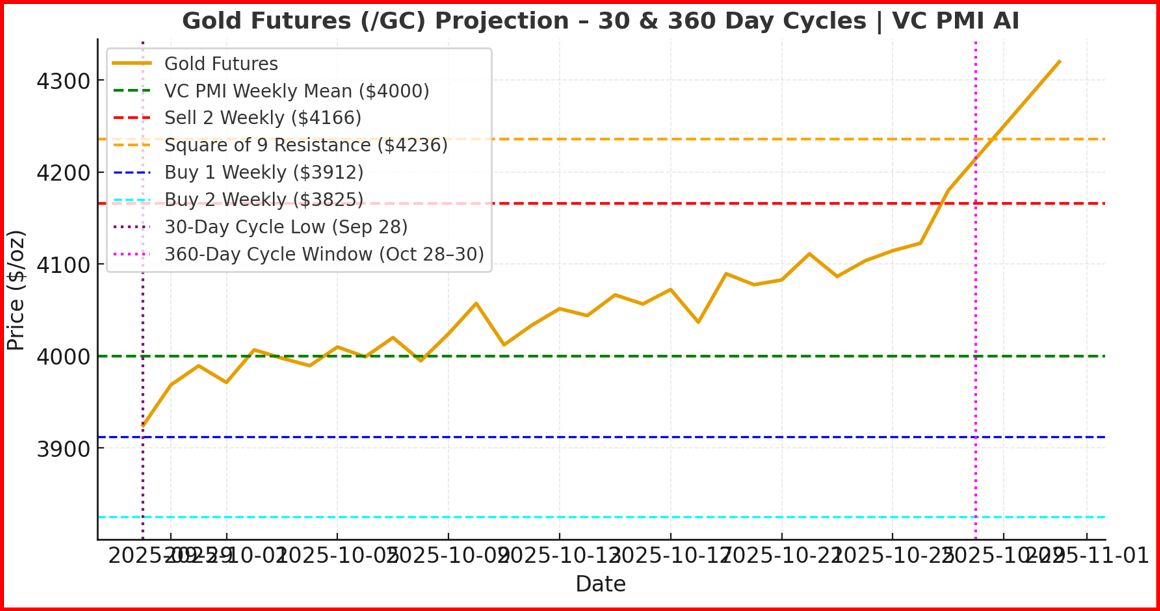

As the golden tide of 2025 enters its final quarter, Gold Futures (/GC) stand at a critical inflection point—$4,150, a price vibrating precisely at the intersection of cyclical time and geometric expansion. The recovery from the late-September low at $3,957.9 marked more than a rebound; it was the ignition of the 30-day cycle that had been building pressure beneath the surface since late August. The VC PMI AI algorithm registered deep undervaluation below the Buy 2 Weekly ($3,825) level, where probability clusters historically converge for long-term mean reversion rallies.

What followed was a textbook surge: volatility contracted into the first week of October, and the MACD shifted upward, signaling a phase transition from accumulation to expansion. The closing pivot above $4,000 (VC PMI Weekly Mean) confirmed that the market had regained equilibrium, resetting the long-term bias from neutral to bullish.

The 30-Day and 360-Day Time Window

The current uptrend sits inside a dual harmonic window—the 30-day cycle low of September 28 aligning with a 360-day major time pivot, which historically triggers energy releases of multi-week magnitude. The last time these cycles converged (October 2024), gold launched a sustained 8% rally into year-end.

This cycle’s amplitude projects a time-price convergence zone between October 28–30, 2025, where volatility, volume, and momentum harmonics suggest a potential breakout toward the Square of 9 resistance cluster at $4,236–$4,320. Within Gann’s geometric framework, this area corresponds to the 45° price rotation from the $3,957 pivot, forming a resonance with the 9-year fractal that underlies this decade-long expansion phase in metals.

Structural Levels and Mean Reversion Dynamics

The market’s structure is now perfectly defined by VC PMI symmetry:

- Mean (Gravity Center): $4,000

- Daily Sell Zone: $4,039–$4,078

- Weekly Sell Zone: $4,084–$4,169

- Square of 9 Expansion Target: $4,236–$4,320

These layers form concentric price harmonics, each representing a potential mean reversion resistance where profit-taking accelerates before the next cyclical reset. The inverse side of this structure—$3,912 (Buy 1 Weekly) and $3,825 (Buy 2 Weekly)—acts as the natural stop-loss buffer zone for traders aligning with the upward trend.

As long as price remains above $4,000, the probabilistic wave function of mean reversion favors long positioning. The compression of volatility preceding the breakout indicates accumulated energy, which statistically resolves through an upward release of 3–5 sigma deviations before returning to equilibrium.

The Geometry of Acceleration

The Square of 9 spiral provides a geometric translation of time into price. The rotation from $3,957 to $4,236 completes a 45° angle—historically one of the strongest acceleration paths within gold’s fractal resonance. The next harmonic at $4,320 completes the 60° expansion and aligns with the 360-day temporal node, suggesting a potential “escape velocity” moment by the end of October.

Should momentum sustain above the Sell 2 Weekly ($4,166) level, the model implies the probability of entering a new mean reversion band with targets approaching $4,236–$4,320, representing a 5–7% expansion within the current cycle.

The Path Forward

The October 28–30 cycle window stands as the key temporal magnet. Within this range, traders should monitor price behavior relative to the $4,166–$4,236 resistance cluster. A close above this range with rising volume would confirm a phase transition into the 360-day expansion, while failure to maintain above $4,000 could trigger a short-term correction back toward the $3,912–$3,825 demand zone.

The broader harmonic view remains bullish into late Q4 2025, where long-term Gann and Fibonacci geometries intersect near $4,500, projecting the next major inflection before the 9-year super cycle crescendo expected in April 2026.

Conclusion: The Pulse of Gold’s Awakening

Gold has once again demonstrated its cyclical precision—a reflection of the natural order of price, time, and probability. The market’s journey from $3,950 to $4,150 is not random—it is an orchestration of geometric energy responding to the underlying rhythms of human sentiment and capital flow. As the 30-day and 360-day cycles align, gold stands on the threshold of a potential hyperbolic breakout, echoing the eternal principle of mean reversion:

“From chaos to order, from undervaluation to equilibrium—

the market always returns to its mean,

before transcending it.”

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.