UiPath shares surge on NVIDIA, OpenAI partnerships

- Hydrogen is a promising clean energy source

- The U.S. Department of Energy recently designated companies to receive federal funding for hydrogen development.

- The two stocks we will discuss in this article are hydrogen 'pure players' set to benefit from it

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

In a world navigating the shift towards cleaner energies, recent disruptions in fossil fuel markets triggered by the conflict in Ukraine have prompted nations to reassess their reliance on natural gas and oil.

Amid the exploration of various alternative energy sources, hydrogen emerges as a particularly promising yet underdeveloped option. Unlike traditional fuels, hydrogen's combustion leaves no greenhouse gases, producing only water vapor as a byproduct.

However, the challenge lies in its limited availability in easily extractable forms, coupled with the fact that current production methods often involve greenhouse gas emissions, preventing it from achieving economic competitiveness on the scale needed to rival fossil fuels.

US Government Commits to Hydrogen

However, this could change in the years to come. Last month, the US Department of Energy (DoE) designated a number of companies to receive a $7 billion package, a long-awaited announcement of an initiative to accelerate the commercial-scale deployment of clean hydrogen and bring down its cost.

Indeed, the production of clean hydrogen costs around $5 per kilogram, and the U.S. Department of Energy aims to bring the cost of clean hydrogen down to $1 per kilogram over the next decade.

Funded by the Infrastructure Investment and Jobs Act (IIJA), the initiative plans to create seven H2Hubs across the U.S., laying the groundwork for a nationwide network of clean hydrogen producers, consumers and connecting infrastructure. Each hub will include elements of clean hydrogen production, storage, delivery and end-use.

Among the companies that will benefit from the financing are companies with a wide range of profiles, such as major oil companies like Exxon Mobil Corp (NYSE:XOM) or Chevron Corp (NYSE:CVX), but also power companies like Dominion Energy Inc (NYSE:D), or industrial companies like Chemours Co (NYSE:CC) or Rockwell Automation Inc (NYSE:ROK).

However, the financing will also benefit 2 hydrogen "pure players", Plug Power (NASDAQ:PLUG) and Bloom Energy Corp (NYSE:BE).

In the remainder of this article, we'll take a closer look at these two stocks, providing you with more details on their activities and potential, based on InvestingPro data.

1. Plug Power

Plug Power is a pioneer in the hydrogen fuel cell industry. The company has deployed a record 60,000 fuel cell systems for the e-mobility market, is one of the world's largest purchasers of hydrogen, and operates a leading hydrogen refueling network in North America, with over 180 refueling stations.

The company operates an end-to-end green hydrogen network to produce, store, and deliver the fuel in North America and Europe. It plans to produce 2,000 tonnes of green hydrogen per day by 2030. Plug Power's strategy of building the world's first complete green hydrogen ecosystem positions the company as a potential leader.

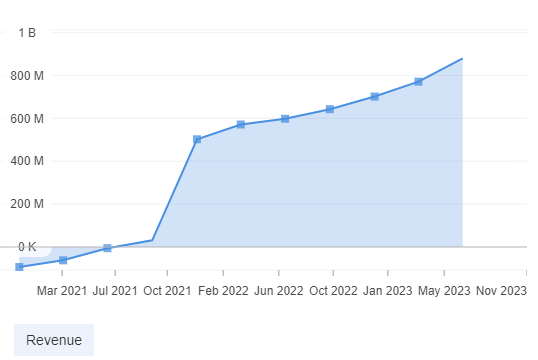

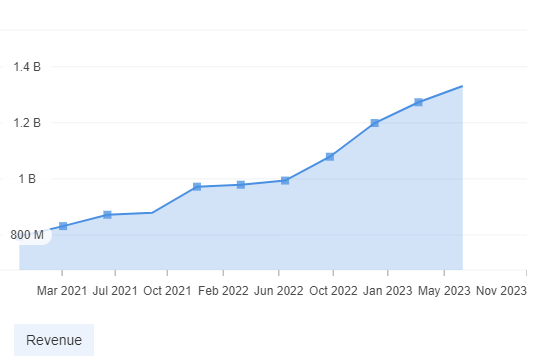

In terms of financial metrics, according to data available on InvestingPro, the company has experienced strong revenue growth over the past three years:

Source : InvestingPro

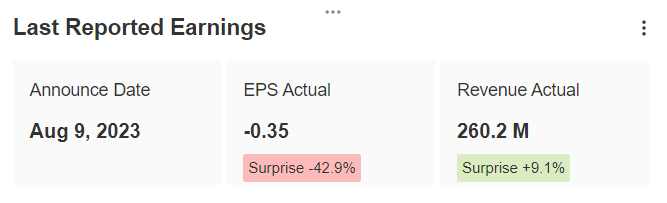

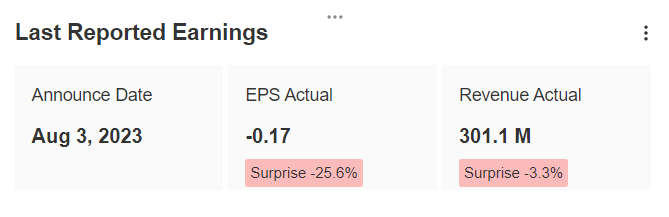

On the other hand, it is not yet profitable, as evidenced by its latest financial results published on August 9, which revealed a loss per share of $0.35.

Source : InvestingPro

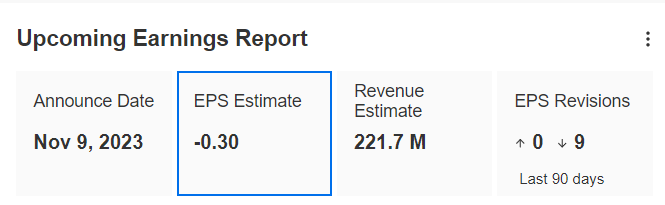

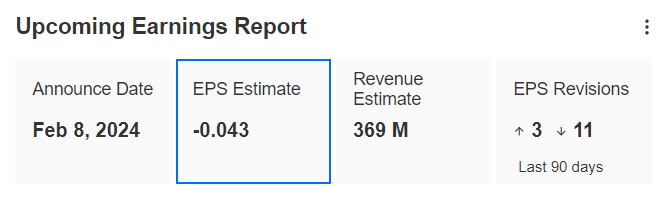

As for the next results, expected this Thursday after market close, consensus forecasts a reduced loss per share of $0.3.

Source : InvestingPro

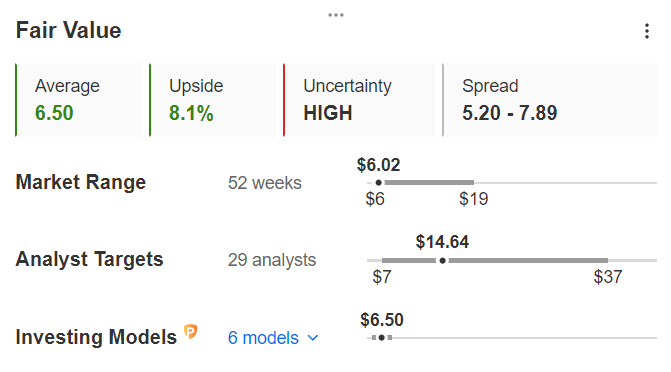

With regard to analysts' targets, the average 12-month target is $14.64, which implies an upside potential of over 107% compared with the current share price.

Source : InvestingPro

In contrast, InvestingPro models based on financial metrics are more conservative. Indeed, the InvestingPro Fair Value, which in this case synthesizes 6 relevant models, stands at $6.5, just 8% above the current price.

2. Bloom Energy

Bloom Energy has developed the Bloom Energy Server, an electric power generation platform. It has also created the Bloom Electrolyzer, which uses the same solid oxide technology as the Bloom Energy Server, and produces clean hydrogen with 15-45% greater efficiency than other available solutions.

Bloom Energy believes that the Bloom electrolyzer represents a major breakthrough for hydrogen, and would like to make this technology available to heavy industries such as steel, chemicals, cement and glass manufacturing to enable them to decarbonize. In addition, electrolyzers can be connected to solar and wind power to produce green hydrogen, which can be stored and eventually converted back into electricity for later use.

As far as revenue trends are concerned, the trend over the last few years has been largely positive, as can be seen in the graph below from InvestingPro:

Source : InvestingPro

On the other hand, as is the case with PlugPower, profitability has yet to materialize, as shown by the latest published financial results:

Source : InvestingPro

On the other hand, analysts are predicting a clear improvement in the next few results, which should bring the company close to break-even.

Source: InvestingPro

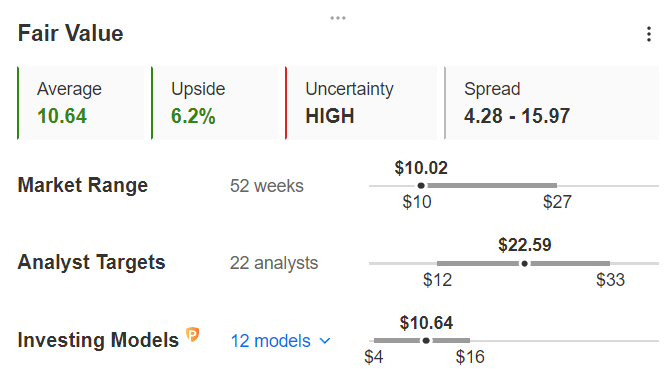

The lack of profitability does not, however, prevent analysts from being optimistic about the stock. Indeed, the average target of the 22 analysts following the stock is $22.59, according to InvestingPro, more than double the current price.

Source : InvestingPro

It should be noted, however, that Bloom Energy's InvestingPro Fair Value, which synthesizes 12 financial models, is far more conservative. It stands at $10.64, just 6.2% above the current price.

Conclusion

Investing in hydrogen stocks, especially pure players, is clearly a speculative gamble. However, the US government's determination to develop this energy source gives us good reason to hope that the gamble will pay off.

And given that PlugPower and Bloom Energy are the only two "pure players" selected by the US Department of Energy for its pilot project to accelerate the development of this energy source, investors interested in this opportunity would do well to keep these stocks on their radar.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.