Bitcoin price today: struggles at $111k as trade tensions, risk aversion weigh

-

Big banks reported strong Q2 profits, driven by trading and investment banking, though CEOs remained cautious about economic risks.

-

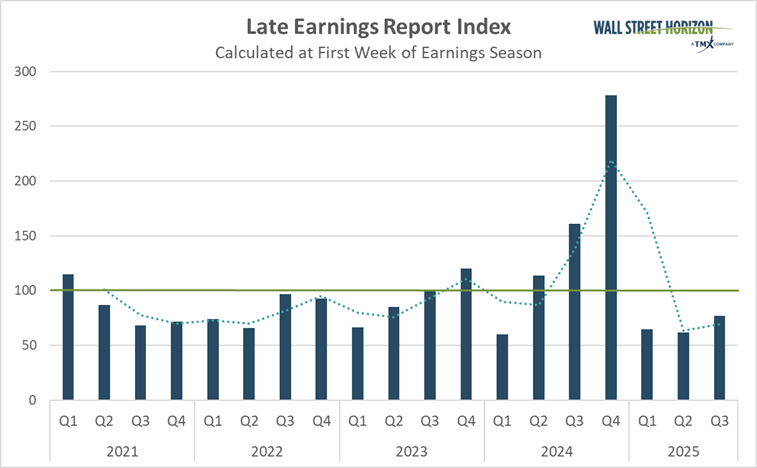

The Late Earnings Report Index (LERI) shows increased certainty, despite more companies setting unusual earnings dates.

-

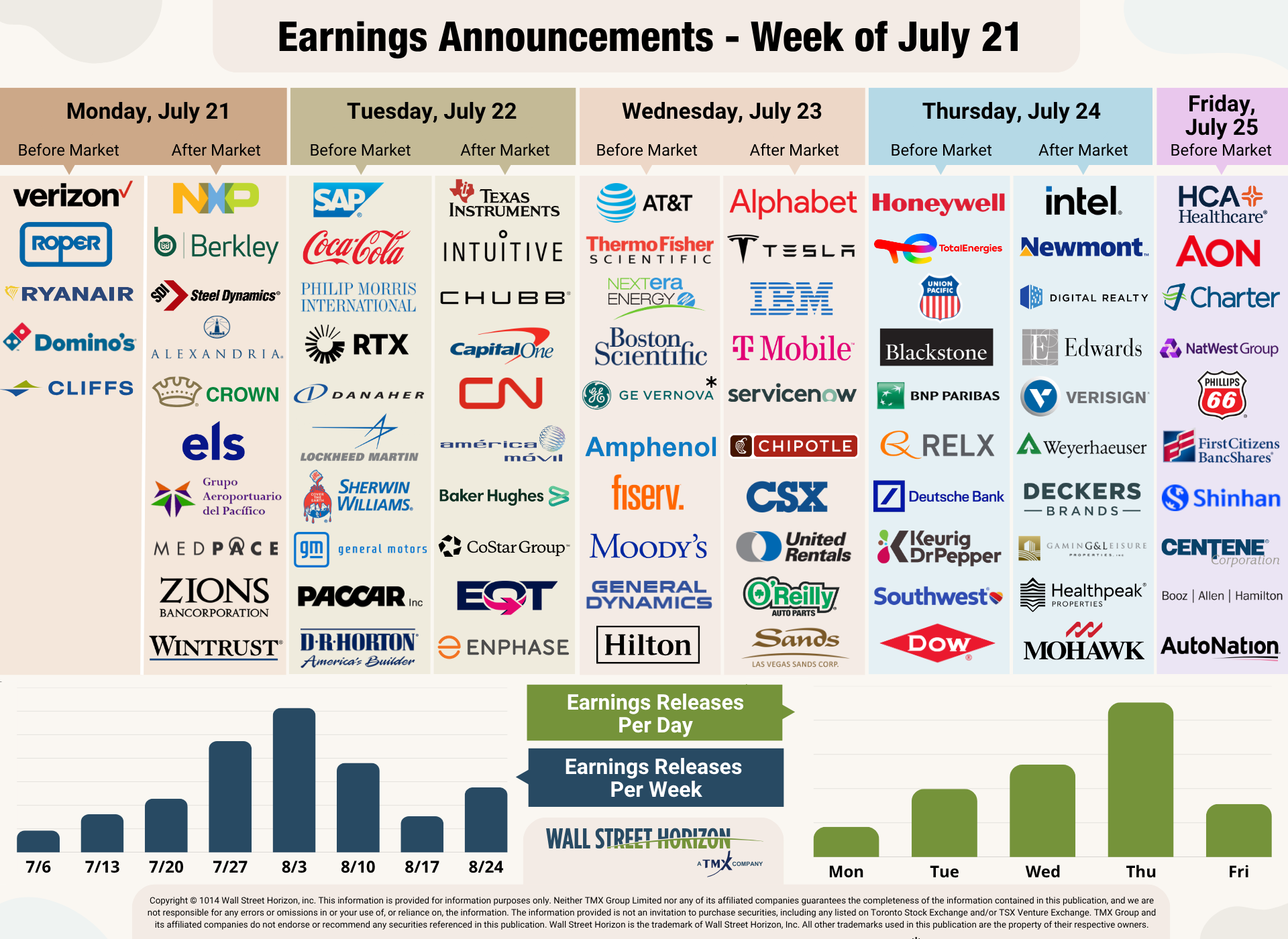

Key tech (Tesla, Alphabet) and industrial companies report this week, with peak earnings season expected from July 28 to August 15.

Big Banks Reported Big Profits in Q2, But Caution Remains

The big banks kicked off earnings season last week when they reported results for the second quarter. We had a watchful eye on a few important metrics, including net interest income (NII), investment banking activity, and trading revenues, all of which were front and center in those reports.

JPMorgan Chase (NYSE:JPM) got things started on Tuesday with results that beat on the top and bottom line. While market volatility cooled down by the end of the quarter, there were some big swings in April due to trade policy uncertainty, benefiting equities trading revenue, which jumped 15%.

Fixed Income trading revenue jumped 14%. Investment Banking ended up being a bright spot after initially starting to slow early in the quarter due to President Trump’s April 2 trade announcements and the confusion surrounding those proposals. Investment Banking (IB) fees ended up 7% higher for the quarter.

Despite the robust results, CEO Jamie Dimon continued with his cautious commentary. While acknowledging that “The U.S. economy remained resilient in the quarter,” Dimon continued on in the release, saying

“The finalization of tax reform and potential deregulation are positive for the economic outlook. However, significant risks persist – including from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits and elevated asset prices.”

This set the tone for big banks, as many others reiterated these points. Citigroup (NYSE:C), Morgan Stanley(NYSE:MS) (NYSE:MS), and Goldman Sachs (NYSE:GS) results were all driven by strong trading revenue and IB activity. On the NII front, both Wells Fargo (NYSE:WFC) and Bank of America (NYSE:BAC) noted that as a weak spot in Q2.

With the results from big banks as well as the 34 other S&P 500 constituents that reported last week, Q2 growth propelled to 5.6% from 4.8% the prior week. Revenues remained relatively unchanged at 4.4% from 4.2% the week prior. Beat rates remain impressive with 83% of S&P 500 companies surpassing expectations on the top and bottom line, better than the 1, 5, and 10-year beat rate averages according to FactSet.

Fewer Companies Have Delayed Q2 Earnings Dates

After rising to its highest level in four years during the last quarter of 2024, the Late Earnings Report Index, our proprietary measure of CEO uncertainty, has now recorded three consecutive quarterly readings below the historical benchmark as companies prepare to report their Q2 results.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, and anything above that indicates that companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests that companies feel they have a pretty good handle on the near-term.

The official pre-peak season LERI reading for Q1 earnings stands at 77. This is well below the baseline reading, suggesting that when companies announced their earnings dates, they were feeling more certain about economic conditions. As of July 15, there were 60 late outliers and 70 early outliers.

This is the second quarter in a row that the number of outliers is significantly higher than usual. For Q3 2025, the total is 130, where in Q3 2024 it was only 103, showing that more companies are scheduling earnings dates outside of their typical date range.

Source: Wall Street Horizon

On Deck this Week - Mag 7 Begin to Report

While peak season isn’t quite here yet, this week kicks into high gear with some big tech reports, including two constituents of the Mag 7. Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) are both scheduled to report on Wednesday, July 23, and remain underperformers of the group so far in 2025 – TSLA stock down ~15%, and GOOGL down ~3% vs. the S&P 500 which is up over 7% YTD.

This week we will also hear from some large Industrials such as Honeywell (NASDAQ:HON) and Texas Instruments (NASDAQ:TXN). The sector is a laggard with bottom-line growth expected to fall 0.8% for Q2, as global growth has waned.

Source: Wall Street Horizon

Q2 Earnings Wave

The peak weeks of the Q2 earnings season are expected to fall between July 28 - August 15, with each week expected to see over 2,000 reports. Currently, August 7 is predicted to be the most active day with 1,269 companies anticipated to report.

Thus far, only 60% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon