Oklo stock tumbles as Financial Times scrutinizes valuation

- As the tech sector continues its relentless climb, investors are eyeing select companies with upcoming earnings reports that could ignite even stronger gains.

- Among the promising candidates are Arista Networks, Cloudflare, and Rubrik.

- Each has demonstrated robust momentum this year, driven by surging demand in AI, cloud security, and data protection.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners!

As the Q3 earnings season kicks into high gear, investors are searching for companies that can not only weather market volatility but also deliver the kind of strong results and positive guidance that can ignite a stock rally. While the mega-cap tech giants often dominate the headlines, the most compelling opportunities can sometimes be found in the essential, high-growth companies providing the critical infrastructure for the entire digital economy.

Arista Networks (NYSE:ANET), Cloudflare (NYSE:NET), and Rubrik (NYSE:RBRK) are three such companies, each a leader in its respective domain and each poised to deliver a strong earnings report that could keep its rally going. Here’s why each is a compelling buy right now.

1. Arista Networks: High-Conviction AI Winner

- Year-To-Date Performance: +32.1%

- Market Cap: $183.4 Billion

Arista Networks has been a breakout star in 2025, with its stock surging over 30% year-to-date, trading near its recent record high of $162.68. This rally is underpinned by the company’s pivotal role in AI infrastructure, where its high-speed Ethernet switches and Extensible Operating System (EOS) are essential for hyperscalers like Meta and Microsoft—customers that account for about 40% of sales.

Source: Investing.com

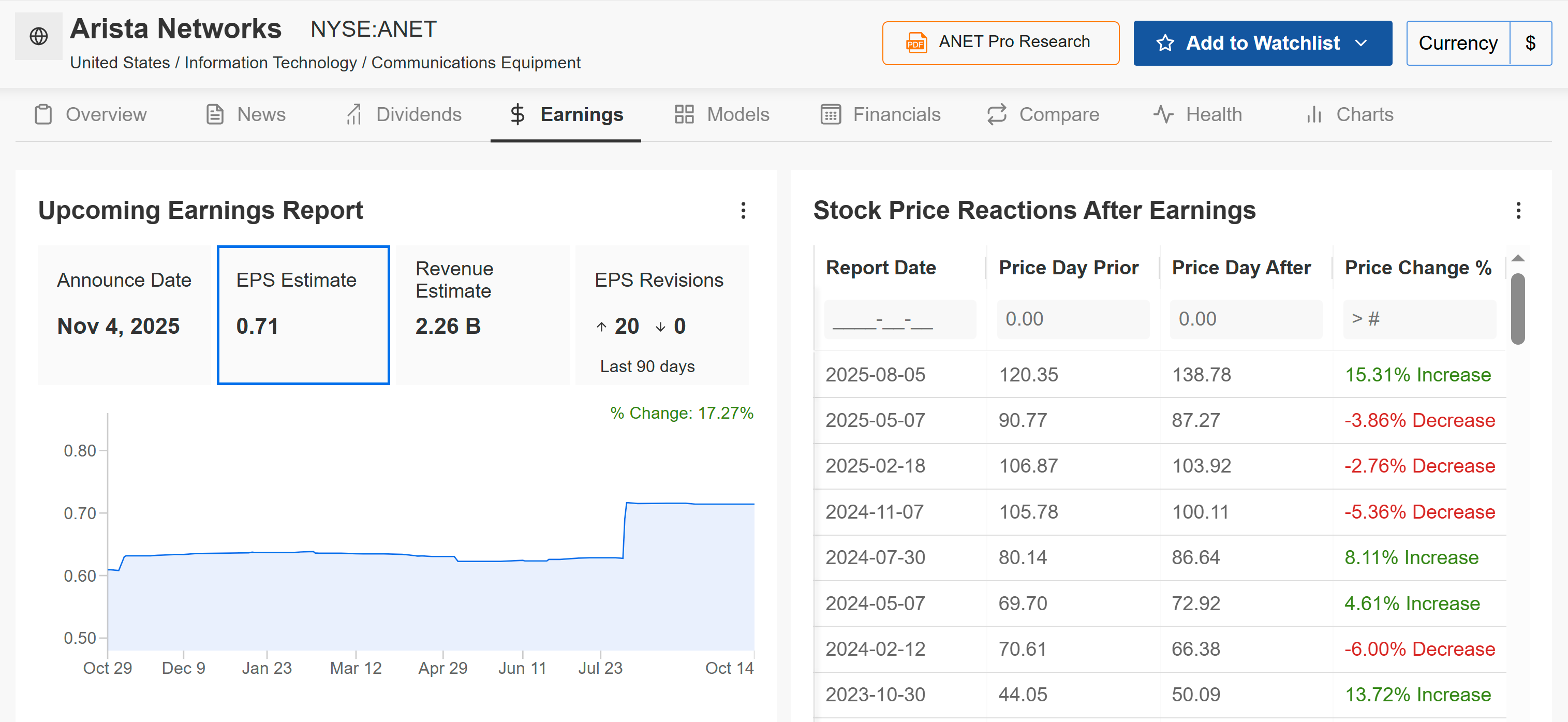

Arista is scheduled to report earnings on November 4. Analysts expect revenue growth of 24.9% year-over-year to $2.26 billion, with adjusted EPS of $0.71, rising nearly 20% from a profit of $0.60 in the year-ago period.

Earnings estimates have been revised upward 20 times in the last 90 days, compared to zero downward revisions, reflecting growing confidence among analysts. The stock trades at a premium (P/E 51.3x forward), but operational leverage and guidance-beating potential could fuel further upside—especially if AI demand surprises to the upside.

Source: InvestingPro

Look for the company to report robust demand for its high-speed 400G and 800G switches. A strong earnings beat, combined with a confident outlook on the AI-driven upgrade cycle, will signal that its growth engine is firing on all cylinders, providing a powerful catalyst to keep its stock rally going.

2. Cloudflare: Riding the AI and Security Wave

- Year-To-Date Performance: +97.8%

- Market Cap: $74.2 Billion

Cloudflare’s stock has been on fire in 2025, delivering a return of nearly 100% year-to-date and trading at $213—near its 52-week high of $230. The company’s global network powers content delivery, cybersecurity, and AI edge computing, serving enterprises hungry for low-latency solutions amid exploding data demands.

Source: Investing.com

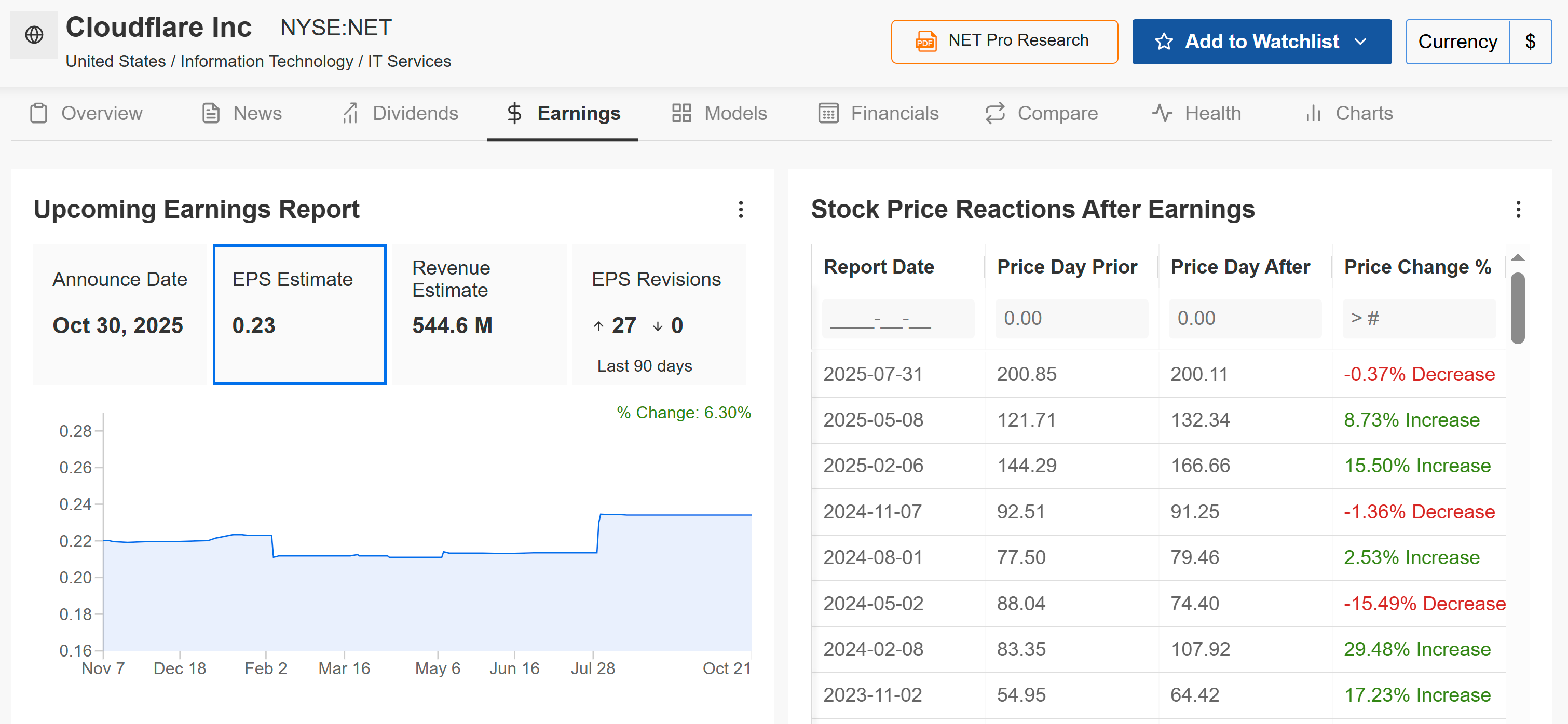

Cloudflare’s Q3 earnings on October 30 carry high expectations: Analysts project EPS of $0.23 (15% YoY growth) and revenue around $544 million, which would represent annual growth of 26.5%. The company is poised to beat earnings estimates due to its powerful "land-and-expand" business model and its increasing success in winning larger enterprise customers.

Trading at 23x trailing sales, Cloudflare’s valuation demands growth, but with 27 positive EPS revisions in 90 days and a neutral-to-bullish sentiment, a beat could propel shares toward $380 by December—a 70% potential pop.

Source: InvestingPro

As a resilient CDN and security play, Cloudflare merits a buy rating for those betting on AI’s edge. Cloudflare’s latest partnerships with Visa, Mastercard, and American Express on AI-powered authentication systems, plus new platform bundles, add fuel to the fire.

3. Rubrick: Under-the-Radar Hyper-Growth

- Year-To-Date Performance: +22.2%

- Market Cap: $15.7 Billion

Since its 2024 IPO, Rubrik has redefined post-attack recovery, and 2025 has been transformative: Shares have rocketed 102% over 52 weeks, with a 22% YTD gain and trading at $79.88—up from a $28.60 low to a $103 high. Now valued at roughly $16 billion, Rubrik’s zero-trust data security platform is outperforming rivals like Dell and Veeam, driven by growing cyber threats and the increasing need for AI-driven data.

Source: Investing.com

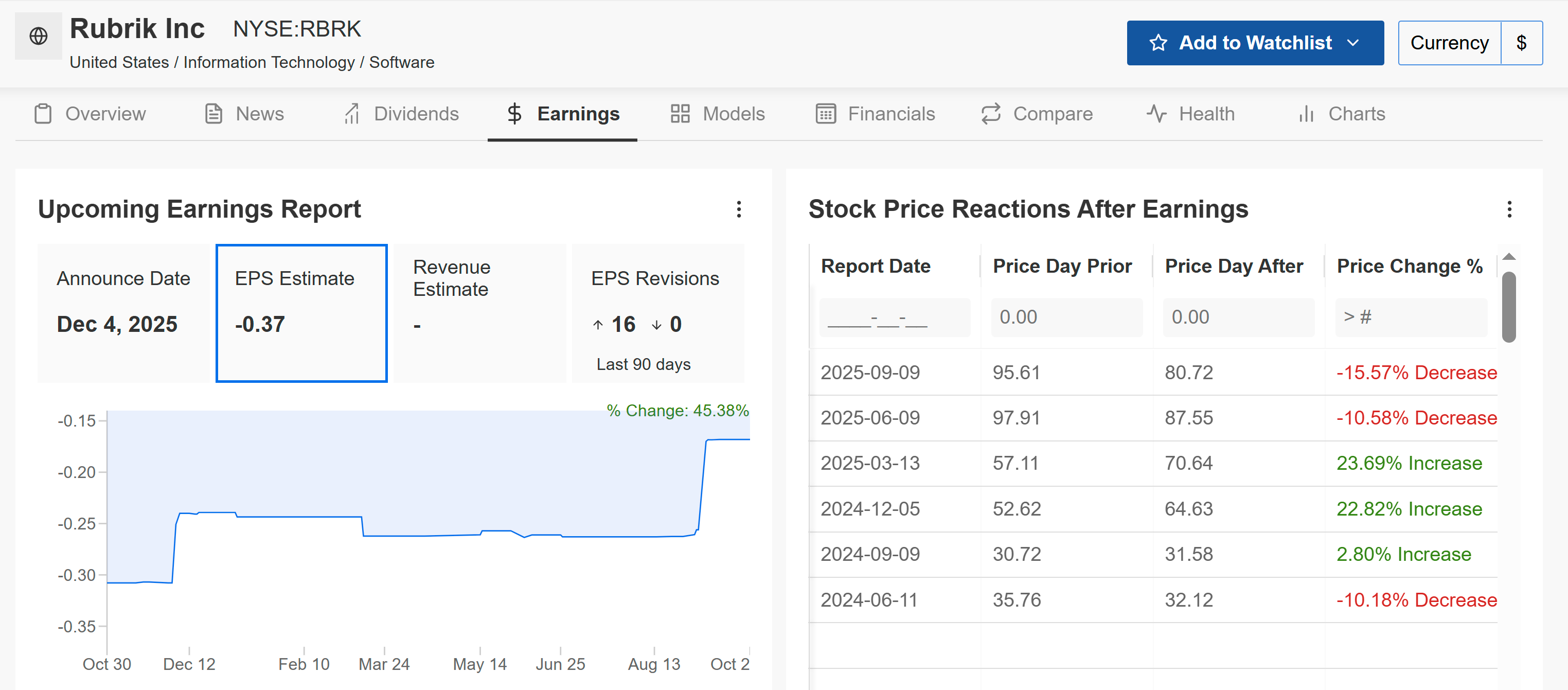

Rubrik’s Q4 earnings scheduled for December 4 look set for another triumph driven by expansions in data protection and AI security. The company has beaten every quarter since going public: Q2 2025 revenue hit $310 million (51% YoY growth, $27.6 million surprise) as subscription sales soared 54% to $266 million.

In a sign of increasing optimism, analysts have made several upward revisions to their earnings forecasts in the weeks leading up to the report. Notably, all 16 of the last revisions were to the upside.

Source: InvestingPro

The key metric to watch will be its Subscription Annual Recurring Revenue (ARR), which is the best indicator of the underlying health of its business. A strong beat on revenue and ARR, coupled with a confident outlook, will signal to the market that its growth story is just beginning and that its leadership position in the critical data security market is secure, which would keep its post-IPO rally alive.

The Takeaway

Each of these tech stocks combines explosive growth, analyst confidence, and unique AI/cybersecurity tailwinds. With earnings on deck, strong financial health, and recent beats, Arista, Cloudflare, and Rubrik have the ingredients for another leg up—if they execute.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.