Here’s why Citi says crypto prices have been weak recently

- On average August has been the US stock market’s worst month

- Market-moving events this month include CPI data and a Fed gathering

- Consider buying Diamondback Energy, ZIM Integrated Shipping Services, and Newmont Corporation

Coming off its best month since 2020, August has gotten off to a volatile start on Wall Street on rising geopolitical tensions as well as the US Federal Reserve’s rate hike plans to combat strong inflation, raising recession fears.

Investors should brace for further turmoil this month amid a plethora of market-moving events, including a CPI report and the Fed’s Jackson Hole meeting.

Since 1986, August has been the stock market’s worst month on average. The Dow Jones Industrial Average's average August return over the past 35 years is negative 0.67%, compared to an average gain of 1.05% for the rest of the year.

So with that in mind here are three companies poised to outperform in the weeks ahead.

Diamondback Energy

- Year-To-Date Performance: +20.4%

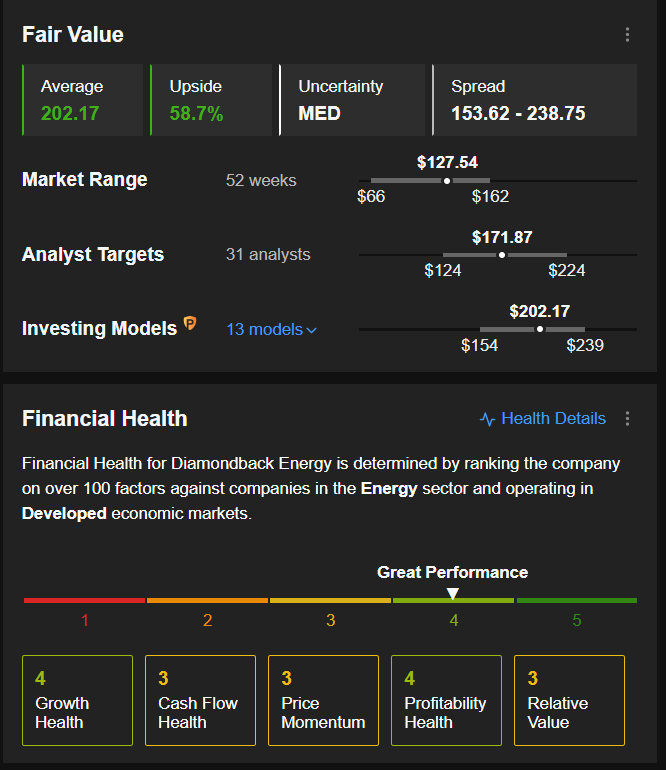

- Pro+ Fair Value Upside: +58.7%

- Market Cap: $22.2 billion

Diamondback Energy (NASDAQ:FANG) is one of the largest crude oil and natural gas producers in the Permian basin, making it a leading player in the energy sector. The region, which spans across western Texas and southeast New Mexico, accounts for approximately 30% of total domestic oil output.

Shares of the Midland, Texas-based energy company, whose core business operations involve exploring, developing, and producing oil, gas, and natural gas liquids, have outpaced the returns of the Dow and S&P year-to-date, gaining 20.4%.

FANG touched an all-time high of $162.24 on June 8 and is up almost 69% over the last 12 months.

With a relatively low price-to-earnings (P/E) ratio of 5.9, Diamondback is at a significant discount compared to other notable names such as EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD), Devon Energy (NYSE:DVN), and Continental Resources (NYSE:CLR).

Diamondback Energy remains one of the best stocks to hedge against further uncertainty due to its continuous efforts to return cash to shareholders with higher dividends and stock buybacks.

Indeed, the shale producer, which topped consensus estimates when it reported Q2 numbers on August 1, recently raised its annual base dividend payout by 7% to $3.00 per share.

Diamondback’s board of directors also announced a special variable dividend of $2.30 per share and approved a $2 billion increase to its share repurchase program to complement its plan to return 75% of free cash flow to stockholders.

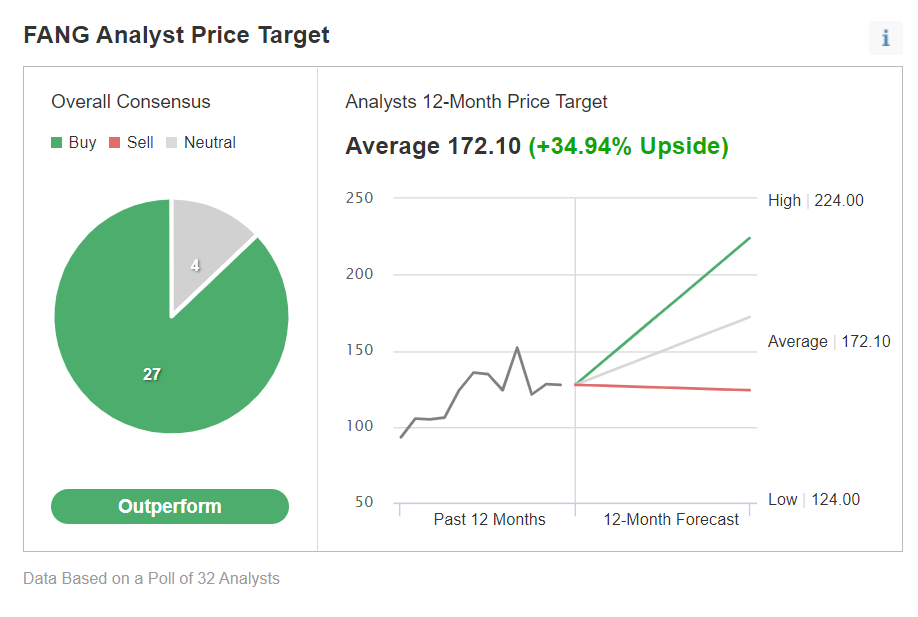

According to an Investing.com survey, analysts remain generally bullish on the stock, with an average price target of $172.10.

Likewise, the quantitative models in InvestingPro point to a gain of roughly 59% bringing shares closer to their fair value of $202.17.

ZIM Integrated Shipping Services

- Year-To-Date Performance: -15%

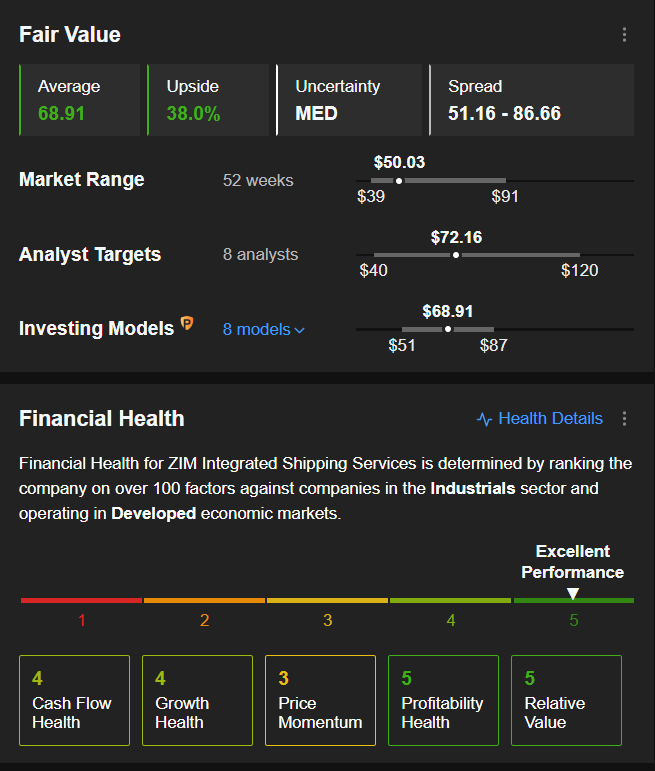

- Pro+ Fair Value Upside: +38%

- Market Cap: $6.0 billion

ZIM Integrated Shipping Services (NYSE:ZIM) is a global cargo shipping company which owns and operates a fleet of 118 vessels, including 110 container vessels and 8 vehicle transport vessels.

The Israel-based company, which made its debut on the New York Stock Exchange in January 2021 at $15 per share, rallied to a record peak of $91.24 on March 17 amid surging freight rates due to a favorable demand environment.

ZIM stock has since retreated from those levels amid easing global supply chain issues and is down 15% ytd but remains up over 30% over the last 12 months.

The shipping giant’s cheap valuation combined with its ongoing efforts to return more capital to shareholders makes it an attractive option for investors looking to shield themselves from further market volatility in the weeks ahead.

ZIM trades at a P/E ratio of just 1.1, which according to Investing Pro, is 90% lower than the sector median of 11.0.

Additionally, the global container liner shipping company currently offers an annualized dividend of $11.40 at a sky-high yield of 16.4%.

According to the Investing Pro model, ZIM stock is extremely undervalued and could see an increase of 38% from current levels.

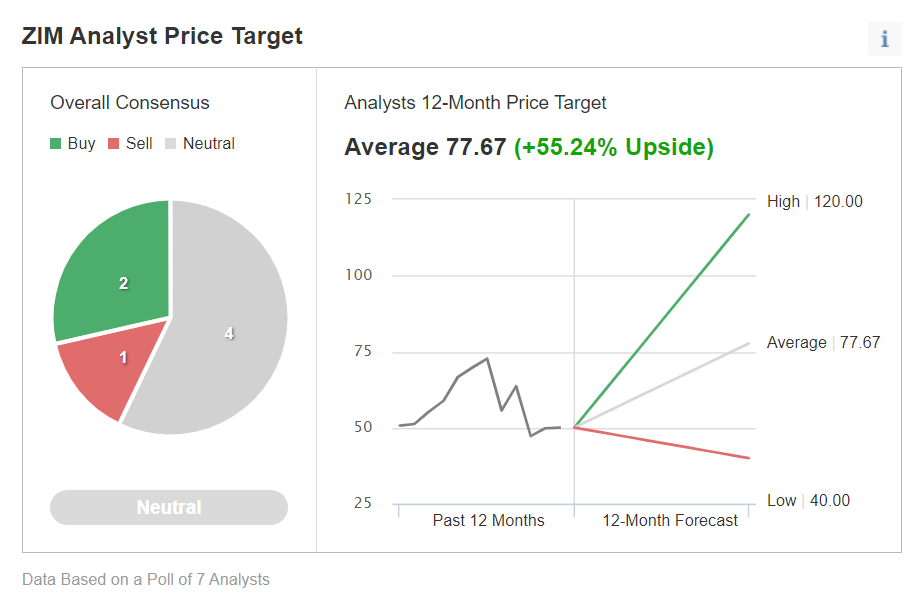

Analysts are also optimistic on the global container liner, citing strong shipping market fundamentals.

According to an Investing.com survey, six out of seven analysts covering ZIM rate the stock as either ‘outperform’ or ‘hold.’

ZIM is expected to deliver solid earnings and revenue growth when it releases its latest financial results before markets open on Wednesday, August 17.

Consensus expectations call for second-quarter earnings per share of $13.24, up 79.1% year-on-year (yoy). Revenue is forecast to climb 56.3% yoy to $3.72 billion due to higher freight volumes and rising shipping rates.

Newmont

- Year-To-Date Performance: -27.7%

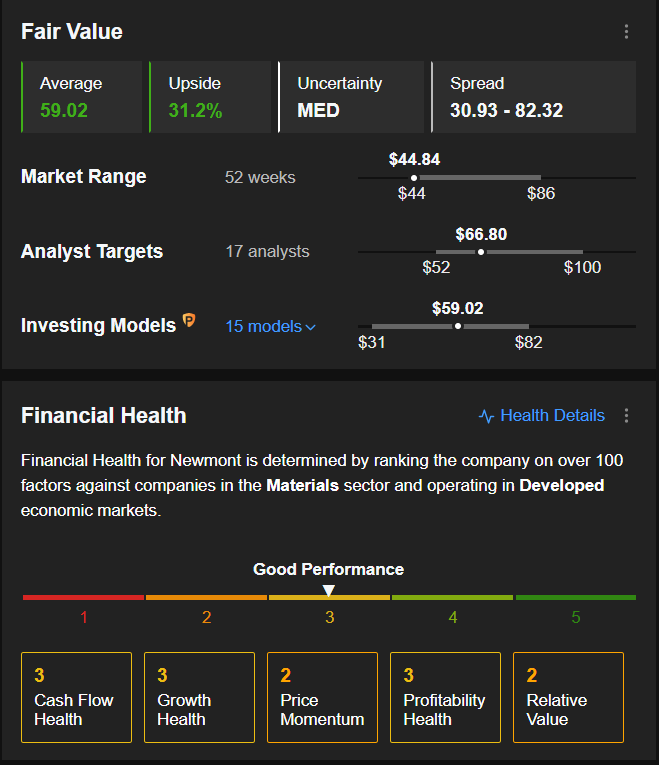

- Pro+ Fair Value Upside: +31.2%

- Market Cap: $35.6 billion

Newmont Goldcorp (NYSE:NEM) is the world’s largest gold producer by market value, output, and reserves. The company, which owns a portfolio of assets anchored in favorable gold mining regions in North America, South America, and Australia, also engages in the production and exploration of copper, silver, zinc, and lead.

After soaring to an all-time high of $86.37 on April 18, NEM stock, which is down 27.7% ytd, tumbled to a low of $44.00 on July 25. The shares have since staged a modest rebound but are approximately 48% below their record peak.

We expect the positive trend in Newmont to resume as gold prices charge back towards recent highs.

Newmont reported Q2 earnings which fell short of estimates due to higher operating costs related to labor, energy, and supplies amid sustained inflationary pressures. But revenue rose more than expected, benefitting from the sharp increase in gold prices as well as higher sales volumes.

Newmont generated $514 million in free cash flow in Q2, ending the quarter with roughly $4.3 billion of cash in hand.

Newmont currently offers an annual yield of 4.90%, one of the highest in the sector.

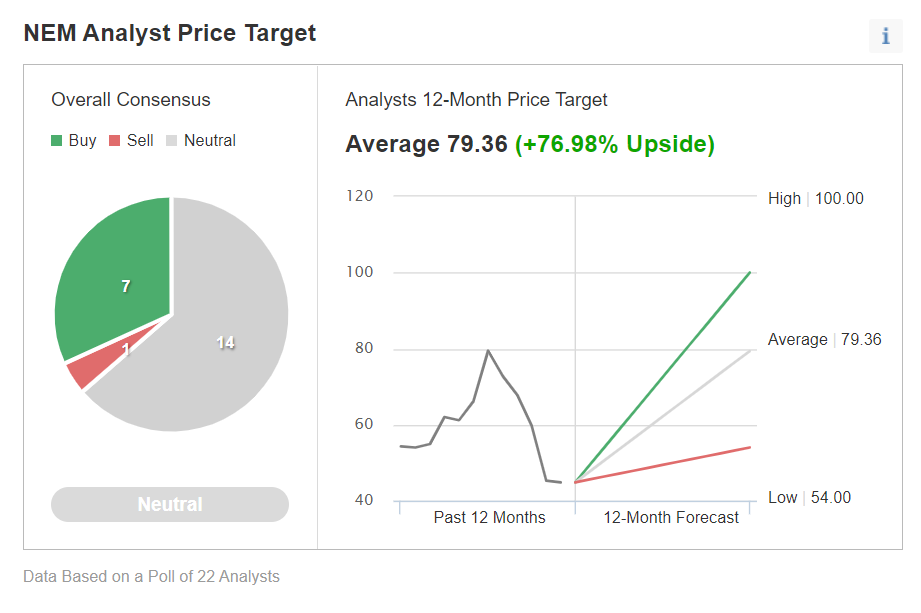

Per an Investing.com survey, seven analysts rate NEM a ‘buy’, 14 consider it a ‘hold’, and only one has it at ‘sell’.

The average fair value for Newmont on InvestingPro is $59.02, a potential 31.2% upside.

Disclaimer: At the time of writing, Jesse had a position in FANG shares. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.