e.l.f. Beauty stock plummets 20% as revenue and guidance fall short of expectations

- The AI-led rally looks poised to continue higher.

- Investors looking to capitalize on the AI craze should consider the three software stocks discussed below.

- By utilizing InvestingPro's comprehensive research and analysis features, you too can find the next big winners in the stock market.

- The InvestingPro Summer Sale is live: Subscribe for under $8/month!

As the AI revolution continues to gain momentum, several software companies are uniquely positioned to benefit from the surge in enterprise spending on AI infrastructure.

Among these, Palantir (NYSE:PLTR), Palo Alto Networks (NASDAQ:PANW), and CrowdStrike (NASDAQ:CRWD) stand out for their innovative advancements in AI and strong financial health.

By leveraging the advanced research and analysis tools available through InvestingPro, let's take a closer look at why these three companies are set to capitalize the most on the AI craze.

Are You Still Chasing the Next Hot AI Stock?

There's a whole market out there, and ProPicks can help you uncover hidden gems poised to explode.

Our cutting-edge AI analyzes mountains of data to identify 90+ high-potential stocks every month before they take off.

Alongside that, you also get to follow the same strategy that has more than doubled the S&P 500's gains this year - so far.

Get ready to watch your portfolio grow - Subscribe now for less than $8 a month as part of our summer sale using this link!

Continuing our analysis, let's delve deep to analyze the stocks further.

1. Palantir

- 2024 Year-To-Date: +50.5%

- Market Cap: $57.5 Billion

Palantir stock was trading at $25.85 as of Friday morning, just below its 2024 peak of $27.50 from March 7. Shares are up 50.5% year-to-date amid excitement over the software maker’s leading role in artificial intelligence.

Source: Investing.com

At current levels, the Denver, Colorado-based big-data firm has a market cap of $57.5 billion. Notwithstanding the recent turnaround, PLTR still trades well below the all-time intraday high of $45.00 set in late January 2021.

-

AI Advancements:

Palantir has been at the forefront of AI innovation, leveraging its cutting-edge data analytics platforms, Palantir Foundry and Palantir Gotham. These platforms integrate advanced AI and machine learning capabilities to help organizations make data-driven decisions.

Palantir's AI solutions are widely used across various industries, including defense, healthcare, and finance, to analyze massive datasets and uncover actionable insights.

-

Capitalizing on AI:

With the growing demand for AI-driven data analytics, Palantir is well-positioned to capitalize on the trend. The data-mining specialist’s continuous investment in AI research and development has resulted in state-of-the-art products that cater to the increasing needs of enterprises seeking to harness the power of AI.

-

Financial Health:

Palantir boasts an excellent Financial Health Score of 4.0 out of 5.0, as assessed by InvestingPro's AI-backed models.

Source: InvestingPro

This score reflects the company's robust growth outlook, strong profitability trends, and efficient cash flow management. Palantir's strategic partnerships and government contracts further solidify its financial stability and growth prospects.

2. Palo Alto Networks

- 2024 Year-To-Date: +15.7%

- Market Cap: $110.5 Billion

Palo Alto Networks stock was trading at $341.20 heading into Friday’s session, a tad below its all-time high of $380.84 reached on February 9, 2024, earning the global cybersecurity leader a market valuation of $110.5 billion.

Source: Investing.com

PANW has seen its stock climb 15.7% year-to-date as cybersecurity threats continue to evolve and businesses prioritize digital security, driving strong revenue growth and market share expansion.

-

AI Advancements:

Palo Alto Networks has integrated AI into its cybersecurity offerings, enhancing its ability to detect and prevent cyber threats. The Santa Clara, California-based company’s Cortex XDR platform uses AI and machine learning to analyze data from multiple sources, enabling faster threat detection and response.

This AI-driven approach helps organizations stay ahead of increasingly sophisticated cyber-attacks.

-

Capitalizing on AI:

As cyber threats evolve, the demand for AI-enhanced cybersecurity solutions is on the rise. Palo Alto Networks is strategically positioned to benefit from this trend, with its comprehensive suite of AI-driven security products that provide superior protection against modern cyber threats.

-

Financial Health:

InvestingPro's AI models highlight Palo Alto Networks' strong Financial Health Score of 4.0/5.0, highlighting its solid profitability and promising growth trajectory.

Source: InvestingPro

The cyber specialist's focus on innovation and its expanding customer base contribute to its impressive financial performance, making it a compelling investment in the AI-driven cybersecurity space.

3. CrowdStrike

- 2024 Year-To-Date: +51.6%

- Market Cap: $94.2 Billion

CrowdStrike stock was trading at $387.18 as of time of publication on Friday morning, slightly below its intraday record peak of $394.64 from June 17. Shares of the Austin, Texas-based security software company have significantly outperformed the broader market so far this year, climbing roughly 52%.

Source: Investing.com

With a market cap of $94.2 billion, CrowdStrike is one of the leading names in the cloud-based cybersecurity industry.

-

AI Advancements:

CrowdStrike leverages AI extensively in its Falcon platform, which provides endpoint security, threat intelligence, and cyberattack response services. The Falcon platform uses AI and machine learning to continuously analyze data and detect threats in real time, ensuring proactive protection for its clients.

As cybersecurity remains a top priority for businesses worldwide, the information security specialist’s cutting-edge technology and robust growth trajectory are likely to persist amid the uncertain geopolitical climate.

-

Capitalizing on AI:

With the increasing frequency and complexity of cyber threats, CrowdStrike's AI-driven approach to cybersecurity is in high demand. The company's ability to deliver real-time threat detection and response through its AI-powered platform makes it a preferred choice for organizations seeking robust cybersecurity solutions.

-

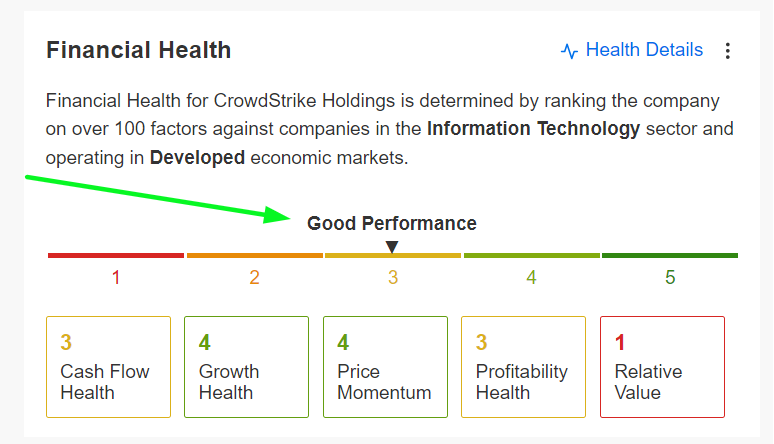

Financial Health:

CrowdStrike's above-average Financial Health Score, as evaluated by InvestingPro's AI-backed models, reflects its healthy profitability outlook, strong sales prospects, solid cash flow growth, and expanding market share.

Source: InvestingPro

The endpoint security leader’s impressive fundamentals and long-term growth prospects underscore its effectiveness in capitalizing on the growing need for advanced cybersecurity solutions.

Conclusion

Palantir, Palo Alto Networks, and CrowdStrike are three software stocks uniquely positioned to capitalize on the AI craze. Their advancements in AI technology and strategic focus on innovation make them leaders in their respective fields.

Additionally, each company has a strong Financial Health Score, underscoring their robust growth outlook and profitability trends.

For investors looking to tap into the AI-driven growth, these three stocks offer compelling opportunities. Leveraging tools like InvestingPro's AI-powered models can help identify such high-potential investments, ensuring informed decision-making in the rapidly evolving tech landscape.

Our InvestingPro Summer Sale Is Now Live!

Readers of this article can subscribe to InvestingPro for less than $8 a month as part of our summer sale.

To apply the discount, don't forget to use the coupon code PROTIPS2024.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, George Soros, and Ray Dalio are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.