Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

- Bitcoin bulls face key resistance with a potential double-top forming near historical highs.

- HYPER nears $10 million ICO goal, blending Bitcoin’s security with Solana’s speed.

- Ethereum breaks $4,000, aiming for record highs as demand strengthens in August.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off amid the summer sale!

In recent days, buyers in the crypto market aimed to push prices to new all-time highs. That attempt has failed for now. For Bitcoin, a double peak is forming, which does not confirm a bigger correction yet, but it will take time to see how far sellers can push prices down.

Attention is now turning to the HYPER project, a crypto payment-focused initiative designed to combine Bitcoin’s security with the speed and low transaction costs of networks like Solana.

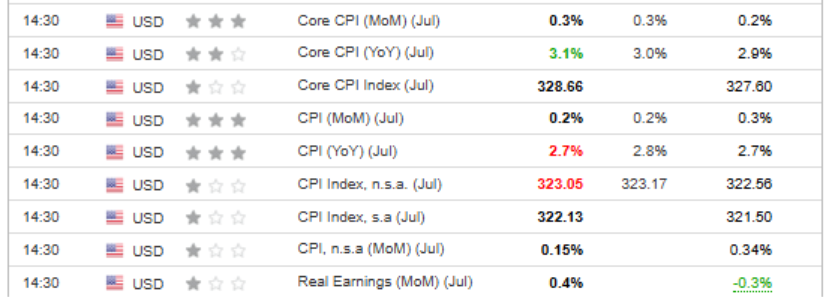

The project is raising money through an ICO (initial coin offering) and is close to reaching $10 million. Yesterday, US inflation data showed core CPI slightly below expectations, but core inflation above target. This has raised the chance of another rate cut in September to over 90% and gave the US dollar a short-term boost.

Key Factors Fueling HYPER’s Growth Potential

Bitcoin, often called digital gold, remains a strong hedge against the erosion of purchasing power in traditional currencies. Its weakness lies in payments, where high fees and slow speeds limit day-to-day use. HYPER aims to bridge this gap, combining Bitcoin’s security with the fast, low-cost transaction capabilities of networks like Solana.

Built on Bitcoin’s second layer and powered by the Solana Virtual Machine, HYPER will allow users to move BTC from the primary layer to a faster payment layer, execute transactions, and then burn tokens on the second layer as they move back. This design promises speed without sacrificing Bitcoin’s trust factor.

Still in pre-sale with no fixed end date, HYPER could scale based on investor demand — positioning itself as a future-ready blend of store-of-value strength and real-world payment utility.

Bitcoin Holds the Line at Historical Highs

Bitcoin’s upward momentum faces a pause as sellers defend the $123,000 historical peak, creating the potential for a double top. Buyers are holding the short-term uptrend line, but a breakdown could open the way for a test of the $118,000 level.

In the medium to long term, the base case remains a continued push higher, with $130,000 as the next major target.

Ethereum Rally Driven by Strong Demand

After a sluggish run from May to July, Ethereum momentum has finally shifted in August. A strong rally has pushed prices through successive resistance levels, breaking decisively above the $4,000 mark and signaling renewed strength on the demand side.

This breakout sets the stage for buyers to target Ethereum’s all-time highs just below the $5,000 mark. Short-term pullbacks could offer entry points, with a key support confluence around $4,100 from the accelerated trend line. A deeper retreat toward $3,500 would likely require a sharp shift in sentiment.

****

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

ProPicks AI

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

Fair Value Score

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

WarrenAI

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

Financial Health Score

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.