Futures higher amid U.S.-China trade talks progress - what’s moving markets

- Dow-30 member 3M is up more than 2.5% in 2021, but down about 7.9% in the past three months.

- MMM has come under pressure due to supply-chain issues and inflationary worries.

- Despite further potential volatility in the stock, long-term investors could consider buying MMM shares now.

Investors in the multinational conglomerate 3M (NYSE:MMM), a member of the Dow Jones, have not had much to report in 2021. So far this year, MMM stock is up 2.7%. By comparison, the Dow Jones index returned 16.6% in 2021.

MMM stock’s 52-week range has been $163.38 - $208.95. The current price supports a dividend yield of 3.32%. In early May, shares hit a 52-week high of $208.95. Since then, the stock has lost about 33% of its value. Meanwhile, the current market capitalization stands at $103.1 billion.

3M, whose history goes back to 1902, manufactures and markets more than 60,000 products that range from adhesives to abrasives, automotive aftermarket products, medical protective gear and tapes. Some of its well-known products and brands include FOREO, Nexcare, N95 respirator masks, Post-it, Scotch, Scotch-Brite, Scotchgard, and Thinsulate.

The company generates revenue in four segments: safety and industrial; transportation and electronics; health care; and consumer.

MMM released Q3 earnings in late October. Revenue came in at $8.9 billion, up 7.1% year-over-year. Earnings per share were $2.45. During the quarter, the group returned $1.4 billion to shareholders via dividends and share repurchases.

On the results, CEO Mike Roman said:

“In the face of continued global challenges, the 3M team executed well and delivered broad-based organic growth, along with strong margins and cash flow.”

Despite management’s upbeat tone, investors have not been pleased with the metrics. Since the announcement, they have hit the ‘sell’ button, in part, due to concerns over supply-chain issues and inflationary pressures.

What To Expect From 3M Stock

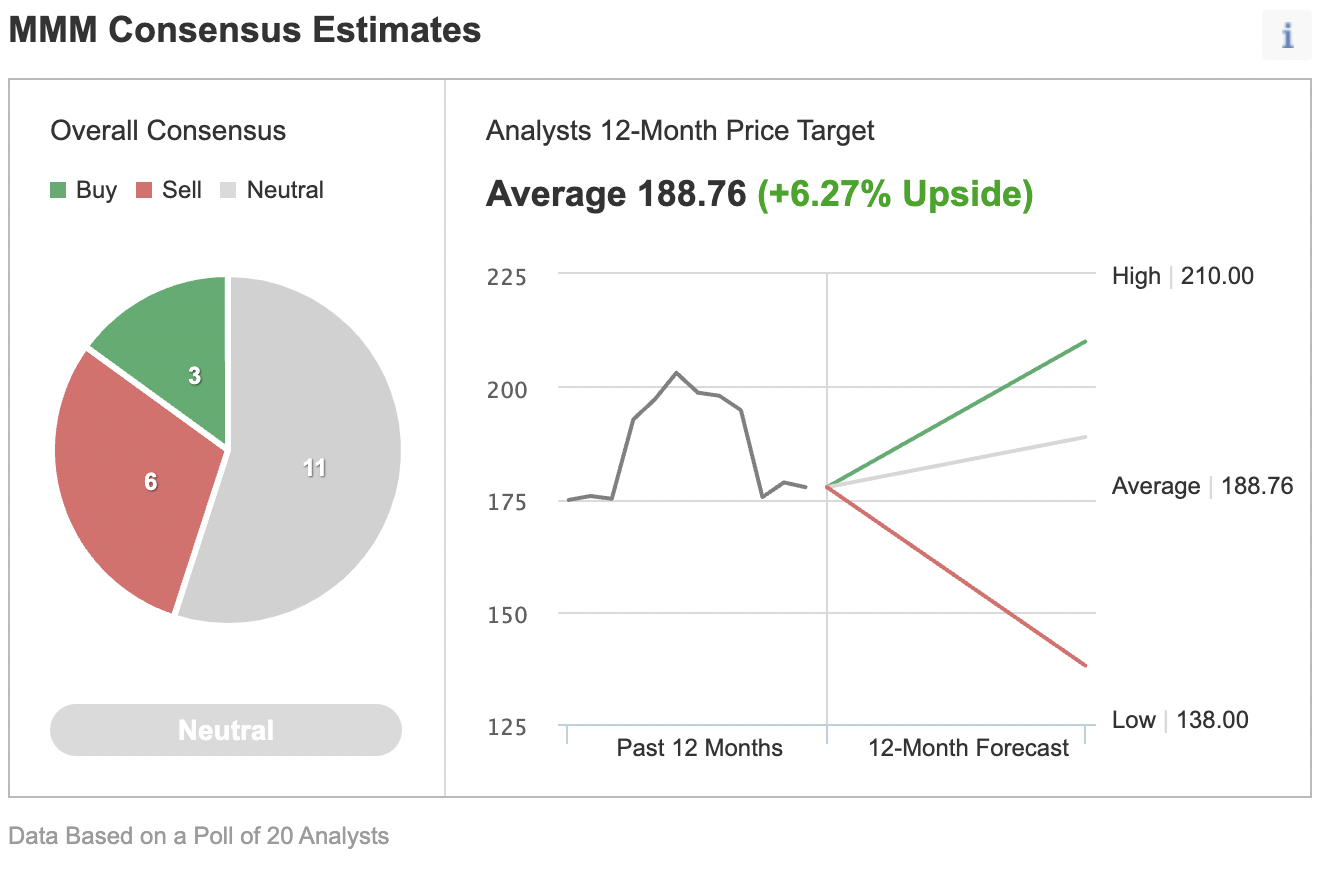

Among 20 analysts polled via Investing.com, MMM stock has a “neutral” rating.

Analysts also have a 12-month median price target of $188.76, implying an increase of about 5% from current levels. The 12-month price range currently stands between $138.00 and $210.00.

Similarly, according to a number of investing models, like the 10-year Discounted Cash Flow (DCF) model growth exit method or those that might consider dividends and P/E multiples, the average fair value for MMM stock stands at $239.50.

Trailing P/E, P/B and P/S (based on Last Twelve Months) ratios for 3M stock stand at 17.3x, 7.1x, and 2.9x, respectively. By comparison, average ratios for its peers are 27.7x, 5.4x, and 3.5x.

In addition, despite the price decline in the past several weeks, a number of MMM stock’s short- and intermediate-term indicators are still cautioning investors.

As part of the short-term sentiment analysis, it would be important to look at the implied volatility level (IV) for MMM stock options, which typically shows traders the market's opinion of potential moves in a security. This indicator, however, does not forecast the direction of the move.

MMM’s current implied volatility is 19.6, which is higher than the 20-day moving average of 16.9. In other words, IV is trending up, which might mean that the options market is expecting more choppiness in the coming days.

Our first expectation is for MMM stock to continue to slide toward $170, or even $165, after which it should find support. Then, it will likely trade sideways between $170 and $180 and establish a new base. Afterwards, a new bullish move is likely to start.

3 Possible Trades On 3M Stock

1. Buy MMM Shares At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in 3M stock now.

On Nov. 24, the stock traded at $178.60. Buy-and-hold investors should expect to keep this long position for several months while the stock makes an attempt toward $188.76, a level which matches analysts’ estimates. Such an up move would mean a return of about 5%. Those long-term investors would also receive dividends.

Readers who plan to invest soon but are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With 3M As A Holding

Anyone who does not want to commit capital to MMM stock, but would still like to have exposure to the shares, could consider researching a fund that includes the company as a holding.

Examples of such ETFs include:

- Invesco Dow Jones Industrial Average Dividend ETF (NYSE:DJD): The fund is up 15.8% YTD, and MMM stock’s weighting is 4.40%;

- Schwab US Dividend Equity ETF™ (NYSE:SCHD): The fund is up 22.5% YTD, and MMM stock’s weighting is 3.72%;

3. Diagonal Debit Spread On 3M Stock

Our third trade is a diagonal debit spread on MMM using LEAPS options, where both the profit potential and the risk are limited. We have provided numerous examples of this type of options strategy (e.g., for Apple and two semiconductor stocks. Since the strategy involves options, it will not be appropriate for all investors.

In this set up, a trader first buys a “longer-term” call with a lower strike price. At the same time, the trader sells a “shorter-term” call with a higher strike price, creating a long diagonal spread.

These call options for the underlying stock have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

Most traders entering such a strategy would be mildly bullish on the underlying security. Instead of buying 100 shares of 3M, the trader would buy a deep-in-the-money LEAPS call option, where that LEAPS call acts as a surrogate for owning the stock.

On Nov. 24, MMM stock traded at $178.60. For the first leg of this strategy, the trader might buy a deep in-the-money (ITM) LEAPS call, like the MMM Jan. 19, 2024, 130-strike call option. This option is currently offered at $52.75. It would cost the trader $5,275 to own this call option that expires in more than two years instead of $17,860 to buy the 100 shares outright.

The delta of this option is close to 80. Delta shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

If MMM stock goes up $1 to $179.60, the current option price of $52.75 would be expected to increase by approximately 80 cents, based on a delta of 80. However, the actual change might be slightly more or less depending on several other factors that are beyond the scope of this article.

For the second leg of this strategy, the trader sells a slightly out-of-the-money (OTM) short-term call, like the MMM Apr. 14, 2022, 180-strike call option. This option’s current premium is $11.05. The option seller would receive $1,105, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point in this trade. The maximum potential is realized if the stock price is equal to the strike price of the short call on its expiration date. So the trader wants the MMM stock price to remain as close to the strike price of the short option (i.e., $180 here) as possible at expiration (on Apr. 14, 2022), without going above it.

Here, the maximum return, in theory, would be about $1,176 at a price of $180 at expiry, excluding trading commissions and costs. (We arrived at this value using an options profit-and-loss calculator).

By not investing $17,860 initially in 100 shares of 3M, the trader’s potential return is leveraged.

Ideally, the trader hopes the short call will expire out-of-the money (worthless). Then, the trader can sell one call after the other, until the long LEAPS call expires in more than two years.