Oil prices dip but set for weekly surge over fresh sanctions on Russian oil

We warned it was coming, and it came fast.

Just two days ago, we talked about how gold had become one of the most crowded trades in the world. The rally had gone too far, too fast, and too many traders were on the same side of the trade. When that happens, all it takes is one spark to set off an avalanche. That spark hit on Tuesday, and the results were historic.

Gold prices collapsed 5.7% in a single session, the steepest one-day decline since April 2013. Statistically as Kobeissi letter pointed out, that’s what’s called a 4.5-sigma move, which simply means it was far outside the normal range of volatility.

To put that in perspective, in a perfectly “normal” market, a move this large would happen only once every 240,000 trading days, or roughly once every 1,000 years. In other words, it’s the kind of drop that’s almost never supposed to happen, but it just did.

Silver got hit even harder, tumbling nearly 9% in a single day, its worst performance since the 2020 crash. Combined, gold and silver wiped out nearly $3 trillion in market value in just 24 hours. For traders, especially those trading prop capital, this wasn’t just a wild chart. It was a painful reminder that even the strongest trends can break without warning.

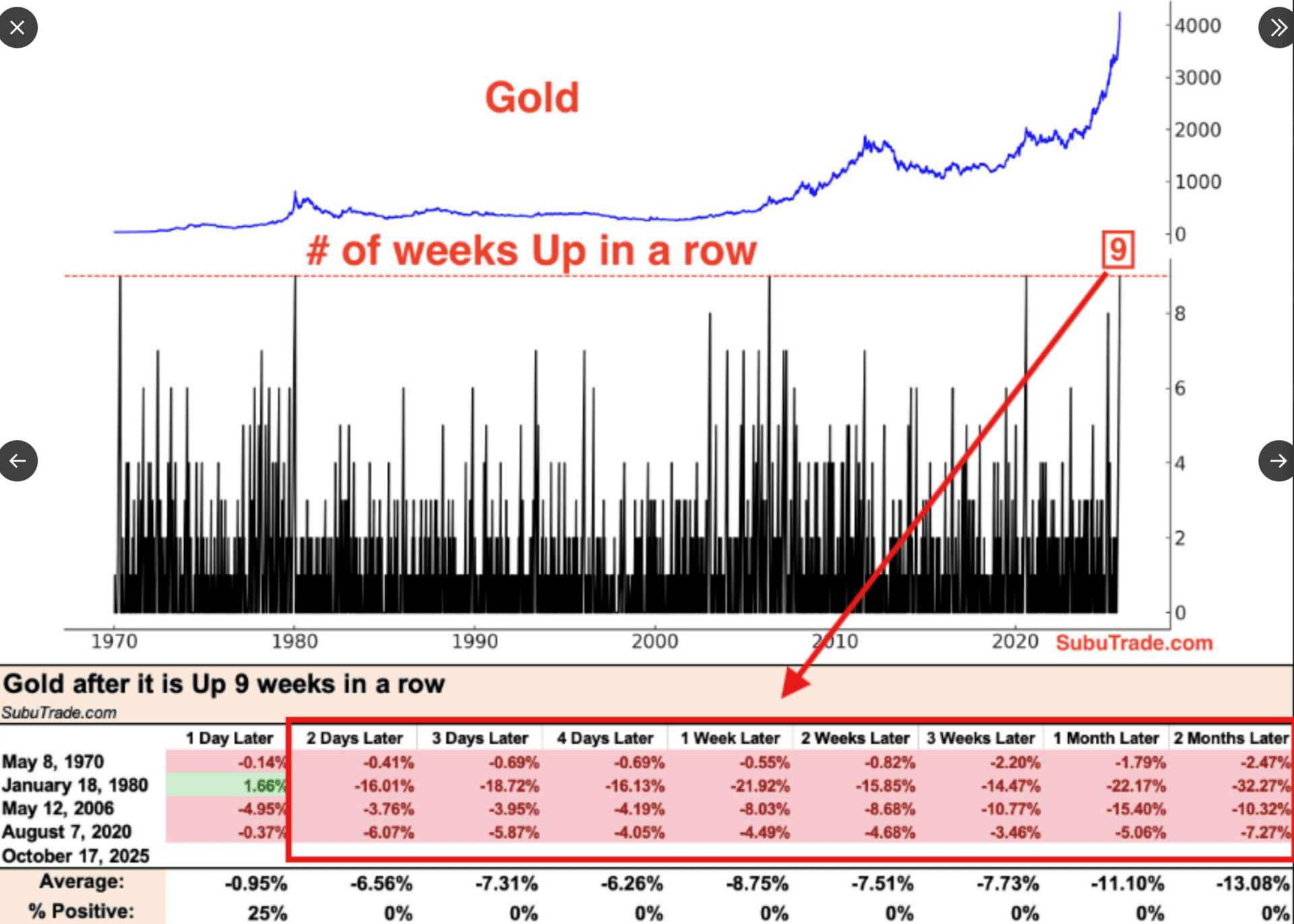

This wasn’t random. The signs were flashing red for weeks. Leading up to the drop, gold had rallied for nine straight weeks, something that’s happened only five times in history. Each previous streak ended with a major pullback, an average 13% decline within the next two months. The market was also bloated with inflows. In early October alone, gold and silver ETFs saw $17.7 billion pour in, the largest two-week inflow ever recorded. Everyone was long, everyone was confident, and no one expected the party to end. When everyone is positioned in the same direction, there’s no one left to buy. One sharp move lower can trigger a chain reaction of forced selling, margin calls, and algorithmic liquidations that quickly snowballs into a full-blown crash. That’s exactly what happened. Ironically, the long-term story for gold hasn’t changed much. Inflation remains sticky, government spending is ballooning, and central banks are still buying. U.S. debt just crossed $38 trillion for the first time ever, rising $400 billion in a single month, about $25 billion every day. At the same time, one in four institutional investors still call “long gold” their favorite trade, according to a recent Goldman Sachs survey, even more popular than “long AI.” So the demand side remains strong. But after this week’s selloff, positioning is what matters most. When too many traders pile into the same idea, even a fundamentally sound trend can crack under its own weight.

Ironically, the long-term story for gold hasn’t changed much. Inflation remains sticky, government spending is ballooning, and central banks are still buying. U.S. debt just crossed $38 trillion for the first time ever, rising $400 billion in a single month, about $25 billion every day. At the same time, one in four institutional investors still call “long gold” their favorite trade, according to a recent Goldman Sachs survey, even more popular than “long AI.” So the demand side remains strong. But after this week’s selloff, positioning is what matters most. When too many traders pile into the same idea, even a fundamentally sound trend can crack under its own weight.

This week’s selloff was a textbook crowded unwind. Too many traders were in the same trade with too much leverage and no room to escape when the tide turned. The good news is that it’s also a powerful reminder. Markets don’t punish the disciplined; they punish the overconfident. If you’re actively trading gold or other volatile instruments, make sure your prop structure gives you the flexibility to survive the outliers, the days that aren’t supposed to happen.