Here’s why Citi says crypto prices have been weak recently

- Dividend stocks can provide regular income and outperform the broader market.

- When building a dividend portfolio, investors should consider two key factors: dividend yield and annual cash flow.

- Four U.S. companies exhibit a high dividend yield and healthy annual cash flow.

In this article, we will use InvestingPro tools to review four companies that exhibit two crucial characteristics that dividend investors are looking for:

1. A Good Dividend Yield

The dividend yield shows the dividends a company pays out to its shareholders each year in relation to its stock price. It tells us how much of our investment we can get back just from what the company pays out.

It is expressed as a percentage and is calculated by dividing the profit on the investment by the money invested:

Profitability (%) = (Profit /Amount invested) * 100

For example, if a company's shares are trading at $13.29 and pay a dividend of $0.75 per share, with a dividend yield of +5.6%.

2. A Healthy Annual Cash Flow

This reflects a company's liquidity status and ability to meet debt obligations.

The difference between income and expenses is called net cash flow, which is the payments already received instead of net sales, which includes receivables.

Net cash flow shows that the company's assets can repay debts, reinvest in the business and return money to shareholders.

Well, now that we are clear on the concepts of dividend yield and cash flow, let's look at four companies with these two characteristics.

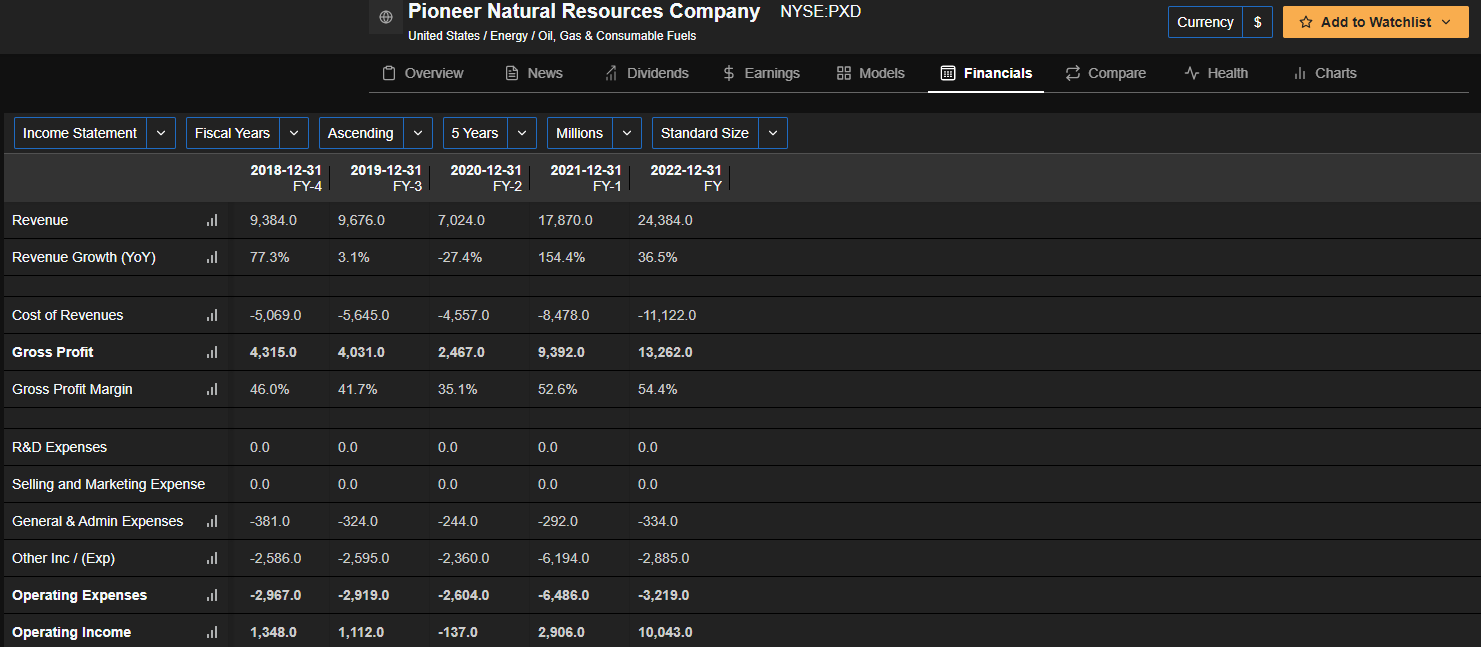

1. Pioneer Natural Resources

Pioneer Natural Resources (NYSE:PXD) is an American hydrocarbon exploration company based in Irving, Texas. The company was founded in 1997 due to the merger of Parker & Parsley Petroleum Company and MESA Inc.

Source: InvestingPro

It reported quarterly results on April 26, with earnings per share (EPS) of $5.21, beating expectations. Its dividend yield is +12%, and it generated $7.4 billion in cash flow in the last 12 months.

It bottomed in mid-March and is moving higher now. It has even managed to overcome the downward-sloping trendline and hit the first two Fibonacci upside targets.

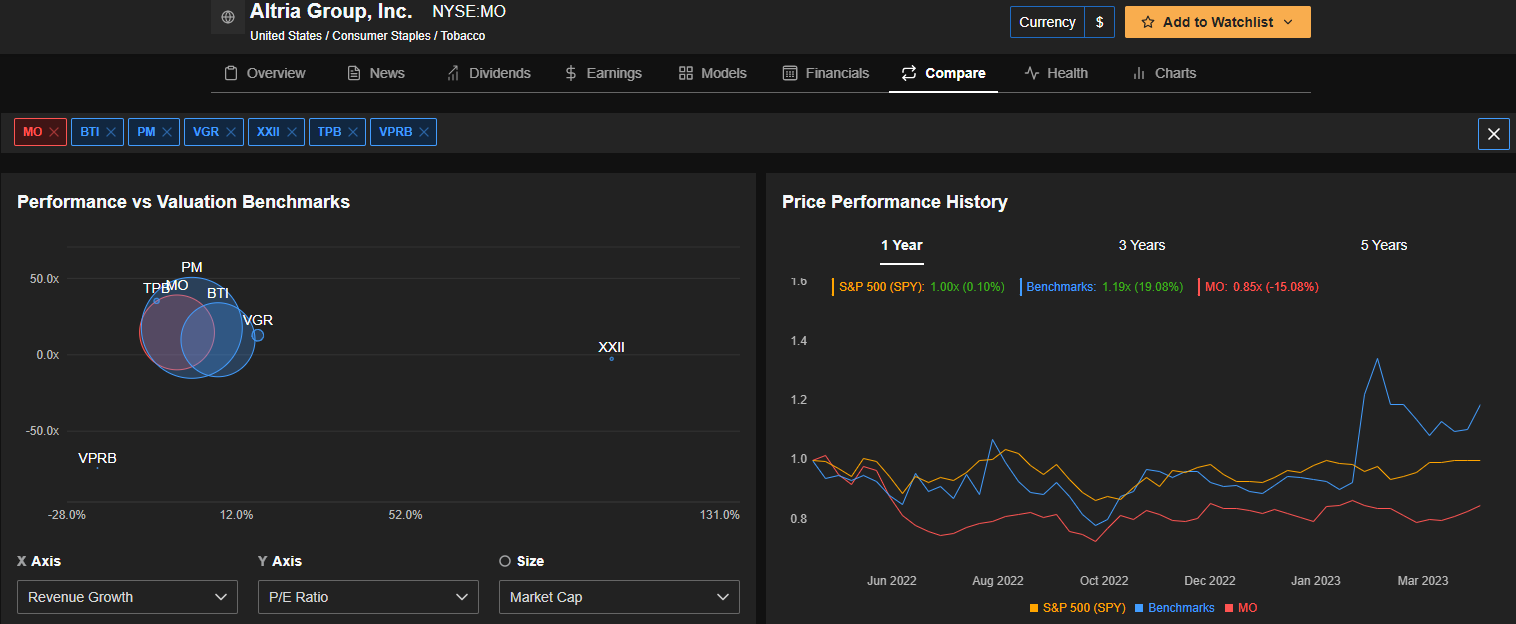

2. Altria

Altria Group (NYSE:MO) is one of the largest U.S. companies marketing food, beverages, and tobacco products. It has its headquarters in Virginia, near the city of Richmond. It owns the Marlboro brand through Philip Morris (NYSE:PM). It also owns a quarter of AB InBev (EBR:ABI).

Source: InvestingPro

It reported quarterly results on April 27, and its earnings per share (EPS) was at $1.18, in line with expectations. Its dividend yield is +8%, and it generated $8 billion in cash flow in the last 12 months.

It is trying to break above the rectangular range formed last July. There will be no weakness as long as it stays above $43.40.

3. ConocoPhillips

ConocoPhillips (NYSE:COP) is an international energy company headquartered in Houston, Texas, although it has offices in several countries. It is the third-largest oil company in the United States. It was created after the merger of Conoco and Phillips Petroleum Company on August 30, 2002.

Source: InvestingPro

It presents quarterly results on May 4 and is expected to report earnings per share (EPS) of 2.07 dollars per share. Its dividend yield is +5.5%, and it generated $18 billion in cash flow in the last 12 months.

The price remains in the range of its descending channel. However, it has reached the first Fibonacci target on the upside. Pulling back to $92 could result in a rebound.

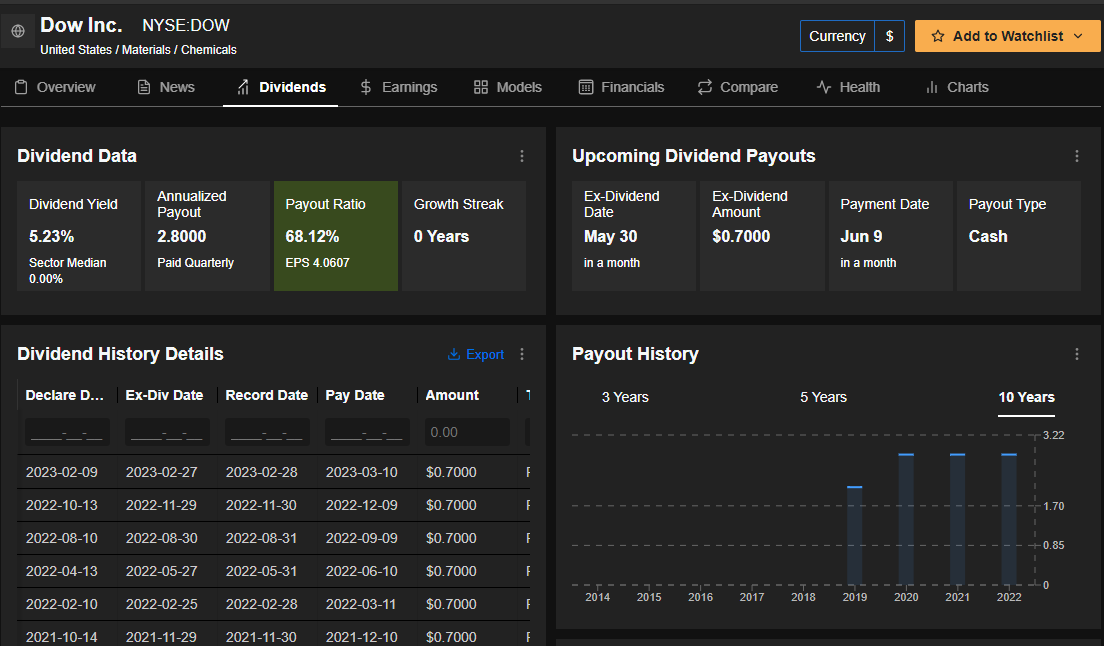

4. Dow Inc

Dow Inc (NYSE:DOW) is a multinational corporation headquartered in Midland, Michigan. It is one of the world's largest chemical companies, along with DuPont (NYSE:DD) and BASF (ETR:BASFN).

Source: InvestingPro

It reports quarterly results on July 25 and is expected to report earnings per share (EPS) of $0.39. Its dividend yield is +5.3%, and it generated $5.5 billion in cash flow in the last 12 months.

It is taking a breather after rallying for a month. A pullback to the $49.60 level could spark a rebound to the upside.

Disclosure: The author does not own any of the securities mentioned.