Vsee Health regains Nasdaq compliance after equity increase

- As Donald Trump’s return to the White House edges closer, there are several mid-cap stocks with significant fair value upside potential.

- Using the Investing.com stock screener, I identified five stocks poised to thrive in a Trump 2.0 era.

- Together, these five companies offer a unique opportunity to benefit from expected pro-growth policies, regulatory rollbacks, and strong fair value upside potential under Trump’s influence.

- Looking for more actionable trade ideas? Subscribe here for up 55% off as part of our Early Bird Black Friday sale!

As Donald Trump’s anticipated return to the White House approaches, several mid-cap stocks with notable fair value upside, according to InvestingPro’s AI-backed quantitative models, appear poised for gains.

These companies are uniquely positioned to thrive under the anticipated pro-growth, deregulation-focused policies of a Trump administration, providing investors with growth potential and robust fair value upside.

Here’s a look at five stocks positioned to thrive under a Trump 2.0 era, along with the factors expected to drive each.

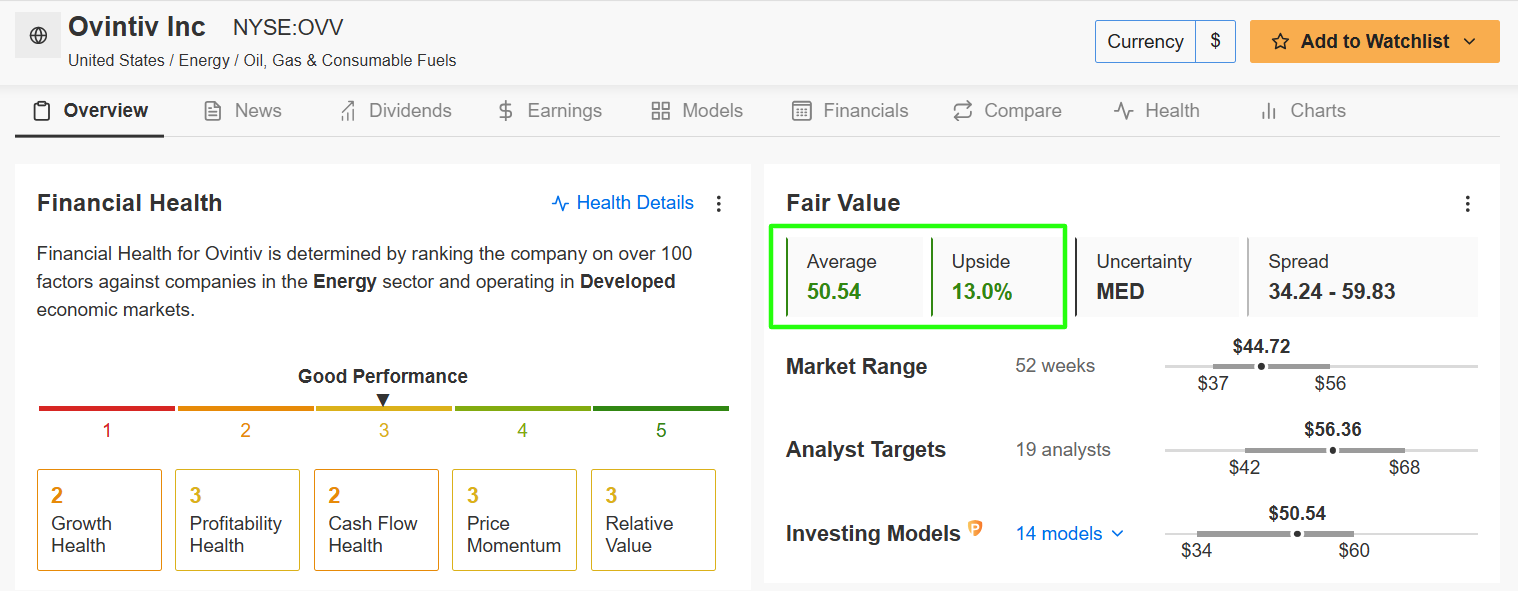

1. Ovintiv - Energy

- Current Price: $44.72

- Fair Value Estimate: $50.54 (+13% Upside)

- Market Cap: $11.6 Billion

Why It’s Set to Benefit: Trump’s “drill, drill, drill” approach would ease regulations on fossil fuels, creating an ideal environment for U.S.-based oil and gas producers like Ovintiv (NYSE:OVV) to capitalize on expanded drilling opportunities.

With a major focus on shale production and a robust asset base, Ovintiv could boost output in a supportive policy climate, likely resulting in a significant revenue surge.

OVV stock is currently trading at a bargain valuation, according to the AI-backed models in InvestingPro. Shares could see an increase of 13% from Thursday’s closing price, bringing it closer to their ‘Fair Value’ of $50.54 per share.

Source: InvestingPro

Wall Street analysts surveyed by Investing.com are even more optimistic and see the stock at $55.13 per share, implying upside potential of 23.3%.

2. Columbia Banking System - Financial Services

- Current Price: $31.12

- Fair Value Estimate: $36.48 (+17.2% Upside)

- Market Cap: $6.5 Billion

Why It’s Set to Benefit: Expectations of deregulation are already giving banking shares a lift. Columbia Bank, a regional banking leader, stands to benefit from lessened regulatory pressures, enabling greater lending and higher margins.

With a strong customer base in lending, Columbia’s earnings and investment banking revenues may climb if restrictions are relaxed, creating a favorable landscape for growth.

According to the InvestingPro model, Columbia Banking System (NASDAQ:COLB) stock is presently priced well below its 'Fair Value' estimate. Anticipated growth of roughly 17% from its current price could bridge the gap to $36.48 per share.

Source: InvestingPro

Furthermore, all 12 of the analysts surveyed by Investing.com rate Columbia Bank’s stock either as ‘buy’ or ‘hold’, reflecting a bullish recommendation.

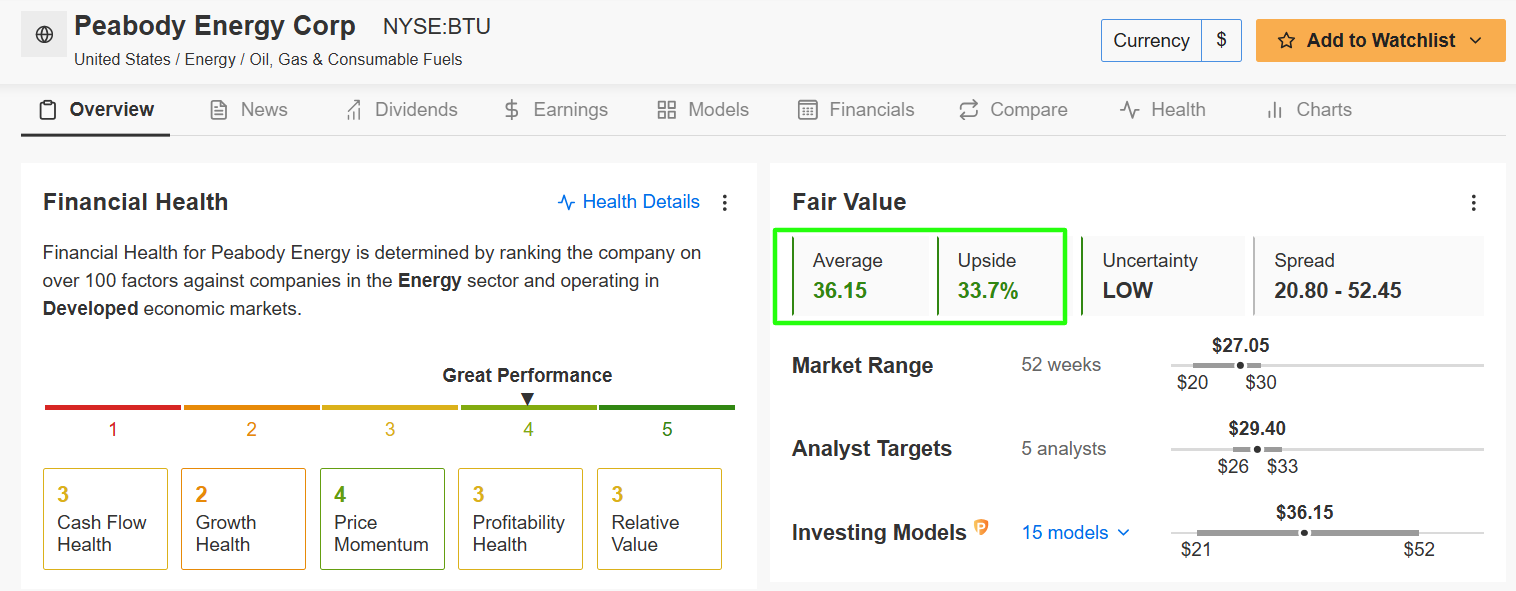

3. Peabody Energy - Coal

- Current Price: $27.05

- Fair Value Estimate: $36.15 (+33.7% Upside)

- Market Cap: $3.3 Billion

Why It’s Set to Benefit: Trump’s win could translate to relaxed environmental policies, enabling extended lifespans for coal-fired plants and boosting Peabody’s production and exports.

As one of the world’s largest coal producers, Peabody (NYSE:BTU) is positioned to capitalize on new demand, especially if U.S. coal sees renewed market support. This favorable backdrop suggests substantial earnings upside if regulations remain relaxed.

The present valuation of BTU stock suggests it is a bargain, according to the InvestingPro model. There's potential for a gain of almost 34% from its current price, aligning it with its 'Fair Value' target estimated at $36.15 per share.

Source: InvestingPro

Additionally, Wall Street has a long-term bullish view on Peabody Energy, with all five analysts surveyed by Investing.com rating the stock as either a ‘buy’ or a ‘hold’.

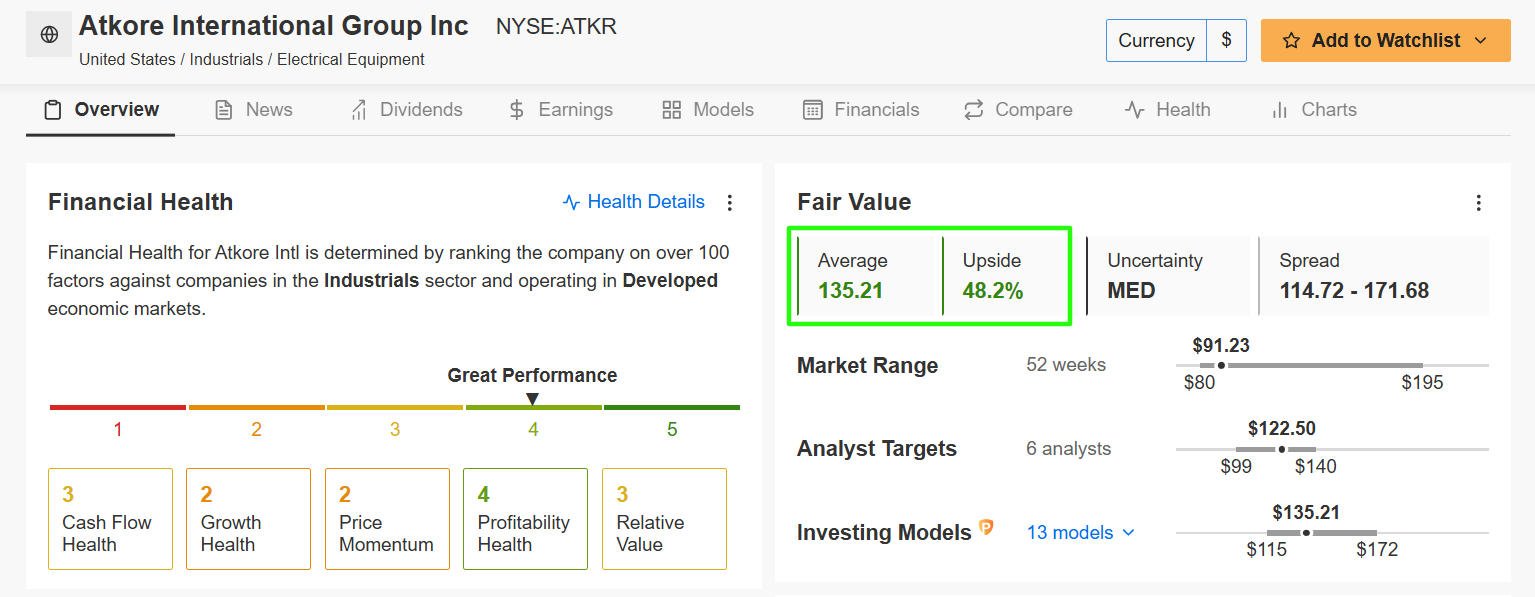

4. Atkore - Industrial Products

- Current Price: $91.23

- Fair Value Estimate: $135.21 (+48.2% Upside)

- Market Cap: $3.2 Billion

Why It’s Set to Benefit: With a focus on electrical conduits and industrial materials, Atkore (NYSE:ATKR) would benefit from Trump’s expected infrastructure spending and supportive tariffs on domestic manufacturing.

Tariffs could bolster domestic sales as Atkore’s products support major U.S. infrastructure and development projects.

ATKR stock currently trades at a bargain valuation, as indicated by the InvestingPro model, reflecting strong investor expectations that construction demand may strengthen its core business. There's a possibility of a 48.2% increase from its current value, moving it closer to its 'Fair Value' set at $135.21 per share.

Source: InvestingPro

In addition, Wall Street remains optimistic on Atkore, as per an Investing.com survey, which revealed that analysts have a stock price target of $122.50, implying potential upside of roughly 35%.

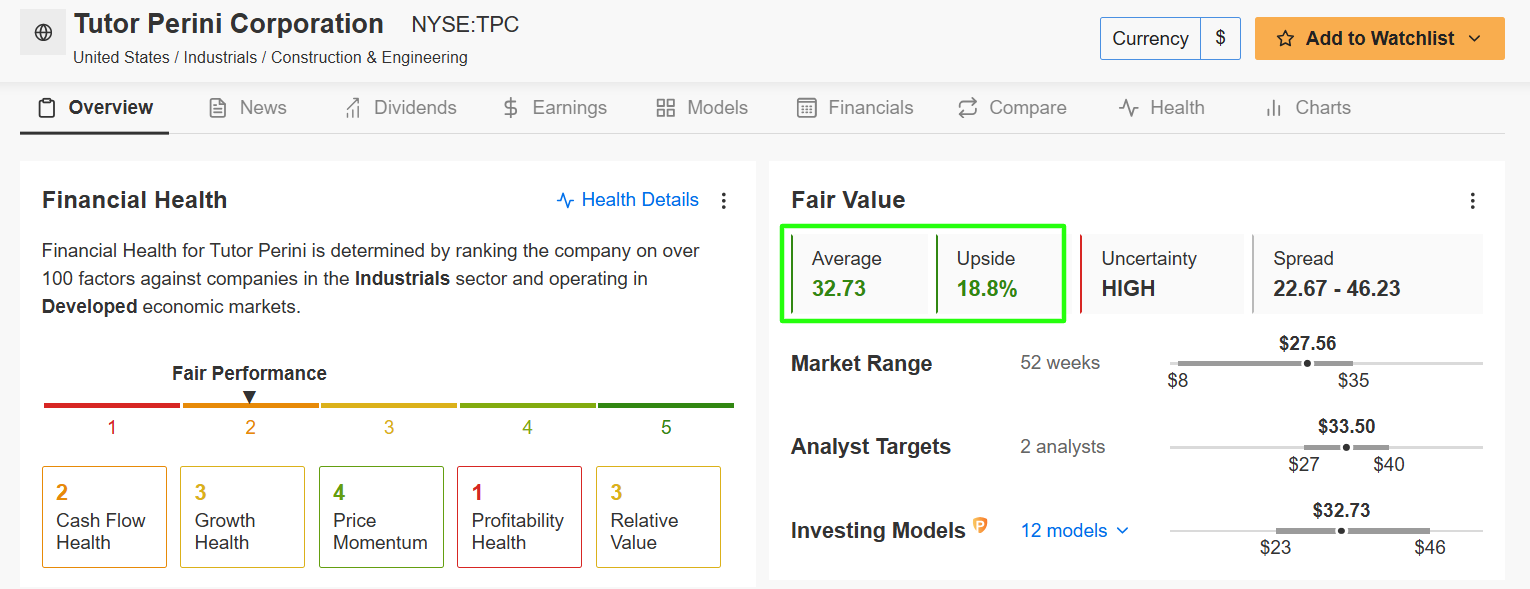

5. Tutor Perini - Construction

- Current Price: $27.56

- Fair Value Estimate: $32.73 (+18.8% Upside)

- Market Cap: $1.5 Billion

Why It’s Set to Benefit: Tutor Perini (NYSE:TPC), a prominent infrastructure builder, could see gains from Trump’s pro-construction policies, including tax incentives and loosened restrictions on building.

The administration’s focus on easing supply shortages in housing and infrastructure could stimulate demand, driving significant revenue growth as Tutor Perini’s large-scale project pipeline meets expanding market needs.

The InvestingPro model indicates TPC stock is currently extremely undervalued. There's a possibility of an 18.8% increase from the current price, bringing it closer to its 'Fair Value' estimation of $32.73 per share.

Source: InvestingPro

Furthermore, the sentiment among analysts polled by Investing.com is overwhelmingly positive, forecasting Tutor Perini’s stock to climb to $33.50 per share, projecting a significant upside of 21.6%.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to take advantage of the 55% off amid the Black Friday sale and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, Bill Ackman, and George Soros are buying.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.