Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

Tuesday's 'black' candlesticks were the red flag for bulls - as often they are - when the sizable opening gaps were quickly pegged back, and in the days that followed, bears were able to continue selling, leading to yesterday's losses.

The net effect of this is that indices are evolving from an attempted recovery off October/November lows into broader sideways ranges.

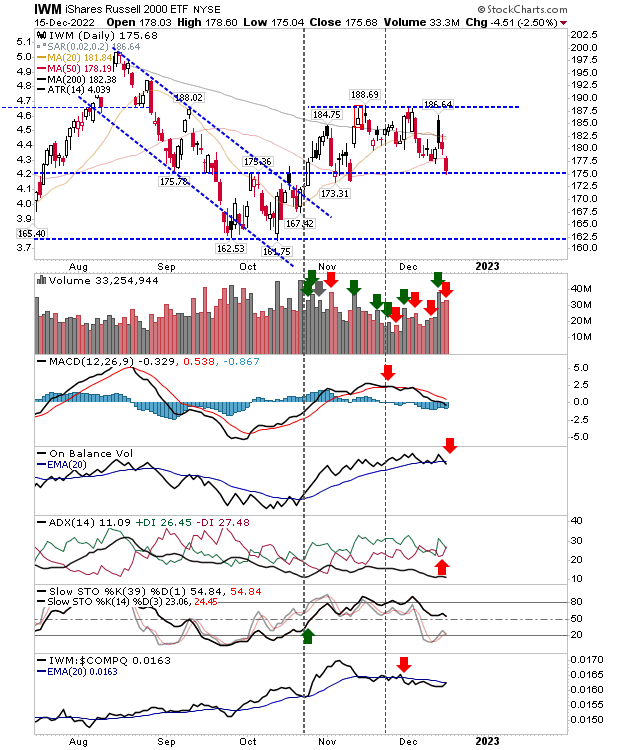

The Russell 2000 (via IWM) is back at former resistance from the October low - now support - in confirmed distribution. There is an opportunity to dig in at support, even allowing for an intraday spike below this support for today's trading.

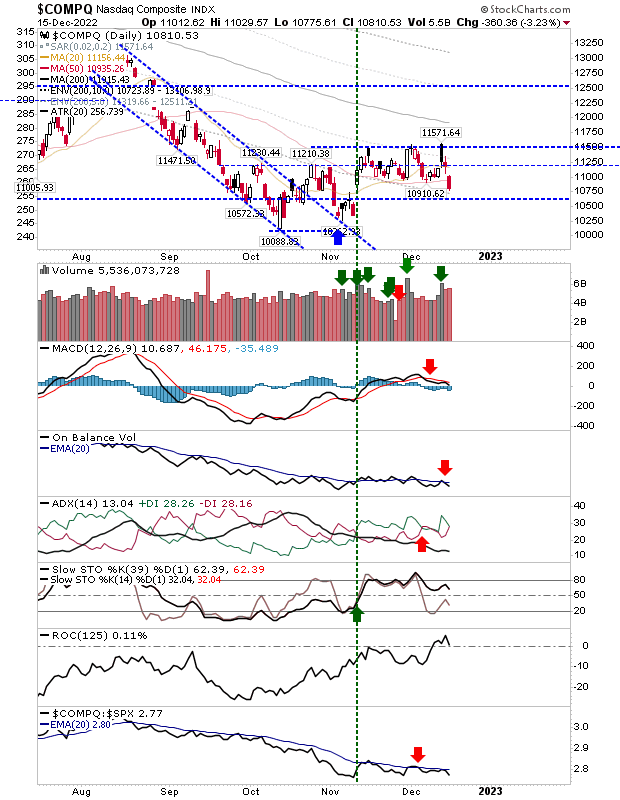

The Nasdaq Composite lost the support level the Russell 2000 is defending and now finds itself in a price congestion area it last traded when it was making its October swing low. Technically, there are 'sell' triggers in the MACD, On-Balance-Volume, and relative performance to the S&P 500.

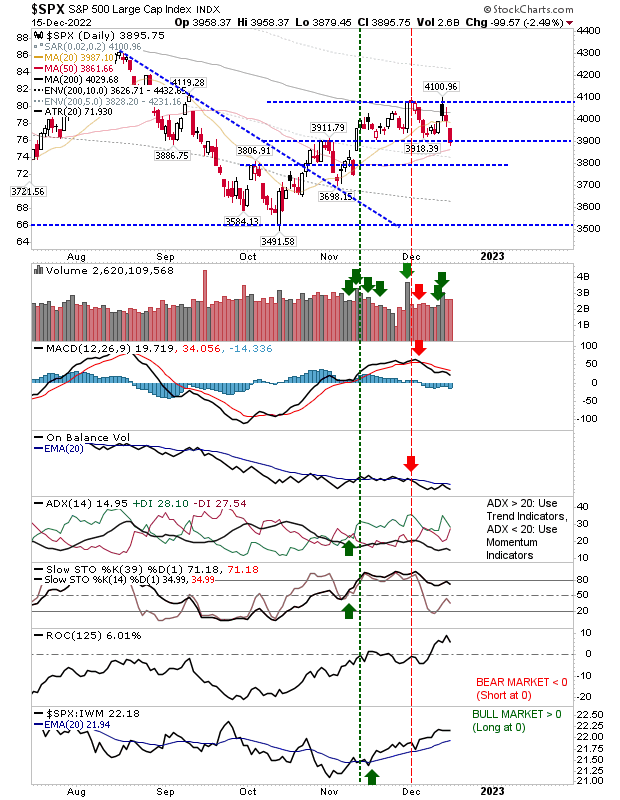

The S&P 500 is heading to a test of its 50-day MA while also defending support from the October swing high. As with the other indices, it has 'sell' triggers in the MACD and On-Balance-Volume to contend with, but is outperforming peer indices. I would be looking for a test of its 50-day MA and then a bounce.

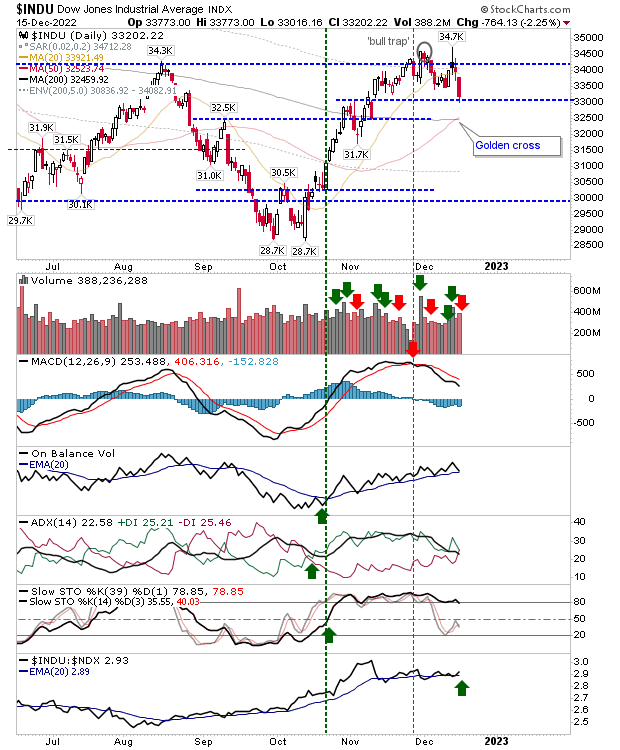

The Dow Jones Industrial Average is the strongest index but it took a big hit today. However, this did not prevent a golden cross between 50-day and 200-day MAs. The index is building a bullish handle as part of its cup-and-handle pattern.

Today's losses are likely to follow through in early morning action, but look for a post-lunch rally to set up a significant spike low. The chance for such a reversal is highest in the Dow Industrial, but any index with nearby support is a possibility.