One & One Green Technologies stock soars 100% after IPO debut

- Bitcoin's recent surge has been fueled by ETF inflows.

- However, that's not the only factor fueling the surge, as Chinese capital outflows have sparked a recent correction.

- Historical data suggests Bitcoin could undergo an explosive rally again, albeit with notable retracements along the way.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

Bitcoin has surged over 50% since the launch of the first Bitcoin ETFs, fueled by a continuous stream of investor money flowing into these exchange-traded funds.

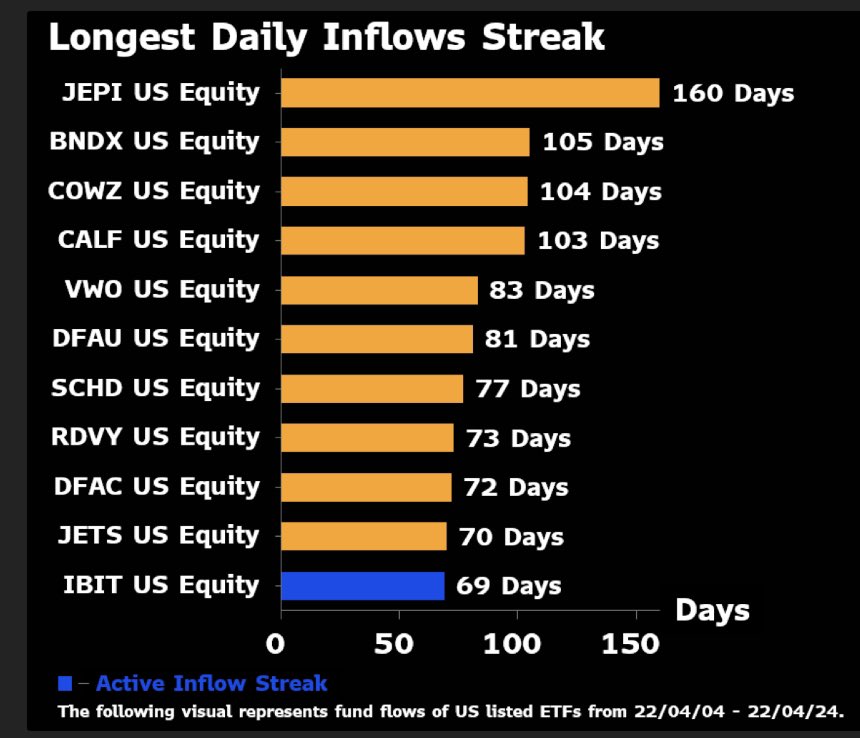

BlackRock's iShares Bitcoin Trust (NASDAQ:IBIT), specifically, has witnessed a remarkable 69 consecutive days of inflows, steadily adding to the positive sentiment surrounding the cryptocurrency.

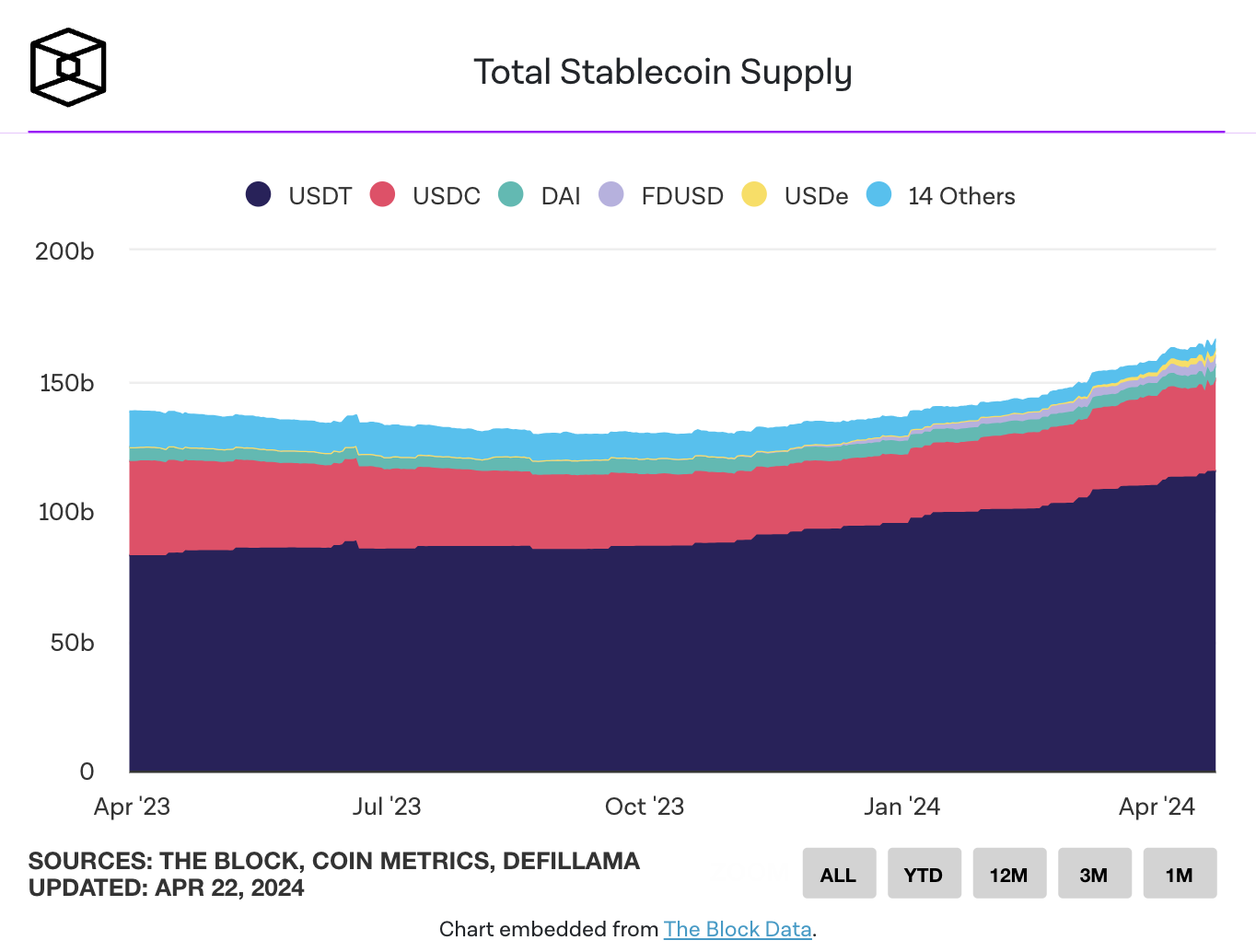

This surge catapulted the ETF into the top 10 for consecutive daily inflows. And that's not all - total stablecoin supply surpassed $165 billion for the first time since June 2022.

The cryptocurrency sector is surging, reaching its highest level in two years. This could signal further bullish bets.

Chinese Outflows Sparked the Correction

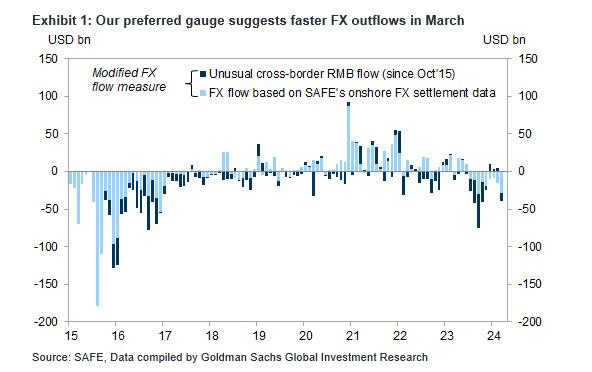

However, an even more intriguing development mirrors the second half of 2023: rising Chinese currency outflows.

Traditionally, gold has been the preferred method for circumventing Beijing's capital controls. But this time, the significant Chinese capital outflow is also a major driver of the cryptocurrency market's over 80% surge in recent months.

To understand this connection further, let's examine the next chart on currency flows. It will detail onshore spot transactions, newly entered and deleted forward transactions, and the SAFE dataset on "cross-border flows."

China's net outflows surged to $39 billion in March, a sharp increase from $11 billion in February. This rapid pace of outflows hasn't been seen since September 2023, marking a significant uptick in recent months.

While the common belief attributes Bitcoin's surge primarily to the launch of Bitcoin spot ETFs, what many overlooked were China's inflows into crypto, a trend persisting since 2015.

These inflows paved the way for further strengthening of the US dollar in March, evidenced by the USD/CNY exchange rate trending upwards.

This movement aligns with expectations during capital flight scenarios, coinciding with Bitcoin reaching new highs.

Bitcoin Could Reach New Highs

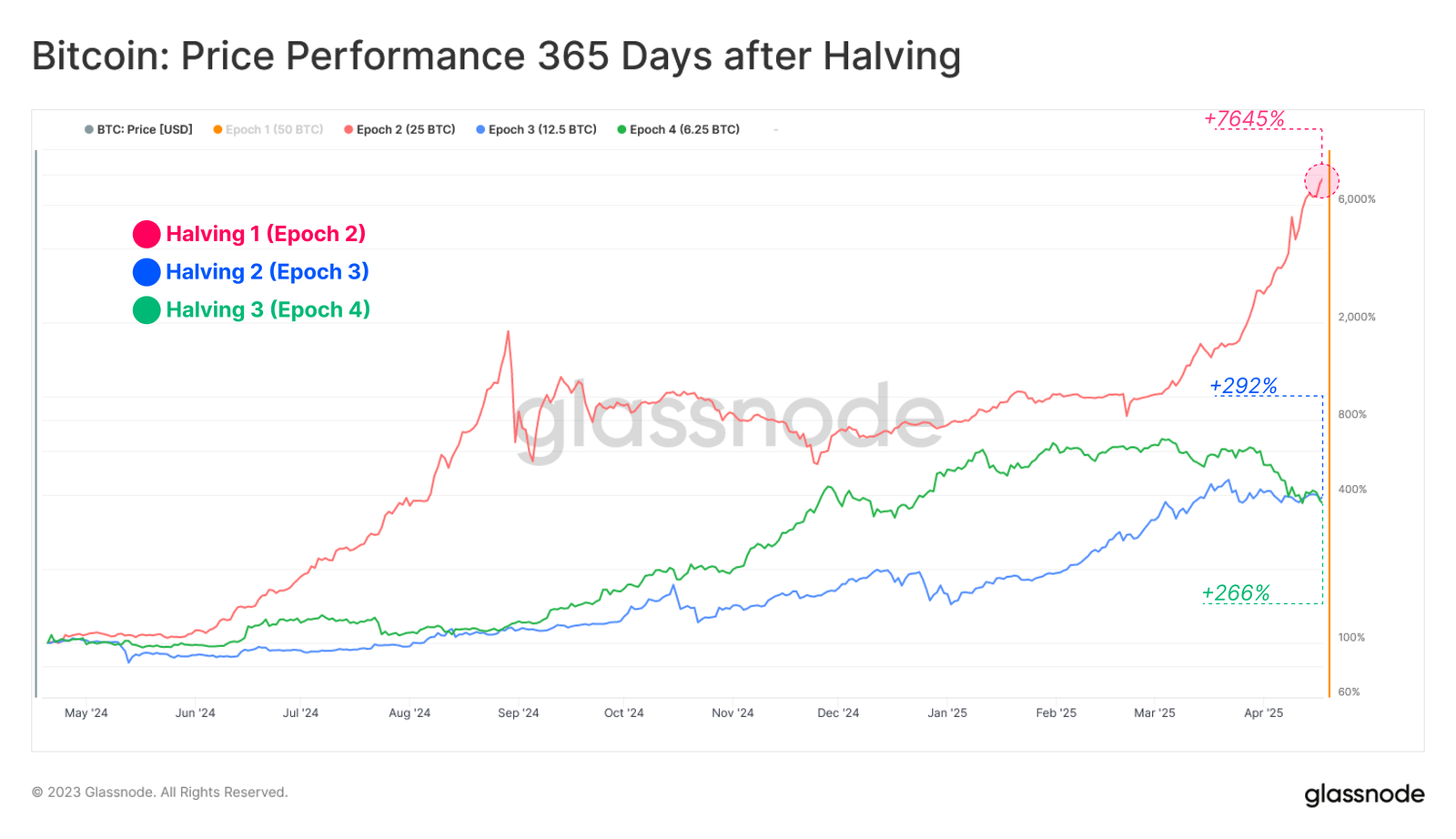

New highs in the coming months for Bitcoin shouldn't catch us off guard. Looking at the price trends during various halving eras, there's a broad pattern. We can observe a similarity between the cycles of 2015, and 2018, and the present one.

Each of these cycles saw significant increases, ranging between about 200% and 300%. Notably, the current cycle stands out as it marked a new all-time high (ATH) before the halving event, a distinction not shared by the previous cycles.

While the outlook appears encouraging and historical data indicates the halving event's strength, it's crucial not to overlook the significant retracements experienced along the way, which have ranged from -30% to -70%.

***

Want to view BTC-related stocks and their Fair Value? Try InvestingPro+ and find out! Subscribe HERE and get over 40% off your annual plan for a limited time!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.