European stocks mixed on Friday after volatile week; U.K. economic woes

- Bitcoin’s inverted head and shoulders pattern hints at potential upward breakout, targeting $117,000.

- Ethereum trades within narrowing consolidation, with key levels set at $4,200 and $4,500.

- Weaker Bitcoin selling and slowed ETF outflows pause declines; inflation data may shift trends.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

At the start of September, the prices of Bitcoin and Ethereum are steady after rising in late August. Sellers gained control because money flowed out of Bitcoin-based ETFs and big holders, known as whales, sold off coins.

The decline has slowed down, and prices are now moving sideways, which might give buyers a chance to push prices up again. This outlook also applies to Ethereum. Additionally, Bitcoin is showing a reverse head and shoulders pattern, which might suggest an upcoming upward momentum.

Bulls Seek Support From ETFs

At the end of August and the start of September, ETF inflows decreased, which might stop the market from continuing its decline. This decline is happening with relatively low trading volumes, with outflows reaching $250-300 million at most, not large enough to push the market further down at this point.

The sell-off in August was likely driven by major Bitcoin holders selling $14.06 billion worth of the cryptocurrency, the most in three years. As we enter September, the activity of these whales has decreased, reflecting the current stable chart pattern. A potential change in this situation could come with the release of US inflation data tomorrow.

The best outcome for cryptocurrencies would be if the inflation numbers are lower than expected, showing that the CPI is nearing the Federal Reserve’s 2% target.

Bitcoin: Will It Complete the Head-and-Shoulders Pattern?

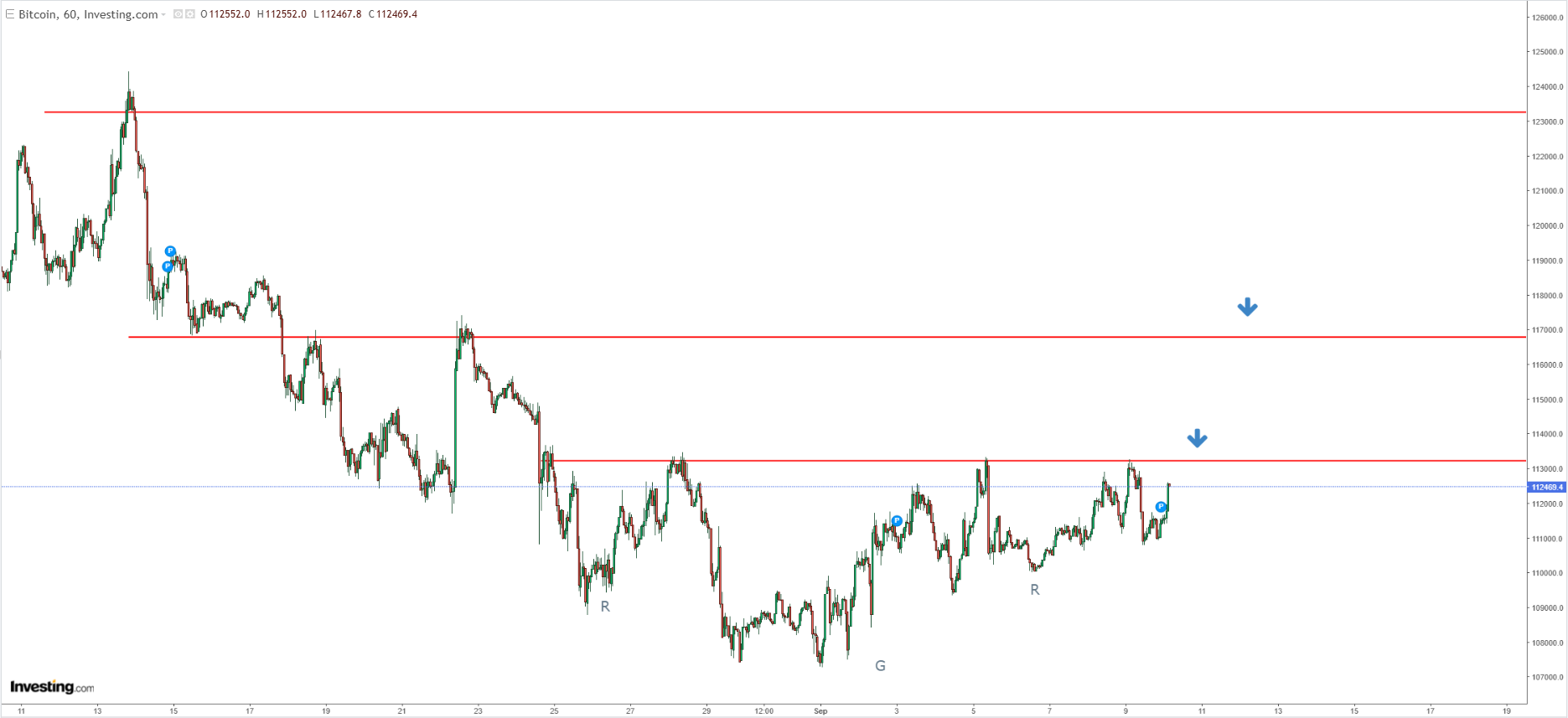

The current stable price movement is forming an inverted head and shoulders pattern, suggesting a possible chance to consider a long position. The critical level to watch is the neckline, found around $113,000 per coin.

The weaker responses from sellers make it more likely that prices will break out from the current area, possibly leading to a move towards the $117,000 resistance level and the start of a new growth phase. However, if the price falls below the right shoulder of the formation, around $109,000, this upward scenario could be invalidated.

Ethereum’s Consolidation Tightens

The current technical situation on Ethereum can be described as consolidation within consolidation, indicating a period of waiting for a breakout to determine the market’s next direction. If prices fall below $4,200, there is potential for a correction down to the key support level near the psychological barrier of $4,000 per Ether.

For the upward trend to continue, breaking above the $4,500 level is crucial, which could then lead to an attempt to reach the historical highs around $5,000.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.