Bubble Wrap maker Sealed Air surges on report of buyout talks

Up to early August, see here, we had for Bitcoin an

“ ideal target zone is between $27300-28100, which fits well with the “$27750-29000” zone we already forecasted in June.”

Everything remained on track until BTC dropped below the lower end of support ($27.5K) on August 17 and has yet to recover back above it. Moreover, now Bitcoin is challenging its June lows, which means our more immediate Bullish thesis is being severely challenged and we must concede to the possibilities of several other options. These are presented in Figures 1, 2, and 3 below.

Meanwhile, we recognize that we like to always be right about the financial markets and assets' next move. But that is unrealistic, and we are humble, flexible, and open-minded to know our forecast is wrong when an invalidation level is reached. Trading is no different, while we can only control our entry, exit, and risk; we cannot control the outcome of a trade, price movement, and other participants.

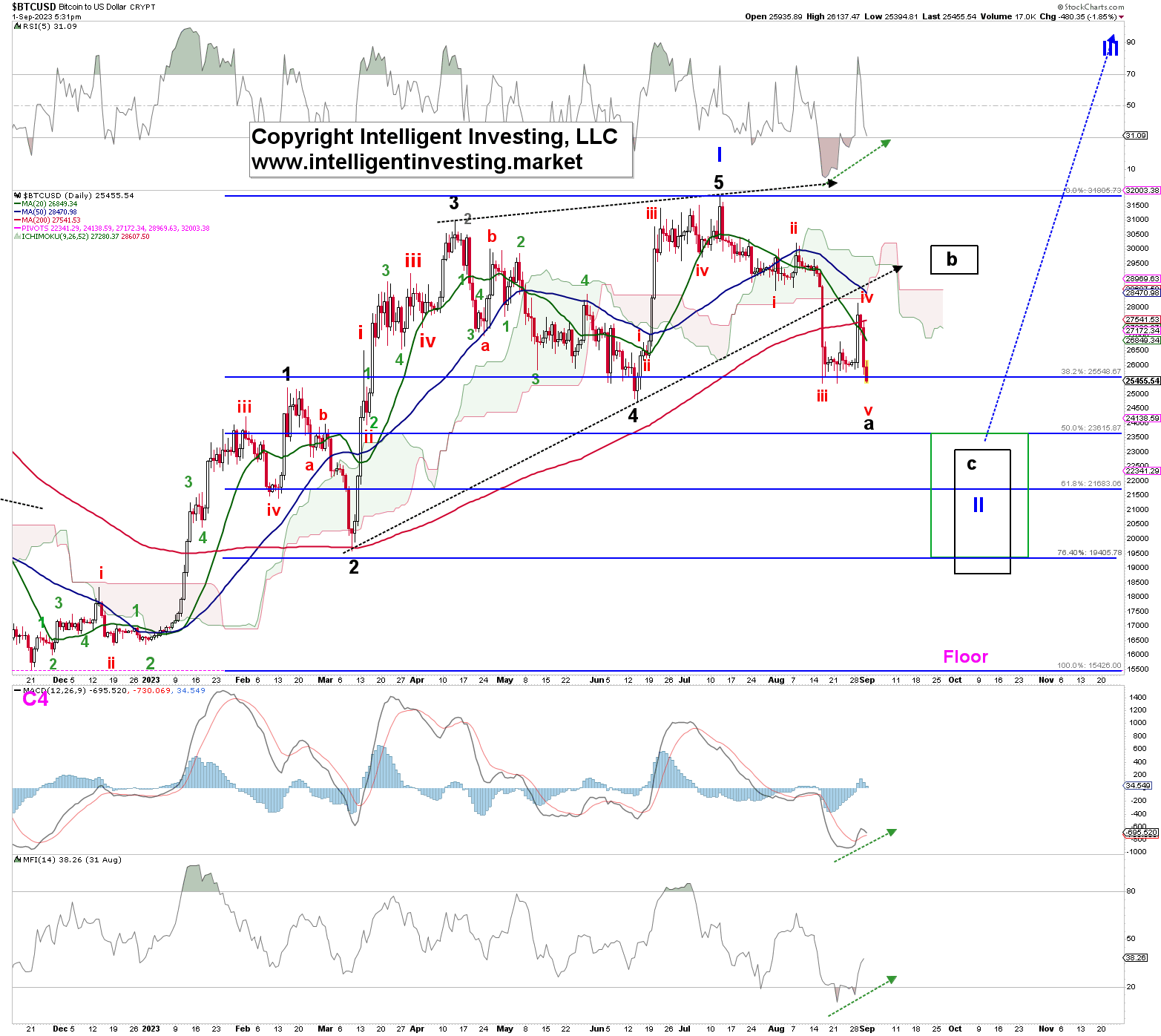

Figure 1. The daily chart of BTC with several technical indicators

The August 17 drop has opened up several options, from an Elliot Wave Principle (EWP), perspective, which is not ideal, but we have to accept the hand the markets deal us. In this article, we will go over the most likely options and present an alternative. Starting with Figure 1 above, we can count the rally from the November 2022 low to the July 2023 high as a leading diagonal (LDs) first wave. BTC is now in the 2nd wave, from where the 3rd wave to new all-time highs will start.

A 2nd wave comprises three waves: W-a, -b, and -c. In this case, black W-a is about to complete in a five-wave sequence around $25-24.5K, and then we can start to look for a decent rally back to $29.5-30.5 zone for black W-b, which will subdivide into W-a, -b, and -c. TBD how exactly. From there, black W-c can kick in, ideally targeting $19-23K, which matches well with the 50-76% retrace zone typical for a 2nd wave. Note the positive divergences developing on the daily TIs, suggesting a reversal soon. Divergence is always a condition, not a trigger. But it must be noted, that it matches the EWP count.

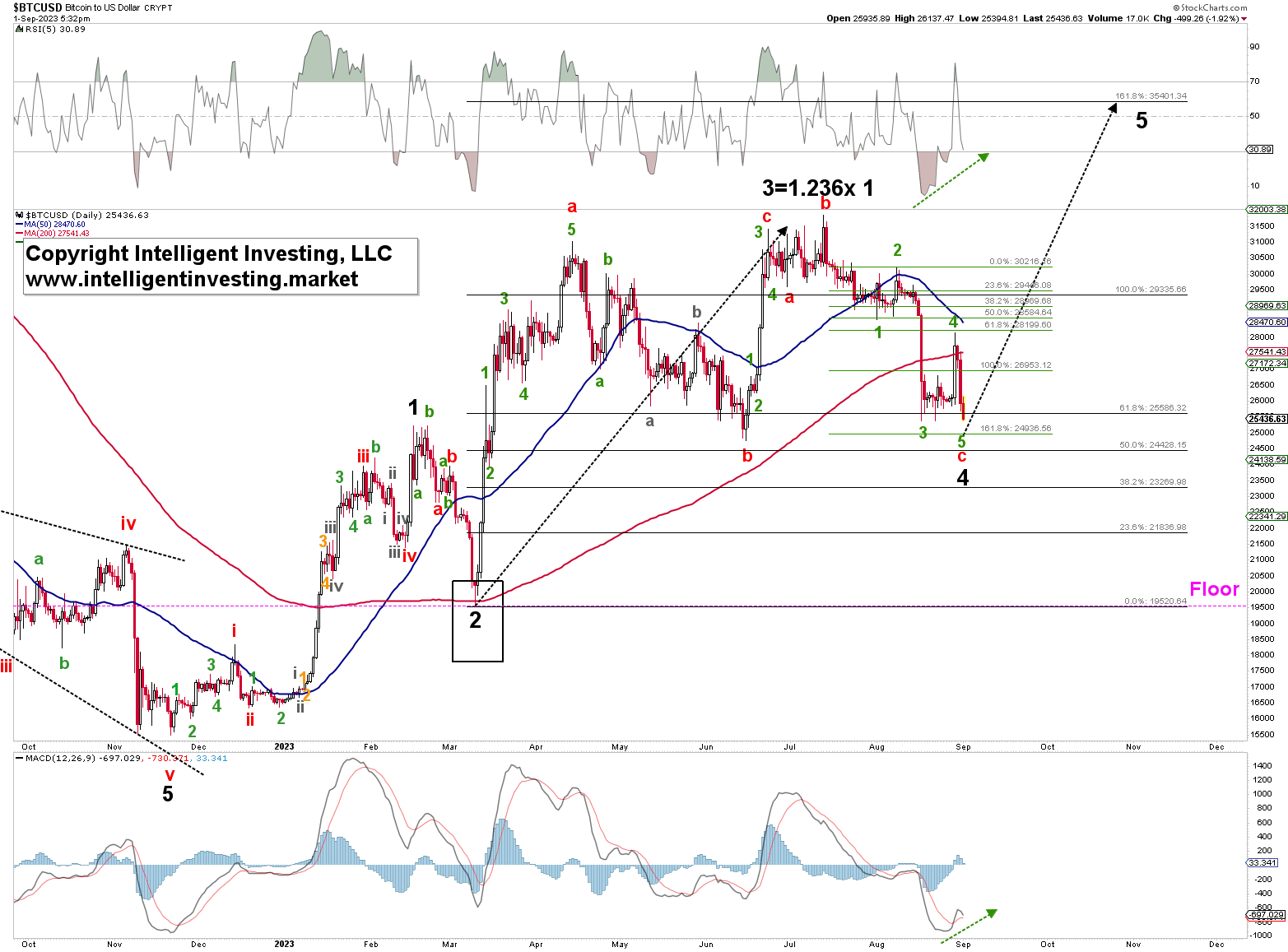

Figure 2. The daily chart of BTC with several technical indicators

The 2nd option is presented in Figure 2 above, and it shows the aforementioned LD 1st wave is not yet complete. Instead, BTC may be completing the black W-4 at ideally around $24.9K+/-200 before the black W-5 to $35.4K kicks in.

Thus, both options tell us to look for a low soon at around the same price levels and then a rally. One rally will just be “a bounce” (black W-b in Figure 1), whereas the other is a more sustainable intermediate-term rally (black W-5). How will we eventually know the difference between the two? Simple. Back above $30.5K, and the odds increase the 2nd option is in play, with confirmation above $31.5K. If Bitcoins stalls at around $30.0+/-0.5K and then drops below current levels option 1 is operable. At this stage, we simply cannot say which of the two it is.

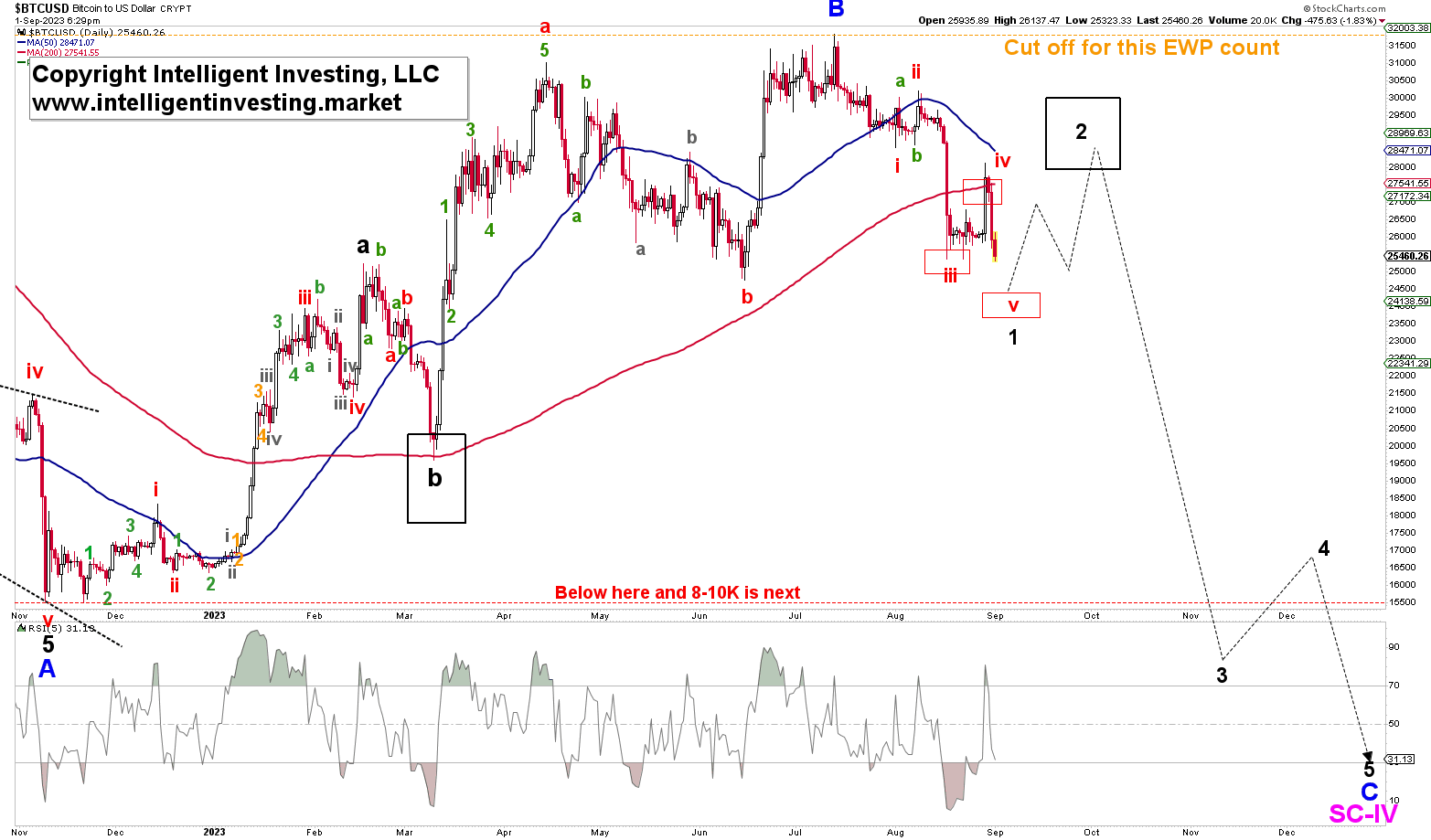

The alternative is presented in Figure 3 below. This 3rd option suggests the November ‘22 to July ‘23 rally was a counter-trend rally (blue W-B) of the November ’21 to November ‘22 Bear market, which is now to resume. BTC is now in the starting gates of the third and last leg lower of that Bear market: Blue W-C, which will subdivide into five smaller waves: black W-1 through 5. Like options 1 and 2 we should soon see a bounce (black W-2), from around $24.0+/-0.5K to ~$29.-+1.0K before the wheels come off and BTC targets $8-10K.

Figure 3. The daily chart of BTC with several technical indicators

Thus, even the alternative is looking for higher prices soon as well but this will be followed by a steep decline. If this decline drops below the March low ($19555) we will make this alternative option our preferred option. Lastly, please note that all three options are long-term Bullish, as our ultimate target for BTC remains a six to seven-digit figure. Even the 3rd option will allow us to attain that, as the blue W-C will complete a Super Cycle 4th wave, and we know from the EWP that after a fourth wave, a fifth wave follows.