Gold prices slide further as easing US-China tensions curb haven demand

Summary:

- Boeing’s latest earnings show the company’s cash flows are improving as airlines slowly begin to take 737 Max orders.

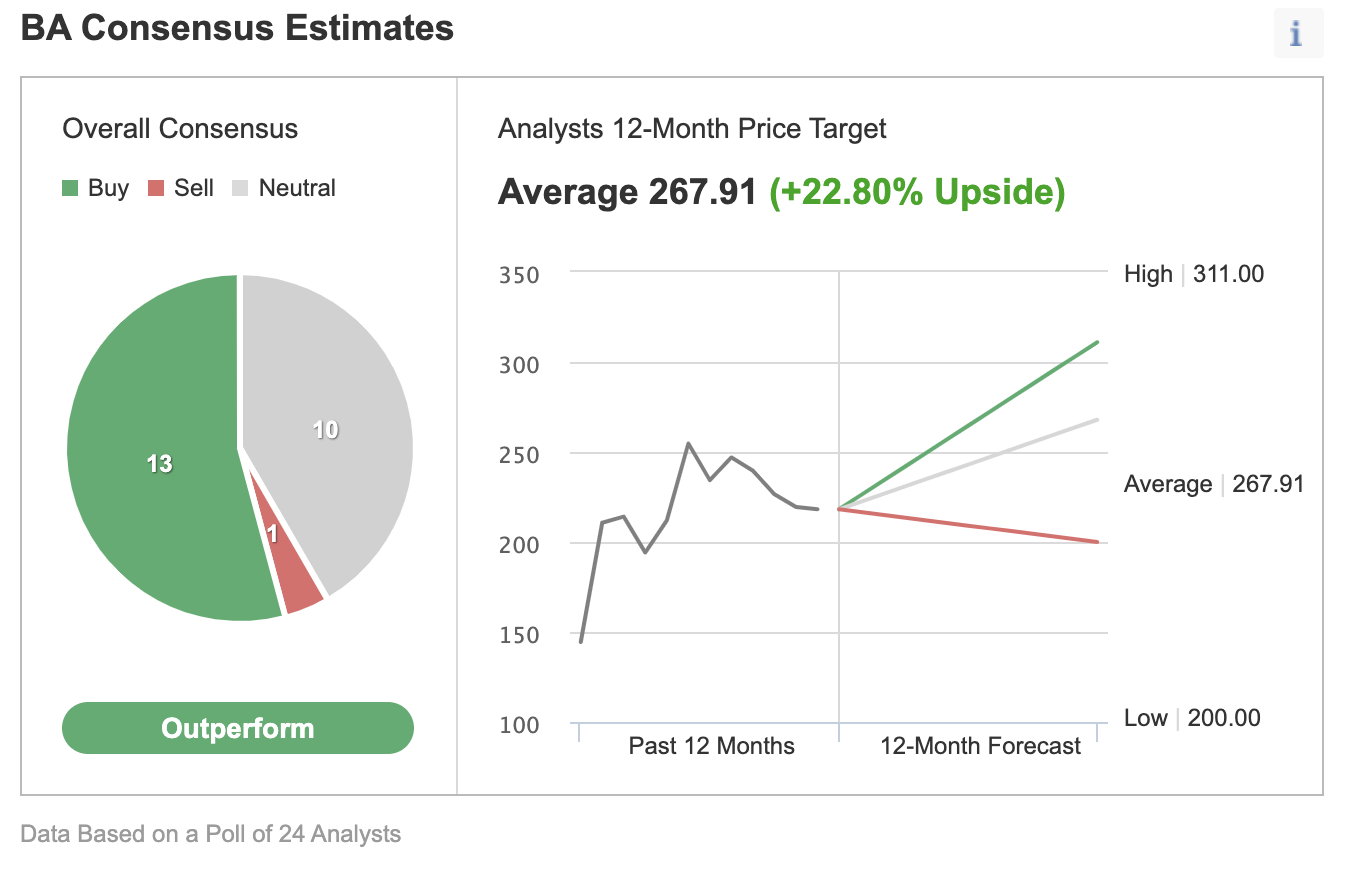

- Despite the earnings surprise, Wall Street remains divided over the long-term appeal of BA stock.

- China, where MAX is still grounded, remains the biggest short-term risk to BA stock.

Among the major US corporations, Boeing (NYSE:BA) presents an interesting risk-reward proposition for long-term investors. While the aerospace giant is slowly regaining its lost ground after three disastrous years, the lingering pandemic and the company’s production woes are holding back a solid recovery in its business.

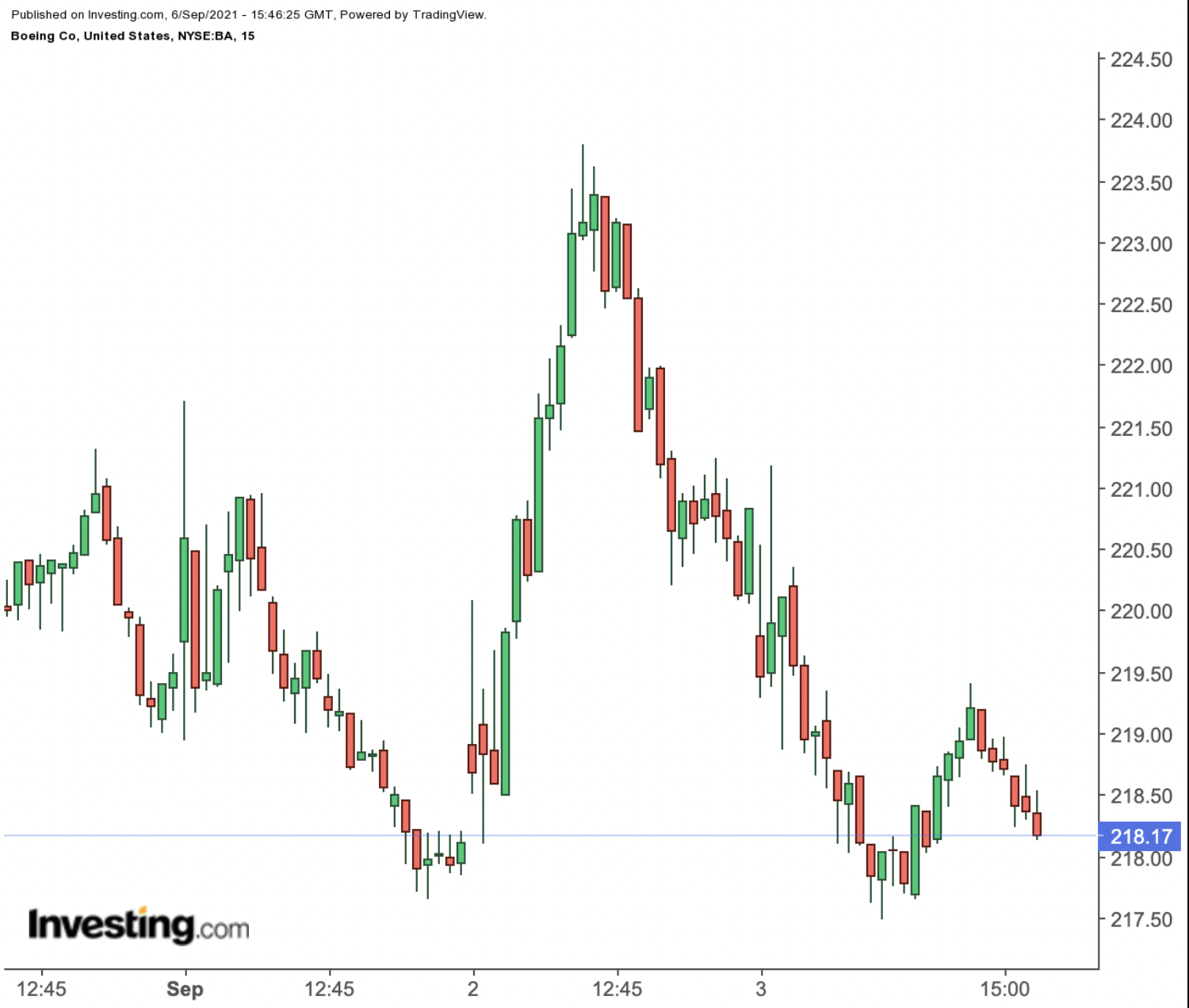

This situation is keeping Boeing stock under pressure, despite a strong rebound from the market crash in March 2020. BA shares are little changed this year, massively underperforming the Dow Jones Industrial Average, which has surged about 16% during this period. Trading at $218.17 at the close Friday before the long weekend, BA remains about 50% than the all-time high it reached in early 2019.

Some investors believe this is a good time to buy BA stock, as the aerospace giant shows signs of a budding recovery after one of the worst financial crises in the plane-maker’s century-long history. Its flagship MAX jets were grounded for nearly two years after two fatal crashes that took 346 lives.

That crisis was followed by the global pandemic, which sapped demand for new airplanes as passengers stayed home and airlines retrenched. During this period, Boeing also grappled with production-quality problems on its 787 Dreamliner.

Bulls favoring Boeing stock are pointing to the company’s earnings momentum in its latest quarterly earnings. That report gave a strong signal that the company is slowly succeeding in reducing its cash-burn and perhaps the worst in this downturn is behind it. For the second-quarter earnings announced on July 28, Boeing reported a profit for the first time in nearly two years, surprising Wall Street.

Adjusted earnings of $0.40 a share weren’t the only sign of progress in the company’s second-quarter financial results. In addition, the manufacturer burned through just $705 million in cash, better than the $2.76-billion outflow that analysts had predicted.

Sales rose 44% to $17 billion as jetliner deliveries quadrupled from a year earlier, including 47 of the company’s MAX jets. It has delivered more than 130 MAX jets since the plane was cleared to fly again in some countries late last year. Airlines have also returned more than 190 of the once-grounded jets to service.

Analysts Are Divided On Recovery

With its business stabilizing, Boeing has halted large-scale job cuts well short of earlier plans to eliminate nearly 20% of its payroll as it gears up for a production increase over the next few years.

Chief Executive Officer Dave Calhoun said on an earnings call:

“We are turning a corner and the recovery is gaining momentum. I’ve said before that we view this year as a critical inflection point, and it’s proving to be just that.”

However, the strong Q2 performance isn’t enough to change the minds of some of the more skeptical analysts, including Bank of America’s Ronald Epstein.

In a note, Bank of America stated:

“We estimate that Boeing is still sitting on almost 400 737 jets of excess inventories. We maintain our neutral rating. While we think Boeing will participate in the commercial aerospace recovery, there are some company-specific challenges ahead.”

Bank of America has a $265 price target on the stock.

Wells Fargo, which has an equal-weight rating on the stock, with a $244 price target, also urged caution, given business uncertainties over the long run.

In a recent note, the bank said:

“We expect positive demand trends for Boeing in the near term, including a strong summer travel season given pent-up demand and improving airline cash, which could bring further aircraft orders. Longer term prospects are less clear as international travel remains muted, 737 MAX likely continues to lose share of the key narrow-body market, capital is constrained on high debt/new aircraft development costs and we believe the defense portfolio will continue to underperform peers.”

Of 24 analysts polled by Investing.com, 13 have a buy rating, while 11 remain neutral, with a consensus 12-month target of $267.91 a share.

China Key Risk For BA Stock

China remains one of the biggest risks to Boeing’s recovery efforts. Souring US-China trade relations have restricted sales in the world’s largest growth market for jets, with no new orders since 2017. China hasn’t yet lifted a ban on the MAX 737, keeping people guessing about its intentions.

In its analysis in June, Reuters pointed out:

“Trade power tensions, regulatory hurdles and attempts by the West to counter Chinese competition are delaying a return of the 737 MAX in China, frustrating Boeing as a potential rival demonstrates its growing influence.”

China is forecast to surpass the US as the world’s biggest aviation market by 2024, according to the International Air Transport Association, making the Communist nation a vital customer for both Boeing and Airbus Group (OTC:EADSY). Boeing expects China to buy 7,690 jetliners worth $1.19 trillion over the next two decades, accounting for nearly a quarter of global demand. It says 5,730 of those will be single-aisle jets like the 737 MAX.

Boeing CEO Dave Calhoun warned in June that a prolonged trade deadlock between the US and China is threatening Boeing's role as a leader in the aviation industry.

Said Calhoun of the Chinese market in a Bloomberg report:

“If I’m not allowed to serve, I cede global leadership. I’ll never give up on that. But it’s going to create real issues for us in the next couple of years if we can’t thaw out some of the trade structure.”

Bottom Line

Boeing is certainly in a better financial position than it was two years ago. The company is slowly overcoming its problems and improving its cash position. That said, its stock remains in a long-term bearish cycle, given the company’s production missteps, changing travel patterns after the pandemic, and due to the company’s huge dependence on China for growth. These factors, despite the company’s strategic importance, make BA stock less attractive than other opportunities available in the market.