Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

President Donald Trump on Thursday nominated Council of Economic Advisers Chairman Stephen Miran to serve out the remaining term of Federal Reserve Governor Adriana Kugler. Trump said Miran will serve in the role until January 31, 2026, while he continues a search for a permanent replacement. The Senate will probably confirm his nomination quickly and before the September meeting of the FOMC.

If so, then there could be at least three dissenters on the FOMC if the committee votes to pass on a cut in the federal funds rate (FFR) in September. They will argue that a weakening labor market justifies a rate cut. There might be a new group of dissenters if the Fed cuts the FFR. They might object that a rate cut risks heating inflation.

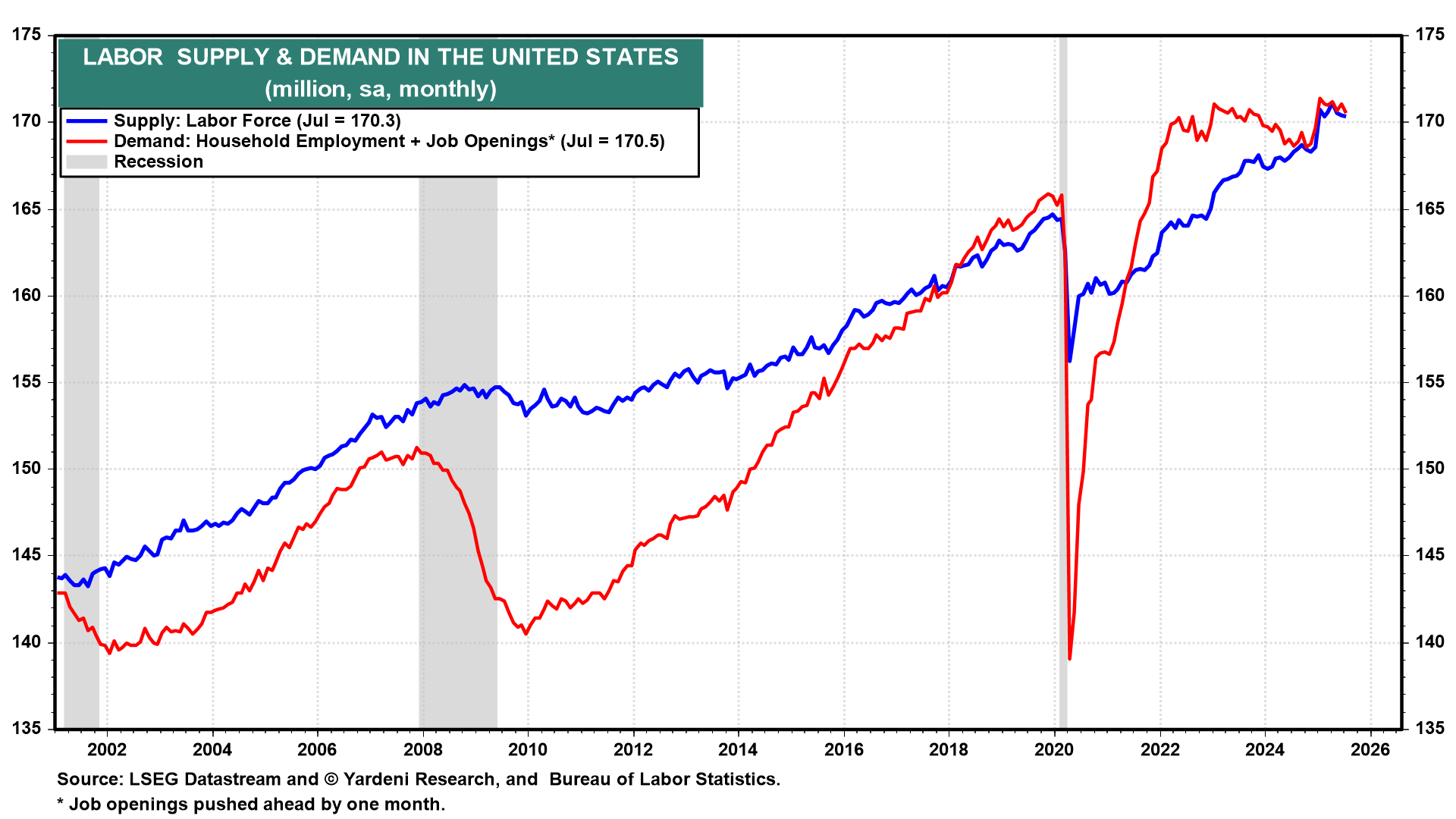

The current big debate is whether the weakness in Friday’s employment report reflects a labor market in which the demand for labor is weakening or whether there is a shortage of workers. It may be both at the same time.

On the demand side, Trump’s Tariff Turmoil (TTT) since April may have caused many employers to postpone their hiring plans until they were more certain of the impact of TTT on their businesses. If so, there should be less uncertainty about this now, and their hiring should resume. In this case, the Fed should hold off on cutting the FFR, and the dissenters will disagree.

In our opinion, the problem is mainly on the supply side of the labor market (chart). The labor force has stopped growing so far this year as a result of the Trump administration’s very effective closing of the border, as well as ongoing deportations. In this case, the Fed should also hold off on cutting the FFR since that would boost demand for workers, exacerbating the shortage of labor, which would put upward pressure on wage and price inflation rates.