Xia Yu, director at Summit Therapeutics, buys $9.9 million in shares

- Boeing has fallen almost 25% over the past year

- Reports Q2 results Apr. 27

- Wall Street consensus is shares are massively undervalued

- Market-implied outlook is moderately bearish

Shares of aerospace behemoth Boeing (NYSE:BA) have fallen 24.5% over the past 12 months, as compared with a 6.6% gain for the aerospace and defense industry (as defined by Morningstar) and 1.5% increase for the US equity market as a whole.

BA is the only stock in the top 10 holdings of the iShares US Aerospace & Defense ETF (NYSE:ITA) with a negative return over the past 12 months.

The aerospace giant is in the midst of a seemingly endless series of challenges, both internal and external. The ongoing COVID-related collapse in airline travel, along with safety concerns and production delays that have impacted the certification and delivery of aircraft are the two biggest problems for the Chicago, Illinois headquartered airplane manufacturer.

Source: Investing.com

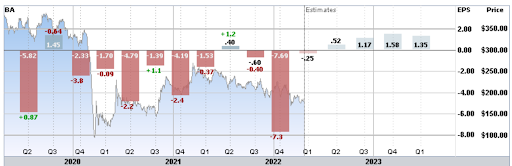

Boeing has consistently underperformed expectations in recent years, with quarterly earnings that have missed the consensus expected values for three of the last four quarters, and nine of the last 12 quarters. Q4 of 2021, reported on Jan. 26, 2022, was particularly bad, with expected EPS of -$0.42 and actual EPS of -$7.69. Management attributed the disappointing Q4 results largely to higher-than-expected costs in the 787 program.

Source: E-Trade

The challenge for investors is deciding whether there is enough bad news already reflected in the share price and whether there are indications that the company is getting back on track.

On Oct. 25, 2021, I thought that the odds were good that Boeing was turning the corner. As the Q4 results soundly demonstrated, I was wrong.

When I wrote that post, the Wall Street consensus rating was bullish, and the consensus 12-month price target was 27.5% above the share price. The consensus view implied by options prices, the market-implied outlook, was neutral. With the bullish Wall Street consensus and the neutral outlook implied by options prices, I wrote that I was cautiously optimistic and maintained a buy rating. Since then, BA has returned -16.9%, as compared with -5.9% for SPDR® S&P 500 (NYSE:SPY) and +0.5% for the iShares US Aerospace and Defense ETF.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles all of the option prices. This is the market-implied outlook and represents the consensus among buyers and sellers of options.

With six months since my last analysis, and Q2 earnings to be reported on Apr. 27, I have updated the market-implied outlook for BA and compared this with the Wall Street consensus outlook, as in my previous post.

Wall Street Consensus Outlook For BA

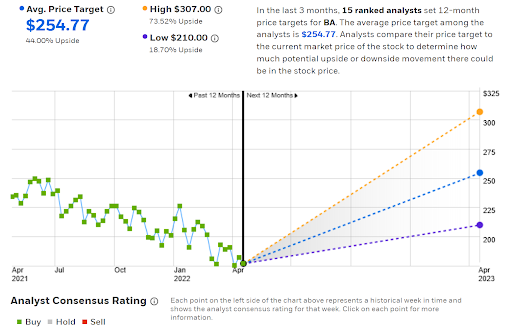

E-Trade calculates the Wall Street consensus outlook by aggregating the views of 15 ranked analysts who have published rating and price targets over the past there months. The consensus rating is bullish, as it has been for all of the past 12 months, and the consensus price target is 44% above the current share price. While there is a fair amount of dispersion among the individual price targets, even the lowest is 18.7% above the current share price.

Source: E-Trade

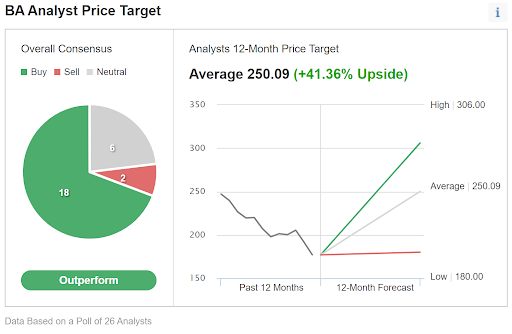

Investing.com’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 26 analysts. The consensus rating is bullish and the consensus 12-month price target is 41.36% above the current share price.

Source: Investing.com

The prevailing view among the analysts is that Boeing is substantially undervalued, as was the case back in October. While the consensus 12-month price target is slightly lower than it was in late October, the decline in the share price since then has been large enough to substantially increase the expected return over the next 12 months.

Market-Implied Outlook For BA

I have calculated the market-implied outlook for BA for the 8.9-month period from today until Jan. 20, 2023, using the price of call and put options that expire on this date.

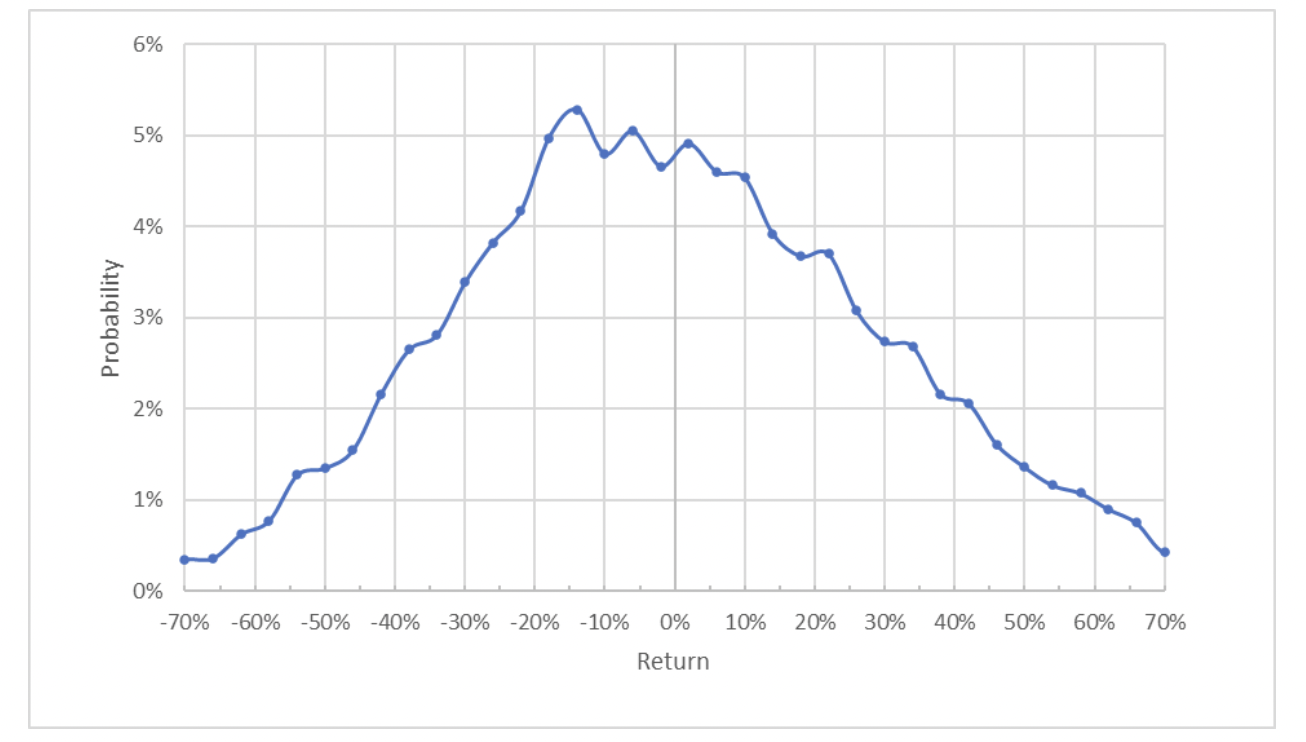

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook is tilted to favor negative returns, with the peak in probability corresponding to a price return of -14%. This is a somewhat bearish outlook. The annualized volatility calculated from this distribution is 41.5%, as compared with 40% implied volatility calculated by E-Trade for the options expiring on Jan. 20, 2023.

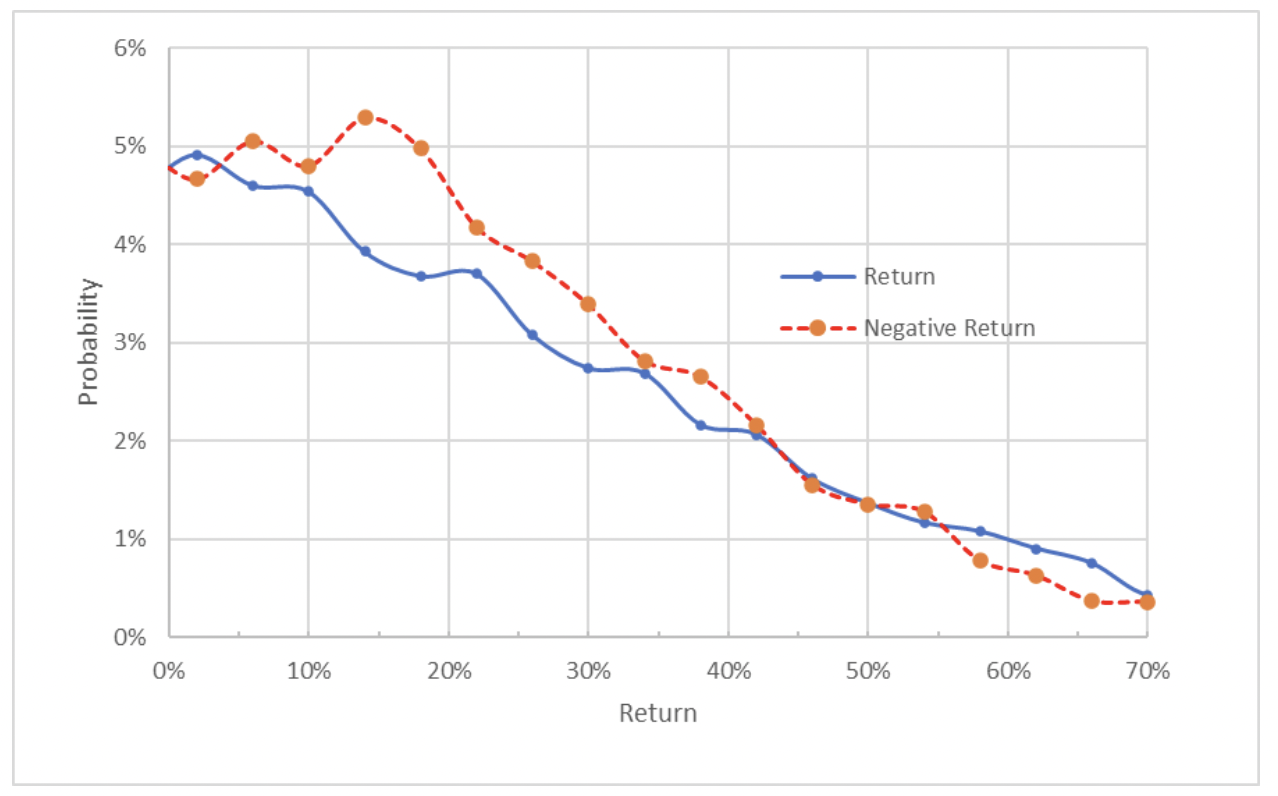

To make it easier to directly compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view highlights the higher probabilities of negative returns, as compared with the probabilities for positive returns, across a wide range of the most probable outcomes (the dashed red line is above the solid blue line over most of the left half of the chart above). This is a more pronounced negative orientation than in late October.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk-averse and, thus, tend to overpay for downside protection (put options). There is no way to robustly estimate the magnitude of this bias, however. Even considering the potential bias (which requires qualitative judgment), I interpret this market-implied outlook as somewhat bearish.

Summary

Boeing has been beset by mishaps in recent years. The litany of safety concerns, production delays and certification challenges do not inspire confidence in management.

While the shares are trading at a substantial discount to their value 12 months ago, the question is whether the cheaper shares provide sufficient compensation, given the risks.

The Wall Street consensus outlook is bullish, with a 12-month price target that is about 43% above the current share price. As a rule of thumb, for a buy rating, I want to see an expected 12-month return that is at least half the expected volatility (which is 41.5%). BA far exceeds this threshold if we take the consensus price target at face value. The analysts have been too optimistic over all of the past year, so I discount their views.

The market-implied outlook is moderately bearish, with peak probability corresponding to a return of -14% over the next 8.9 months. I am changing my rating on BA from bullish/buy to neutral/hold.