SharkNinja shares soar 11% as third quarter results crush expectations

This article was written exclusively for Investing.com.

- British Petroleum is a leading global oil company

- A Russian joint venture

- Addressing the trend towards alternative energy

- The stock is trending higher - An attractive dividend and lots of upside potential

- Levels to watch in BP

Finding value in the stock market is challenging these days. The leading indices are a stone’s throw from all-time highs. The risk of a correction rises with the share prices. As the US prepares to taper quantitative easing and raise taxes, we could see an overdue downdraft in stocks as they sit at lofty levels. It may not be a question of if the market will fall, but when it will occur. We are at a time of the year when stocks traditionally hit a speedbump and sometimes crash.

Preparing for the next correction is critical for investors. Identifying the best future opportunities come from identifying value and potential. One sector that has lagged the rest of the market has been energy. Oil-related stocks have underperformed the rest of the market consistently over the past years. As the US and Europe prepare to address climate change by attacking fossil fuels, shares of the leading oil companies have suffered.

However, there is lots of value out there in the oil patch. Oil companies are cashing in on the energy commodity at the $70 level for nearby NYMEX WTI crude oil and near $74 for the nearby Brent futures contract. British Petroleum (NYSE:BP) is a leading oil and gas company ringing the profit register as fossil fuel prices climb.

British Petroleum is a leading global oil company

BP is a global energy company that operates through Gas and Low Carbon Energy, Oil Production & Operations, Customers & Products, and Rosneft segments.

BP produces and trades in crude oil, oil products, natural gas, biofuels, and onshore and offshore wind power. The company operates solar power generating facilities and provides decarbonization solutions and services, such as hydrogen and carbon capture usage and storage.

BP also operates and manages the sale of fuels to wholesale and retail customers and provides convenience products, aviation fuels, petrochemicals, and Castrol lubricants. BP also refines, supplies, and trades oil products and operates electric vehicle charging facilities.

The company invests in upstream, downstream, and alternative energy companies. With headquarters in London, BP has been in business for more than a century as its roots date back to 1908. In 2021, BP is the fifth largest oil company worldwide. At $24.83 per share on Sept. 20, BP’s ADR had a market cap of $85.077 billion. The ADR trades an average of nearly 9.24 million shares each day.

A Russian joint venture

BP’s joint venture with Rosneft provides the company with a 19.75% share of the Russian oil company. BP nominates two representatives to Rosneft’s board of directors. BP currently has three Russian joint ventures.

Russia is the world’s leading oil-producing nation, surpassing the US for the position in 2021. Saudi Arabia is second, with the US third in daily crude oil output.

Rosneft is the top Russian oil-producing company, putting BP in a unique position via its joint venture. While Russia is not an official OPEC member, since 2016, Russia’s influence has grown to a level where the world now calls the cattle OPEC+, with the plus referring to the Russians.

Russia and Saudi Arabia determine the cartel’s production policy. As the US has shifted towards a greener path in energy, shunning hydrocarbons in favor of alternative energy sources, OPEC+’s profile has risen to a point where it now controls worldwide prices.

The Biden administration recently asked OPEC+ to increase output. The cartel refused. BP’s relationship with Rosneft puts the company at the table with Russia and Saudi Arabia for production decisions.

Addressing the trend towards alternative energy

BP is highly sensitive to the trend towards alternative energy sources in the US, Europe, and worldwide. The company’s website addresses sustainability issues and its plans to achieve net-zero carbonization, meeting the 2015 Paris Climate Accord goals.

BP’s focus on low carbon includes investments in wind and solar power to generate electricity, bioenergy, and hydrogen and carbon capture investments worldwide.

The stock is trending higher - An attractive dividend and lots of upside potential

In March 2020, as the price of Brent crude oil futures sank to the lowest level of this century and WTI futures fell to the lowest price since trading began in the 1980s, BP shares dropped to an over two-and-one-half-decade low.

Source: Barchart

The chart highlights the decline to $15.51 per share in March 2020, the lowest level since April 1994. In October 2020, BP fell to a lower low at $14.74 per share, a level not seen since 1993.

Source: Barchart

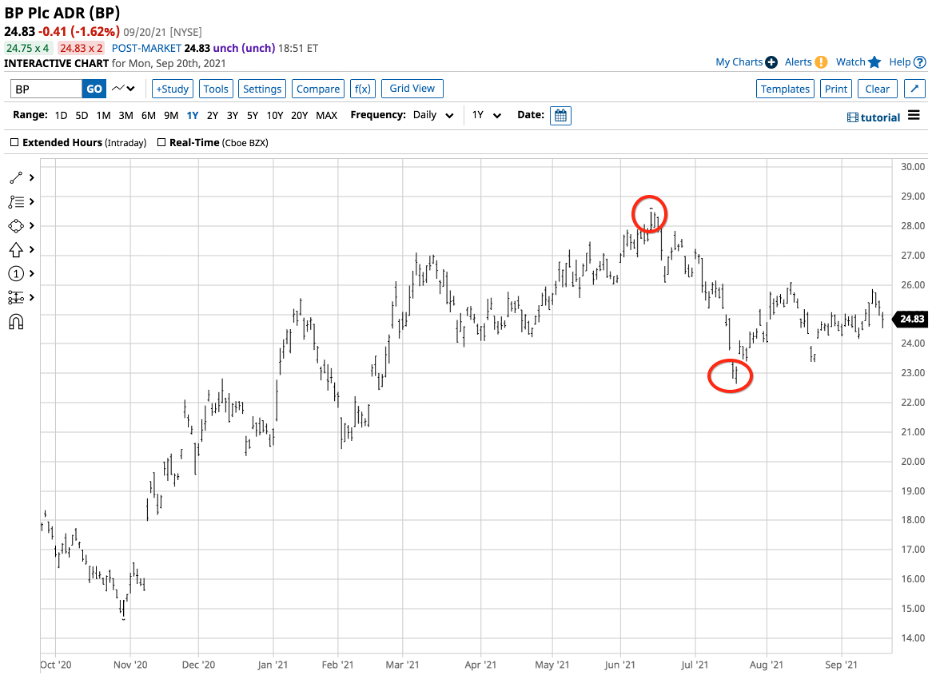

The chart shows BP shares have made higher lows and higher highs over the past year. The stock rose from $14.74 to a high of $28.49 in mid-June 2021. At $24.83 per share on Sept. 20, BP shares were closer to the high than the low over the past year.

BP’s current $1.29 annual dividend provides shareholders with a 5.2% yield as they wait for capital appreciation. The stock’s trend is bullish, and it pays an above-market dividend, the best of both worlds.

Levels to watch in BP

Crude oil was trading near the $72 per barrel level at the end of last week on the nearby NYMEX futures contract with Brent futures over $75 per barrel. Crude oil prices are near the highs in post-pandemic trading. Natural gas at over $5 per MMBtu is at the highest price since early 2014. Ethanol and biofuel prices have moved appreciably higher. Energy demand is booming, and OPEC+ is back in control of the worldwide fossil fuel arena. The prospects for the world’s fifth-leading are bullish. BP is translating its position into profits.

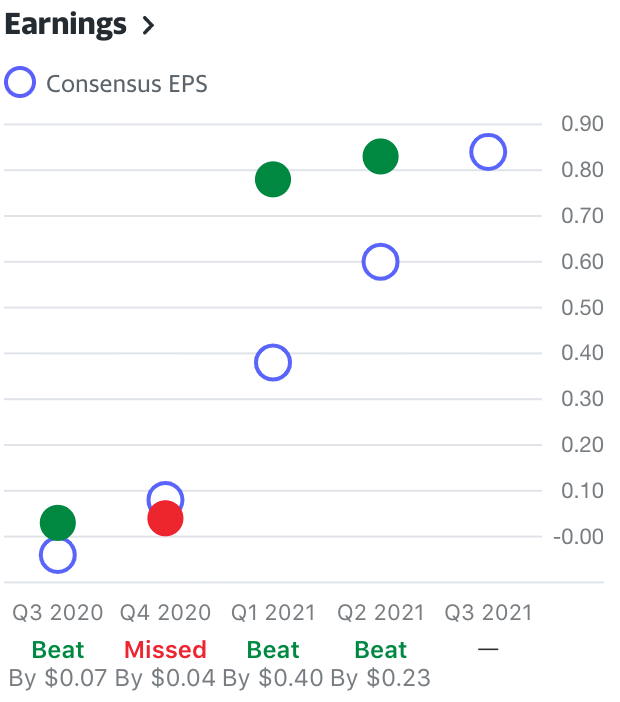

Source: Yahoo Finance

The chart shows that BP beat analysts’ forecasts in three of the past four quarters. In Q2 2021, the company earned 83 cents per share, 23 cents above the consensus projections. A survey of twelve analysts on Yahoo Finance has an average price target of $33.45 for BP, with forecasts ranging from $27 to $41 per share. At $24.83 per share, BP is in bargain-basement territory, below the low end of the forecast range.

Source: Yahoo Finance

The chart shows that short-term support for BP stands at the July 20, $22.64 low with technical resistance at the June 14 $28.49 high. In June 2020, BP reached $28.57 level, which could be a launchpad for much higher prices above the $40 level where the stock traded in early 2020 before the pandemic.

BP’s trend is bullish. Earnings and energy demand support a higher share price, its joint venture with Russia, and the company’s plans for decarbonization to address climate change make BP more than a bargain at $24.83 per share.