Adaptimmune stock plunges after announcing Nasdaq delisting plans

Both manufacturing and service sector ISM headline readings came in weaker than any analysts were forecasting. Business activity is cooling and employment is contracting in both surveys. Price components are elevated due to tariffs, but we don’t see inflation pressures being sustained and look for the Fed to respond with rate cuts.

Weak Output, Falling Employment Suggest Rate-Cut Momentum Will Build

More disappointing US data today in the form of the July ISM services index, which fell to 50.1 from 50.8, rather than rise to 51.5 as predicted by the consensus. As with the manufacturing ISM survey from last Friday, this was weaker than anyone surveyed predicted.

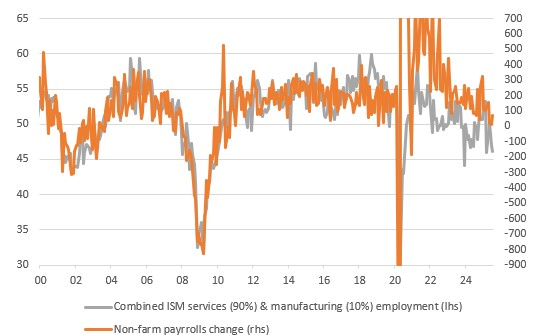

Employment fell to 46.4 from 47.2, which doesn’t bode well for August’s jobs report given we already knew the manufacturing employment version dropped to the weakest level since June 2020. If we weight them 90% for services and 10% for manufacturing we see that these readings are historically consistent with non-farm payrolls dropping by more than 100,000. While the relationship with payrolls hasn’t been as strong since the pandemic, at the very least it suggests we should be braced for soft jobs growth through the second half of the year at the very least. In particular, Federal government workers who accepted the severance packages from the Department of Government Efficiency are set to drop off employment numbers in September.

Source: Macrobond, ING

Tariff-Related Inflation Is Unlikely To Be Sustained

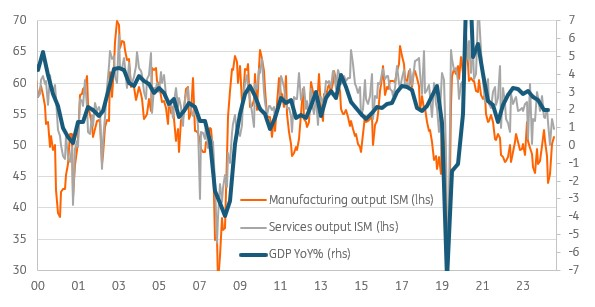

Meanwhile, new orders fell to 50.3 from 51.3 with export orders dropping back into contraction (sub-50) territory of 47.9. Overall business activity is still growing as signalled by an above 50 print of at 52.6, but this is down from 54.2 in June. As the chart below shows, the output series of manufacturing and services are consistent with further cooling in economic GDP growth to sub 1% YoY in the second half of the year.

Source: Macrobond, ING

The inflation components remain a concern though with prices paid within services rising to 69.9 from 67.5, the highest print since October 2022. In manufacturing they dipped a touch, but remain very elevated at 64.8. This is due to near-term tariff worries, but with benign energy prices, a cooling housing market and subdued wage growth we don’t think inflation pressures will have anywhere near the same intensity or duration as following the post-Covid supply chain stress led inflation of 2021-2022. As such the case for interest rate cuts in response to the weakening economy will continue to build.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more