Novo Nordisk, Eli Lilly fall after Trump comments on weight loss drug pricing

-

Q1 2025 buybacks reached a record $293B, with analysts expecting 2025 total buybacks to hit $1T.

-

The top 20 S&P 500 companies continue to dominate buyback activity, although more S&P 500 companies are now repurchasing stock.

-

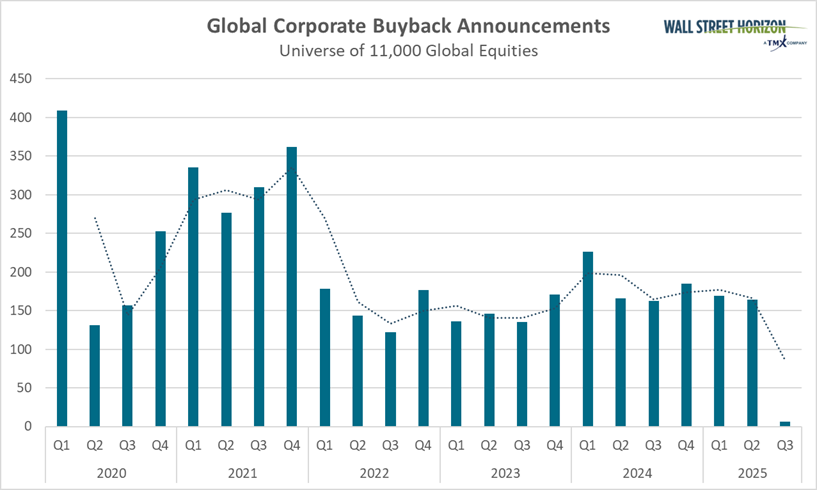

Globally, the number of buyback announcements remains historically low despite record dollar levels, with 164 announcements in Q2.

As we head into the second half of the year, expect record stock buyback activity for companies in the S&P 500. While we wait for official numbers to come out for Q2 which just closed last Monday, June 30, the year was off to a stellar start when Q1 buybacks hit a record of $293B, according to S&P Global. The previous record was set in Q1 2022 when buybacks totaled $281B. Analysts have said they expect 2025 to hit $1T in total buybacks.

Buybacks remained top heavy, with the top 20 S&P 500 companies accounting for 48.4% of Q1 2025 buybacks, a slight decrease from 49% in Q4 2024. While the concentration amongst top stock repurchases still exists, more companies within the S&P 500 have been repurchasing stock as of late, and the number purchasing over 1% of their public stock has increased. This story changes slightly when you look globally.

Total (EPA:TTEF) Number of Global Companies Announcing Buybacks is Lower

Despite the dollar level of buybacks hitting records, Wall Street Horizon data shows that the actual number of announcements has been relatively low, historically speaking. The second quarter closed out with 164 announcements, that comes after Q1 recorded 168 buyback announcements. The quarterly average over the last five years has been 204 announcements. You can see in the chart below that those numbers are steadily climbing after bottom-ing out in 2023.

Source: Wall Street Horizon

An Age-Old Debate: Are Buybacks Good or Bad?

As interest rates fall, as many are expecting at the next Fed meeting on July 30, holding onto cash tends to become less attractive to corporations who want to deploy and put it to work. Typically, buybacks are a good thing for shareholders as well, as they artificially improve earnings per share of a company, if not actually improving earnings. Share repurchases come under fire for this reason as well, with many arguing that companies could have put the money to better use by investing it back into the company. Investors tend to prefer companies that are buying back shares while also investing in growth. A great example is the mega tech names, many of which are the largest buyers of their own stock, but also tend to invest heavily in research and development and AI, among other things.

The Bottom-Line

As the Q2 earnings season begins on Tuesday, July 15th with reports from major banks, investors should closely monitor buyback announcements. An increase in share repurchases would indicate corporate America’s renewed willingness to deploy cash, which could have positive implications for the US economy.