Flutter Entertainment beats Q3 earnings estimate despite sports results impact

- Weak US job data boosts September rate cut bets, pressuring USD/JPY downward.

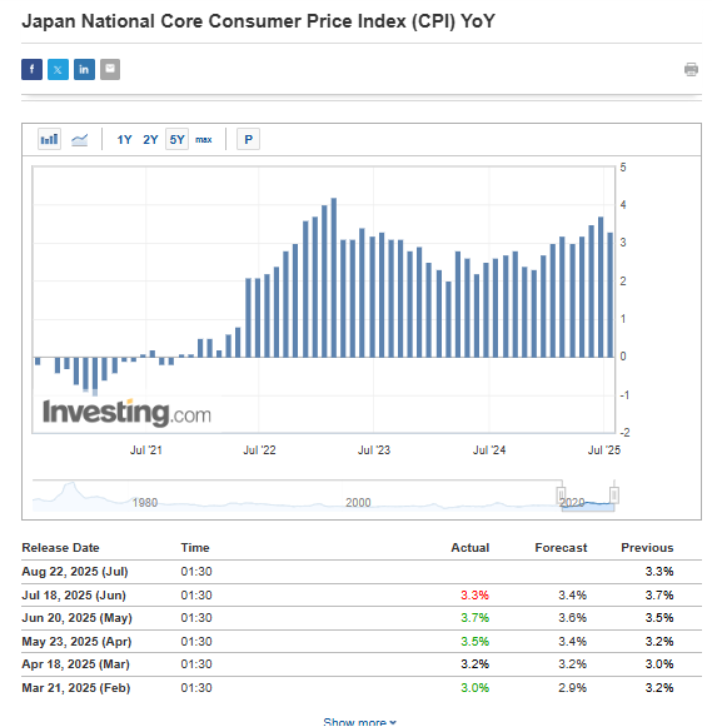

- BOJ keeps rates steady but signals tighter policy amid persistent core inflation.

- USD/JPY eyes 146 support; a break could trigger moves toward 143 and 140 levels.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off amid the summer sale!

In the last few days, investors received several important updates that affected the USD/JPY currency pair. The focus remains on central banks, both of which kept interest rates unchanged. But they are now moving in different directions — the Bank of Japan is expected to raise rates soon, while the Federal Reserve is likely to cut rates in September.

The biggest impact came from US labor market data. A downward revision in past job numbers made the data look worse than expected, which weakened the US dollar. As a result, selling pressure on USD/JPY has increased, and the recent upward move in the pair may be coming to an end.

Japan to See Another Rate Hike in October?

As expected, the Bank of Japan kept interest rates unchanged and continued its cautious monetary policy, mainly due to concerns about the trade war. However, that uncertainty has eased after Japan and the US agreed on the terms of their trade deal, which Governor Ueda highlighted in the BOJ’s statement.

Meanwhile, inflation remains above target. The bank raised its average core inflation forecast for the year from 2.2% to 2.7%. Policymakers also noted that inflation in food prices is likely to persist for a while, but they do not expect it to significantly affect core inflation.

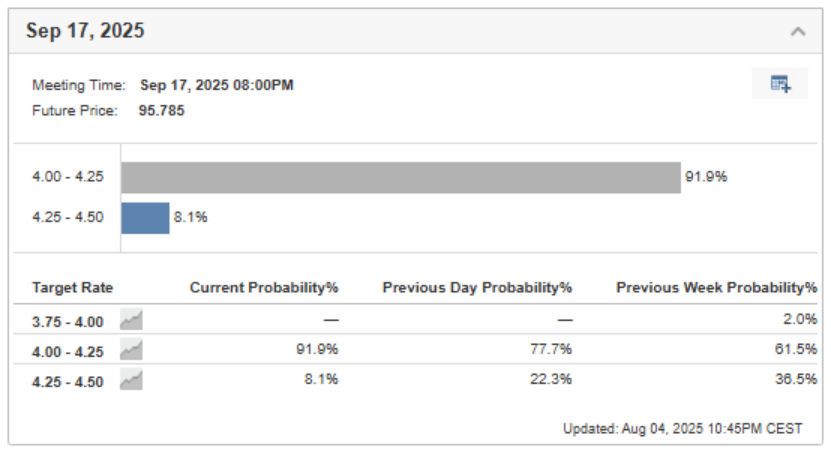

Meanwhile, across the Pacific, the Federal Reserve has also kept interest rates steady and offered no clear guidance on future changes. At the same time, weaker labor market data from the US has pushed the chances of a rate cut in September to above 90%.

Before that, though, several key economic reports from the US are due, especially on inflation. So far, the data shows that the slowdown in inflation has started to lose momentum. If the upcoming numbers come in higher than expected, the Federal Reserve could find itself in a tough spot—balancing signs of a slowing economy with inflation that remains above its target. On top of this, political pressure on the Fed Chair and growing opposition at home could end up pushing the central bank closer to cutting rates.

USD/JPY Technical Analysis

Friday’s US labor market data triggered a sharp drop in the US dollar, pushing USDJPY lower. The next likely move for sellers is to test the local support zone near 146 yen per dollar.

If sellers manage to break below 146, the next support levels to watch are 143 and 140 yen per dollar. On the upside, 151 remains a key resistance level that would challenge any bearish momentum.

****

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

- ProPicks AI

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

- Fair Value Score

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

- WarrenAI

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

- Financial Health Score

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

- Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.