LENZ stock tumbles after retinal tear case surfaces in FDA database

- Ethereum has been falling since Nov. 10

- The second leading crypto makes a lower low

- Excitement over Ethereum 2.0 caused buying, bailing

- Ethereum still a bullish beast for early buyers

- Technical levels to watch: Sentiment only critical factor

Ethereum remains the second leading cryptocurrency among the more than 19,850 cryptos currently available. At near the $1,173 level on June 16, Ethereum has a market cap of $140.57 billion.

While Ethereum’s market cap is less than half that of Bitcoin, it is way more than two times higher than Tether. In mid-June 2022, the cryptocurrency asset class had a total value of $950.7 billion, and Ethereum’s value represents more than 15.5% of the entire crypto market.

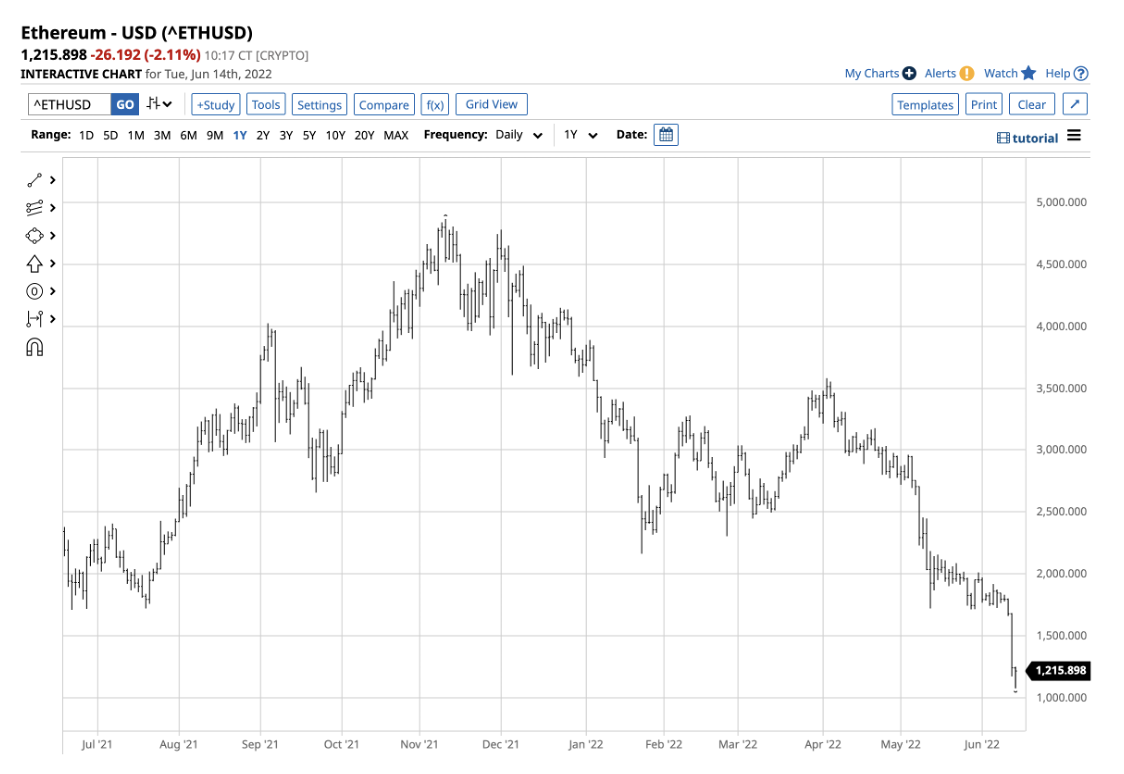

While Ethereum remains a dominant crypto, its price action has been bearish since late 2021. ETH tokens became a falling knife on Nov. 10, when BTC and ETH both put in bearish key reversal patterns on their daily charts.

This week, Ethereum fell to its lowest level since January 2021. Ethereum may be a leader, but its price action is a laggard compared with Bitcoin.

Ethereum Falling Since Nov. 10

Nov. 10, 2021, was an ugly day in the cryptocurrency arena as Bitcoin and Ethereum reached record highs and turned lower. The bearish key reversal on that day has led to more than six months of bearish price action in the volatile asset class.

Source: Barchart

As the chart illustrates, Ethereum traded to a high of $4,865.426 last year on Nov. 10 and settled below the $4,555 level. The low on Nov. 9 was $4,715.74. The reversal had a powerful impact on Ethereum’s price, and Bitcoin made the same technical pattern that day. Ethereum reached a low of $1,077.694 on June 14.

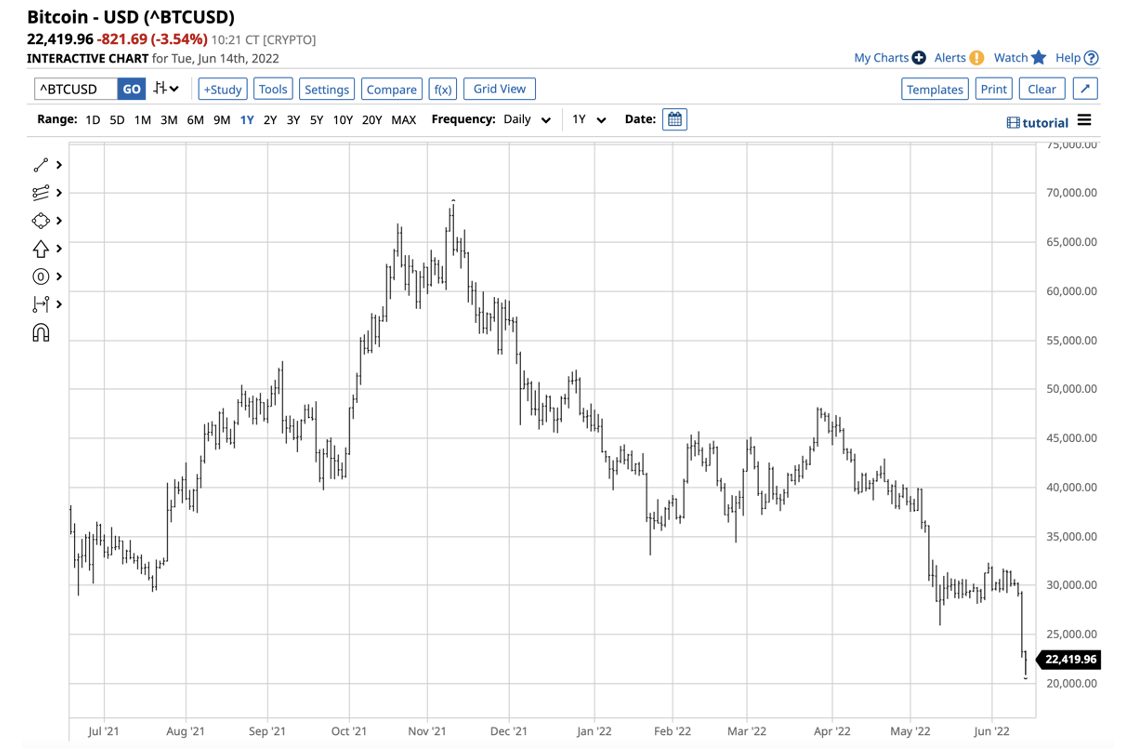

Second Leading Crypto Makes Lower Low

Bitcoin, the leading crypto, reached a low of $20,885.96 on June 14.

Source: Barchart

The charts show Ethereum did worse than Bitcoin. At the June 14 low, Ethereum was 77.85% below the Nov. 10 high. Over the same period, Bitcoin declined by 69.7% from the $68,906.48 peak on Nov. 10.

Ethereum has been the weaker link of the two cryptos that have more than 60% of the asset class’s overall market cap.

Excitement Over Ethereum 2.0 Caused Buying, Bailing

Ethereum's underlying technology is changing, and the 2.0 version will employ a proof-of-stake consensus mechanism to verify transactions via staking instead of the current proof of work protocol.

Proof of work is a competition between miners to solve cryptographic puzzles and validate transactions to earn block rewards. Proof of work is highly energy-intensive. Proof of stake uses randomly chosen validators to make sure the transaction is reliable, with crypto compensation. Proof of stake depends on holdings and requires far less energy.

Ethereum’s plans, announced in August, to roll out its 2.0 version caused a flurry of buying in late 2021. But the bearish trend has driven many late-comers to the second-leading crypto to bail out of long risk positions as Ethereum made lower highs and lower lows.

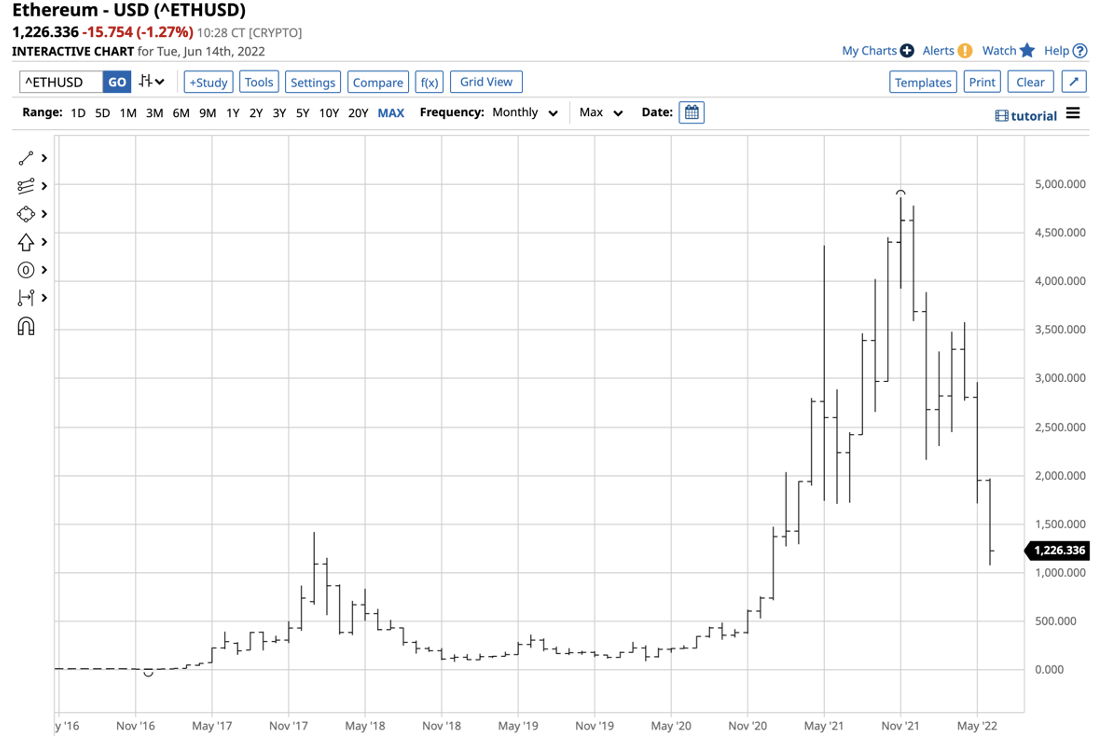

Ethereum Still A Bullish Beast For Early Buyers

Meanwhile, Ethereum has come a long way over the past years and remains a bullish beast for those who purchased the tokens before 2018.

Source: Barchart

Ethereum’s long-term chart highlights the rise from $11.13 per token in May 2016. It remained below the $100 level until April 2017.

While the price rose to over $1,400 in January 2018, it corrected to a low of $82.408 in December 2018 and $89.505 in March 2020. Therefore, long-term holders remain deep in the money on risk positions at almost $1,200 per token on June 16.

Indeed, over the past years, buying Ethereum on corrections has been the optimal approach to the second-leading cryptocurrency. As well, for those paying attention to fundamental inputs, additional phases of Ethereum 2.0 are scheduled to go live in August 2022, with the full release predicted to not occur until 2023.

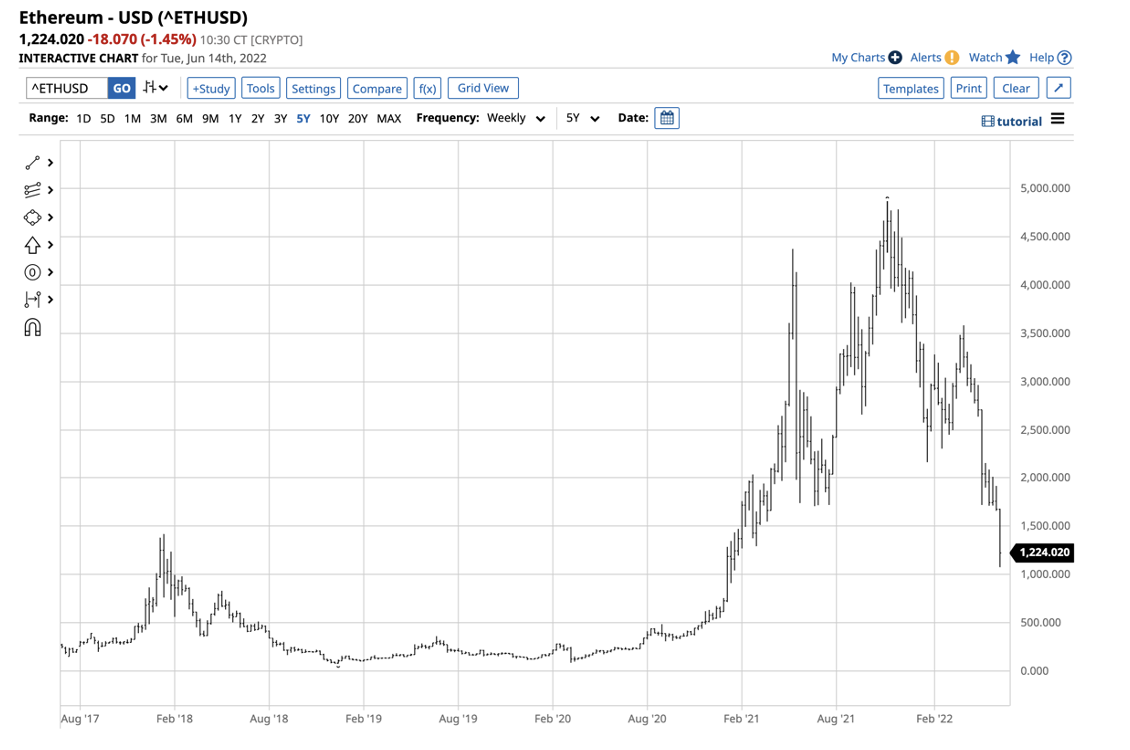

Technical Levels To Watch: Sentiment Only Critical Factor

Time will tell if the switch to Ethereum 2.0 will create a relief rally in Ethereum or if various phases will help boost the token in the interim.

Source: Barchart

The chart shows that critical technical support now sits at the psychological $1,000 per token level, a price not seen since January 2021. Technical resistance is at the April 2022 peak of $3,579.86. The range is wide, but cryptocurrencies are highly volatile assets.

With Ethereum a lot closer to support than resistance, it is in the buy zone for investors and traders brave enough to purchase the crypto that has been a falling knife over the past six months. Ethereum will find a bottom when the sentiment shifts and the asset class moves back into a bullish trend. Crypto values are solely a function of bids and offers in the market.

Only invest capital you are willing to lose in Ethereum or other cryptocurrencies, as the potential for incredible rewards comes with commensurate risks. Though Ethereum has been a leader in the cryptocurrency asset class over the past years, but it has been a laggard since November, as the flurry of buying turned into a stampede of selling.

The herd could change direction over the coming months and the switch to the 2.0 version could be the spark needed to reserve the trend. Expect lots of volatility in Ethereum, and you won't be disappointed.