InvestingPro’s Fair Value model captures 63% gain in Steelcase ahead of acquisition

This article was written exclusively for Investing.com

- Bullish crypto trend continues with market cap near the $2 trillion mark

- Few cryptos with market caps over $1 billion

- Celsius in the top 100

- Fantom is ranked nearby

- Only invest what you're willing to lose

At the end of last week, Bitcoin was sitting at just under the $59,000 level and at time of writing it's back over $60,000. During the same period, Ethereum was over $2,070 per token and is now trading above $2,100. The parabolic moves for these cryptocurrencies have been perhaps the most dramatic in our lifetimes.

Some crypto devotees continue to believe that there is lots of upside left for the two leaders that hold over 67% of the entire digital currency market cap. While their share is dominant, it has been dropping recently, meaning other tokens are outperforming the leaders.

Finding value in the digital currency arena is a highly speculative adventure. With 9,190 coins to choose from at the end of last week, there are hidden gems for the future. However, the vast majority will fade into the abyss. Many of the tokens with marginal market caps are nothing more than lotto tickets with slim chances of a pay-off for investors.

When searching for value in this new asset class, I look for the tokens that have already established a degree of critical mass. The $1 billion market cap level is currently my cutoff for consideration. Celsius (CEL) and Fantom (FTM) are two tokens above the one-billion level. As well, they're in the top 100 of the cryptocurrency hierarchy.

Bullish crypto trend continues with the market cap near $2 trillion mark

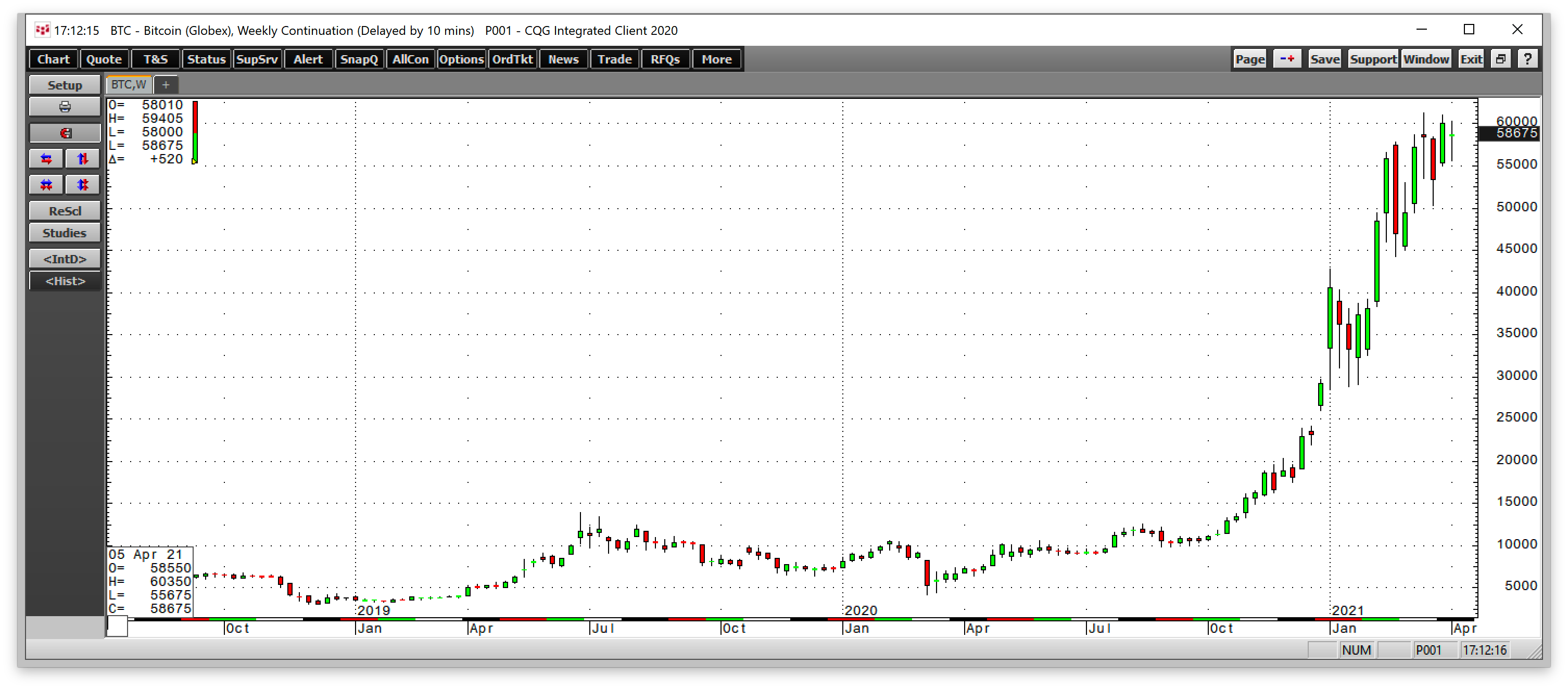

After making a high of $61,255 per token in mid-March, Bitcoin was sitting at just under the $59,000 level on Apr. 9.

Source: CQG

The chart above highlights that Bitcoin was consolidating at the end of last week, just a stone’s throw away from its all-time peak.

Source: CQG

Meanwhile, Ethereum futures, which began trading on Feb. 8, 2021, reached a new record high on Apr. 6 at $2,185.50, were just under $2,090 at the end of last week and are heading back to their peak at time of writing.

The market cap of the 9,190 digital currencies stood at the $1.986 trillion level. Bitcoin’s total value was at $1.091 trillion, and Ethereum’s was $240 billion, amounting to 67% of the asset class’s market cap. The other 9,188 cryptos account for 33%, but the top-tier digital currencies have a far larger share.

The top ten and their market caps include:

- Bitcoin (BTC)- $1,091 billion

- Ethereum (ETH)- $240 billion

- Binance Coin (BNB)- $68.9 billion

- XRP (XRP)- $48.3 billion

- Tether (USDT)- $43.8 billion

- Cardano (ADA)- $38.6 billion

- Polkadot (DOT)- $37.9 billion

- Uniswap (UNI)- $15.6 billion

- Litecoin (LTC)- $15.0 billion

- Chainlink (LINK)- $13.3 billion

The other 9,180 tokens share under 19% of the digital currency asset class’s market cap.

Few cryptos with market caps over $1 billion

As of Apr. 9, ninety-six tokens, or 0.105% of the cryptocurrency market, had a market cap over the $1 billion level. Meanwhile, 436 tokens, or 0.474%, were worth more than $100 million. 1667, or 18.1%, were worth over $1 million.

The remaining 7,000+ tokens were nothing more than lotto tickets with little chance of paying off. There may be diamonds in the rough out there among the low-value tokens, but the odds are that most will fade into a worthless abyss and become dust collectors in those digital wallets in cyberspace.

When looking for an opportunity in the asset class, as I said earlier, I favor those with $1 billion market caps and higher. Liquidity is critical for any investment. The ability to buy and sell on a tight bid-offer spread increases the chances of profits. In the digital currency world, liquidity improves the odds of a token’s survival.

Celsius in the top 100

Currently, Celsius (CEL) is the 69th leading cryptocurrency. The celsius network is a financial technology or fintech platform that offers interest-bearing savings accounts, borrowing, and payments with digital and fiat assets. Celsius returned 80% of its revenue to network users in rewards, while the other 20% funds project expansion. The celsius website highlights the network and its “utility” token.

The celsius token was trading at the $7.61 level at the end of last week, with a market cap of $1.818 billion.

Source: CoinMarketCap

As the chart shows, the CEL token has traded from a low of under five cents to a high of $7.61 since October 2018. The token has been trending higher, rising from below 37 cents in September 2020 to the most recent high last week. At over the $1.8 billion level, CEL has the liquidity that makes it a candidate for trading and investing.

Fantom is ranked nearby

Fantom (FTM) is currently 93 on the crypto hit parade with a $1.11 billion market cap at $0.43608 per token. Fantom seeks to be the all-in-one DeFi (decentralized finance) suite for users.

Fantom’s EVM-compatible (Ethereum Virtual Machine) blockchain gives users the ability to mint, trade, lend, and borrow digital assets directly from their wallets. FTM charges virtually zero feeds and provides instant transactions. Fantom’s website outlines the details of the token and technology.

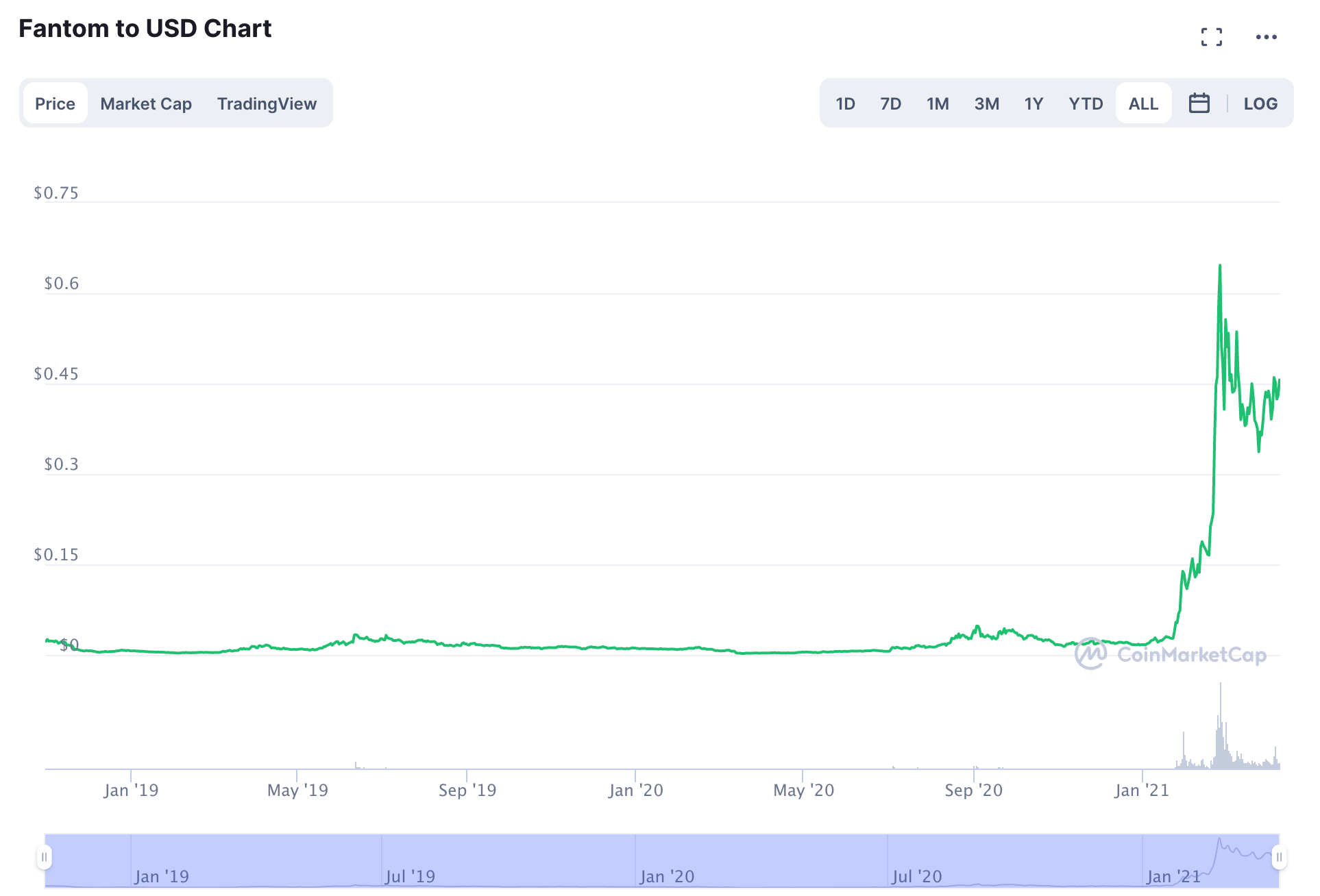

Source: CoinMarketCap

The chart shows the range in FTM from below $0.005 to a high of $0.6465 since late 2018. The high came on Feb. 25, 2021. FTM had pulled back to the 45 cents level at the end of last week. With a $1.11 billion market cap, FTM is another token that offers liquidity for investors and traders.

Only invest what you're willing to lose

A market cap with critical mass creates the liquidity that tightens bid-ask spreads. It also highlights a degree of wide acceptance for a token.

One of the most crucial considerations when dipping a toe in the volatile digital currency asset class is a plan for risk-reward dynamics. Whether you are considering a trade or investment in Bitcoin with a more than $1 trillion market cap or CEL or FTM with over $1 billion in total value, only invest what you are willing to lose.

Gravity has a nasty habit of turning parabolic markets into falling knives. It is impossible to pick highs or lows in any market. Since cryptocurrencies have experienced the most dramatic moves compared to all other asset classes in our lifetime, use extreme caution with any of the 9,190 tokens.

My rule is that I am prepared to lose any capital I invest or trade in the asset class. While I may invest in the smaller cap tokens with market caps below the $1 billion level, I would only trade those with critical mass and liquidity to enter and exit risk positions on tight bid-offer spreads. In my view, CEL and FTM are candidates for investment and trading.