Street Calls of the Week

-

Q1 earnings season winds down with retail reports over the next few weeks

-

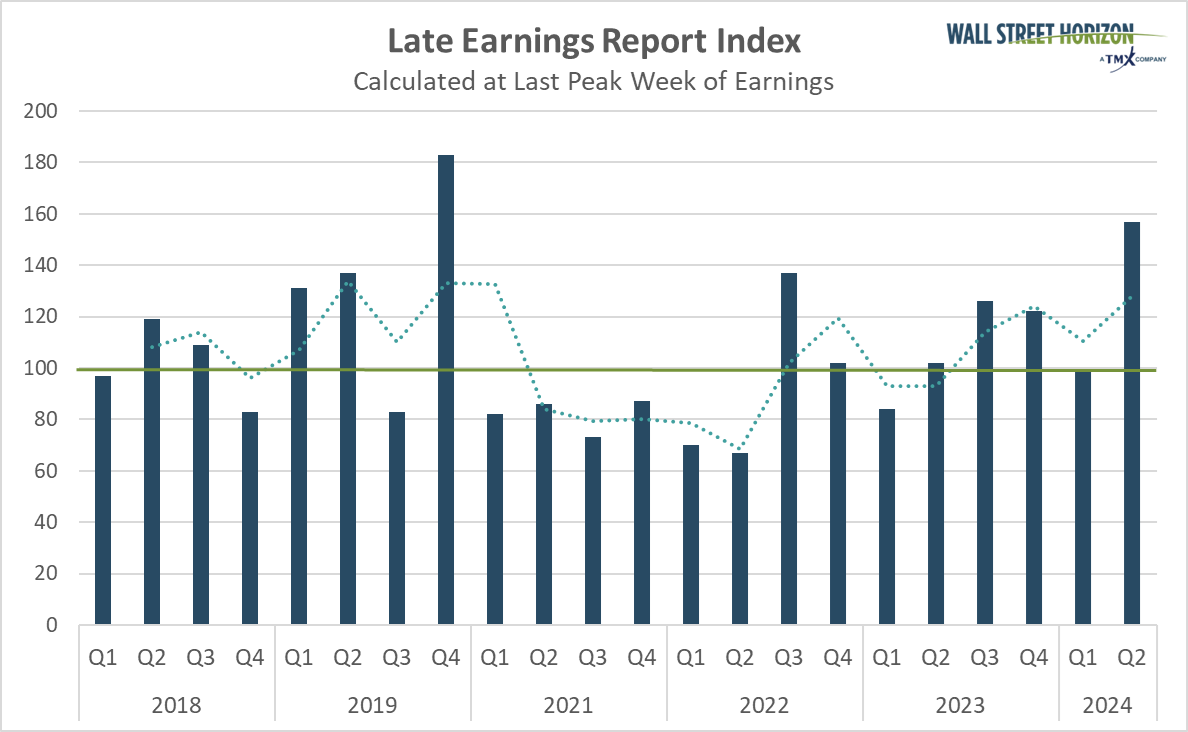

The post-peak LERI reading came in at 157, showing US CEO uncertainty remains high

-

Outlier earnings date for the week ahead: Under Armour (UAA)

-

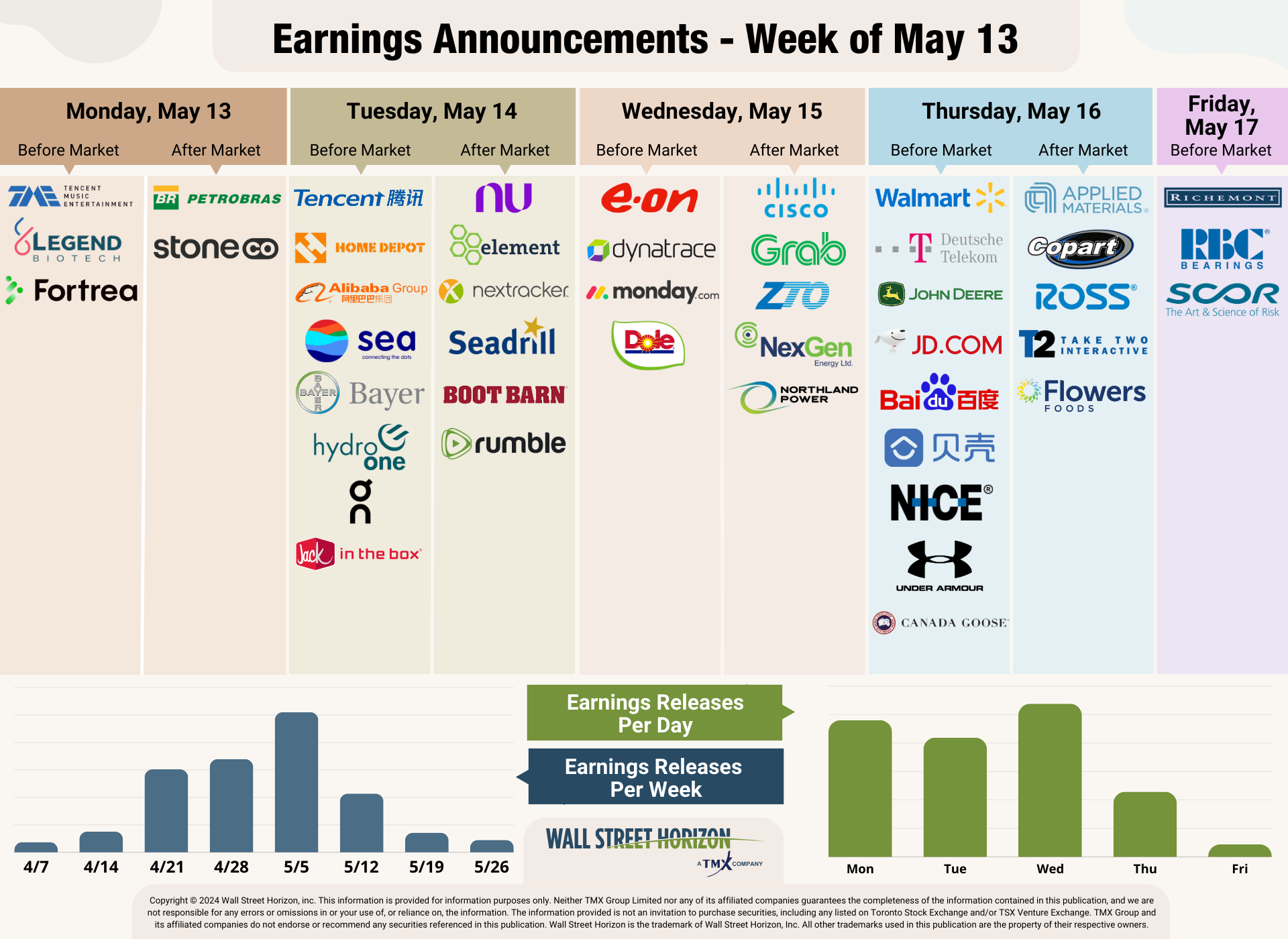

This week 1,739 companies are expected to report earnings

Decent Earnings Give Markets a Welcomed Boost

Last week closed out the final peak week of the Q1 2024 earnings season. With 92% of S&P 500 companies now reporting, the S&P 500® growth rate looks like it will settle around 5.4% according to FactSet.

All major indices performed relatively well, the Dow Jones Industrial Average with an 8-day winning streak, due to a combination of better-than-expected earnings and the belief that interest rate cuts are still in play this year. That sentiment was further promoted on Thursday when weekly jobless claims came in at 231k for the week ending May 4, the highest reading since August.

Those results jived with April Nonfarm payrolls, unemployment and wage growth data reported last week. All readings showed that overall the US labor market is starting to soften. In particular, investors were happy to see wage growth falling to 3.9%. The Fed often cites 3% wage growth as being consistent with their 2% inflation goal. The CME FedWatch tool now places the likelihood of a September rate cut at over 60%.

Despite signs that inflation may be starting to cool, the University of Michigan Consumer Sentiment Index published Friday showed that higher prices remained a top concern of US shoppers in May. The initial reading for the month came in at 67.4, down significantly from 77.2 in April. Expectations for inflation were also higher with the one-year inflation outlook increasing 0.3 percentage points MoM to 3.5%, the highest level since November 2023.

CEO Uncertainty Remains High as Q1 Earnings Season Comes to a Close

After falling to its lowest level in its nine years of existence last quarter, the Late Earnings Report Index, our proprietary measure of CEO uncertainty, was back up for the Q1 earnings season.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The official post-peak season LERI reading for Q1 (data collected in Q2) stands at 157, well above the baseline reading, suggesting companies are feeling less certain about economic conditions than they were at the beginning of the year. As of May 10, there were 107 late outliers and 62 early outliers.

Source: Wall Street Horizon

Retail Parade on Deck

This week begins what’s often referred to as the retail earnings parade portion of the reporting season. We’ll get a good read on what the US consumer has been up to, and if they’re still hanging in there. We’ve already heard from some consumer-focused companies, specifically the restaurants, that showed inflation may be starting to take its toll. Add to that a slightly worse labor scenario, and the consumer resilience that’s been in play the last two years may start to crack.

This week we get results from Home Depot (NYSE:HD), Walmart (NYSE:WMT), Ross Stores (NASDAQ:ROST) and Under Armour (NYSE:UA).

Source: Wall Street Horizon

Potential Surprises This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.

This week Under Armour (UAA) is the only S&P 500 constituent that has pushed their Q1 2024 earnings dates outside of historical norms.

Under Armour (UAA)

Company Confirmed Report Date: Thursday, May 16, BMO

Projected Report Date (based on historical data): Thursday, May 9, BMO

DateBreaks Factor: -2*

Under Armour is set to report FQ4 2024 results on Thursday, May 16. This is a week later than expected, and a week later than the athletic apparel company reported last year. It’s important to note, however, that the company could still be finding it’s reporting footing since switching to a fiscal year end (FYE) of March 31 from the previous FYE of Dec 31. That change went into effect last year.

Whether or not this later-than-usual date is indicative of “bad news” to come on the upcoming call, or just the continued transition to a new fiscal calendar, is unknown at this time. However, expectations for this name have been better. According to FactSet, FQ4 EPS for UA is anticipated to show a YoY decline of 56%, while revenues are expected to fall 5%.

*Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

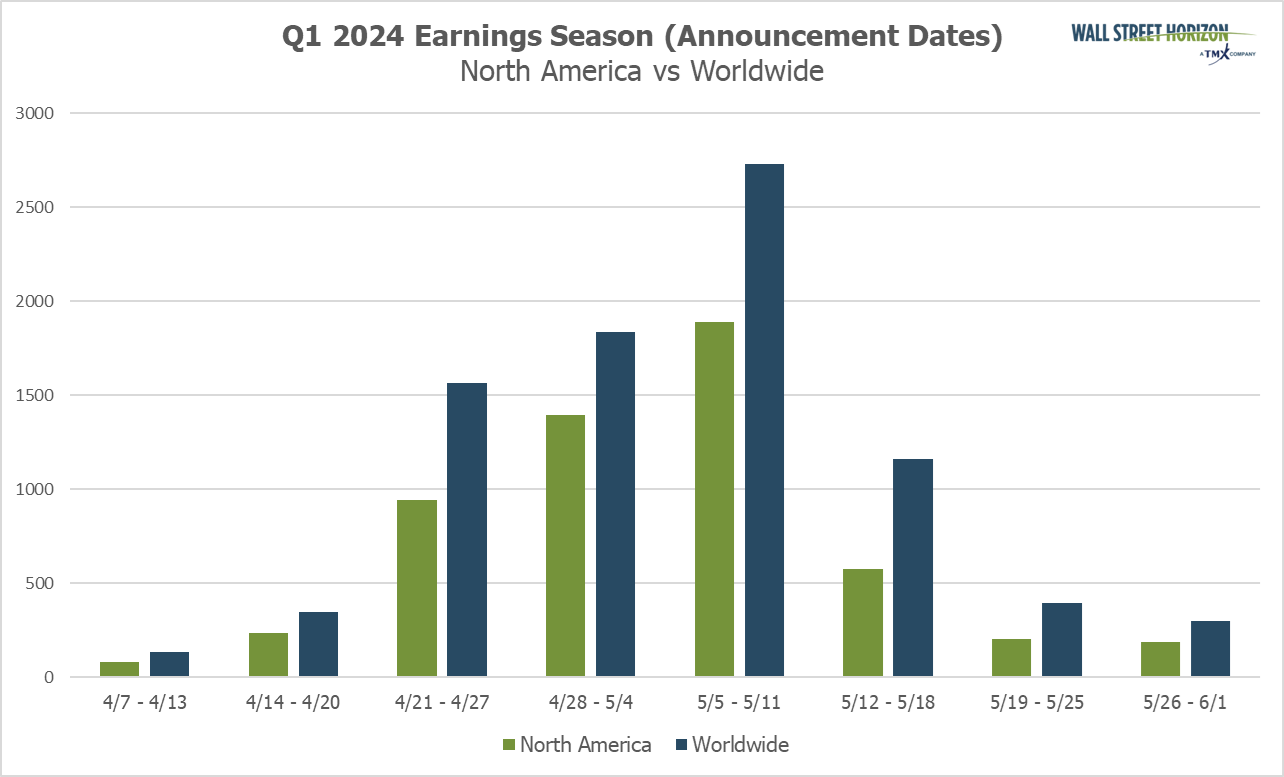

Q1 Earnings Wave

Earnings season continues to wind down from here on out. This week 1,739 companies are set to report. Thus far 71% of companies have reported (out of our universe of 10,000+ global names).

Source: Wall Street Horizon