Gold prices dip as December rate cut bets wane; Fed, econ. data in focus

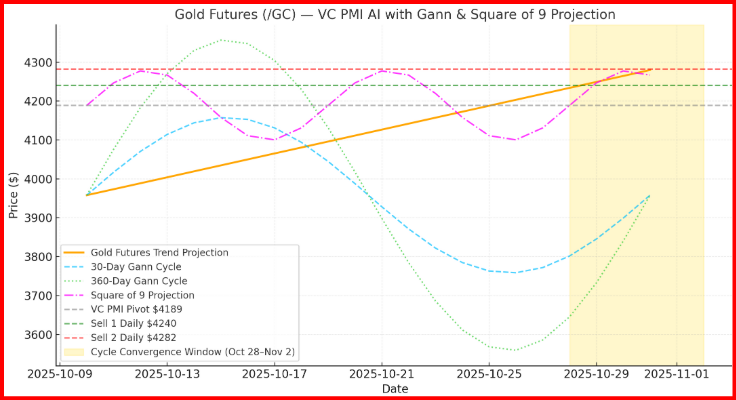

Gold futures have reached a pivotal moment as the market approaches the time-price convergence window between October 28 and November 2, 2025. The confluence of the VC PMI AI, Gann 30- and 360-day cycles, and Square of 9 geometric resonance identifies this as a period of high probability for volatility expansion.

Key Insights

- The magenta line (Square of 9 projection) maps harmonic rotations that align closely with both the Sell 1 ($4,240) and Sell 2 ($4,282) levels — confirming geometric resonance at the top of the current price spiral.

- The 30-day Gann cycle (blue dashed) and 360-day long wave (green dotted) both turn upward into the convergence window, suggesting a probable acceleration zone or reversal trigger.

- The orange trend line points toward $4,300+ targets before potential mean reversion near $4,160–$4,200, completing the Gann square and VC PMI symmetry.

The current price near $4,278 has not only surpassed the VC PMI weekly resistance levels but is now oscillating within the Sell 2 daily zone ($4,274), marking a technically overbought condition. Yet, historical patterns suggest that when these conditions coincide with major cycle alignments, price can extend briefly into a parabolic final thrust before reverting to equilibrium. The chart illustrates a harmonic rhythm where time, price, and geometry converge—an ideal setting for a short-term speculative climax or consolidation pivot.

VC PMI AI, Gann, and Square of 9 Alignment

The VC PMI AI model defines a structured range between Buy 2 ($4,119) and Sell 2 ($4,277), with the pivot mean ($4,1) as the statistical equilibrium. Overlaying this with Gann’s 30-day cycle (blue dashed) reveals that the next rhythmic trough aligns directly with the October 28 cycle date, suggesting that a reversion to the mean could occur from current highs. The 360-day Gann wave (green dotted) confirms a macro uptrend—indicating that any pullback into the $4,160–$4,200 region would likely serve as a setup for accumulation rather than trend reversal.

The Square of 9 projection (magenta line) adds a geometric dimension, showing angular resonance between $4,240 and $4,282—precisely where the current advance encounters resistance. This confirms that the market is spiraling through a critical geometric octave, often preceding a shift in market polarity or breakout continuation once resolved.

Strategic Outlook and Trading Implications

From a tactical perspective, the VC PMI AI probability model suggests that prices closing above $4,240 sustain the bullish bias toward $4,350–$4,420, while a close below $4,198 would activate mean reversion toward the Buy 1 zone ($4,161). Traders should expect volatility compression and directional breakout within the highlighted cycle window, making it one of the most critical inflection periods of Q4 2025.

In summary, gold stands at the intersection of time and price—where cyclical mathematics, geometric symmetry, and statistical probability converge. The compression of these forces implies that the next two weeks could define the path for the remainder of the year. Whether through a brief spike above $4,300 or a controlled pullback to reset momentum, the October 28–November 2 window marks a gateway to the next leg of this historic gold cycle.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.