Street Calls of the Week

A little-known AI research lab from China, DeepSeek, has unsettled Silicon Valley. It released AI models that outperform American counterparts despite using lower costs and less advanced hardware. DeepSeek introduced a free, open-source large-language model (LLM) that was built in two months for under $6 million, using Nvidia’s H800 chips, which are less powerful than those usually employed.

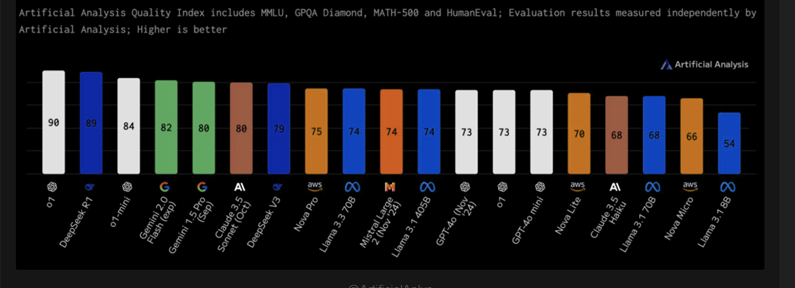

In benchmarks, DeepSeek’s model outperformed Meta’s Llama 3.1, OpenAI’s GPT-4o, and Anthropic’s Claude Sonnet 3.5. It excelled in problem-solving, mathematics, and coding accuracy. These developments raise concerns about the US’s dominance in artificial intelligence. They also question whether significant investments by major tech firms in AI and data centres are justified.

Source: Artificial Analysis

DeepSeek hasn’t risen to prominence overnight. Over the past two years, it released several impressive models, attracting some media attention in mid-2024. Interest, however, surged after it launched on December 26, 2024. The latest version, DeepSeek R1, debuted on January 20 and quickly topped the Apple (NASDAQ:AAPL) App Store rankings by the weekend. This milestone sparked a wave of online discussions, particularly on X. Tech investors had already been tracking the company closely in the weeks leading up to this spike.

Market Impact - Short-Term Volatility

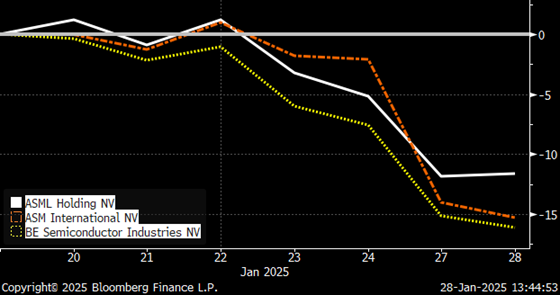

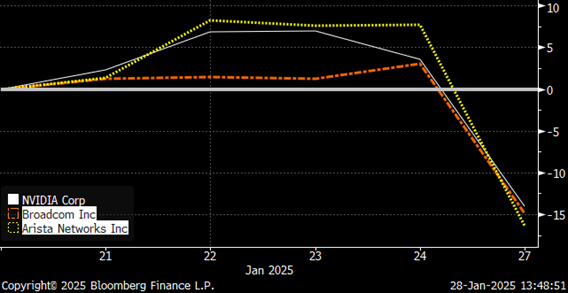

DeepSeek has caused market volatility, but its effects appear temporary. On Monday, 27 January 2025, European semiconductor stocks fell sharply. ASML (NASDAQ:ASML) dropped 7%, BE Semiconductor fell 11%, and ASM declined 12%. In the US, the S&P 500 fell 1.46%, and the Nasdaq plunged 3.07%. Nvidia (NASDAQ:NVDA) experienced a historic 17% drop, losing $600 billion in market value - the largest single-day loss for a US company.

On Tuesday, 28 January, markets appear to have stabilized. S&P 500, Nasdaq 100 and Dow Jones futures were broadly flat (at the time of writing), while Nvidia Broadcom (NASDAQ:AVGO) and Oracle (NYSE:ORCL) saw slight recoveries in after-hours trading.

The "Magnificent 7" companies are expected to report over 20% earnings growth this week for Q4 2024. These reports may further ease investor concerns and highlight their adaptability to market changes. Excluding the “Mag 7”, the rest of the S&P 500 companies are expected to report earnings growth of 9.7% this quarter, the highest since Q2 2022. The overall blended rate for the S&P 500 stands at 12.5%.

Valuations for key “Mag 7” firms remain reasonable: Nvidia is trading at 27x forward P/E (down from 33x last week), Microsoft (NASDAQ:MSFT) at 33x, Alphabet (NASDAQ:GOOGL) 21x, and Meta (NASDAQ:META) 26x. This compares to S&P 500 forward P/E currently at 22x, meaning that those companies trade at a premium that is justified by their superior earnings growth. However, those companies that benefit most from the AI capex boom, such as Broadcom and Arista Networks (NYSE:ANET), have traded at higher multiples, and those multiples contracted due to the recent market reaction.

ASML, ASM International and BESI

Nvidia, Broadcom and Arista Networks

Strategic Context: US vs China

DeepSeek represents the latest chapter in the technology race between the U.S. and China. While the U.S. is widely regarded as holding the upper hand with companies like OpenAI, Anthropic, and Meta, it has also imposed strict export controls on AI chips and semiconductor equipment to limit China’s progress. Just last week, the U.S. President reinforced the nation’s AI ambitions by announcing Project StarGate—a massive $0.5 trillion investment in AI infrastructure over the coming years. However, viewing this competition as a zero-sum game may be short-sighted, given China’s immense financial resources and deep talent pool. DeepSeek’s success highlights the rapid strides China is making in the AI sector.

Efficiency in Training LLMs

DeepSeek’s efficiency in training LLMs benefits the broader AI sector. Lower costs will encourage wider adoption and application of LLMs. This will drive further demand for data centre capacity. Investments in data centres remain vital, but efficiency gains mean firms can achieve more with the same resources.

Open Source and Rapid Adoption

DeepSeek’s open-source model ensures its efficiency breakthroughs will spread quickly. Microsoft CEO Satya Nadella called the DeepSeek model “super impressive” for its inference-time efficiency. This suggests companies like Microsoft may adopt similar techniques in their operations.

AI Capex Debate

The AI capex debate remains favourable for leading AI companies. Greater efficiency allows firms to achieve more within existing budgets. There is little risk of overcapacity in data centres at this stage. We are still in the early phases of AI-driven capex expansion. As LLMs become more efficient, their training and usage will increase. This will ensure sustained demand for data centres.

Threat for Nvidia?

Nvidia faces pressure, as seen in its 17% share drop on January 27, as investors are questioning growth assumptions tied to AI capex. However, the long-term impact may be less negative.

Nvidia maintains a significant technological lead over competitors. Its GPUs are expected to remain the primary AI hardware for years. The ongoing growth in demand for data-centres will ensure sustained demand for Nvidia’s chips, even if AI models like DeepSeek achieve greater efficiency.

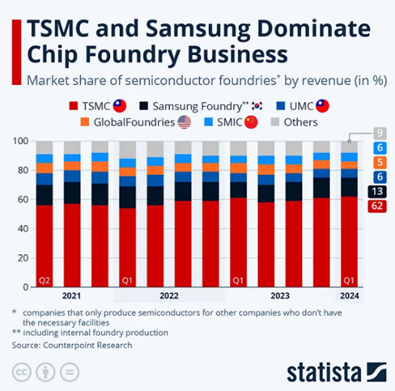

While chip designs can theoretically be replicated, doing so requires time and significant cost. Only three foundries—TSMC, Samsung, and Intel—can produce advanced AI chips at 4, 3, or 2 nanometres. China lacks the advanced semiconductor equipment needed for such manufacturing. All in all, Nvidia’s investment case remains strong and it stands to retain its position as a category winner in the AI chip segment.

Source: Statista

Conclusion

DeepSeek’s advancements have raised questions about US dominance in AI, but are unlikely to pose an existential threat to key "Mag 7" players, including Nvidia. The "Magnificent 7" are expected to report strong earnings growth this week. They will likely reaffirm their 2025 AI capex plans, and demonstrate their ability to adapt to emerging competition.

Valuations for these firms remain reasonable and are supported by solid fundamentals. DeepSeek’s rise underscores the need for vigilance but does not undermine the long-term prospects of established AI leaders. These firms are well-equipped to adapt to the evolving landscape.

While near-term growth expectations for the AI-capex exposed names may face scrutiny, we think that DeepSeek’s efficiency breakthroughs may ultimately accelerate AI adoption, driving more demand for data centre infrastructure.