TSX jumps amid Fed rate cut hopes, ongoing U.S. government shutdown

In our previous update about the NASDAQ 100 (NDX), see here, when the index was trading around 24520, we found that, according to the Elliott Wave (EW) Principle, the index is in an impulse (five-wave) move up from the early April lows, targeting 24770-25570 for an interim top.

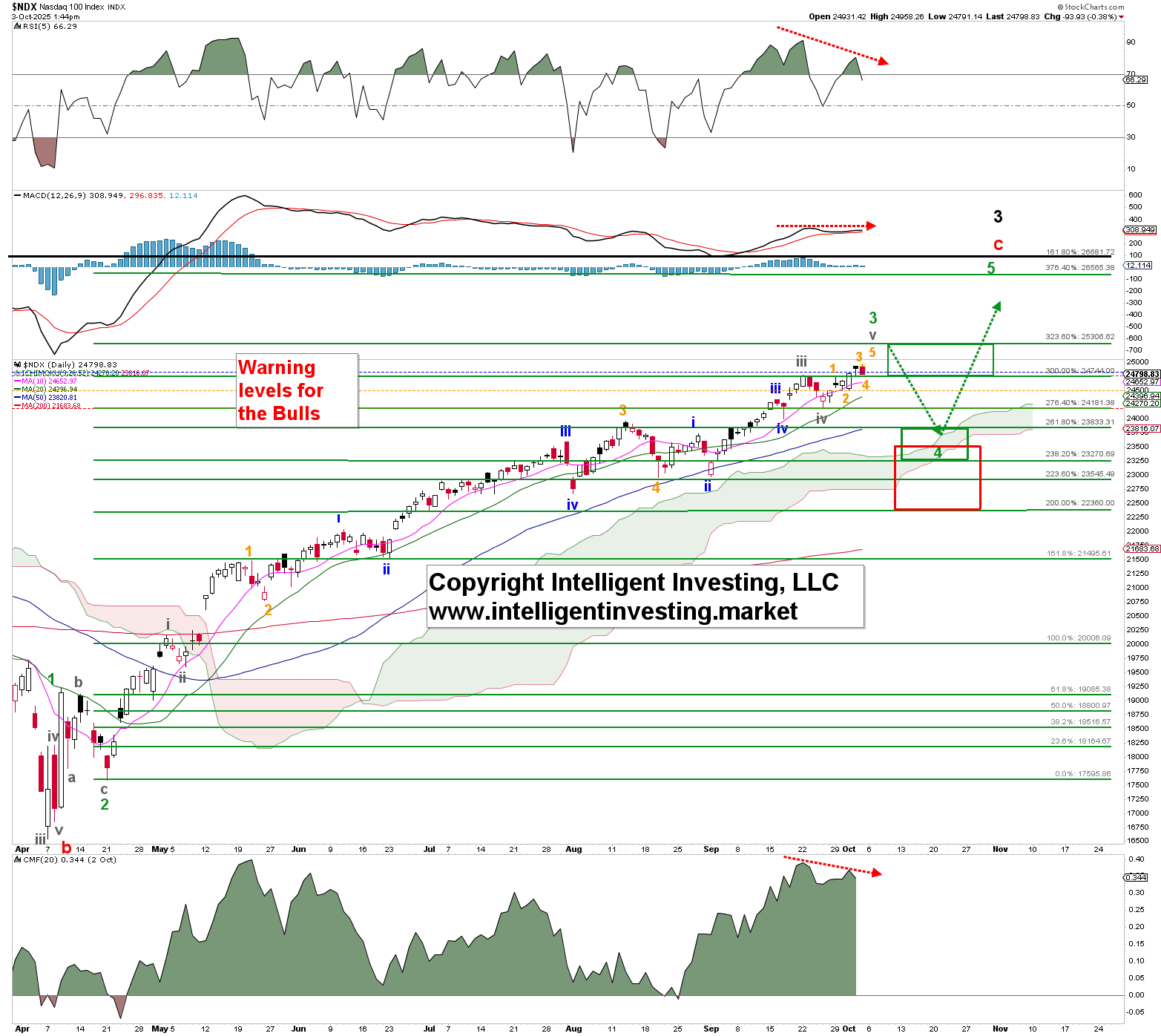

Fast forward two weeks, and the index reached 24958 today. It is perfectly within the ideal target zone and reversed intra-day. Therefore, the odds are increasing that the intermediate (green) W-3 top has been hit. See Figure 1 below.

Figure 1. Our preferred short-term Elliott Wave count for the NDX.

We can allow one smaller (orange) W-5 to reach as high as ~25300, but it is no longer necessary, and that would be like picking up pennies in front of a steam train. Thus, the index has, as expected, entered the zone where the likelihood of a pullback, the green W-4, is high. Additionally, there’s plenty of negative divergence (red dotted arrows) on the technical indicators. However, since these are conditions, not trade triggers, the price will now need to break below the orange warning level* at 24505 to confirm this thesis.

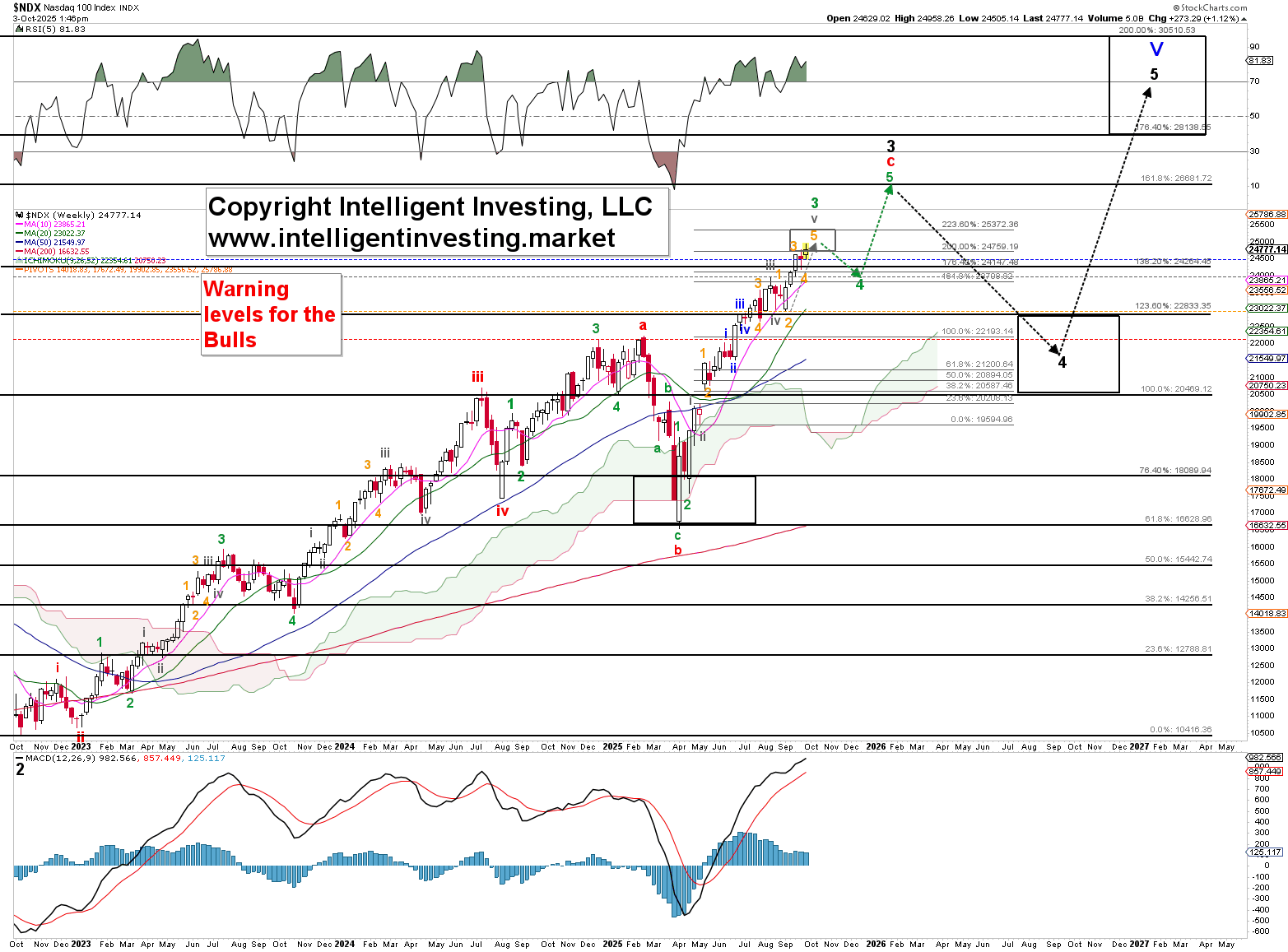

Regardless, the green W-4 is inevitable and should ideally retrace 23.6-38.2% of the green W-3, the red target zone between 22360 and 23500. However, since in bull markets “the downside disappoints and the upside surprises,” while the 4th and 2nd waves are often equal in length, a drop to the orange target zone at 23270-23830 is more likely. From there, we can expect one last fifth wave, the green W-5, to target a point close to the ideal black 161.80% Fibonacci extension, approximately 26680, which is also the green 376.4% extension—a typical extended fifth-wave target—at 26565. Once reached, a bear market like 2022 will follow for the black W-4. See Figure 2 below.

Figure 2. Our preferred long-term Elliott Wave count for the NDX.

*These levels, which serve as our safety nets, as drops below these levels increase the chance (25%, 50%, 75%, 100%, respectively) that the top is in are raised as the index rises: 1st, blue: 24816; 2nd, gray: 24741; 3rd, orange: 24505; 4th, red: 24186.