Intel surges as Nvidia takes $5B stake

- Costco's latest earnings fell short of expectations

- But, the company's moat, its membership system, remains strong, growing by 6.1%

- Despite a disappointing outlook, Costco's financial health remains strong based on InvestingPro data

Retail giant Costco's (NASDAQ:COST) latest earnings revealed a drop in revenue as consumers cut back on non-discretionary spending because of stubborn inflation.

Consumers seem to be prioritizing spending on essential items, and sales of the one-stop retail giant's high-margin products like furniture, toys, and electronics have taken a hit.

This has led the retail giant to issue disappointing forecasts like its peers in the retail space.

So, what does the future hold for the Washington-based retailer?

Let's delve deep into the company's earnings using InvestingPro tools and try and find out.

You can do the same for virtually any stock using InvestingPro tools. Click on this link and start your free trial today!

Costco's Earnings

The company's revenue rose by 1.9% to $52.5 billion, as compared to $51.51 billion in the same period last year. However, it fell short of InvestingPro's estimate of $54.5 billion.

The recently released quarterly report revealed a net income of $1.3 billion and earnings per share of $2.93. In comparison to the same period last year, earnings per share were $3.04 and net income was $1.35 billion.

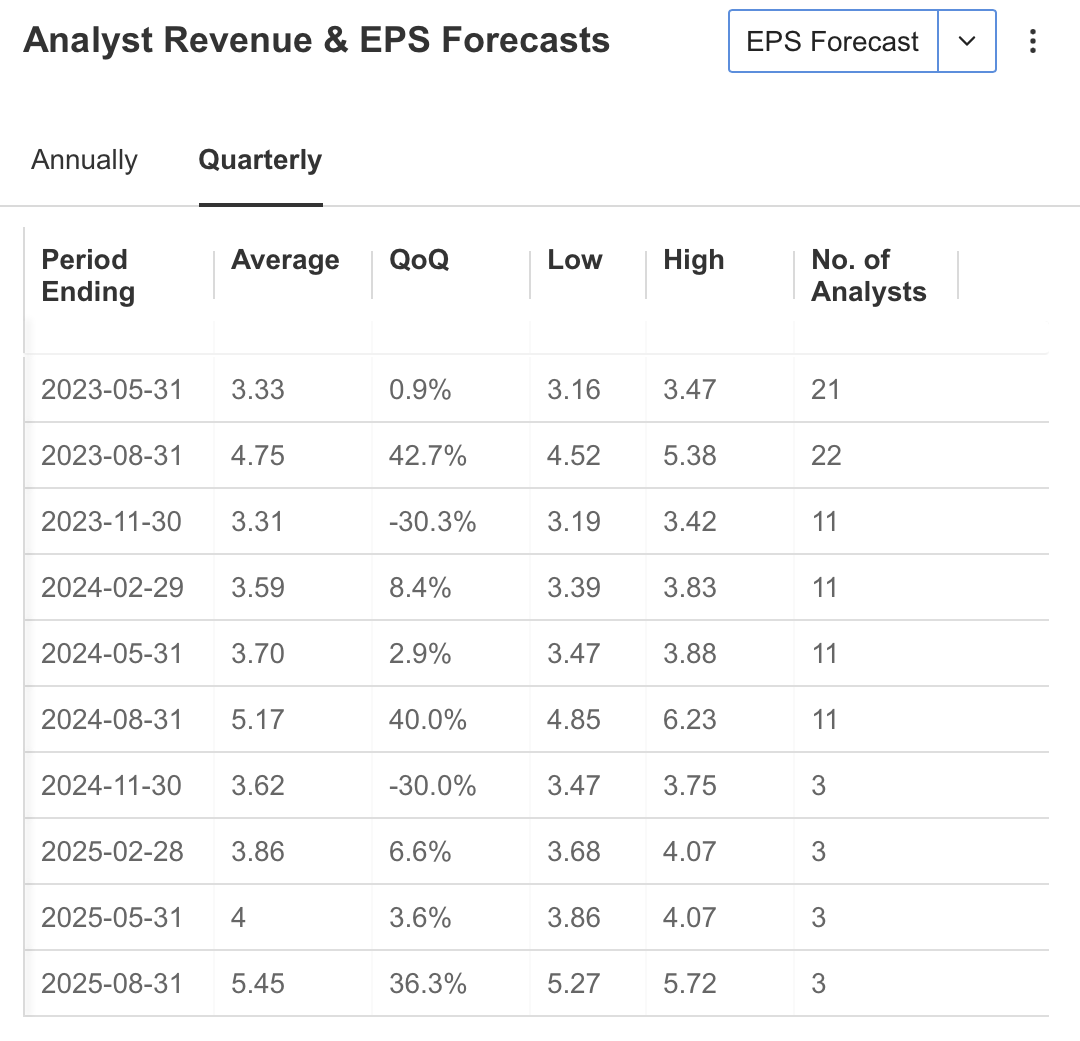

However, earnings per share fell short of the InvestingPro estimate of $3.33, and there was a slight year-on-year decline.

Source: InvestingPro

On the InvestingPro platform, 9 analysts lowered their HBK estimates, while 5 raised theirs. Analysts predict that earnings per share will rise in the first half of the year due to seasonal factors, but anticipate a decline towards the end of the year.

Source: InvestingPro

The Issaquah, Washington-based retailer's quarterly results were lower than expected due to high inflation and uncertain market conditions. However, its membership system remains a competitive advantage in the sector. The latest data showed that Costco's membership revenues increased by 6.1%, reaching $1.04 billion.

Basic necessities remain a top priority for consumers, as indicated by their spending habits, despite the availability of high-margin products like furniture, jewelry, and electronics at Costco. This shift in consumer priorities has prompted companies like Target Corporation (NYSE:TGT) and Home Depot (NYSE:HD) to revise their 2023 forecasts in response.

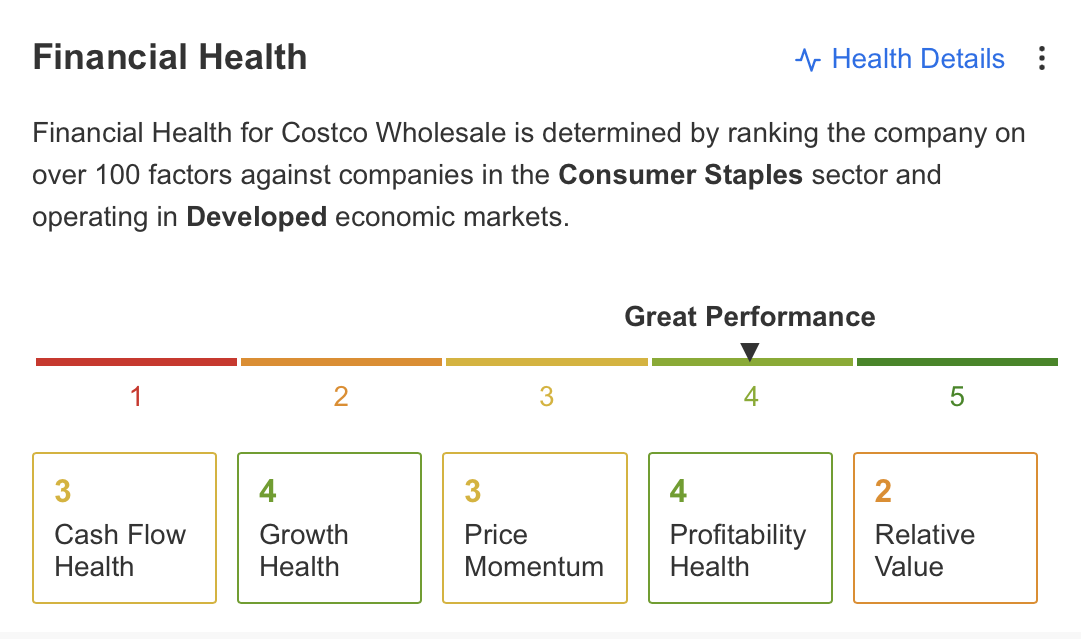

Source: InvestingPro

According to InvestingPro, Costco's financial health remains strong based on recent data. The company's growth and profitability significantly contribute to its financial health assessment. Costco's cash flow ratios indicate good performance, and the company has more cash on its balance sheet than liabilities, which is another positive aspect.

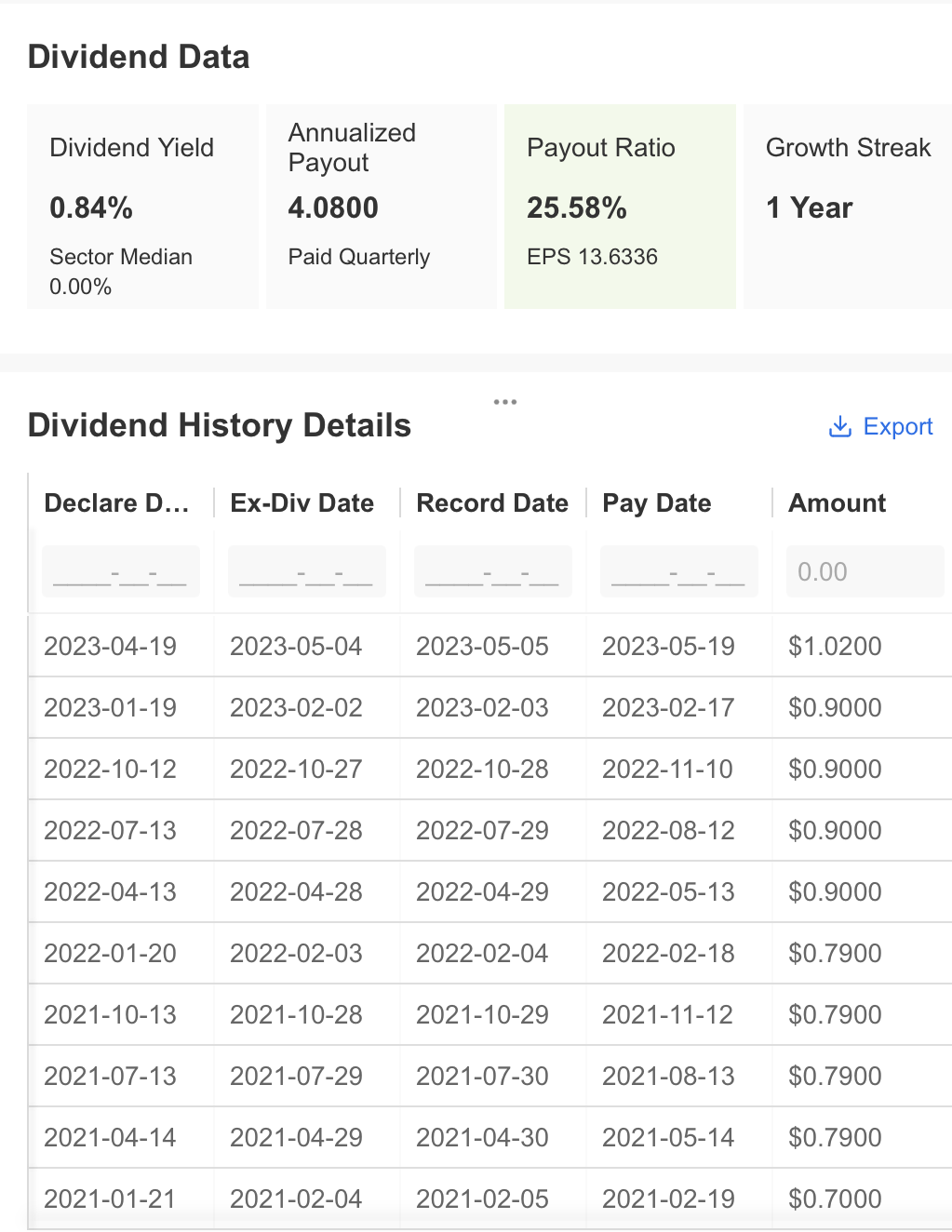

Source: InvestingPro

On the other hand, Costco, which pays regular dividends, currently has a dividend yield of 0.84%. The company is expected to continue dividend payments as it achieves strong earnings.

Source: InvestingPro

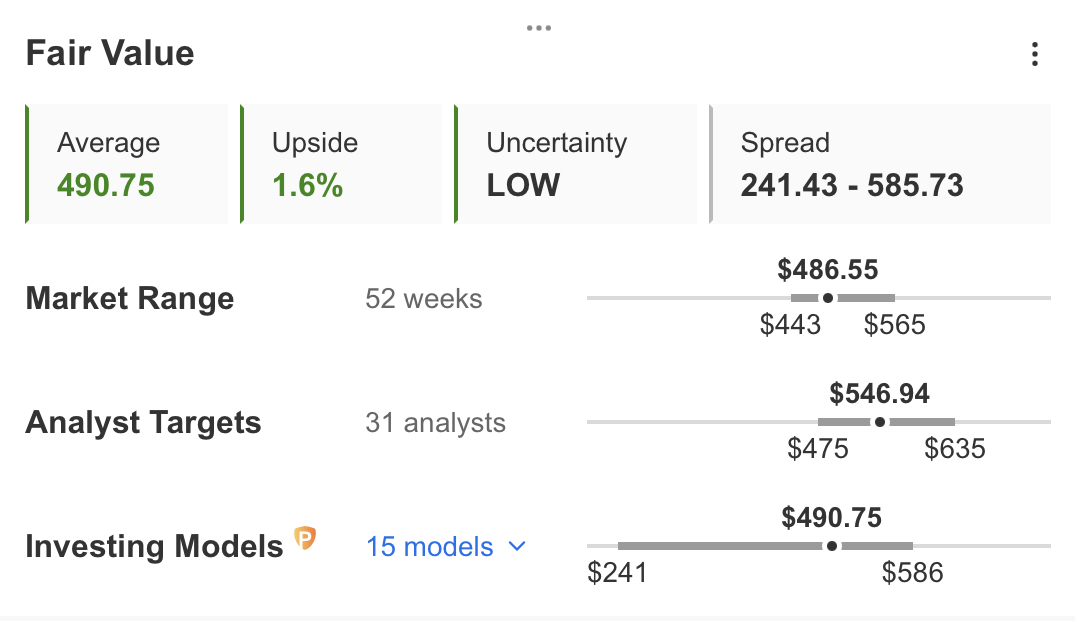

InvestingPro fair value suggests that Costco's fair price is $490, aligning with the current trading price of $486.55. However, 31 analysts' average fair value is $546, indicating that the current price is discounted.

Source: InvestingPro

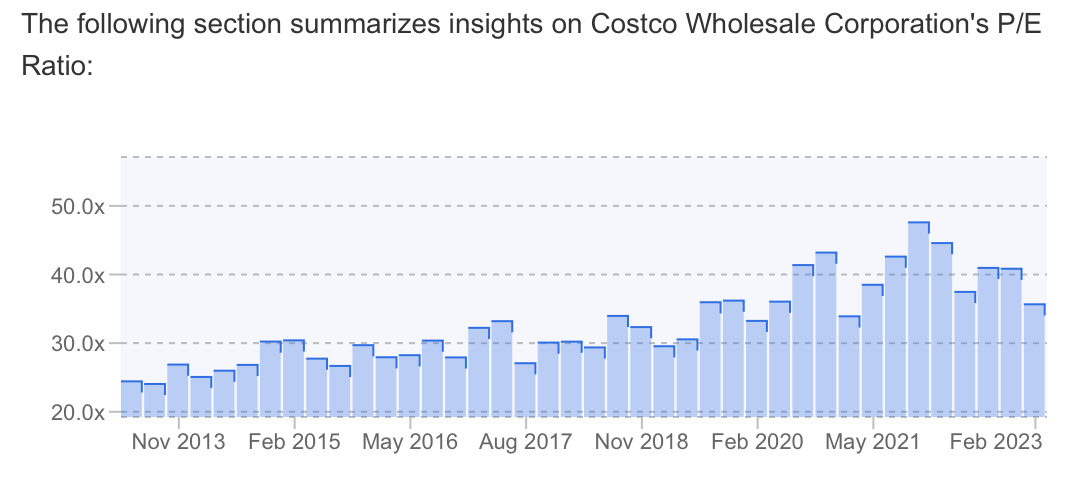

COST's F/K ratio has remained high at 35.7x in the past year, which makes the share price expensive. However, analysts predict a decrease in the F/K ratio starting in 2021, which is a positive.

Source: InvestingPro

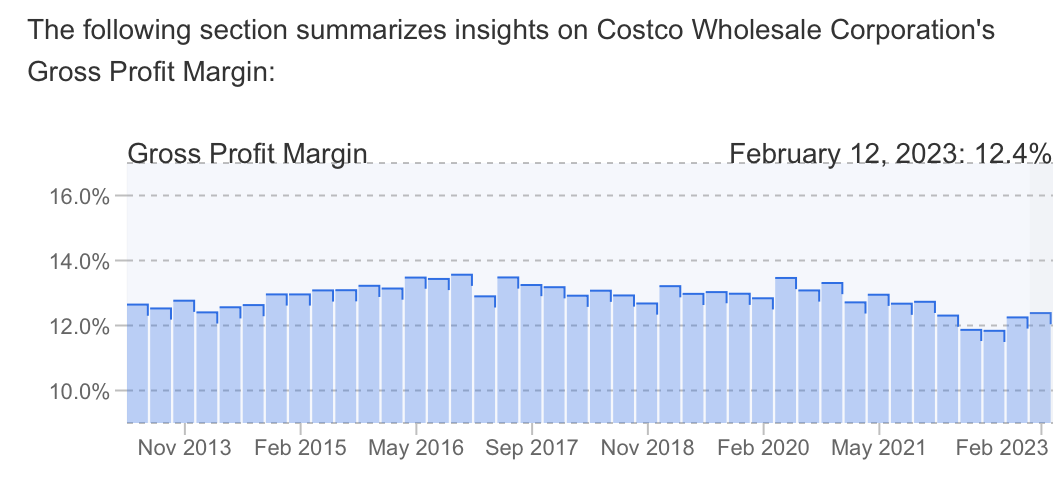

It's worth noting that Costco's profit margins have been declining, which is a drawback for the company. Compared to the industry average of 30%, Costco's margin sits at 12%, which is lower.

Costco: Technical View

COST stock has been in a steady uptrend for the last year but is now showing signs of price compression. It peaked at $600 in April 2020, then dropped quickly to $400. Despite the setback, the price has since formed higher lows and lower highs.

COST stock appears to be in the final phase of price compression, forming a symmetrical triangle pattern. This month, it has reached a critical point where the share price may break out of the triangle's boundaries. If the breakout occurs, there is potential for a significant bounce, around the triangle's size (30%).

Costco's stock needs to maintain above the support level of $475 to prevent losses. If it rises above $510, it could start a new uptrend.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.