Moody’s downgrades Senegal to Caa1 amid rising debt concerns

Once a sleepy corner of the stock market, the S&P 500 Utilities sector is now a hotbed of debate. Fans believe that growth in data centers, cryptocurrencies, electric vehicles (EVs), the reshoring of manufacturing to the US, and ultimately robots will spark sharp growth in electricity demand.

US power demand grew only 1%-2% annually over the past decade, muted by efficiency increases, but over the next 10 years, demand could grow 6%-8% annually, according to a December 19 Fidelity report.

Naysayers warn that a bubble is brewing in data centers that could leave utility bulls charging at air. Last Tuesday, one of those naysayers grabbed headlines: Alibaba (NYSE:BABA) Chairman Joe Tsai warned that the construction of data centers may outstrip demand. Some projects are raising funds before locking in customers, and the building of data centers on spec suggests to him a bubble forming.

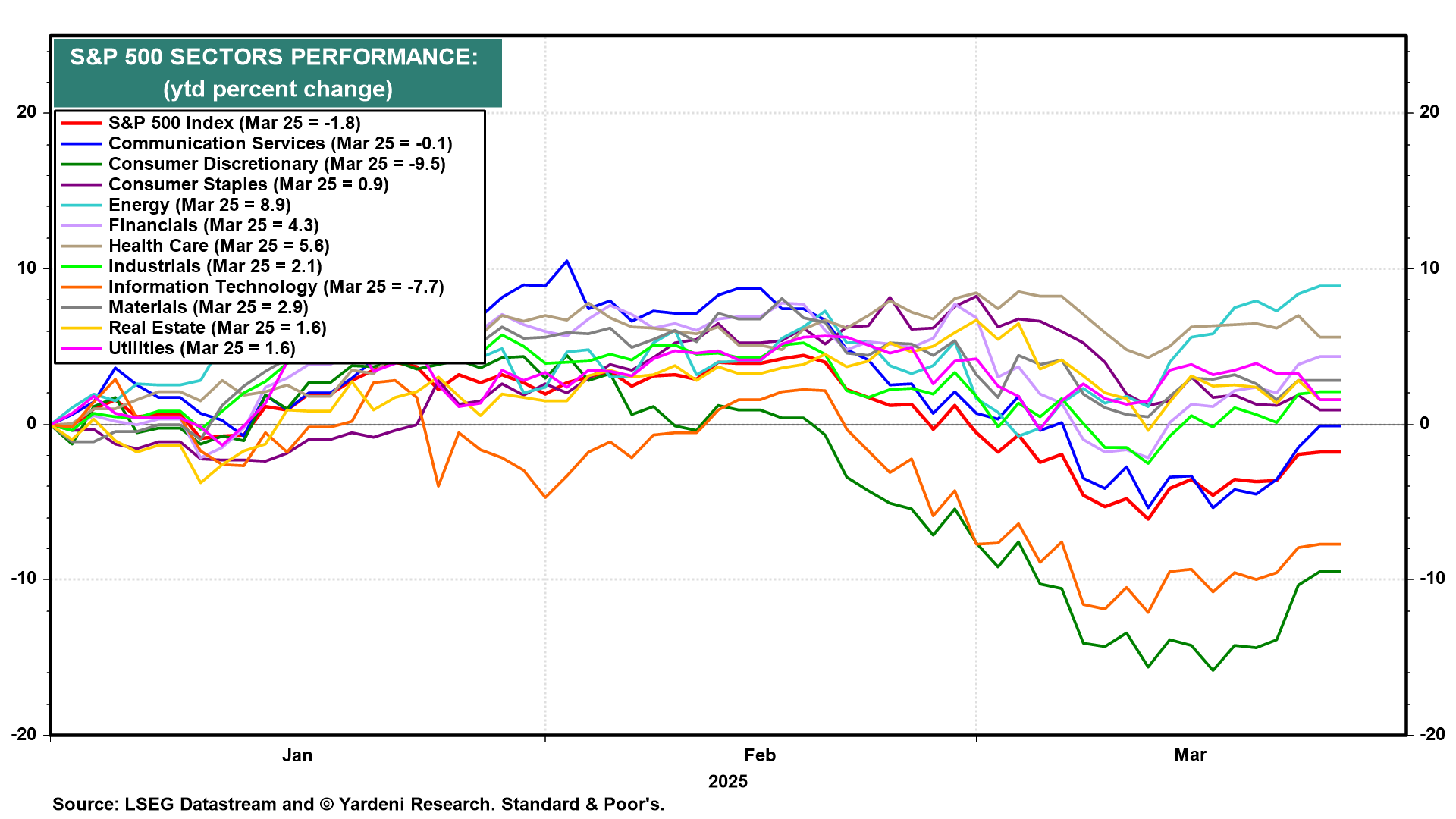

The S&P 500 Utility sector shed 1.6% on Tuesday in the wake of these comments, while the S&P 500 gained 0.2%. Still, the sector is in positive territory ytd through Tuesday’s close, while the S&P 500 is in negative territory.

Here’s the performance derby for the S&P 500 and its 11 sectors ytd through Tuesday’s close: Energy (8.9%), HealthCare (5.6), Financials (4.3), Materials (2.9), Industrials (2.1), XReal Estate (1.6), Utilities (1.6), XConsumer Staples (0.9), Communication Services (-0.1), S&P 500 (-1.8), Information Technology (-7.7), and Consumer Discretionary (-9.5).

Folks who watch the real estate market appear to disagree with Tsai’s assessment. A recent report by Jones Lang LaSalle (JLL) noted that as 2024 concluded, existing data centers were full, space in data centers coming online imminently was largely spoken for, and the market for data centers—and therefore demand for electricity—should remain strong for years to come. Here are some of the report’s highlights:

1. Tight Market in 2024

The US data center vacancy rate fell to a record low of 2.6% by the end of last year. It’s even tighter in the more popular markets, like Northern Virginia, where vacancy is only 0.6%. “Tenants looking to lease any sizable amount of data center capacity must wait 24 months on average.

Limited availability is constraining sector growth,” the report stated. Given the tight market, data center owners were able to boost rents on average by 12% y/y in 2024, and rents have risen by roughly 50% over the past five years.

The market’s tightness was apparent yesterday. Microsoft (NASDAQ:MSFT) abandoned leases on new data center projects set to use two gigawatts (GW) of electricity in the US and Europe because it decided “not to support additional training workloads from ChatGPT, maker of OpenAI,” Reuters reported. But don’t expect those data centers to remain dark.

Alphabet’s Google (NASDAQ:GOOGL) and Meta Platforms (NASDAQ:META) are expected to take over the leases.

In 2024, construction was completed on 2.5 GW of colocation capacity, and almost all of it was absorbed at delivery. At the end of last year, 6.6 GW of colocation capacity was under construction, and 72% of that space has already been leased. Demand comes from cloud providers (43%) and the technology (23%) and finance (9%) industries.

Here’s the market’s concern: Over the next few years, 22.9 GW of planned projects are in the pipeline but not yet under construction. Despite this large wave of potential supply, the bulls have two solid arguments:

(1) Artificial intelligence is a growing source of demand. It represented about 15% of data center workloads, and it could grow to 40% by 2030, JLL noted.

(2) The road from planning to completing a project is long and fraught with issues surrounding zoning land, accessing equipment, and buying electricity. So, the planned projects will take years to complete and won’t hit the market all at once.

2. Challenges to Building

JLL considers obtaining power the “primary challenge facing the data center industry.” The US power grid is operating near full capacity, so building a new data center can require developing new electricity generation capacity. Those utilities that do have available capacity often don’t have enough of it to run a data center, anywhere from 100 megawatts to 1 GW.

Utilities had been inundated with requests from developers that were buying land on spec, hoping to get electricity run to that land with plans of flipping the improved land to make a profit—until, that is, last summer, when utilities began tightening their requirements, the report states.

Utilities want to see project leaders with development experience, signed tenants, and financing that’s in place. They’re charging application fees of $200,000 or more, checking credit, and requiring a load impact study to be done, which can take 8-12 months. Moreover, once approved, developers are being required to pay for the infrastructure hookup costs and being asked to sign take-or-pay contracts obligating them to pay a minimum amount of their planned power usage, even if that power isn’t used.

As a result, developers have found themselves sitting on land they’ve purchased that isn’t generating cash flow for years longer than expected. Proposed data center projects, particularly those in rural areas, often have to wait four years or more for a connection to the grid.

These tougher requirements may make projects more costly or mean they take longer to complete. But they may also mean that only “good” projects come to the fore and a bubble takes longer to develop, if it does at all.

3. Supply Chain Knots

For would-be data center builders who have land and electricity, acquiring equipment can be the next hurdle. According to JLL, it can take 28 weeks on average for the delivery of data center equipment. While that’s improvement from pandemic lead times of 64 weeks, it’s still far longer than the 18 weeks it took in 2019. Generators, transformers, and switchgear have an even longer lead time of 11 months. More than 70% of data center equipment is manufactured in Asia. Some of that manufacturing is relocating to the US or North America, which could improve the situation.

4. Utility data

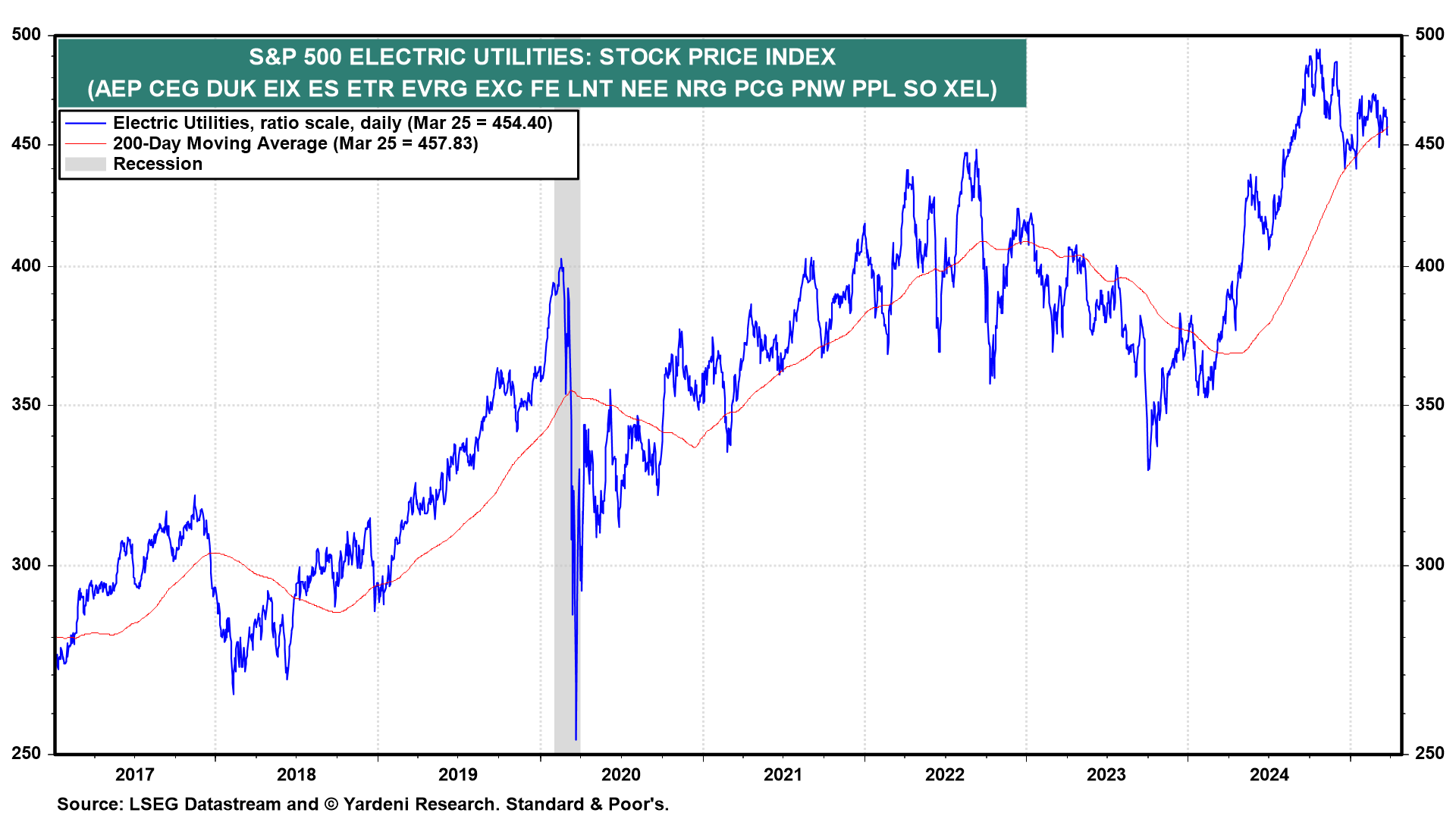

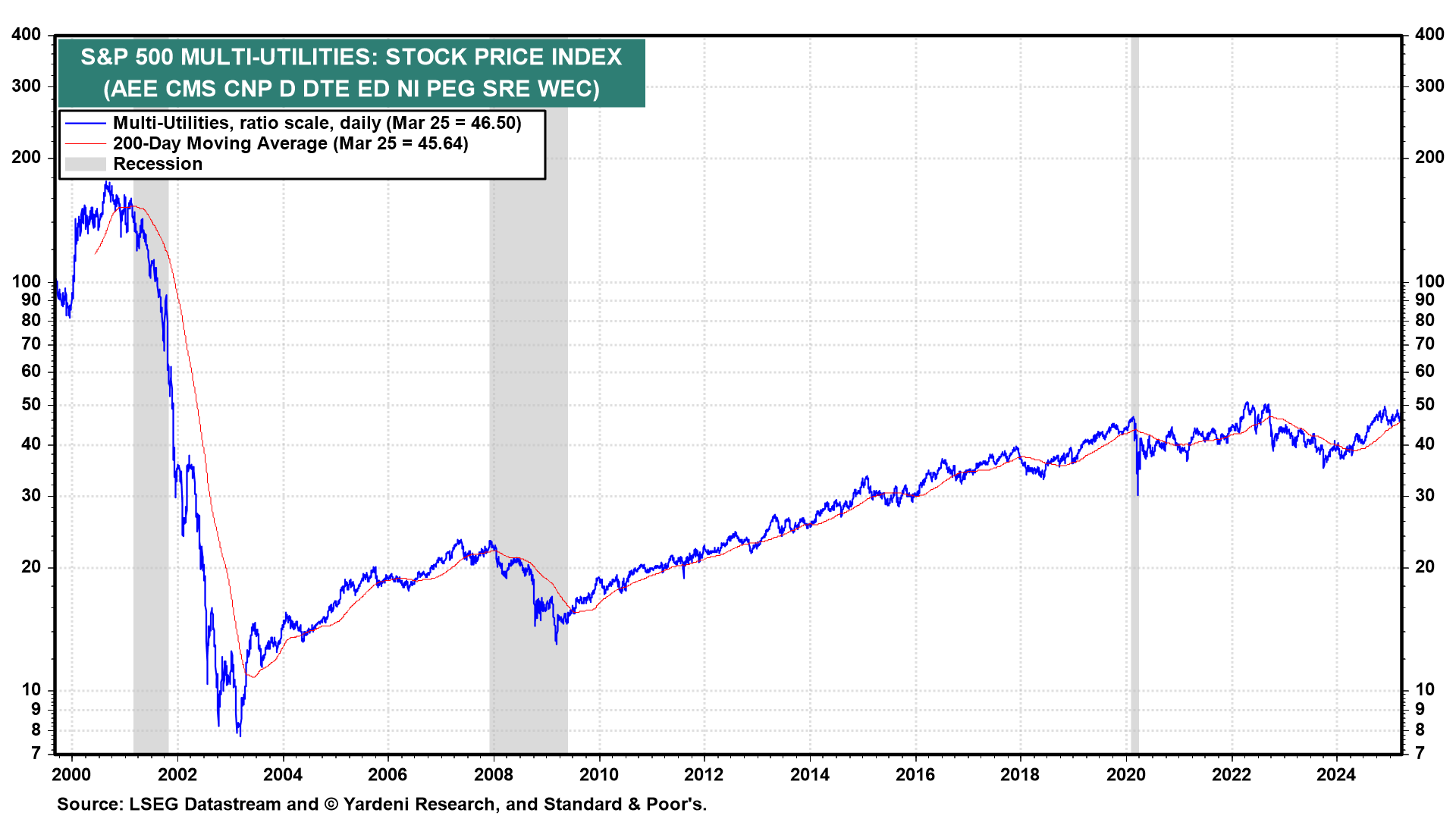

The S&P 500 Utilities sector includes the S&P 500 Electric Utilities industry, populated with companies that generate, transmit, and distribute electricity, and the Multi-Utilities industry, with companies that provide a combination of utility services, including electricity, gas, and/or water. The former industry index is up 3.2% ytd, the latter up 3.3% ytd.

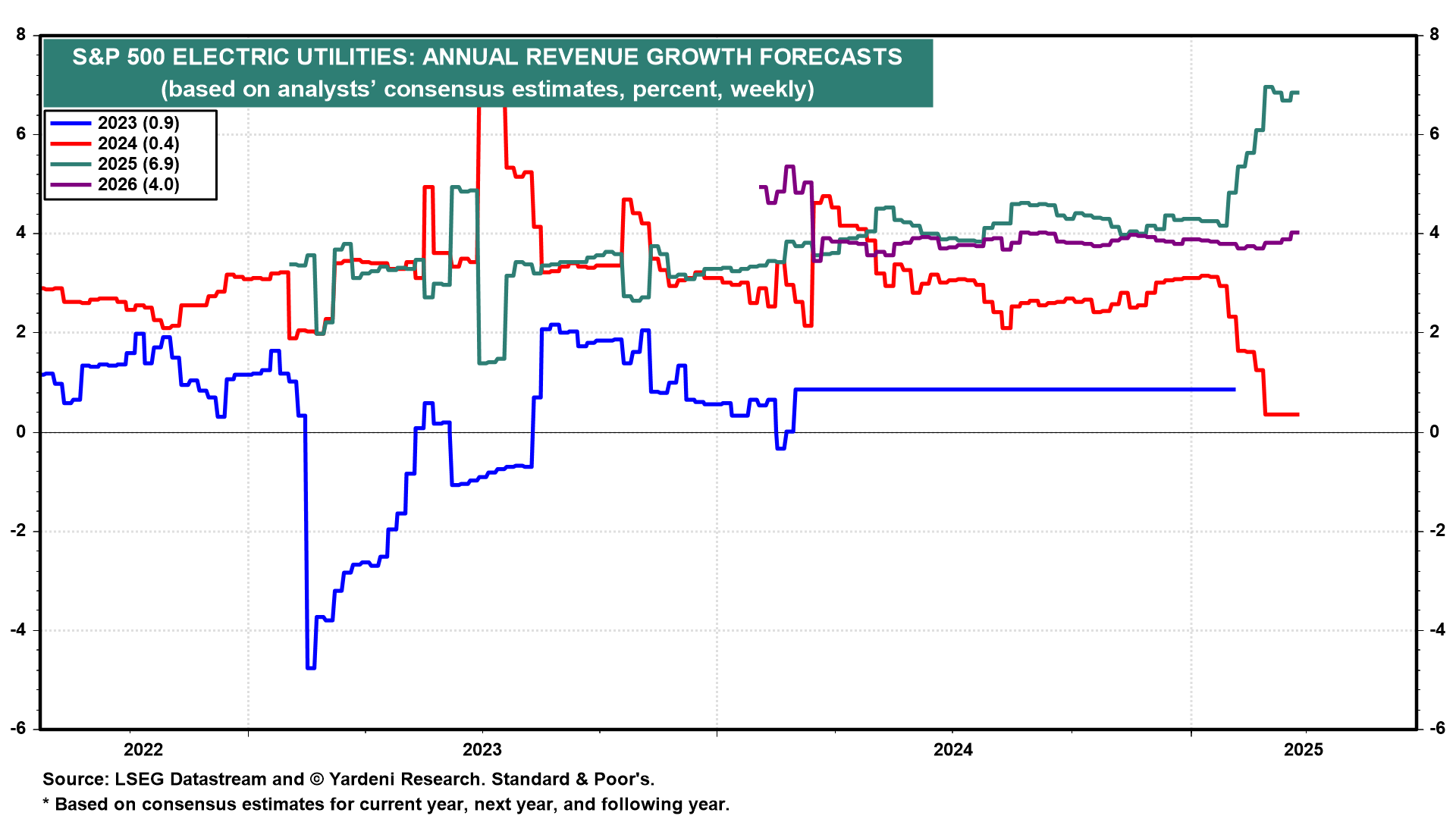

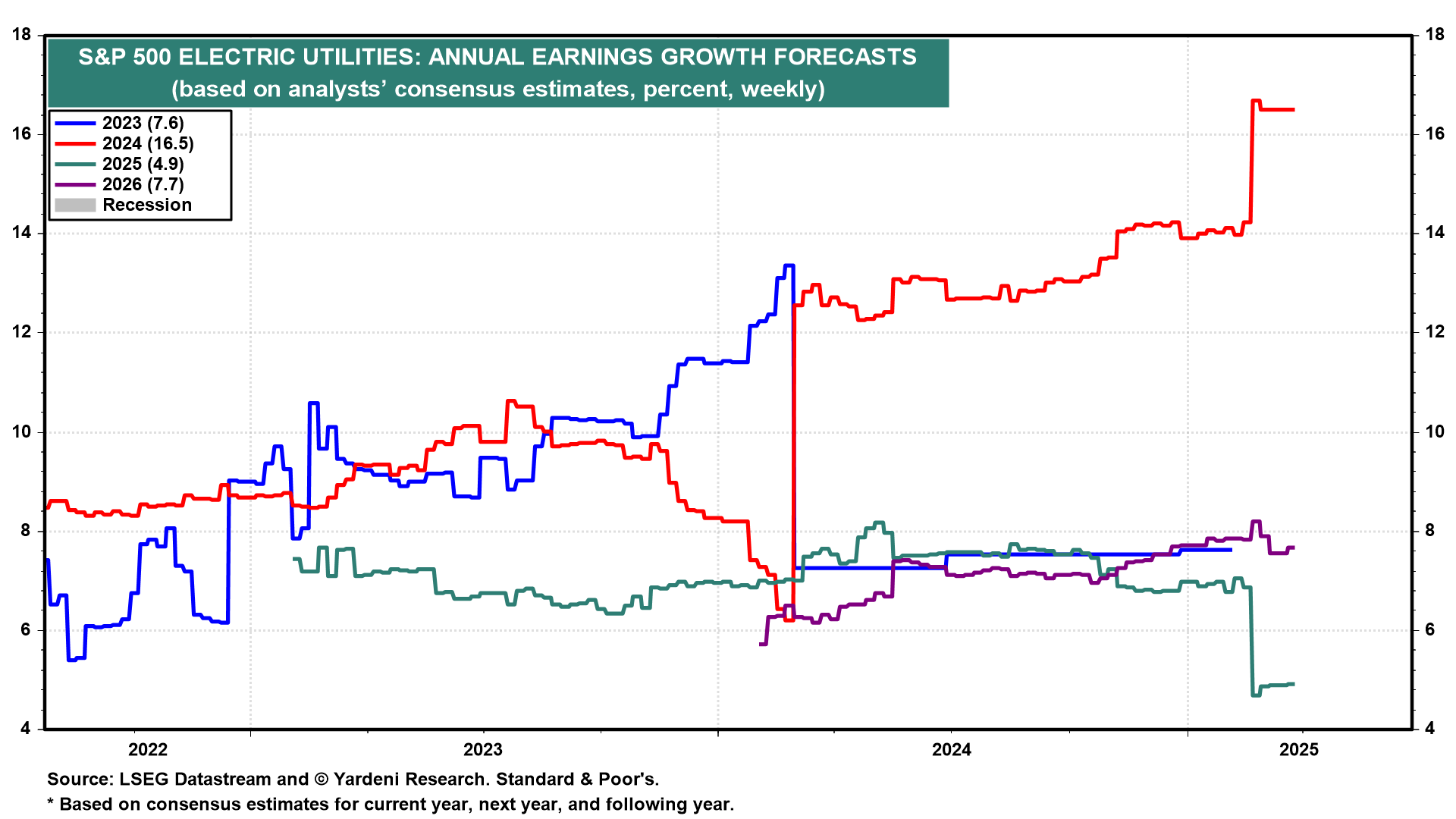

Both are expected to have decent revenue and earnings growth. The Electric Utilities industry’s companies collectively are forecast to grow revenues by 6.9% this year and 4.0% in 2026 and to grow earnings by 4.9% this year and 7.7% next year.

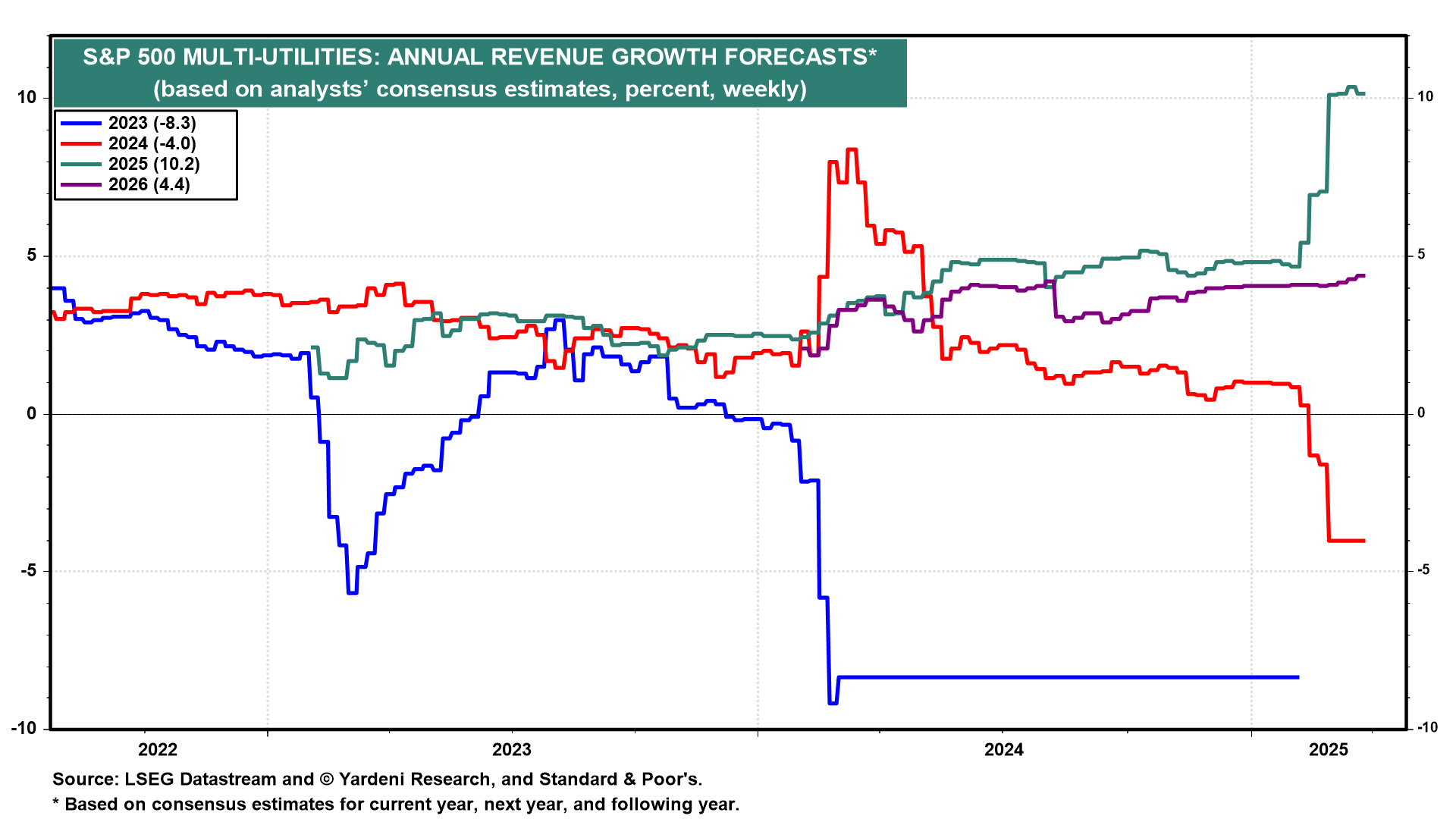

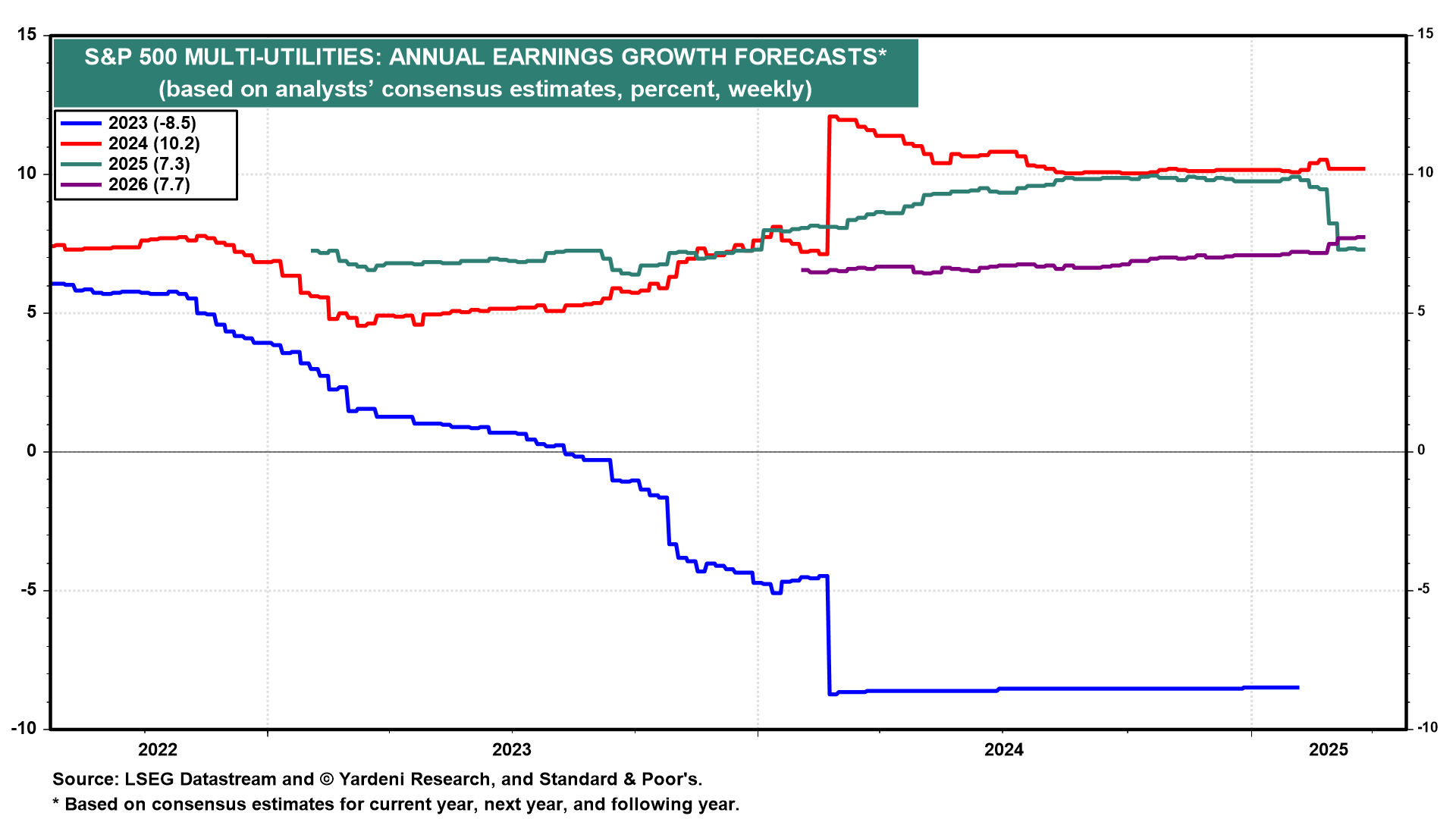

The S&P 500 Multi-Utilities industry is expected to grow a touch faster. Analysts forecast revenues growth of 10.2% this year and 4.4% in 2026, while they predict earnings will improve by 7.3% this year and 7.7% in 2026.

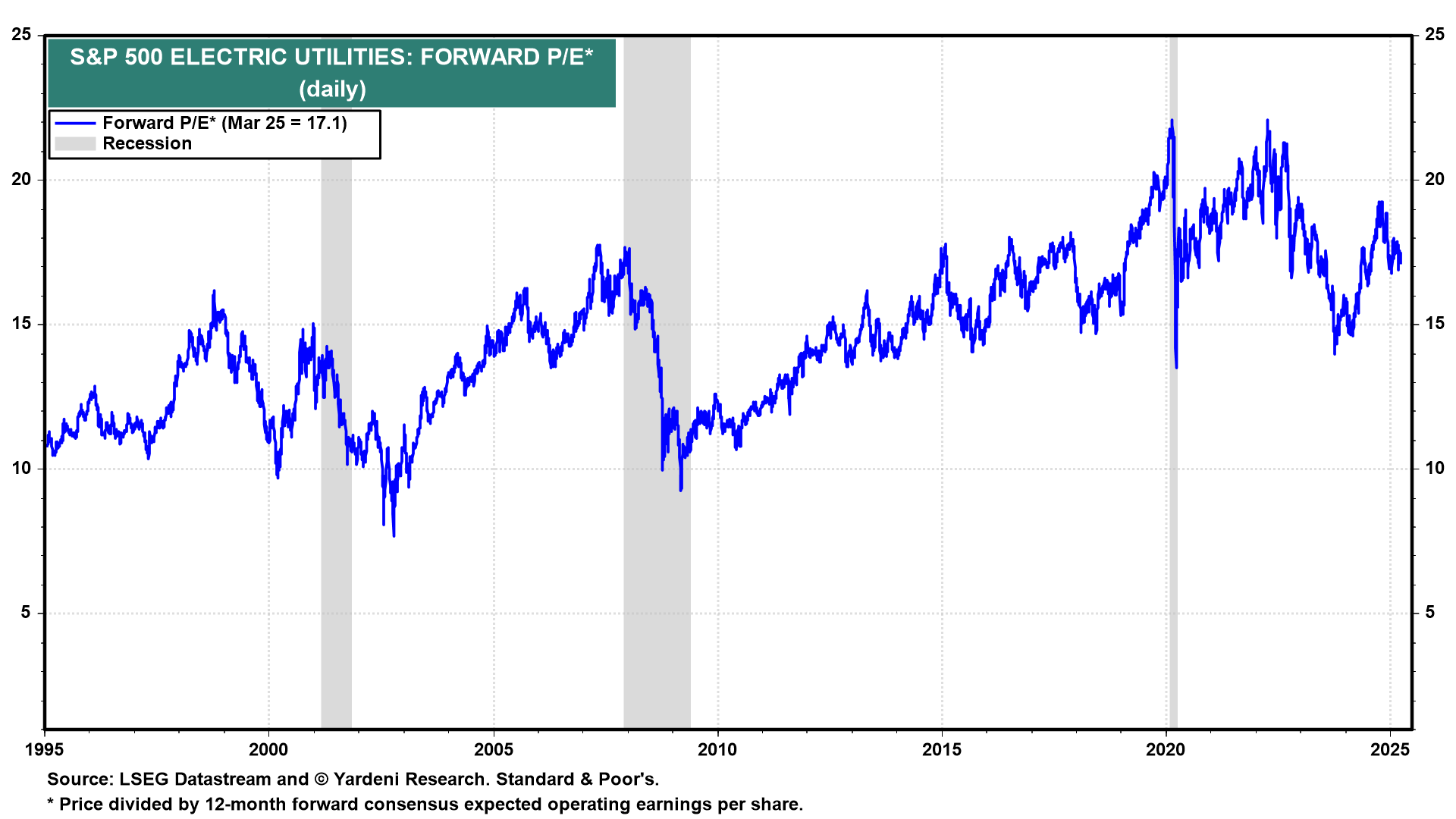

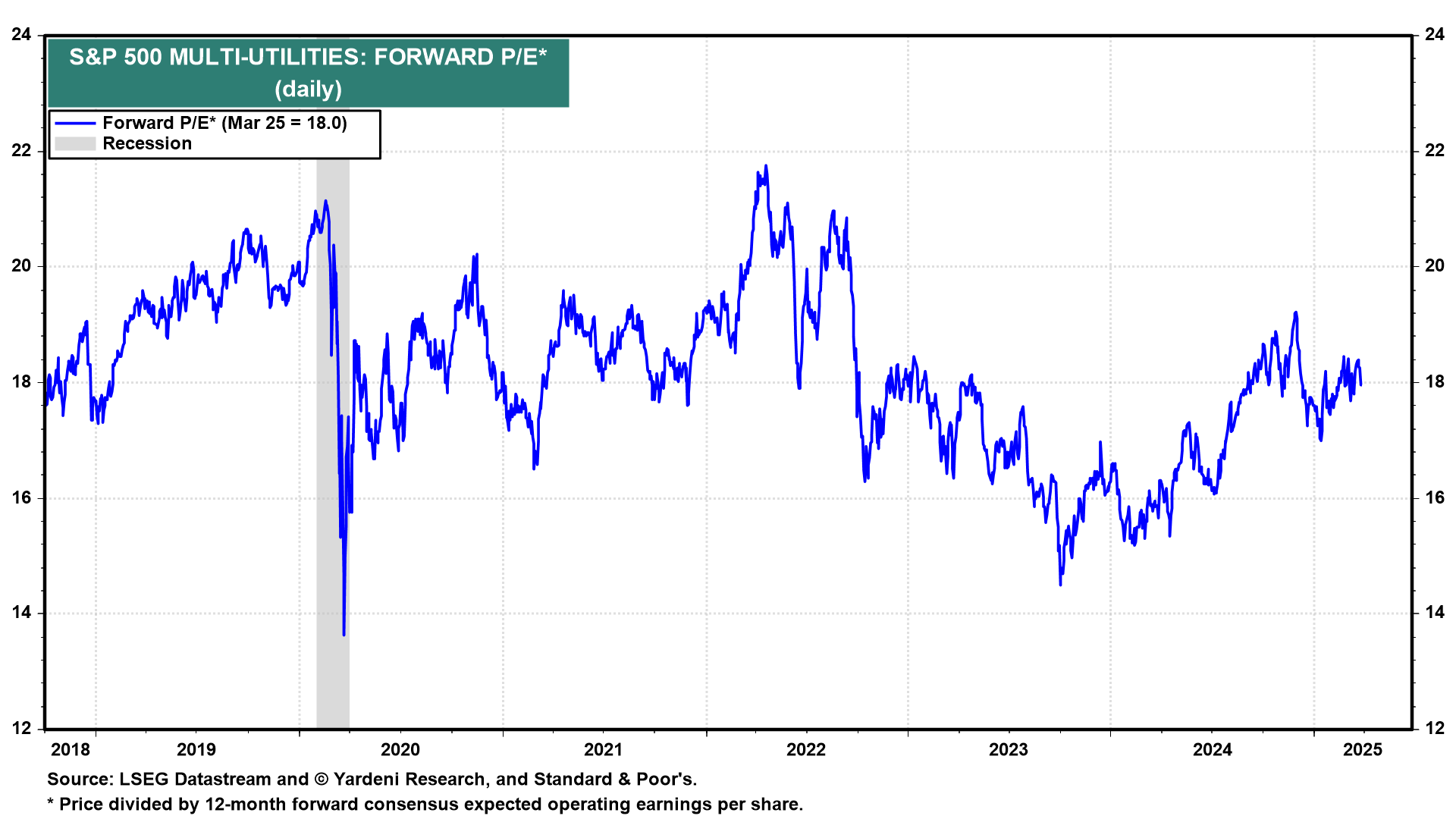

Both industries have sported forward P/Es north of 20 at various times in recent years, and now the Electric Utilities’ forward P/E stands at 17.1, and the multi utilities’ forward P/E is 18.0.