e.l.f. Beauty stock plummets 20% as revenue and guidance fall short of expectations

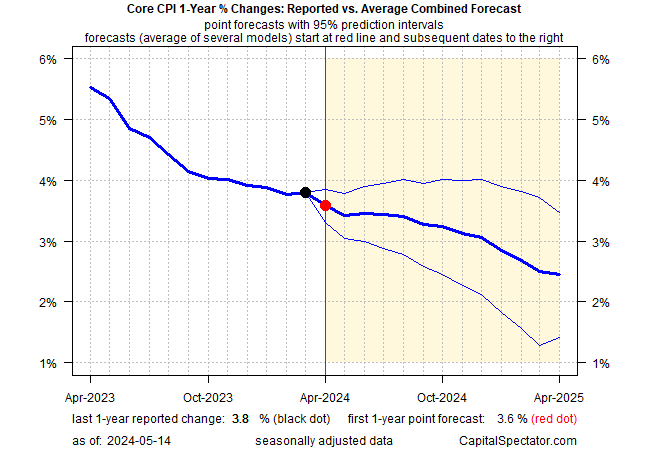

US consumer inflation data was surprisingly firm in March, raising the stakes for tomorrow’s April report (Wed., May 15). Another round of disappointing numbers would arguably confirm that the recent disinflation trend is in serious trouble. No one can rule out that possibility, but I’m expecting we’ll see disinflation will return in some degree.

In particular, the year-over-year change in core CPI is expected to ease to 3.6% through April, based on the point forecast for CapitalSpectator.com’s ensemble model. The prediction interval leaves room for an upside surprise, although the odds that core CPI will accelerate are quite low. The worst-case scenario, according to this modeling, is that core CPI’s 1-year trend holds steady.

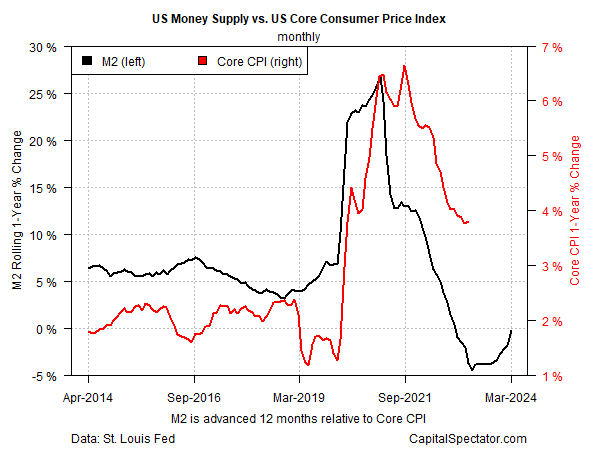

Another factor that suggests that disinflation will continue: the lag effects of monetary policy, which have been relatively hawkish over the past two years. Consider how the year-over-year changes in broad M2 money supply (advanced 12 months) compare with the 1-year change in core CPI. As the chart below suggests, the recent negative comparisons in M2 point to more disinflation ahead.

Timing, of course, is open for debate and so the negative 1-year trend in M2 may not be relevant for any given monthly CPI report. What’s more, the M2-CPI chart above raises a warning for the disinflation outlook, namely: time is running out. The net change in the M2 trend is still negative, but the depth of the contraction is fading and looks set to turn positive soon. The implication: monetary policy’s ability to promote a disinflationary bias is fading.

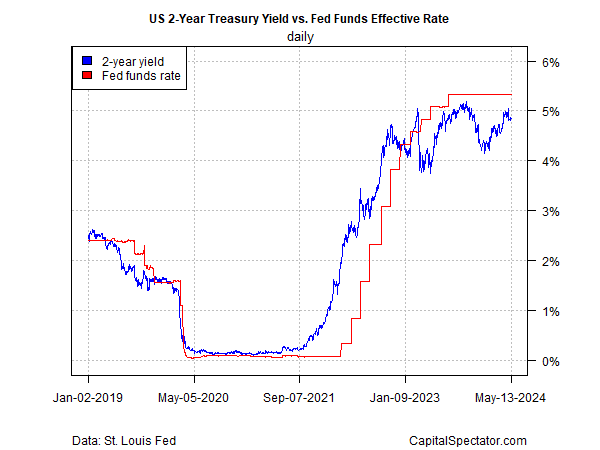

Meantime, market expectations remain aligned with an ongoing disinflation forecast, or so the policy-sensitive US 2-year Treasury yield suggests. Although this key rate’s implied forecast has been wrong for some time — i.e., that the Federal Reserve will cut interest rates — the crowd is sticking to its dovish outlook, per the ongoing 2-year rate trading well below the current Fed funds rate.

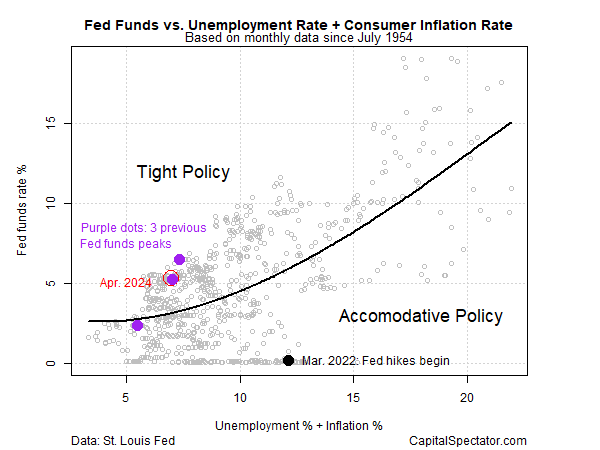

Finally, a simple model using unemployment and headline CPI continue to suggest that monetary policy is tight, which suggests that a disinflationary wind is still blowing.

The acid test, of course, is how the actual CPI results stack up. As it turns out, economists are also projecting that core CPI will ease to a 3.6% year-over-year rate, based on Econoday.com’s consensus point forecast.