Trump to impose 100% tariff on China starting November 1

- Brent Oil surges 4% on US-China tariff reductions, boosting market optimism.

- Saudi Aramco and Russia’s Central Bank express confidence in oil market stability.

- Technical analysis suggests potential resistance at 66.44 and 68.71 for Brent Crude.

- Client sentiment data shows a strong long position on WTI, signaling a possible price decline.

Oil prices surged 4% on Monday after the U.S. and China announced plans to ease some tariffs, sparking optimism about ending their trade war as the top two crude oil consumers.

Markets seem more at ease following the announcement and this was echoed by Saudi Aramco and Russia’s Central Bank. Aramco stated in an earnings conference call that Oil fundamentals remain sound despite recent volatility with the Oil giant touting growth for Q2.

Similar sentiment has emerged from the Russian Central Bank, which said it expects Oil prices to stabilize above $60/barrel as trade tensions ease. This could be seen as a sign that sentiment has undoubtedly improved.

US-China Trade Developments

Markets are taking their cues from US-China developments, but what were the key takeaways from this weekend’s meeting?

The US and China have agreed to lower tariffs on each other’s goods for 90 days to ease trade tensions. US tariffs on Chinese imports dropped from 145% to 30%, while Chinese tariffs on US goods were reduced from 125% to 10%.

President Trump has been commenting on the deal, stating that the agreement doesn’t cover tariffs on cars, steel, aluminum or pharmaceuticals. The President will speak to China’s President Xi at the end of the week.

The President is hoping that China will open up markets to US businesses.

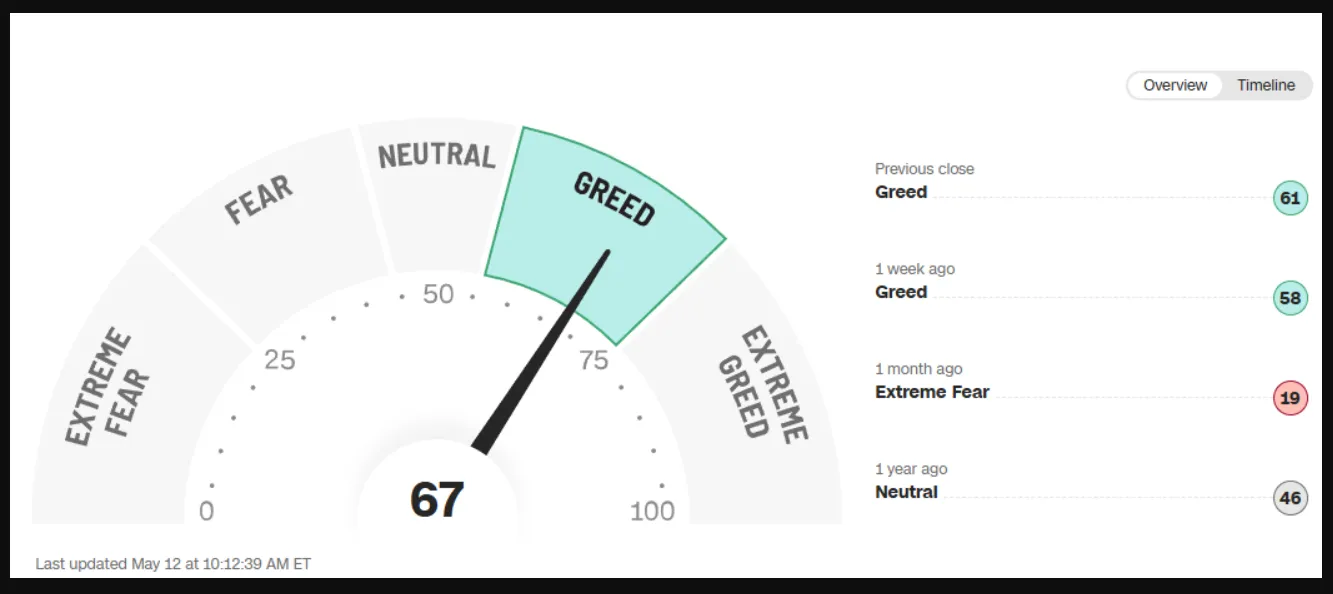

Looking below at the Fear and Greed chart and you can see that sentiment has turned positive and is now in greed territory. Another sign that markets are optimistic about the future after the weekend.

Source: FinalcialJuice

Technical Analysis - Brent Crude

From a technical analysis standpoint, Brent has pushed higher since bottoming out on May 5.

Looking at price action and market dynamics, the RSI period-14 has crossed above the 50 neutral handle. This is usually a sign of a shift in momentum from bears to bulls.

A bullish move from here may find resistance at 66.44 and 68.71, respectively.

A move lower high may find support at 64.00, and 62.81 may come into focus.

Brent Crude Oil Daily Chart, May 12, 2025

Source: TradingView

Client Sentiment Data

Looking at OANDA client sentiment data and market participants are net-long on WTI, with 75% of traders holding long positions. I prefer to take a contrarian view toward crowd sentiment, and thus the fact that so many traders are long means WTI prices could decline further.