60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

-

Better-than-expected results in big tech lift S&P 500 EPS growth for Q1 2023, now set to come in at -3.7%

-

Potential earnings surprises this week: Marriott International

-

Names to watch during the second peak week: AAPL, SBUX, BUD, AMD, UBER, YUM

-

Peak weeks for Q1 season from April 24 - May 12

Earnings Recap - Big Tech Saves the Day

The first quarter 2023 peak earnings season started out last week with a sour earnings report from First Republic Bank (NYSE:FRC) which revealed deposits fell 40% during the quarter. Last month, we pointed out that the regional bank had confirmed a later-than-expected earnings date, 11 days later, to be exact, noting that this was a bearish sign for the upcoming earnings call. After rising ahead of the announcement, the stock is now down 75% since that report, and further news that the bank would likely not be rescued and instead taken into receivership by the FDIC.

However, starting on Tuesday, big tech swooped in to save the day. Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Meta Platforms Inc (NASDAQ:META) and Amazon (NASDAQ:AMZN) all reported better-than-expected earnings and revenue results and mostly bullish guidance, lifting the Dow Jones Industrial Average to its best monthly gain since January. Widespread layoffs appear to have helped improve margins for many tech companies, with more announcements coming in last week for workforce reductions at Lyft (NASDAQ:LYFT) and Dropbox (NASDAQ:DBX).

Robust results in the last week bring the current S&P 500 growth rate up to -3.7% from -6.2% the week prior. We’re still on track for an “earnings recession” as it is unlikely that results will be so good for the quarter that we emerge from negative growth territory. Still, it’s certainly shaping up better than expected, with 79% of companies beating EPS estimates.

Potential Earnings Surprises this Week - Marriott International

With an earlier-than-expected earnings date for the world’s largest hotel chain, travel demand appears to have recovered from pandemic-caused losses.

Marriott International (MAR)

- Company Confirmed Report Date: Tuesday, May 2, BMO

- Projected Report Date (based on historical data): Thursday, May 4, BMO

- DateBreaks Factor: 2*

Marriott International (NASDAQ:MAR) is set to report Q1 2023 results on Tuesday, May 2. While this is only two days earlier than anticipated, it does push MAR’s Q1 report date into the 18th week of the year rather than the long-term trend of reporting during the 19th or 20th week of the year.

Academic research shows when a corporation reports earnings earlier than they have historically, it typically signals good news to come on the conference call. This narrative could make sense for Marriott as travel demand in the US has been high, especially as we head into peak travel season. Large international carriers such as Delta Air Lines Inc (NYSE:DAL), American Airlines (NASDAQ:AAL), and United Airlines (NASDAQ:UAL) have already reported for Q1 and commented on the strength in travel demand as well as record advanced bookings for this coming summer.

On Deck this Week:

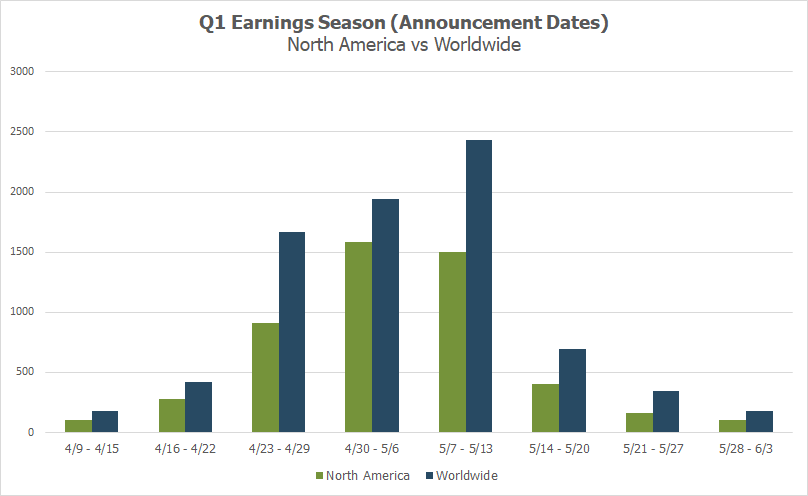

This week will mark the second of peak earnings season, with 2,333 companies in our universe of nearly 10,000 global equities slated to release results for the first quarter. Tech will still be in focus with Apple (NASDAQ:AAPL) results out on Thursday AMC, as well as results from internet service companies such as Shopify (NYSE:SHOP), Etsy (NASDAQ:ETSY) and Zillow (Z), and internet tech names such as Atlassian (NASDAQ:TEAM) and Hubspot (HUBS). We’ll also be getting a smattering of reports from other sectors, with companies like Uber (NYSE:UBER), Starbucks Corporation (NASDAQ:SBUX), and Yum! Brands (NYSE:YUM) are all in focus.

Source: Wall Street Horizon

Q1 Earnings Wave

This season peak weeks will fall between April 24 - May 12, with each week expected to see over 1,000 reports. Currently, May 11 is predicted to be the most active day, with 963 companies anticipated to report. Thus far, 73% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon