Pilgrim Global buys Sable Offshore (SOC) shares worth $14.7m

Wolf pack sightings aren’t uncommon in Grand Teton National Park. But this week, Fed Chair Jerome Powell may find himself fending off a large pack of them again as Federal Reserve officials gather for their annual retreat in Jackson Hole, Wyoming.

The two-plus weeks since July’s week employment surprise have given economic pessimists room to roam. Weaker-than-expected data, though, now confront hotter inflation sightings. Given the core CPI rising 3.1% y/y in July and the most significant jump in producer prices in three years—0.9% m/m—markets are waiting with bated breath for Powell’s speech (Fri).

In the days before that, Fed Governors Michelle Bowman and Christopher Waller, the dovish dissenting duo, will speak in Wyoming (Tue and Wed, respectively). Both dissented with the majority decision not to ease at the Federal Open Market Committee’s (FOMC) July meeting. Though they’ll be speaking at a blockchain symposium, it’s hard to see either rate-cut advocate missing a perfectly timed opportunity to opine that the economy needs a rate cut. We maintain that it’s not howling for an immediate rate cut whatsoever, but is more resilient than the July dissenters think.

At the margin, the minutes of the July 29-30 FOMC meeting (Wed) could fill in some blanks about how dug in the doves were and how intransigent the inflation hawks might’ve been in late July.

Here’s a look at the data releases this week that are most likely to influence the hawks and doves on the Federal Open Market Committee:

(1) Housing starts

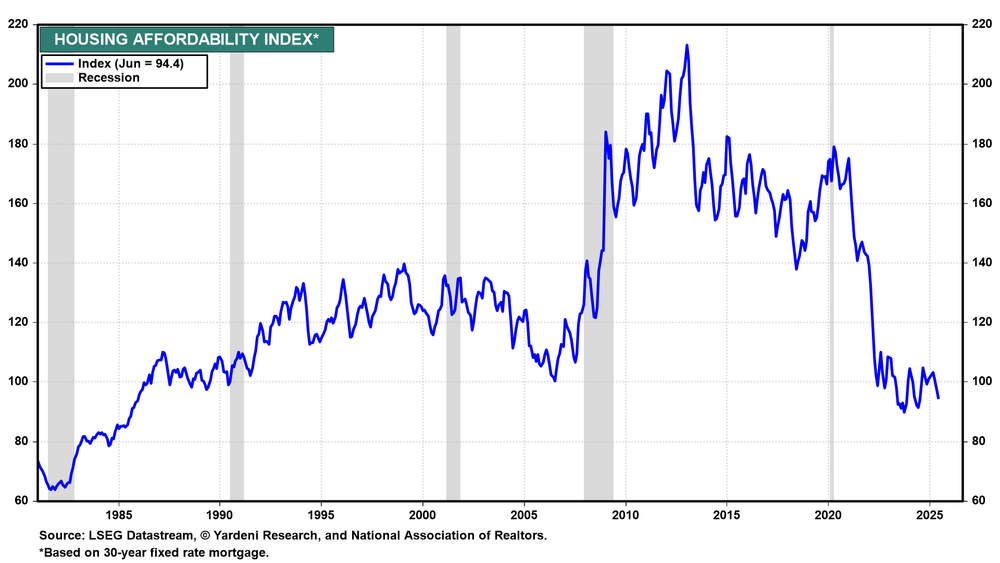

High mortgage rates, lots of economic uncertainty, and a glut of homes for sale probably weighed on July housing starts (Tue) (chart). They likely dropped a bit from June’s 1.32 million unit pace (saar).

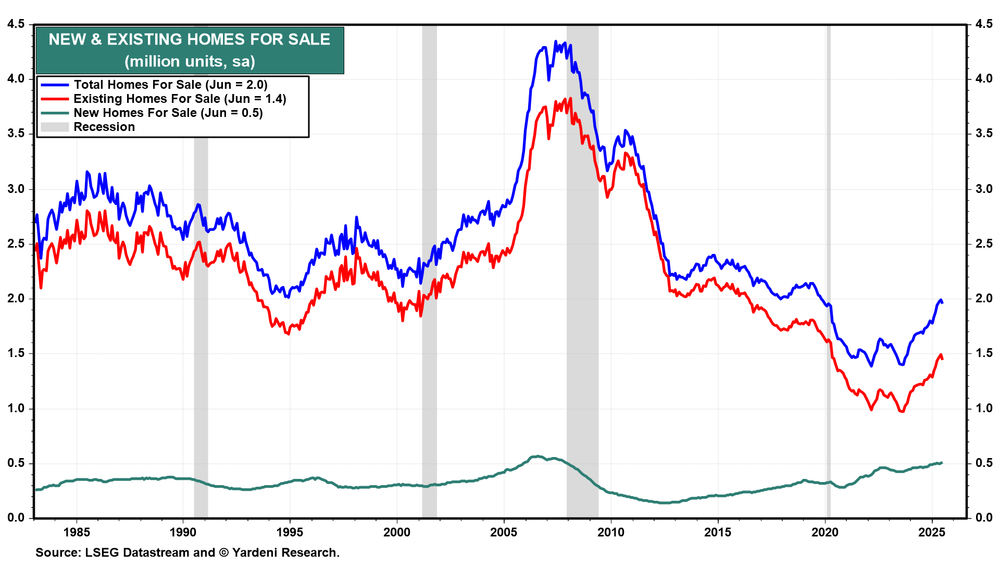

(2) Existing home sales

July existing home sales (Thu) were probably weak as well. Despite the resilience of the economy, generally speaking, data on pending sales volumes and home contract cancellations suggest that affordability remains a big problem in the housing market (chart). Home prices are just too high.

(3) Jobless claims

Given the recent surge in pessimism about the labor market, weekly data on initial unemployment insurance claims (Thu) have rarely been more important. We expect jobless claims to hold to levels close to last week’s 224,000 and, in turn, allay fears that layoffs are rising.

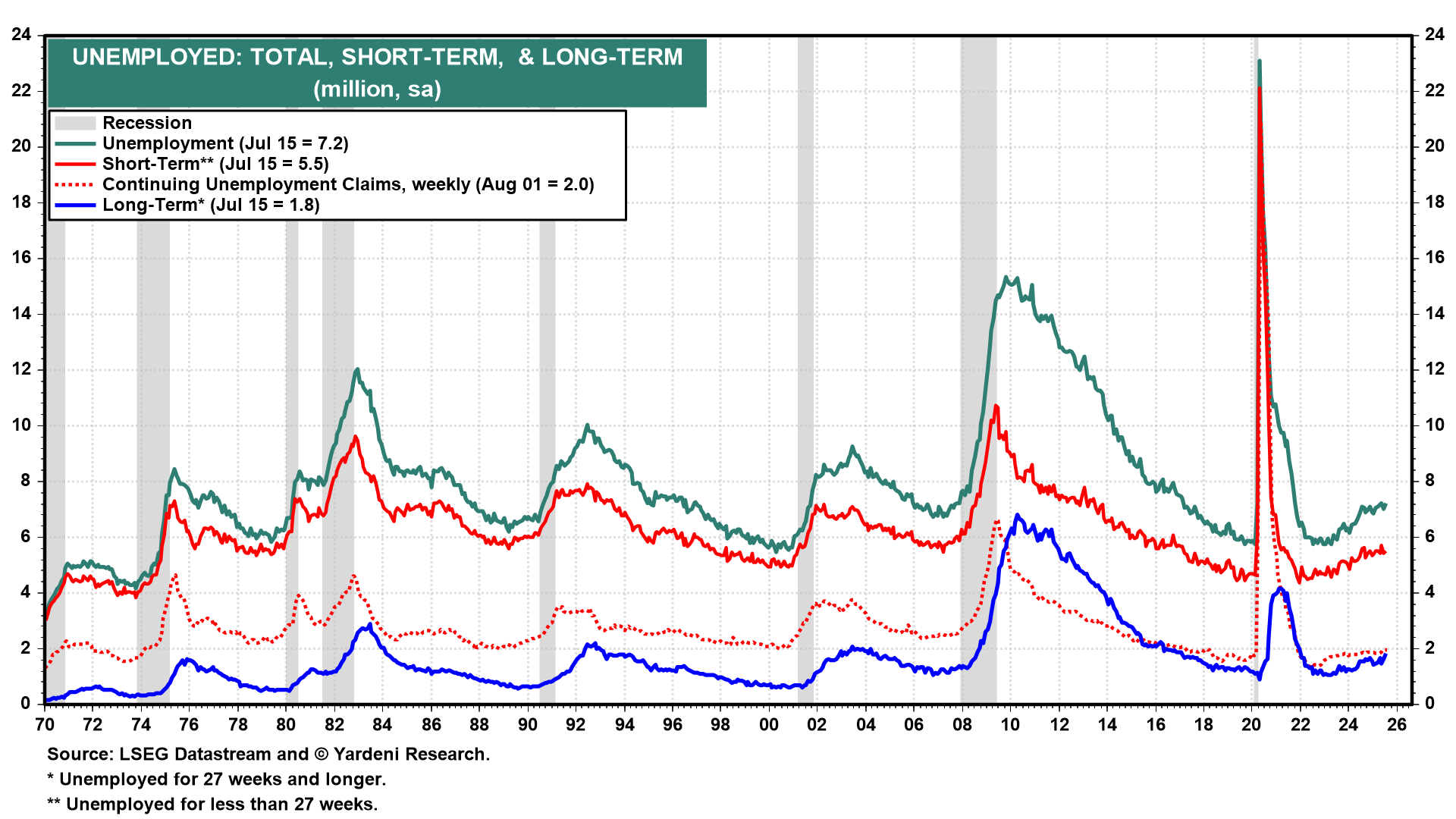

The data point that may matter most to the Fed’s September decision is continuing unemployment claims, which have been hinting that the duration of unemployment might be increasing (chart). The problem in the labor market is that it is taking longer to find a job. But if labor-saving technologies are the cause of that problem, it’s one that the Fed’s easing can’t fix. And ditto if the cause is employers’ hesitancy to hire now, given all the tariff-related uncertainty.

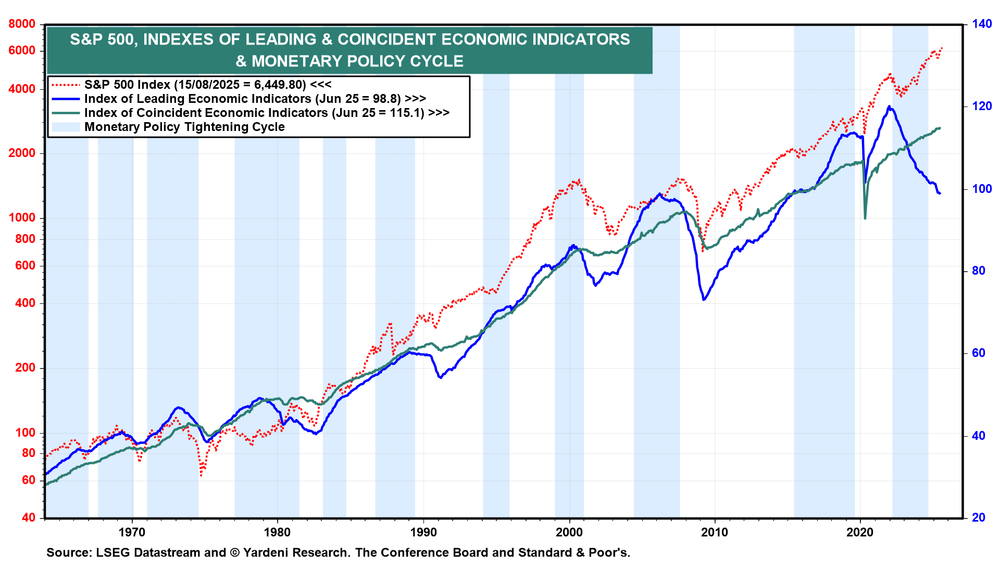

(4) Leading indicators

The Index of Leading Economic Indicators (LEI) (Thu) has been a misleading indicator of an impending recession since late 2022 (chart). The S&P 500 is one of the 10 components of the LEI. It has been much more accurate about the economic outlook than has the LEI. It is currently at a record high, and so is the Index of Coincident Economic Indicators.