UBS Points to Two Top European Luxury Stocks Ahead of 2026 Upswing

There’s a danger that every piece on regional equity markets I write currently goes along the lines of “if you’re worried about US exposure, consider diversifying to x”: “x” being any place that is not the US. I’ve done it with Japan and Europe of late and, inevitably, global emerging markets fall into that category.

Emerging markets outperformed for an extended period up until the global financial crisis, and have largely lagged since. Valuations rose to the point where they were broadly in line with developed markets at the nodal point of the GFC, and have since fallen.

So, they are cheap relative to developed markets and to history. But I think that’s an unconvincing argument, in and of itself: that a market is cheap because it has underperformed doesn’t mean it won’t continue to underperform. The UK has been a case in point, though the case is arguably better now.

Over five years to the end of March, the s Global Emerging Markets sector returned 27.3%, compared to 50.9% for UK All Companies, and 72% for North America. Nevertheless, it still attracted more than £11bn of investors’ cash over the period, although that goes into the red by £5.2bn over three years, and £700m over one (although this is a tenth of the redemptions compared to the same period last year). Despite UK All Companies’ better performance, redemptions from this sector have been much heavier over all periods.

GEMs have also had to contend with the ‘C’ word: China. The country has struggled emerging from Covid, and been weighed down by real estate crises. And now, of course, there is the issue of US tariffs: onerous for most, but especially so for China. In one sense, this is a continuation of the US bipartisan policy on steroids: while Europe has tended to have a somewhat laissez faire approach to the rise of China, the US has tended to see it as a, if not the, rising competitor. It’s notable that Biden didn’t reverse Trump’s tariffs during his administration.

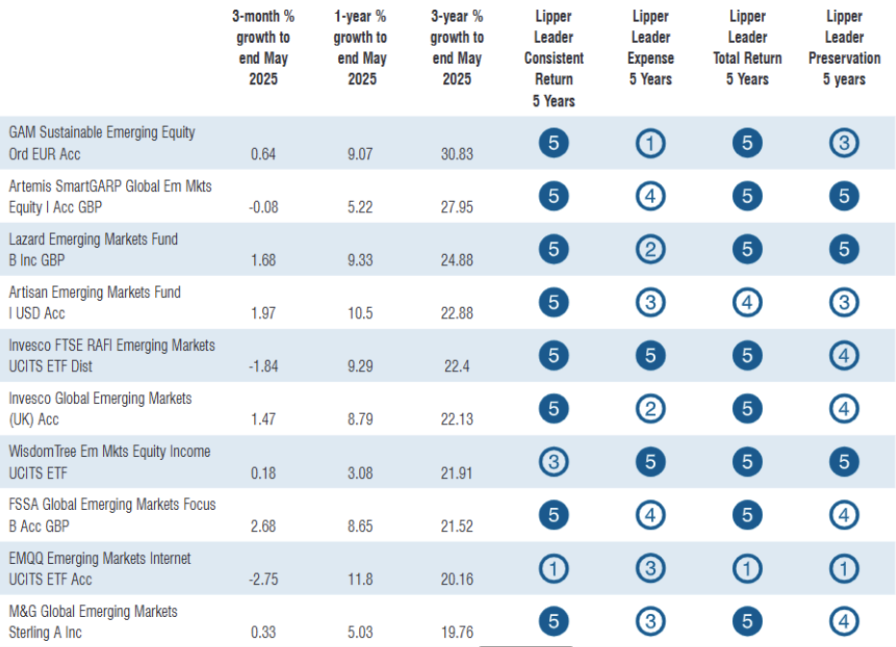

That said, the number of emerging markets funds, launched or repurposed over the past few years as ex-China vehicles don’t seem to have made much of a dent on the market, with assets gathered looking rather anaemic. What’s more, the top two funds over three years in the table below—GAM Sustainable Emerging Equity and Artemis SmartGARP Global Emerging Markets Equity—both have China as their largest holding (and both, along with many, many others, have Taiwan Semiconductor Manufacturing Company as their number one holding.

The company is more than double the weight of the next largest stock in the MSCI Emerging Markets index). To be fair, the sector’s worst performer over the period has an even larger exposure. Plus, the fund with the strongest one-year return (7.8%, with the mean being -0.24%) has no China exposure.

Which leads us back to tariffs. Ongoing uncertainty makes any hard and fast predictions as to what happens if and when things arrive at a new equilibrium, I feel, a mug’s game. Asia is in the firing line—China, of course, and other significant goods importers, such as Vietnam. Except, of course, all those industry-specific exceptions.

Latin American countries seem better favoured, and the FTSE Emerging Latin American index, along with FTSE India, has consequently faired relatively well since the start of April. Emerging Europe does little trade with the US, and has also done relatively well. Countries that are export-orientated and with integrated into global supply chains would be expected to face higher hurdles as tariffs bite. It’s a mixed bag, but that has always been the case with emerging markets.

But, then, no-one knows what a new ‘normal’ will look like, and how long it will take to settle. If the TACO trade plays out, Chinese stocks could rebound more than most on the not-as-bad-as-expected news. If…

So, yes, there is lots to tempt investors in this sector. But, right now, the positive fundamentals are overwhelmed by geopolitical noise, making it hard to sift winners from losers.

Table 1: Top-Performing Global Emerging Markets Over Three Years (With A Minimum Five-year History)

All data as of May 31, 2025; Calculations in GBP

Source: LSEG Lipper