TSX jumps amid Fed rate cut hopes, ongoing U.S. government shutdown

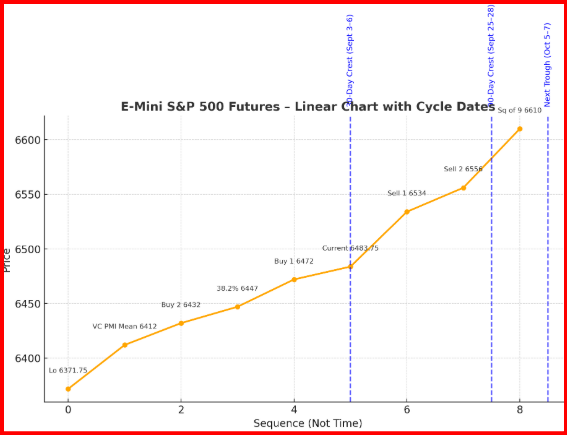

The E-Mini S&P futures are trading at 6483.75, down modestly on the session after an explosive rally from the September 2 low at 6371.75. That low marked a textbook Square of 9 harmonic support cluster, setting the stage for a sharp mean-reversion advance. The rebound carried prices to 6541.75, where supply re-entered the market directly in line with the Sell 1 (6534) and Sell 2 (6556) resistance zone. From a time-cycle perspective, the market is at a critical juncture. The 30-day Gann cycle, anchored from the August 5 pivot low (6285), projected a crest into the September 3–6 window. The rally into this week’s high fits perfectly within that timing band, suggesting that a short-term cycle top is likely forming. Looking further, the 90-day cycle from the July 2 low (6210) projects a more important crest into September 25–28, which implies the market could make one more attempt higher before a deeper correction unfolds into late October.

From a time-cycle perspective, the market is at a critical juncture. The 30-day Gann cycle, anchored from the August 5 pivot low (6285), projected a crest into the September 3–6 window. The rally into this week’s high fits perfectly within that timing band, suggesting that a short-term cycle top is likely forming. Looking further, the 90-day cycle from the July 2 low (6210) projects a more important crest into September 25–28, which implies the market could make one more attempt higher before a deeper correction unfolds into late October.

The Square of 9 harmonics reinforce this picture. Resistance bands align at 6534–6556 (Sell 1–2) and extend toward 6610–6625, a level that may only be tested if momentum carries beyond the current ceiling. On the downside, key harmonic supports sit at 6447 (38.2% retracement), 6412 (VC PMI weekly mean), and 6369, which harmonically mirrors the September 2 low.

Momentum studies, particularly the MACD, show strong upside thrust but are beginning to flatten, warning that the rally is losing steam. With price pressing into overbought territory, the probabilities of mean reversion (90–95%) back toward equilibrium are high if 6556 is not convincingly broken.

In summary, the E-Mini has entered a time-price wall. If buyers can clear 6556, the door opens for a push toward the 6610–6625 Square of 9 cluster, likely aligning with the late September cycle crest. Failure here, however, points to a retracement into the 6412–6447 zone, with potential extension into the October 5–7 trough window near 6369.